Beautiful Work Info About The Balance Sheet And Income Statement

Balance sheets and income statements are both financial statements that provide information about the company’s finances, but they are not the same.

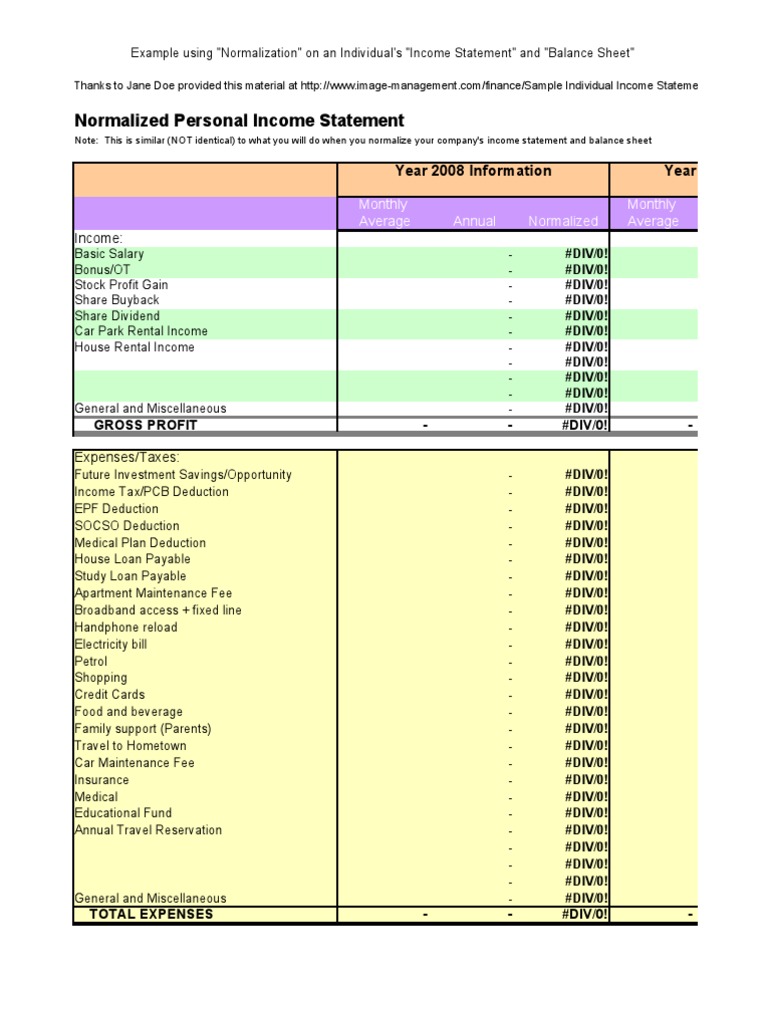

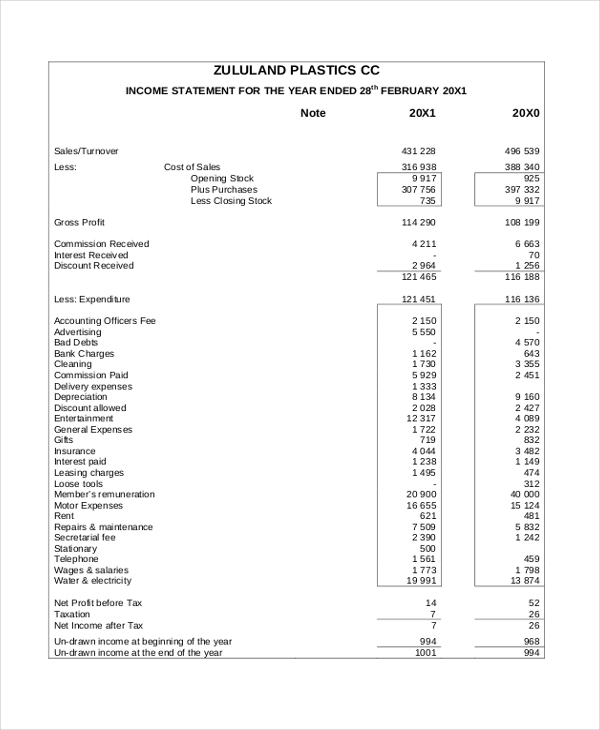

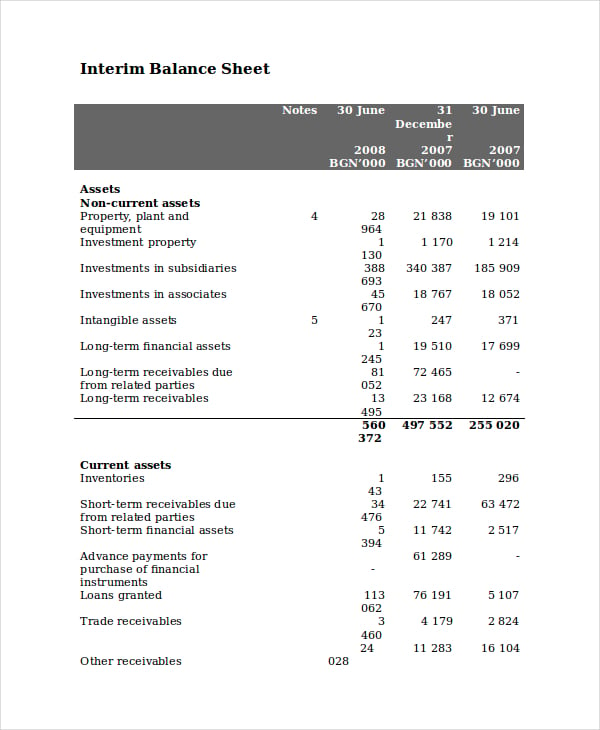

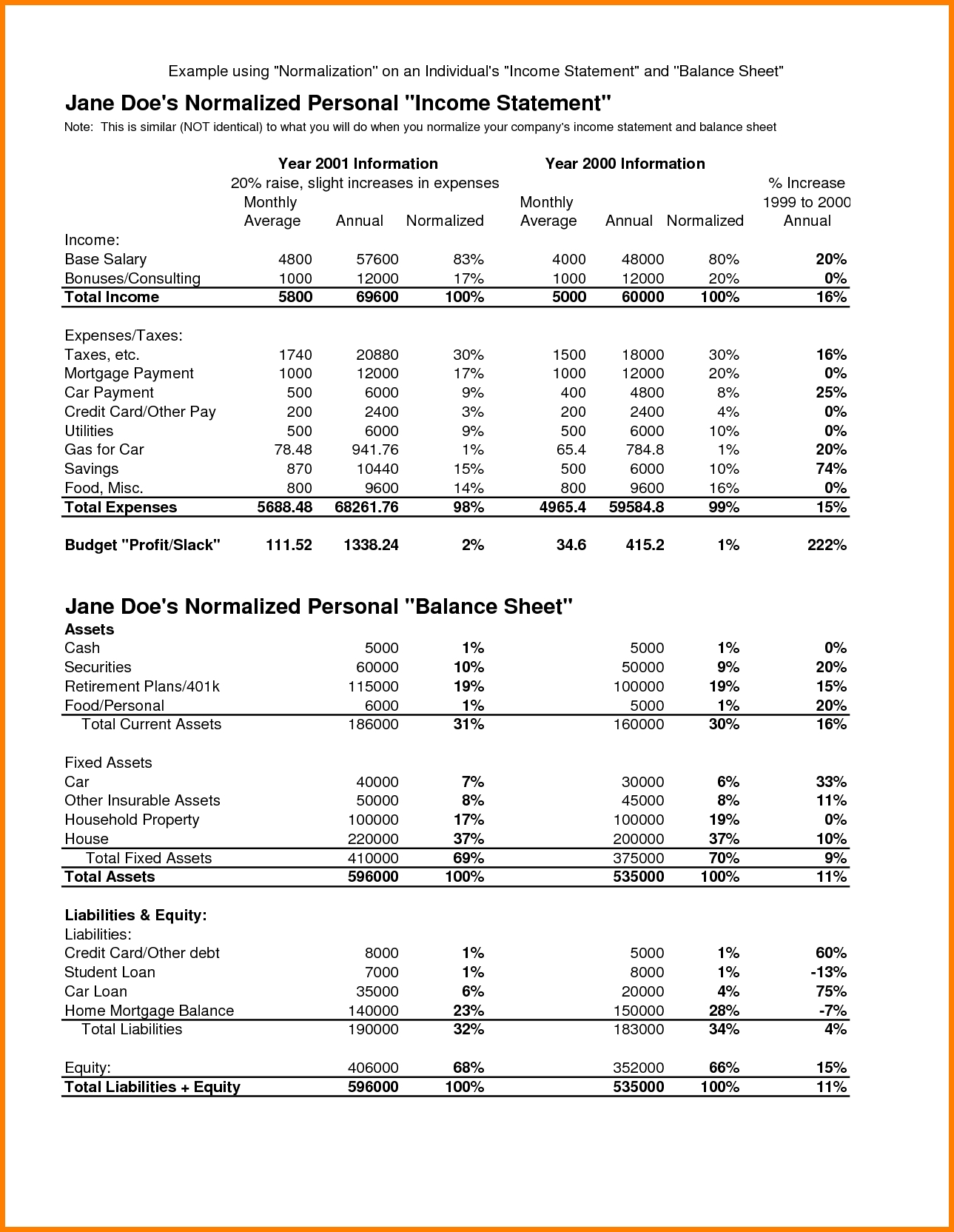

The balance sheet and income statement. By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports. Balance sheets are useful to gain insight into a company’s value and whether it is liquid enough to pay off its debts. How do the income statement and balance sheet differ?

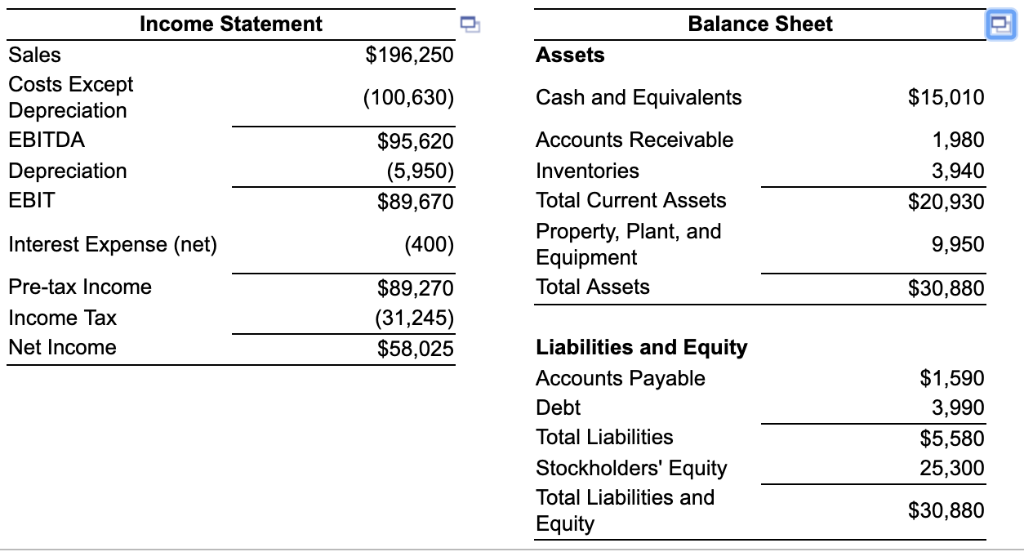

Three core financial statements doing the example with accounts payable growing fair value accounting economics > finance and capital markets > accounting and financial statements > three core financial statements That’s where two financial statements can help: A balance sheet lists assets and liabilities of the organization as of a specific moment in time, i.e.

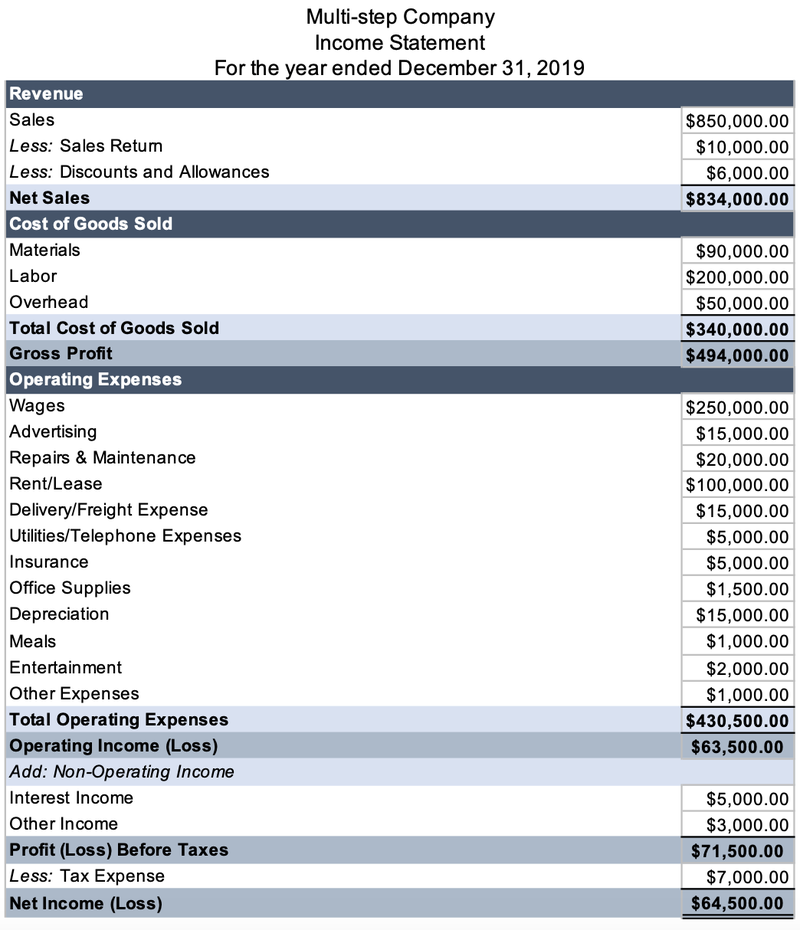

What is the difference between a balance sheet and an income statement? Every time a company records a sale or an expense for bookkeeping purposes, both the balance sheet and the income statement are affected by the transaction. In this article, you will learn all the differences that exist between the balance sheet and income statement, including what makes them so important.

They’re similar, but not the same — and both are important. Those of an income statement is a key differentiator between the two documents. As fixed assets age, they begin to lose their value.

The three financial statements are: Balance sheet and income statement relationship (video) | khan academy course: Investors and creditors analyze the balance sheet to determine how well management is putting a company's.

Net income & retained earnings. The income statement was first since net income (or loss) is a required figure in preparing the balance sheet. The income statement, the balance sheet, and the cash flow statement.

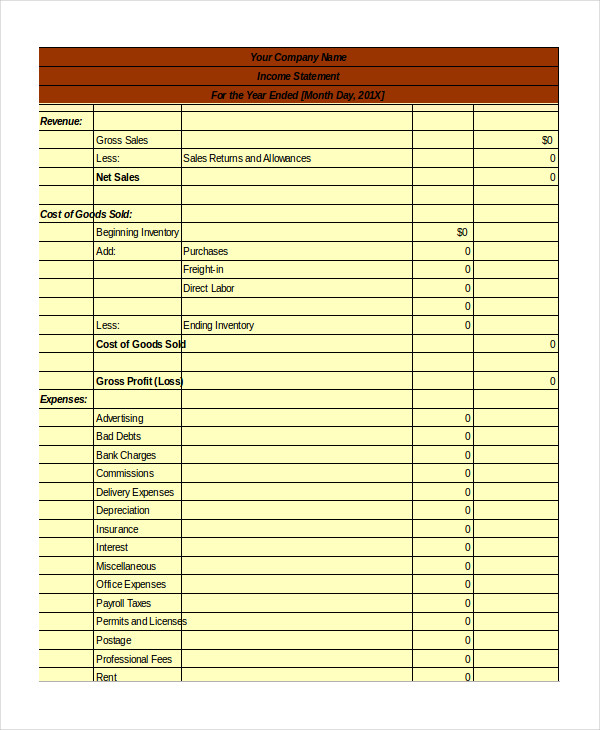

An income statement tallies income and expenses; Your income statement and balance sheet are two of the most important documents you will create as a business owner. Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the company’s financial.

It’s used to understand how much a company owes versus how much it owns. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. Finance and capital markets > unit 5 lesson 2:

All revenue and expense accounts are closed since they are temporary. The balance sheet, income statement, and cash flow statement: While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses.

An income statement is one of the three major financial statements, along with the balance sheet and the cash flow statement, that report a company’s financial performance over a specific. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. The balance sheet is one of the three core financial statements that are used.