Formidable Info About Owners Equity Equals

This equity becomes an asset as it is something that a homeowner can borrow against if need be.

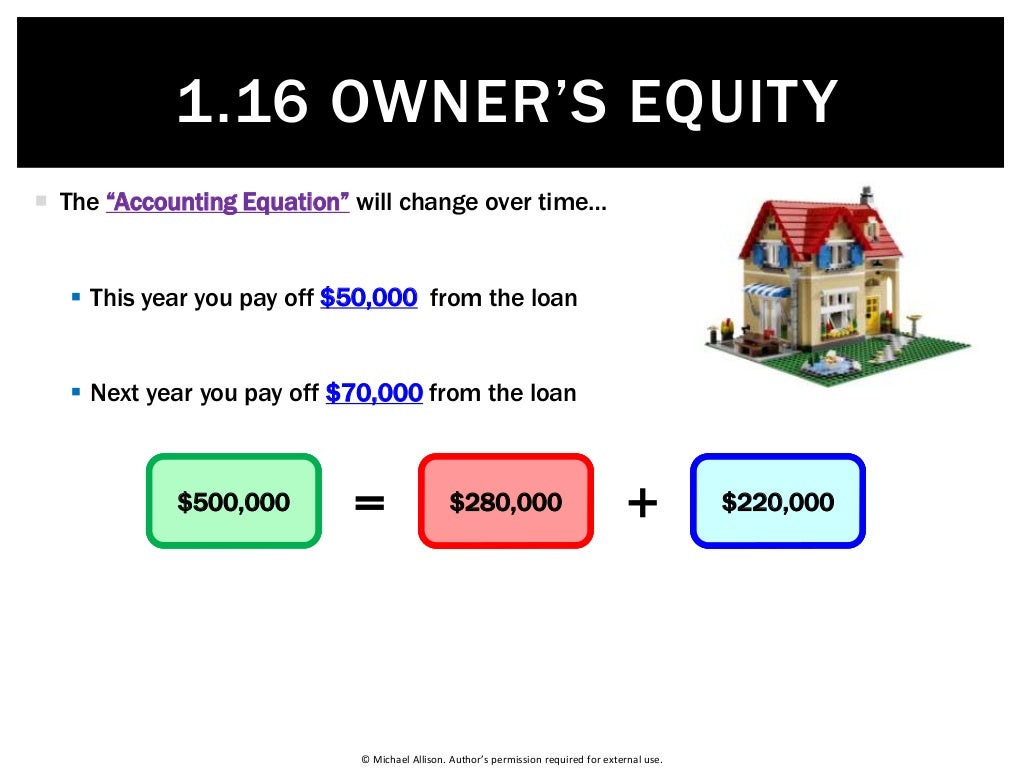

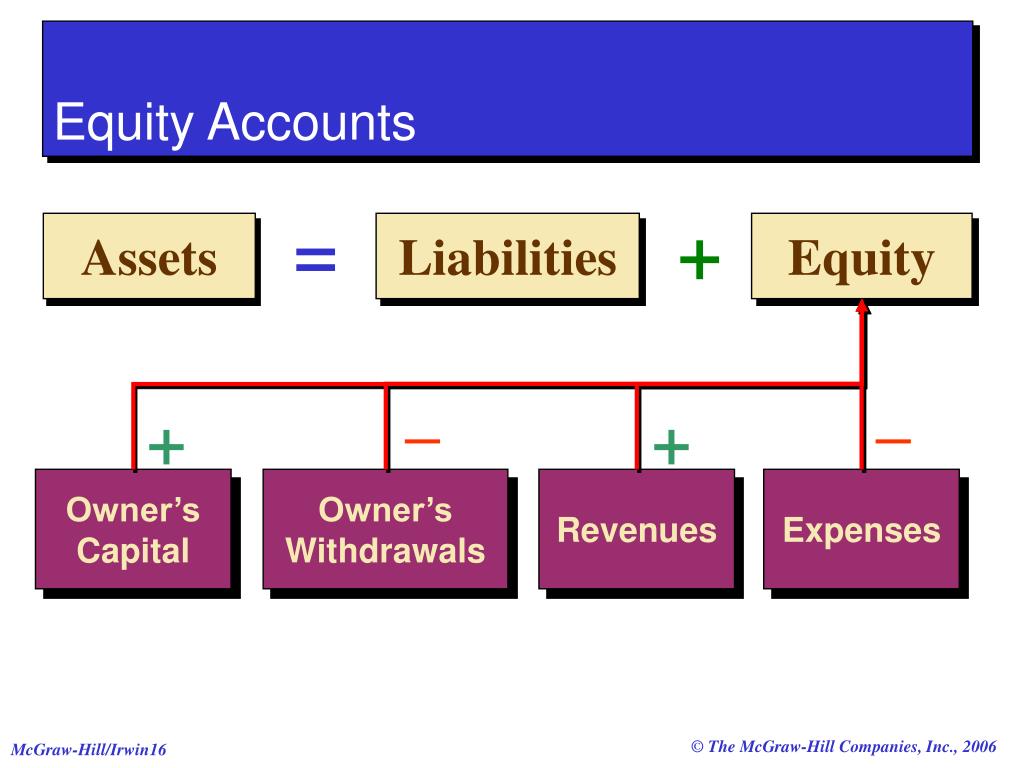

Owners equity equals. The equation that is the foundation of double entry accounting. Think back for a moment to the accounting equation: Owner’s equity is referred to as the rights of the owners in the assets of the business.

The old paradigm of restaurant economics — 30% labor cost plus 30% food cost plus 30% fixed costs equals 10% profit — doesn’t hold water in an era where. It is calculated by deducting the total liabilities of a company from the value of the total assets. The formula can be rewritten:.

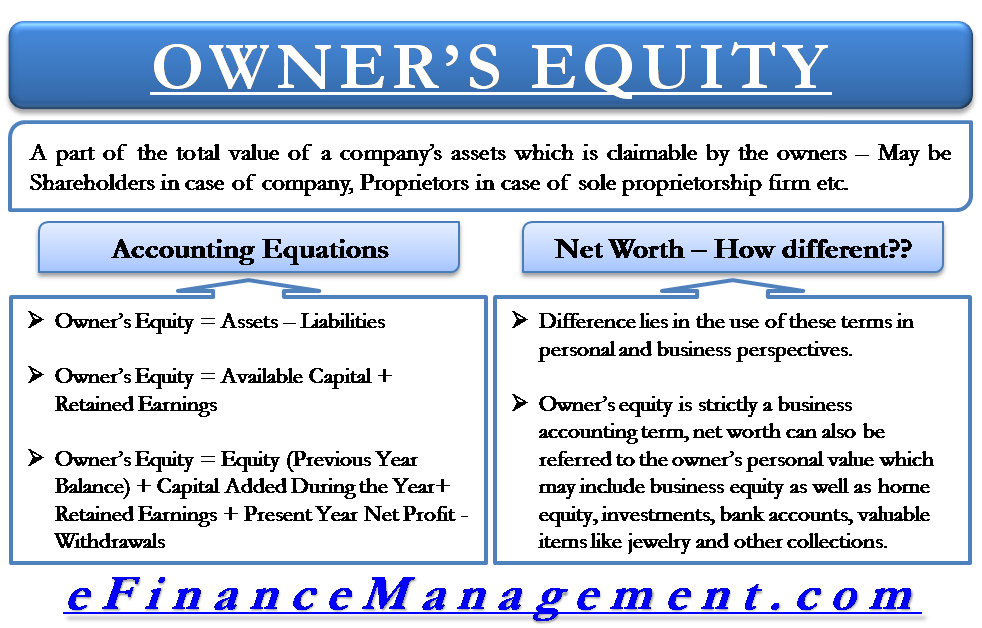

The term owner’s equity is most appropriately used in case of a sole proprietorship. You can calculate it by deducting all liabilities from the total. In this article.

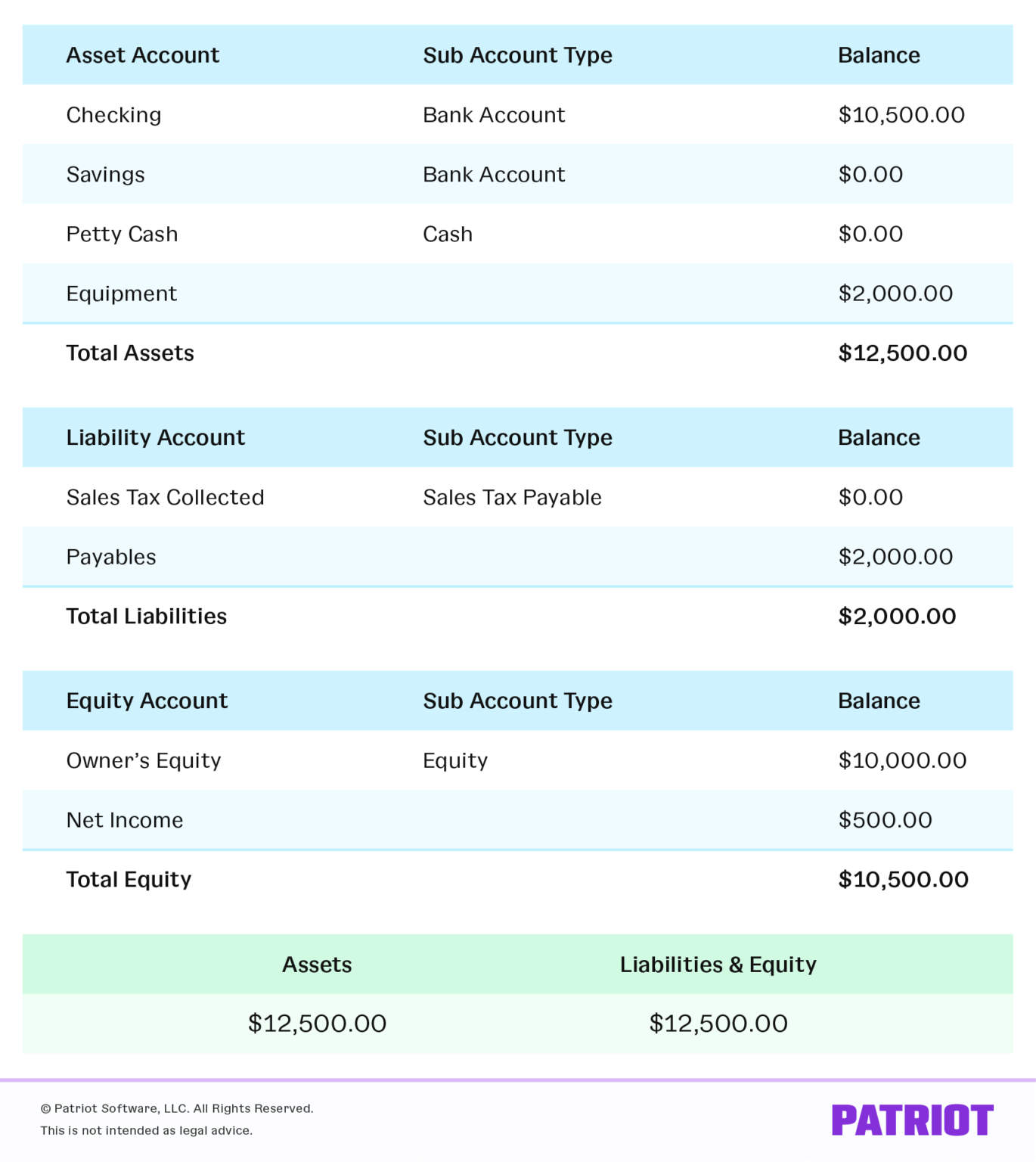

Owner's equity is the portion of a company's assets owned by the shareholders. Enter the total assets and total liabilities of the owner into the. It does this by showing how the earnings for the year (from.

The accounting equation will always be in balance, meaning the left side (debit) of its balance sheet should always equal the right side (credit). According to the accounting equation, owner’s equity equals total company assets minus total company liabilities. Also referred to as net assets or net worth, it is what remains for the owner after all.

Plus, the median household income for black americans was $47,800 in 2022, while the median income for white americans was $75,700. It corresponds to the value of a company's assets minus the liabilities. The accounting equation displays that all assets are either financed by.

Shareholder’s equity is one of the financial metrics that. Owner's equity refers to the amount of equity that an owner of a company has after you deduct all liabilities. Treasury yields were mixed on thursday as investors considered the path ahead for interest rates after minutes from the federal reserve’s.

Balance sheet cash flow statement the statement of changes in equity ties together the p&l and the balance sheet. Note especially that the first equation shows clearly that the firm's assets are partly owned by owners (as equity) and partly owned by creditors (as liabilities). Definition of owner's equity.

The term owner’s equity is. When you take all of your assets and subtract all of your liabilities, you get equity. Owner's equity (oe) refers to the owner's rights to the enterprise's assets.

Owner’s equity is the difference between the value of assets and the cost of liabilities of an owner. Equity can be calculated by subtracting total liabilities from total. For a sole proprietorship or partnership, equity is usually called “owners equity”.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)