First Class Info About Other Income In Profit And Loss Statement

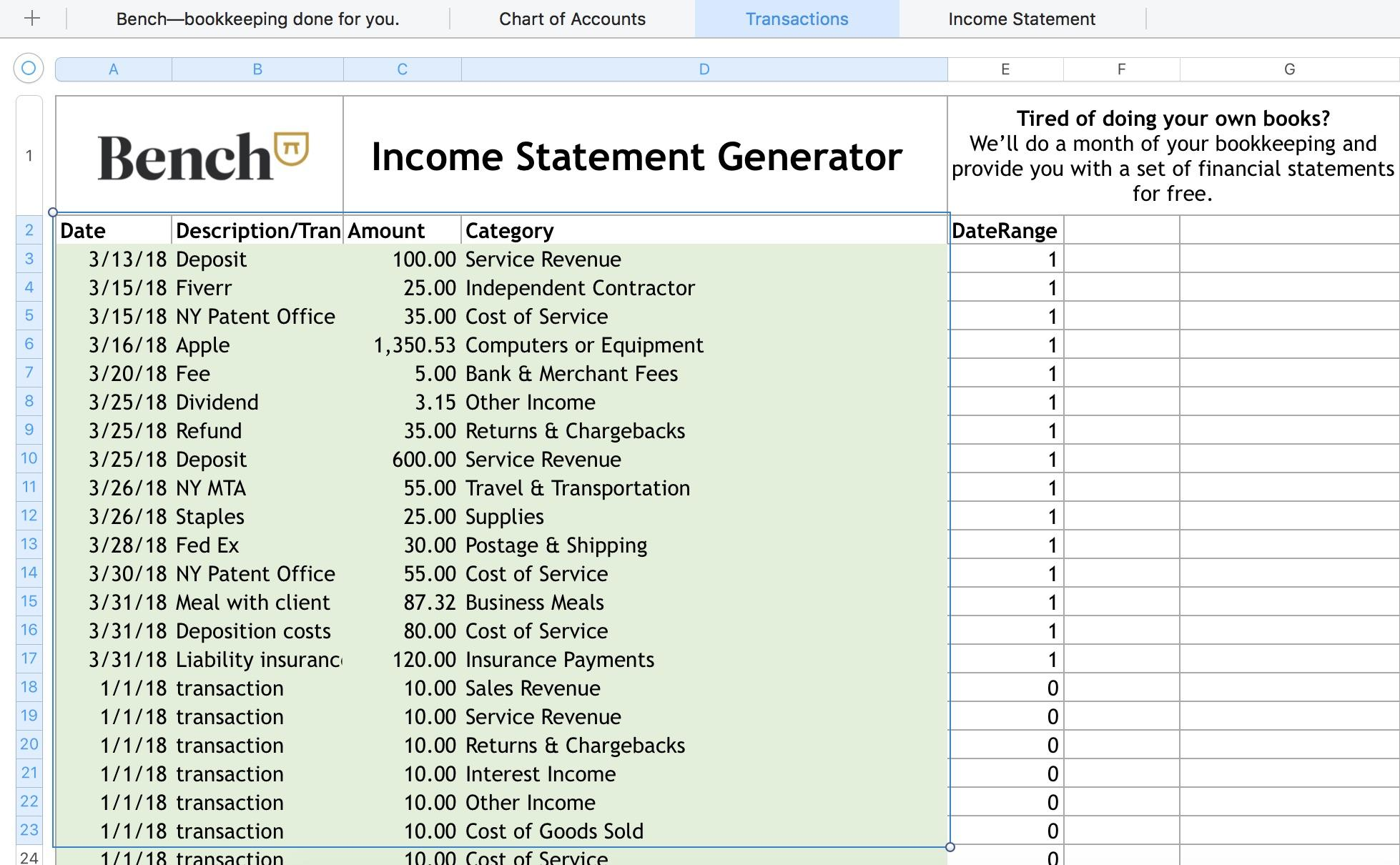

The income statement is a useful way to see how a company makes money and how it spends it.

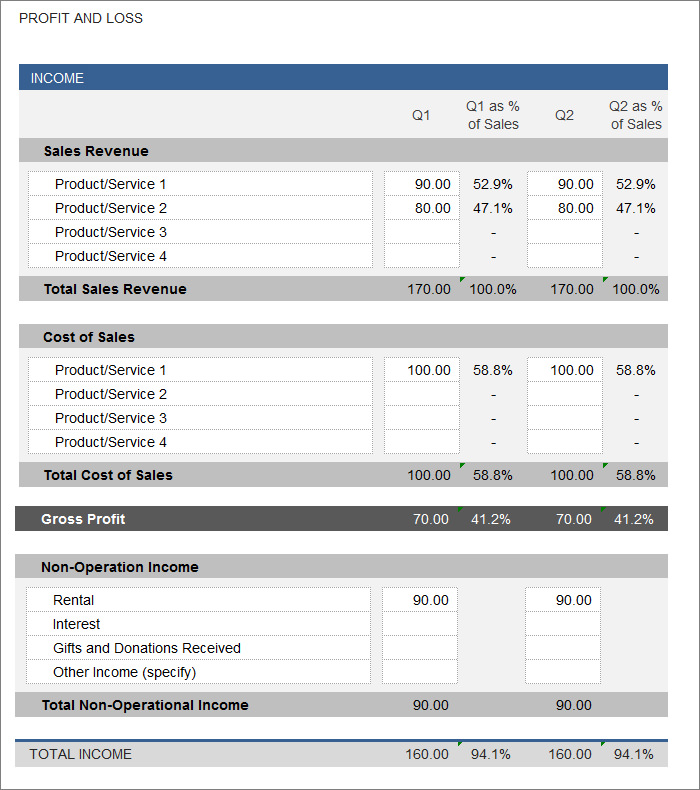

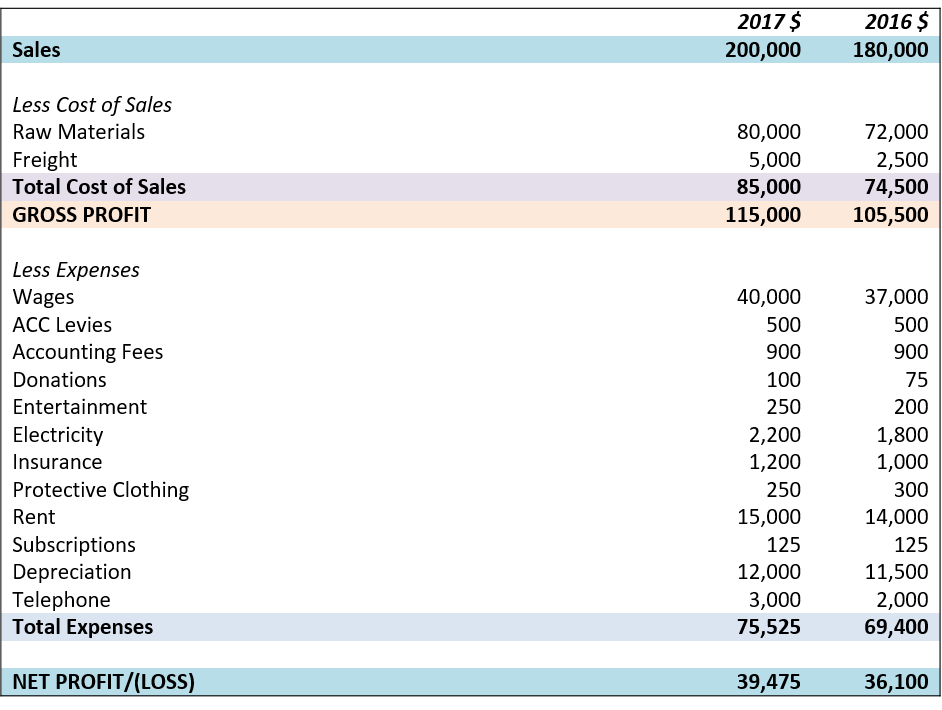

Other income in profit and loss statement. Revenue minus expenses equals profit or loss. It shows the company’s net profit or loss during a specific time for which it is prepared. Other income refers to those sources of income of an individual or business which arise out of activities besides the main activity to be recorded separately in schedule 1 of form 1040 or on the income statement.

An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period. When a new york judge delivers a final ruling in donald j. What is the profit and loss statement (p&l)?

An income statement represents a period of time (as does the cash flow statement ). This information helps them budget, make decisions and implement changes. Sales on credit) or cash vs.

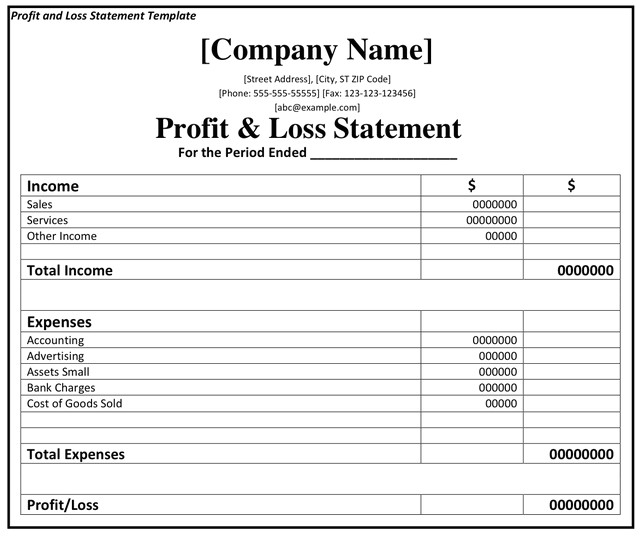

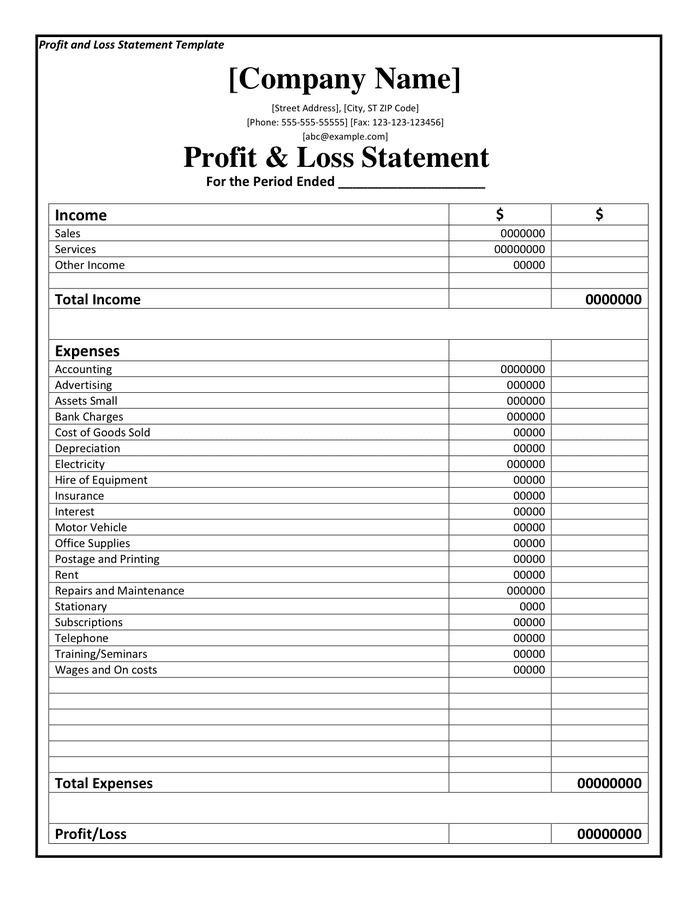

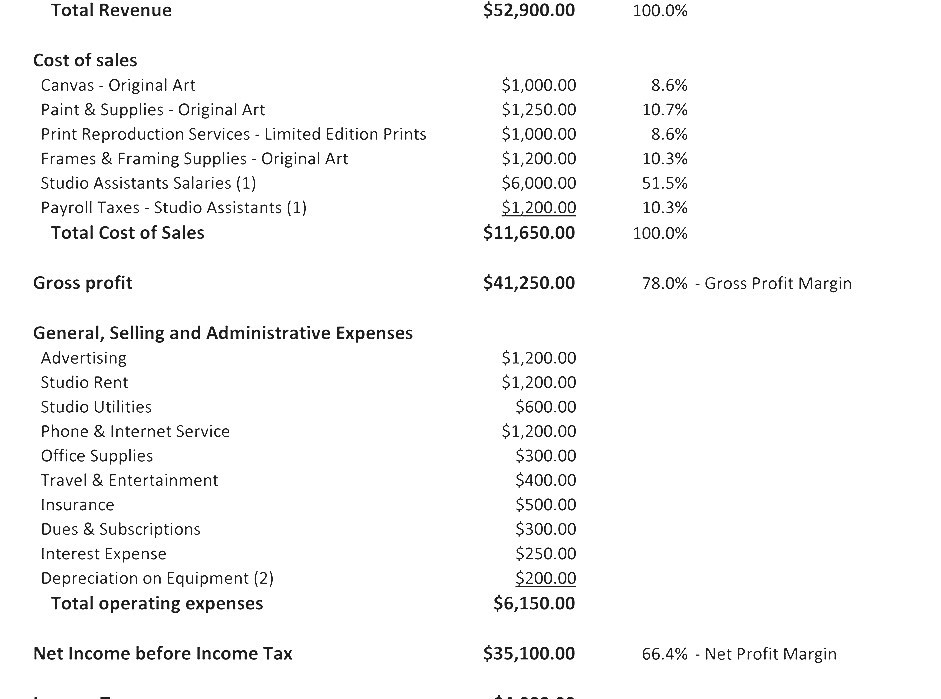

This statement helps companies make informed decisions about their operations and track their. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. A p&l statement provides information about whether a company can.

The p&l statement is one of three. This contrasts with the balance sheet, which represents a single moment in time. A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report.creating one is a.

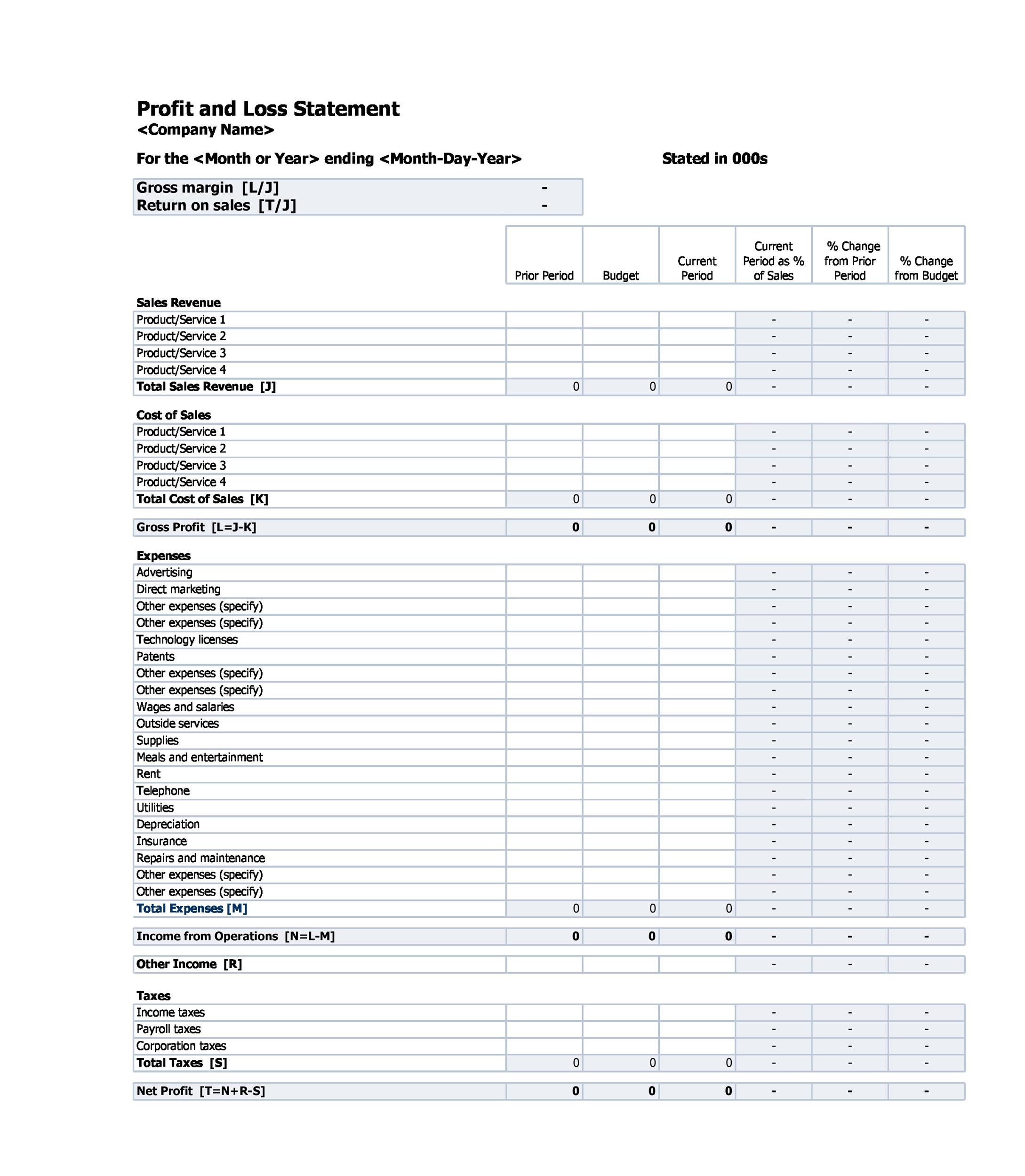

The financial statements that show a company's profits during a certain period are called income statements or profit and loss statements. The format you choose depends on the type of business. A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it captures how money flows in and out of your business.

Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. It shows both turnover and profitability for the company over that length of. The answer is that each company presents this information differently.

The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. Choose an income statement format. Statement of profit or loss and other comprehensive income 81a statement of changes in equity 106 statement of cash flows 111 notes 112 transition and effective date 139 withdrawal of ias 1 (revised 2003) 140 appendix amendments to other pronouncements approval by the board of ias 1 issued in.

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The purpose of the income statement is to show managers and investors whether the company made money (profit) or lost money (loss) during the period being reported. How to prepare an income statement in 7 steps.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)