Divine Tips About Common Size Cash Flow Statement Example

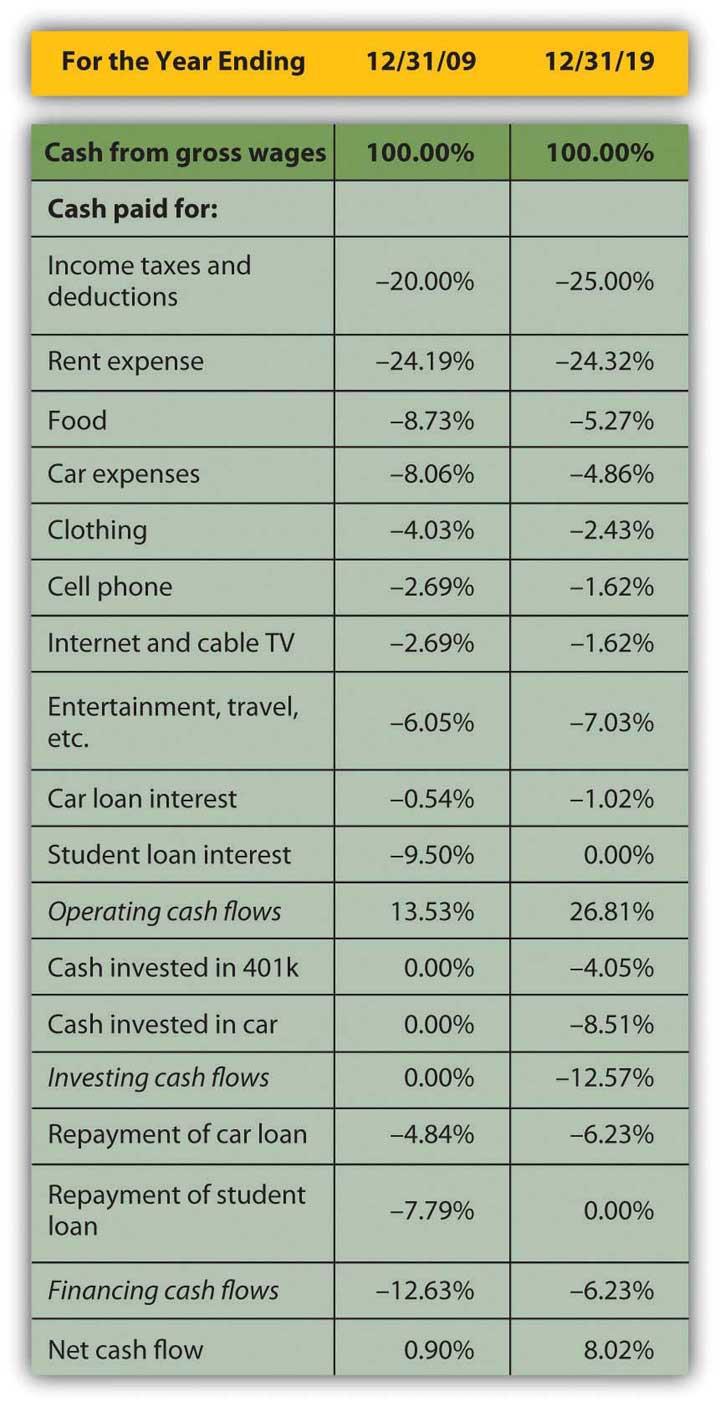

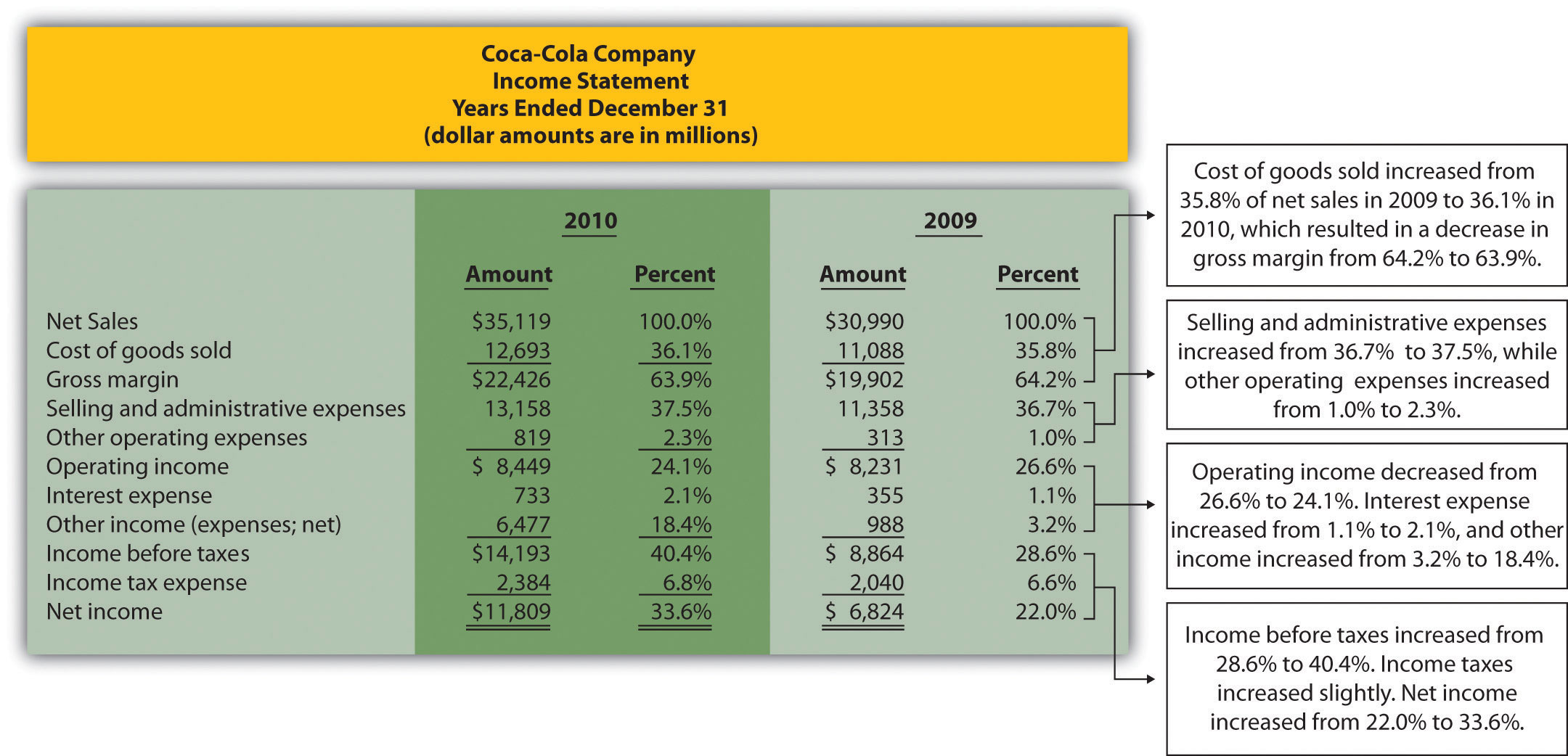

Key takeaways a common size financial statement lists any entries as a percentage of a base figure.

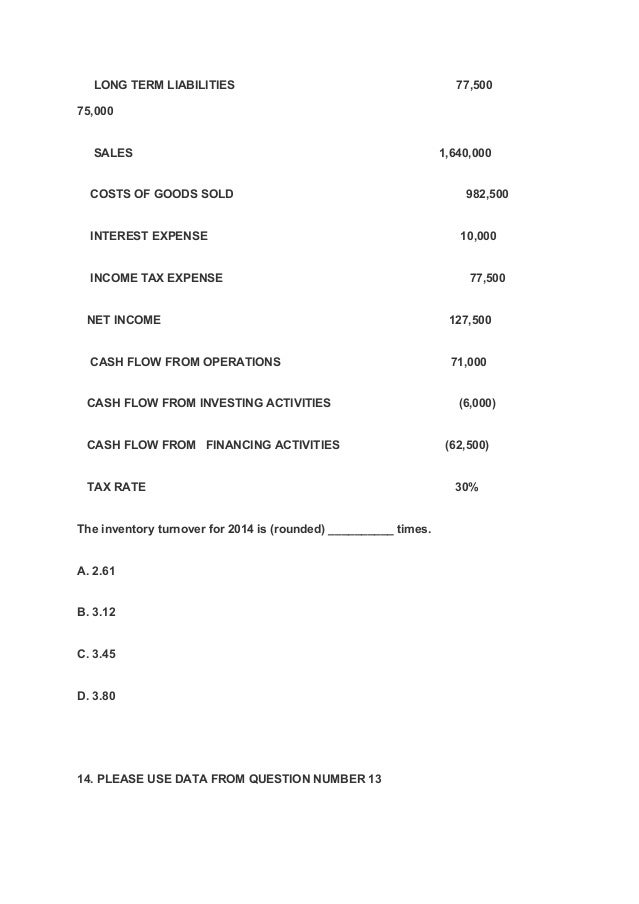

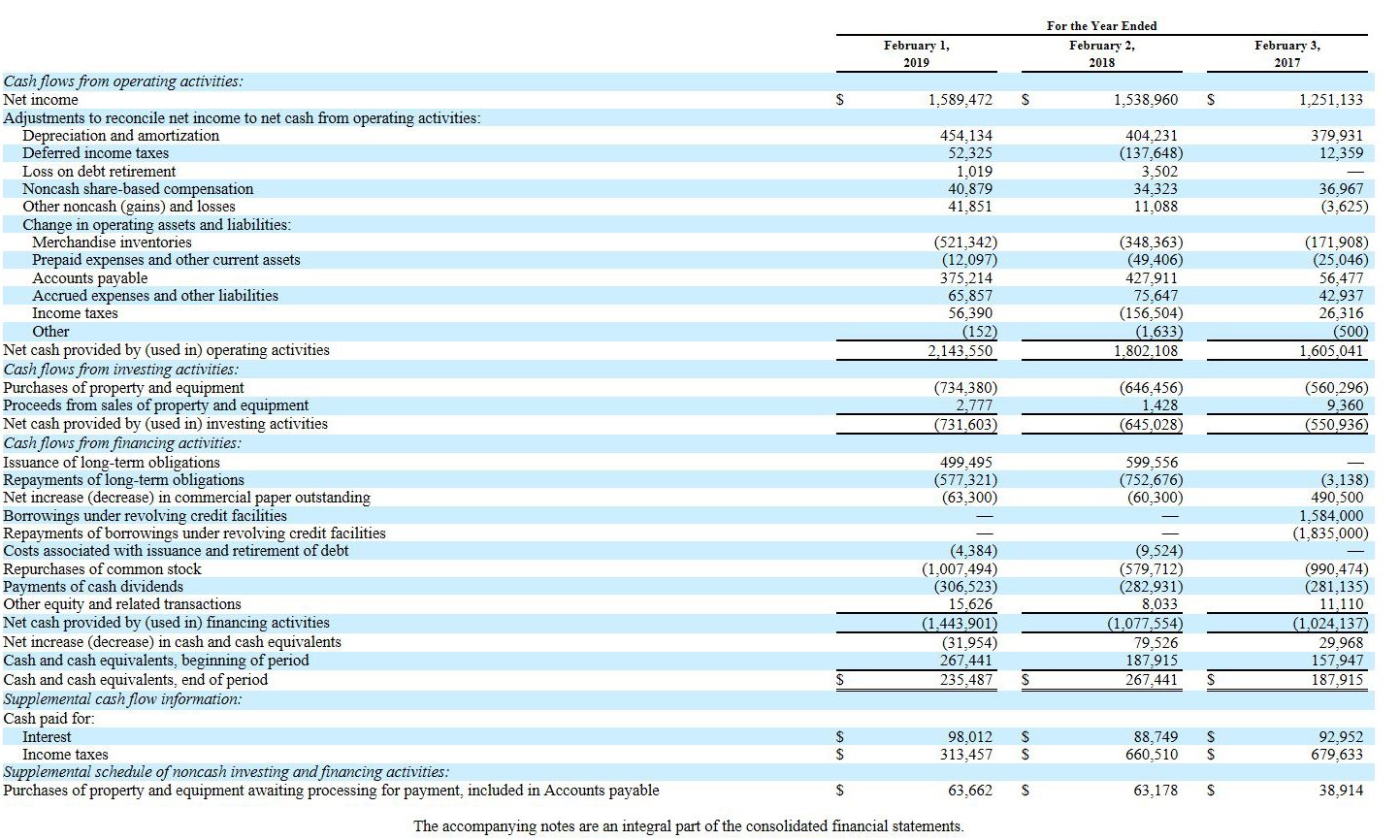

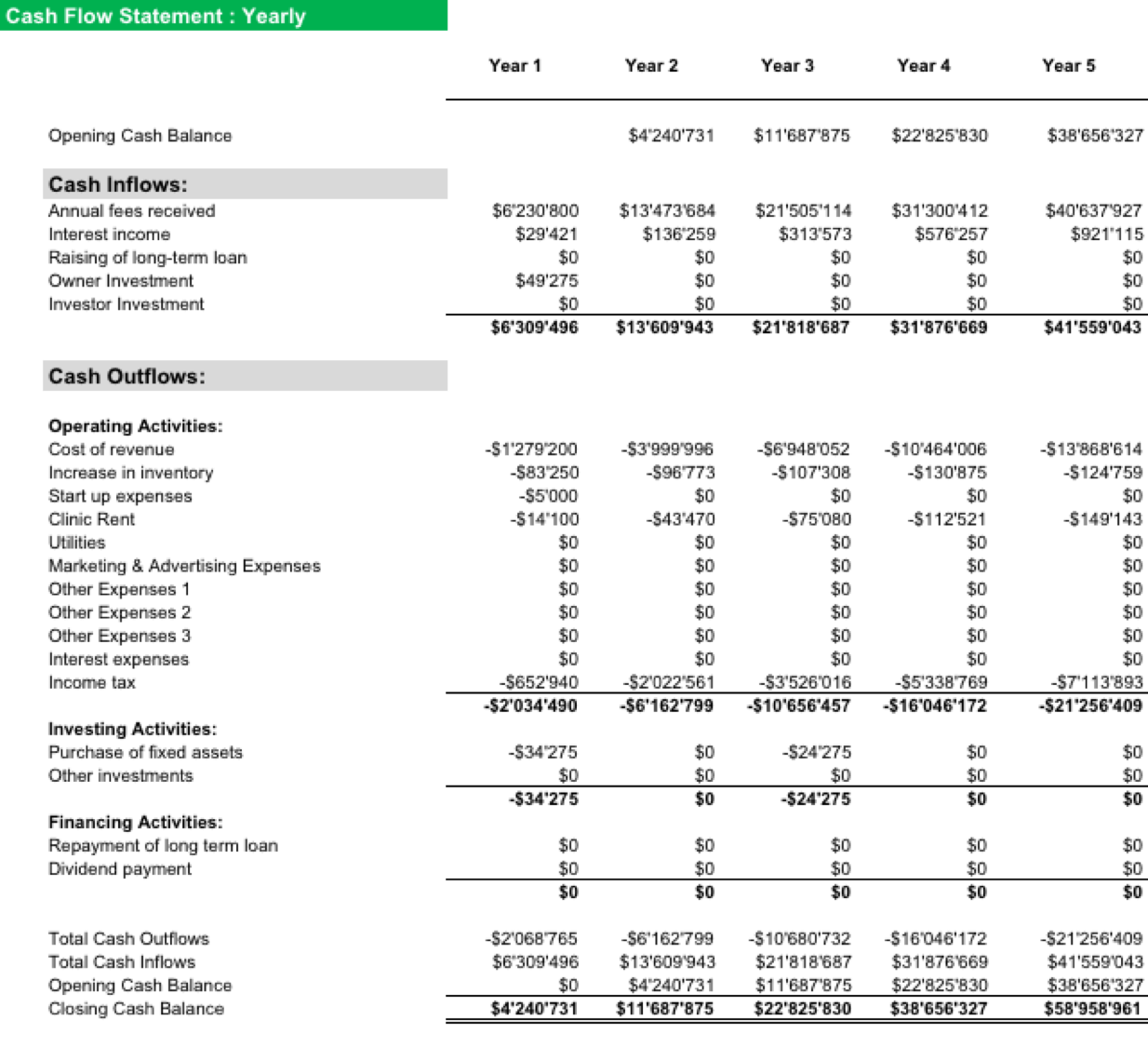

Common size cash flow statement example. Xyz is a conservative player: The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. All three of the primary financial statements — the income statement (or profit and loss statement), balance sheet and statement of cash flow — can be put through common size.

The cfs measures how well a. Common size cash flow statement example. 5.5 the statement of cash flows;

Revenue, cost of goods sold (cogs), selling & general administrative expenses (s&ga), taxes, and net income. Percentage of overall base figure = (line item / overall base figure) x 100 in this formula, the percentage of the base is the ratio of the line item compared to its total amount. Assume company abc has a line item for an operating cash flow, e.g., cash paid to suppliers, of $4 million and net operating cash flow of $20,000,000.

It grows organically and while smaller it is more profitable and more stable than abc. A common size financial statement displays items as a percentage of a common base figure, total sales revenue, for example. The income statement presents each line item as a percentage of total revenue.

The formula for a common size analysis is: The common size ratio is used as a tool for analyzing the company's financial statements, such as the statement of profit and loss, balance sheet, and cash flow. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

This type of financial statement allows for easy analysis between. Clear lake sporting goods, for example, might compare their financial performance on their income statement to a key competitor, charlie’s camping world. The common size ratio refers to any number on a business’ financial statements that is expressed as a percentage of a base.

Cash flow statement: This technique allows managers to identify strategies and investors to evaluate profitability and make informed investment decisions. This method uses one line item on the statement as a base against which to.

For example, cost of goods sold (line item) divided by revenue (base item). Common size analysis is applied to the balance sheet, income statement, and cash flow statement to assess components' relative significance within these statements. Common size analysis evaluates financial statements by expressing each line item as a percentage of a base amount for that period.

5.6 operating cash flow and free cash flow to the firm (fcff). The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. You can use it in financial analysis to compare the relative results of two or more companies.

This can help them understand the company’s business and earnings and predict its future cash flows. Abc is a risky player: Cash ranges between 5% and.

:max_bytes(150000):strip_icc()/IBMCashFlowCommonAnalysis-3e1a06ef5711419db8a7db93b9f56f35.jpg)

:max_bytes(150000):strip_icc()/IBMConsolidatedBalanceSheet-9940405a46b445cdafc87d9da1a41943.jpg)