Great Info About Monthly Cash Budget

Use tools like a spending tracker.

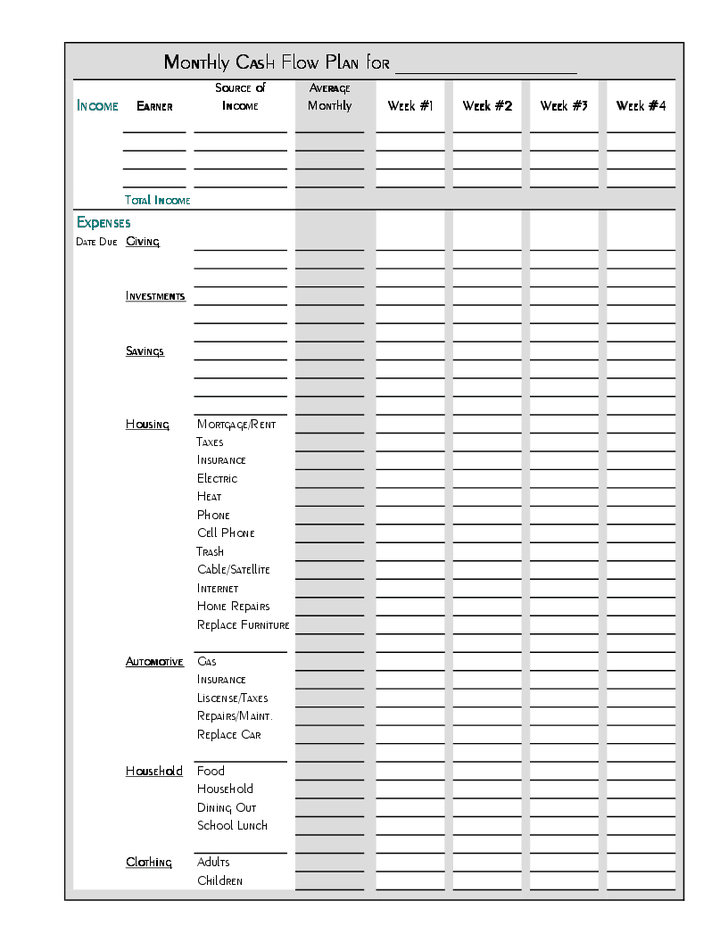

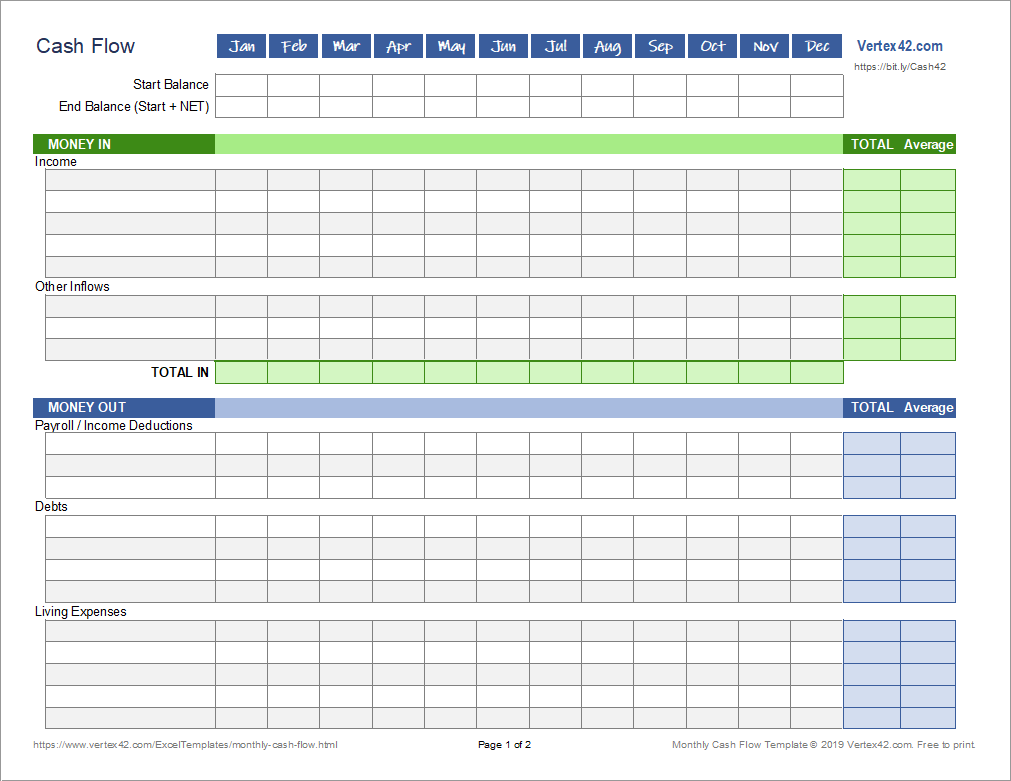

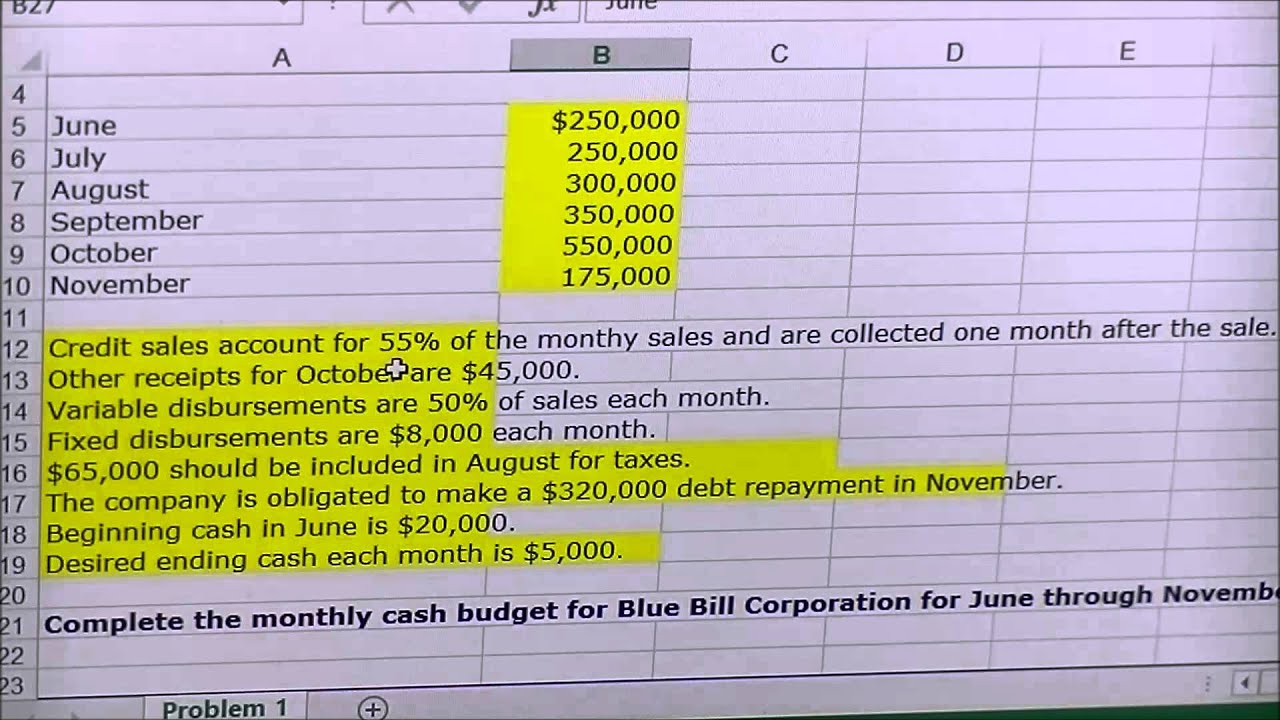

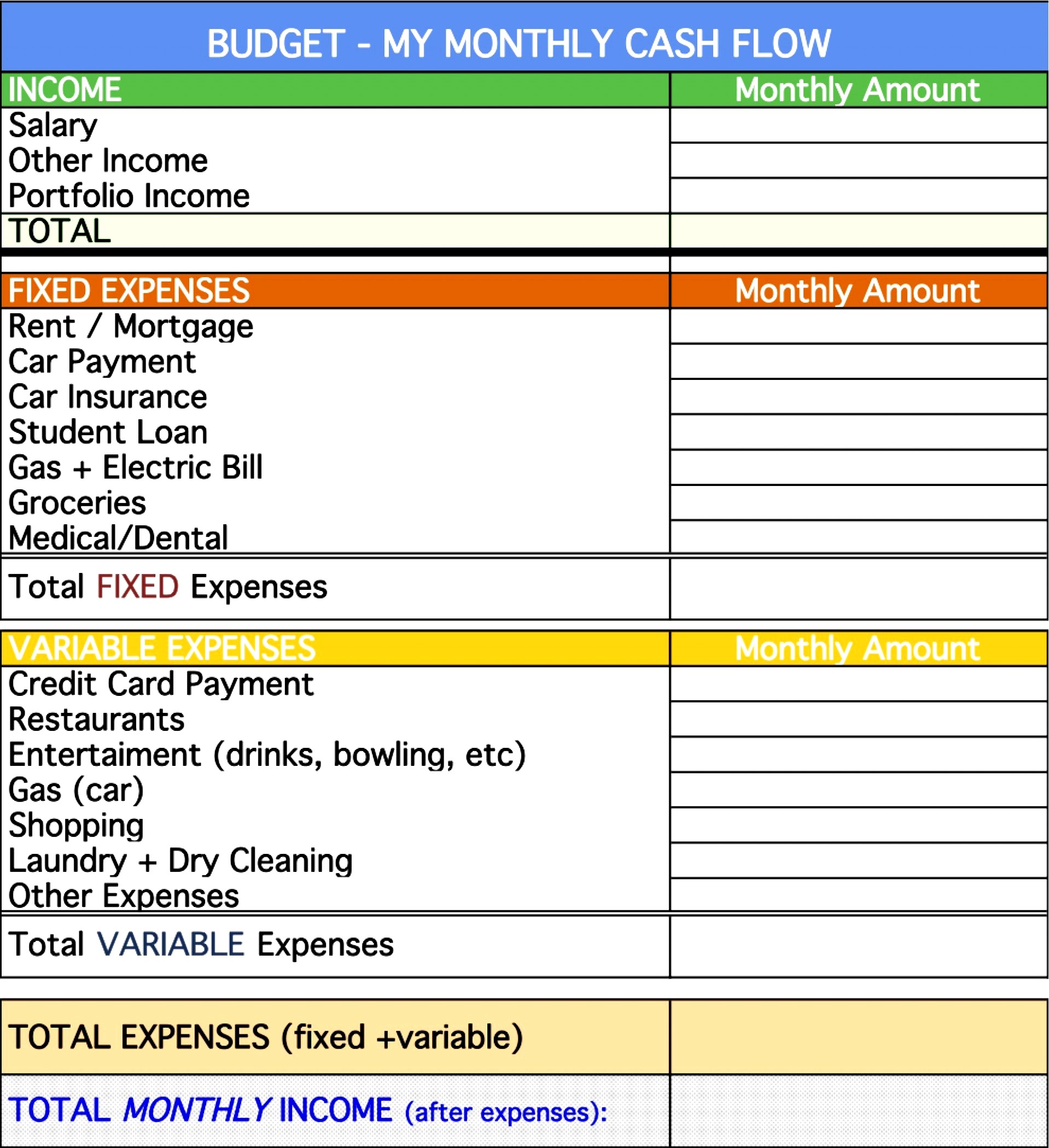

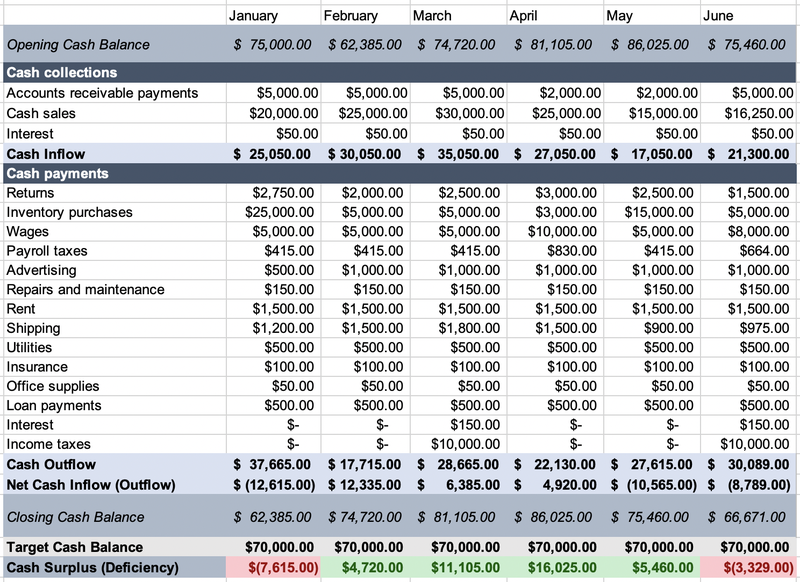

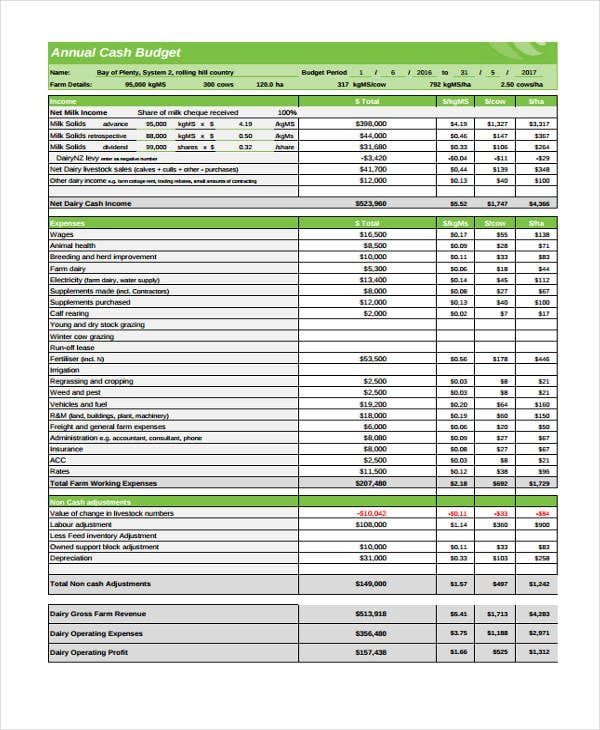

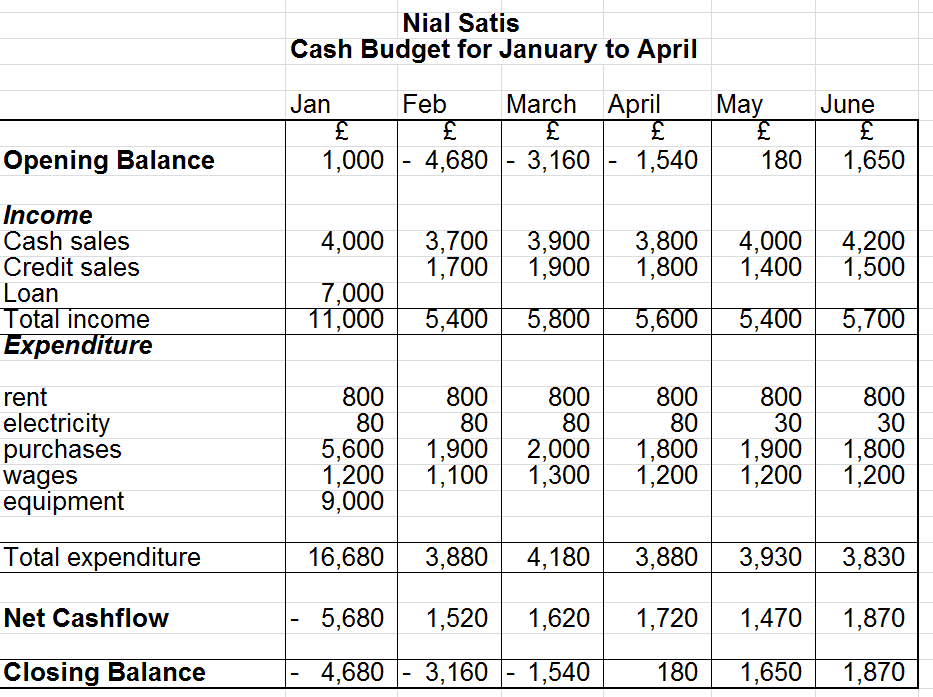

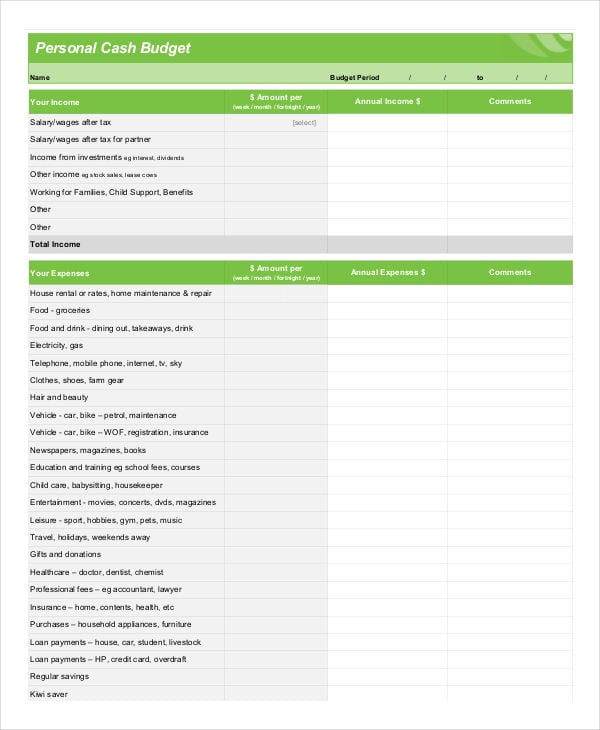

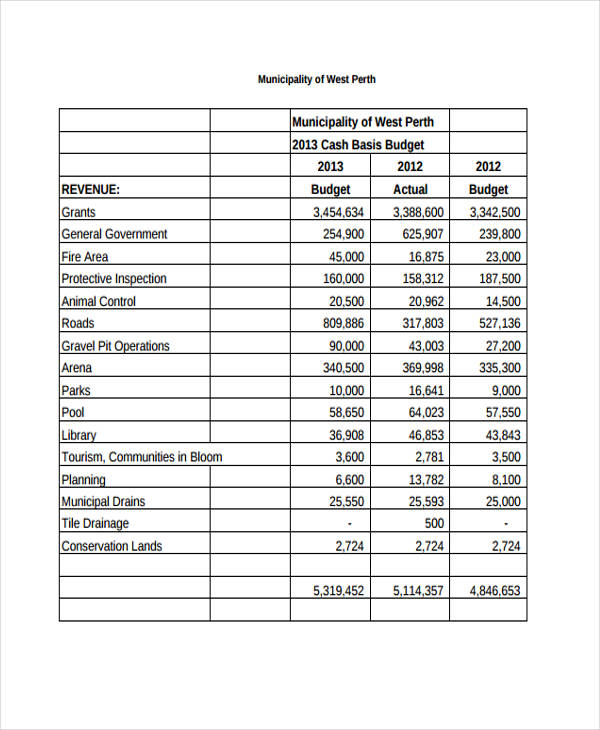

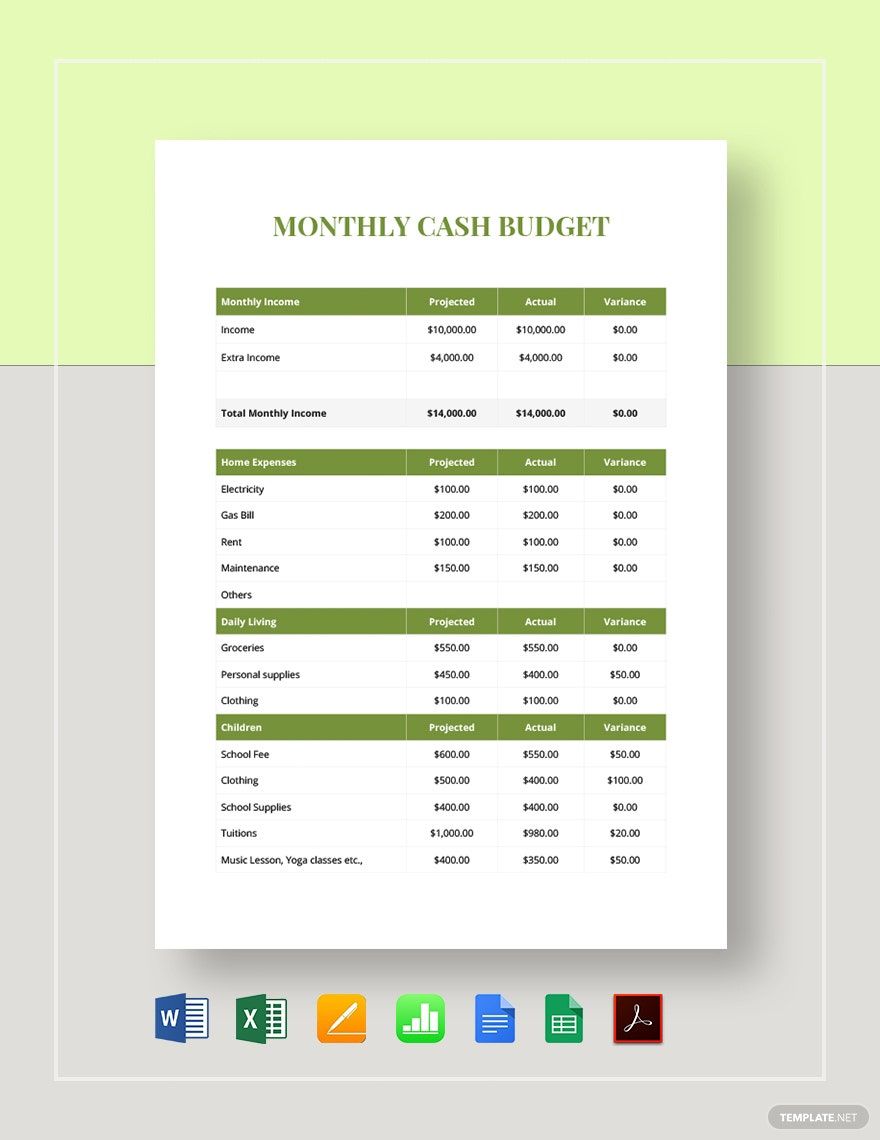

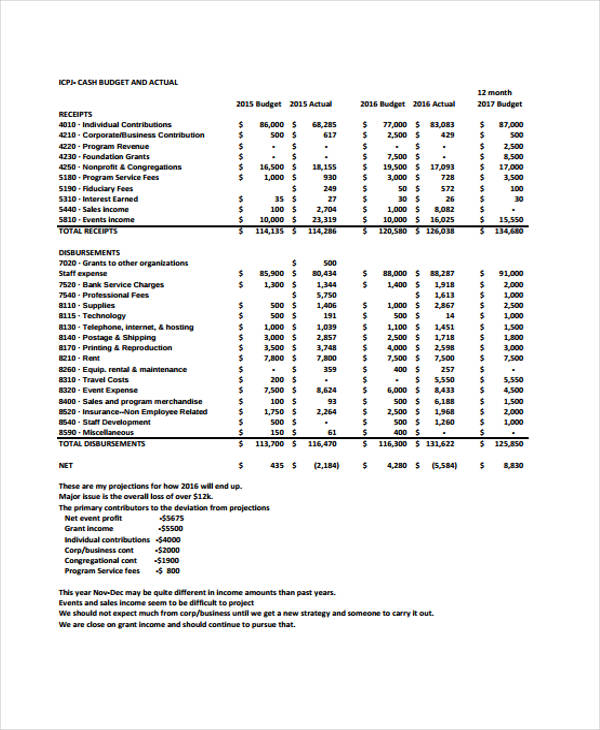

Monthly cash budget. A cash budget is important for personal and business planning, as it indicates how much funding is required or how much surplus cash is produced over a period of time. A cash budget is a type of budget that estimates cash inflows and cash outflows of a business over a specified amount of time. Reasons for cash flow budgeting:

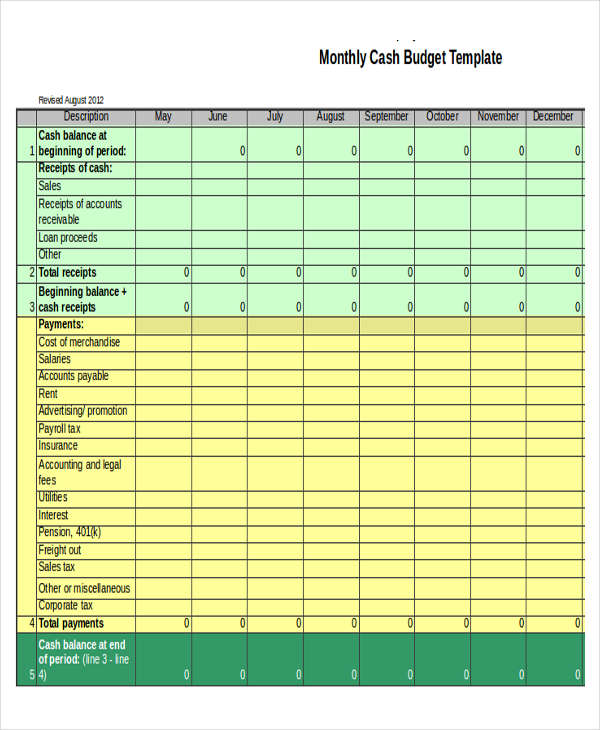

The cash budget provides a company insight. A cash budget is prepared in advance and shows all the planned monthly cash incomings (receipts) and any planned cash outgoings (payments). This budget is used to assess whether the entity has sufficient cash to continue operating over the given time frame.

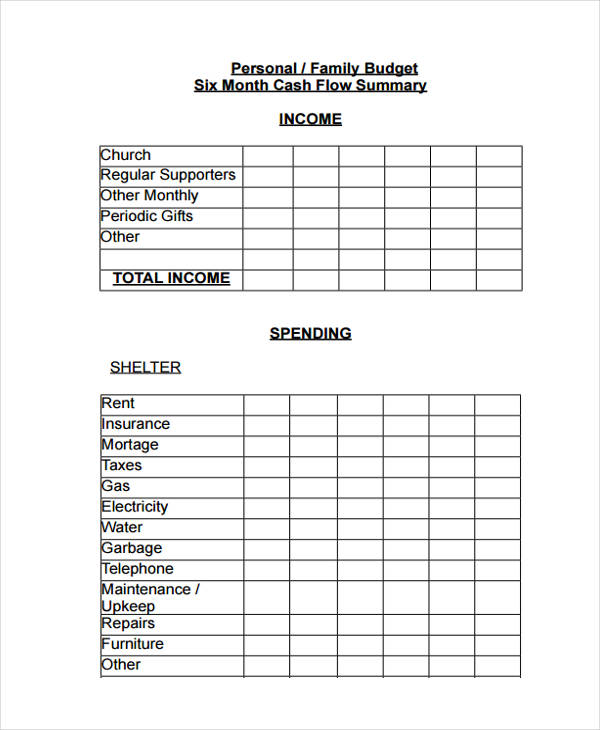

A successful budget planner helps you decide how to best spend your. Creating a monthly budget that is the same each month requires that you use averages for variable expenses (fuel, food, etc.) and periodic expenses (insurance,. Creating a monthly cash budget helps you, the business owner, estimate how much income your business will take in during the coming month, as well as how much the.

A budget planner is a tool, such as a worksheet, that you can use to design your budget. A cash budget itemizes the projected sources and uses of cash in a future period. 71.93% of americans living paycheck to paycheck have $2,000 or less in savings.

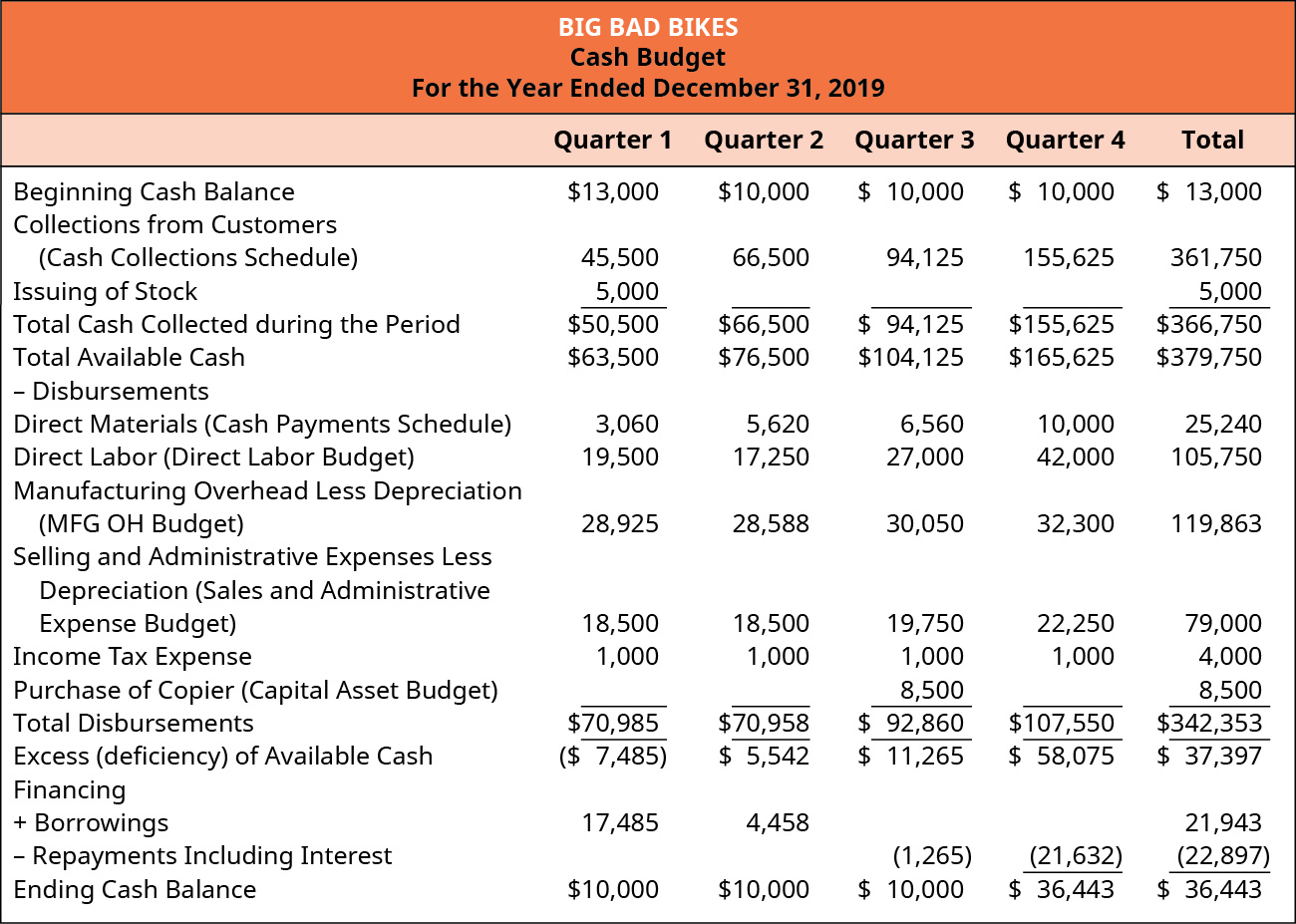

But add in the average cost of internet service ($70), and you'd. Hence, let u’s look at the steps to create cash flow budgeting: Solution cash budget for 2019 problem 3 from the following information, prepare a monthly cash budget for the three months ending 31st december 2019.

A cash budget is an estimate of cash flows for a period that is used to manage cash and avoid liquidity problems. It is used to ascertain whether company operations will provide enough cash. Select the period for the cash flow budget, like weekly to annually.

Sources of cash can, for example, include bill. Monthly cash flow worksheet conclusion: This cash budget template will help you plan your cash inflows and outflows on a monthly basis.

Preparing a cash budget has a. With a rolling monthly cash flow forecast, the number of periods in the forecast remains constant (e.g., 12 months, 18 months, etc.). A cash budget is an estimation of the cash flowsof a business over a specific period of time. this could be for a weekly, monthly, quarterly, or annual budget.

Below is a preview of the cash budget template:. A cash budget is a financial planning tool that forecasts a business’s cash inflows and outflows over a specific period. Some of the reasons for cash flow budgeting are;

Getting the basic disney bundle for $10 a month can save you a total of $6 for disney plus and hulu. By outlining expected revenues and.