Heartwarming Tips About Net Trial Balance

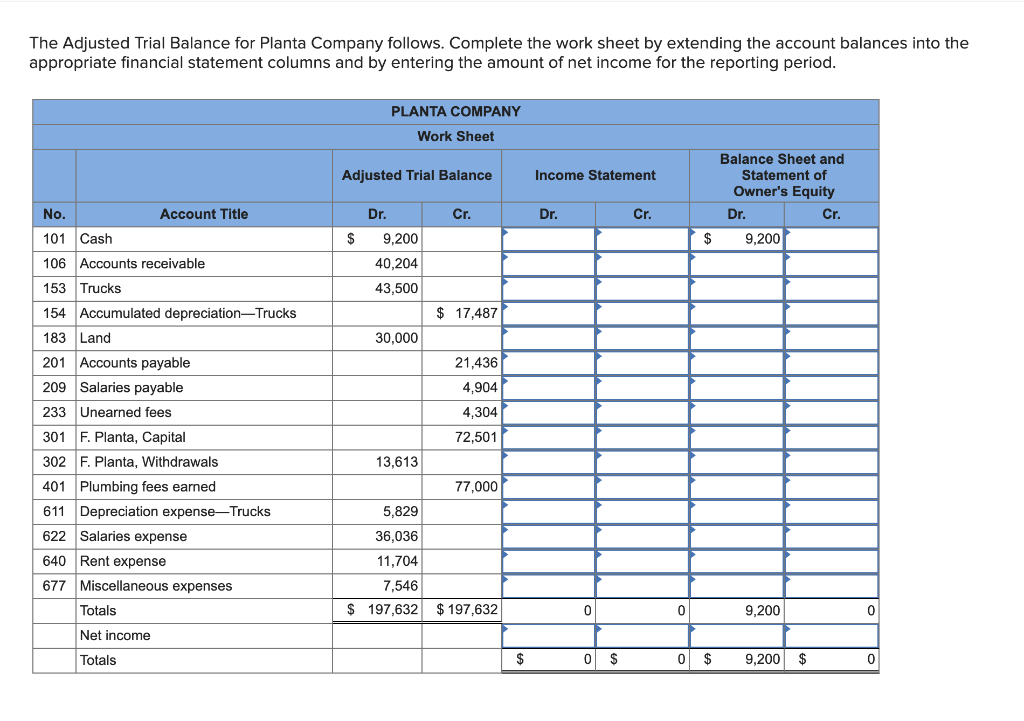

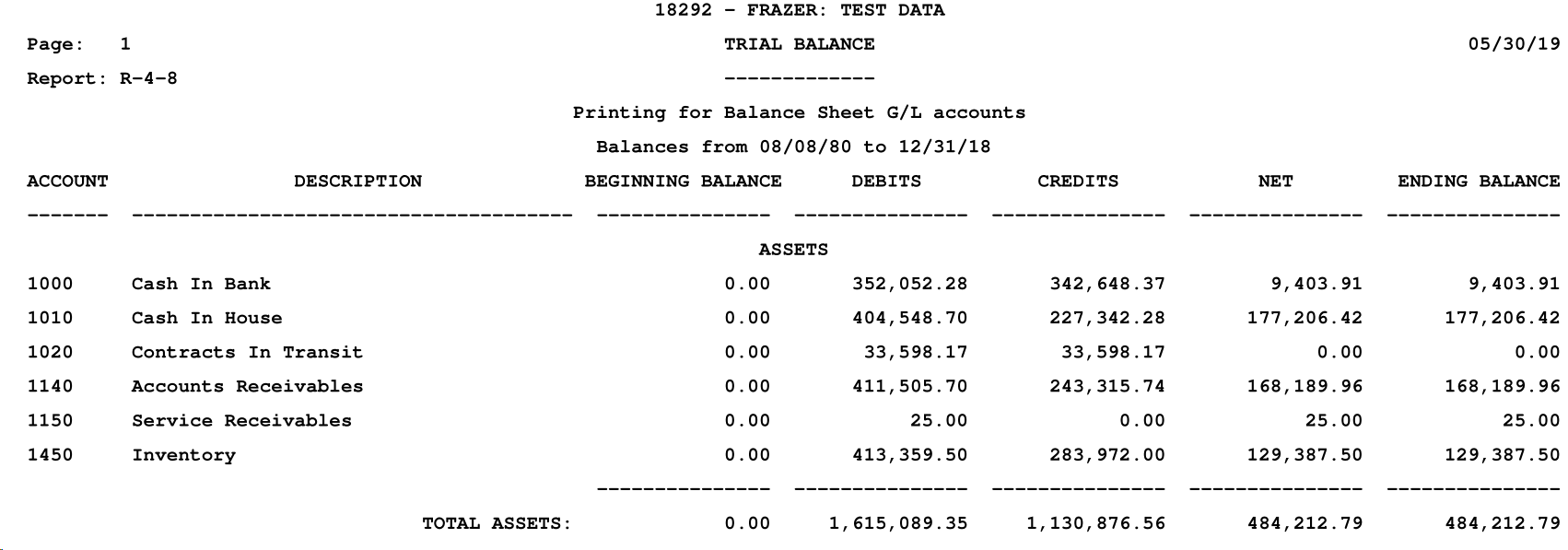

The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances for account totals in the general ledger are equal.

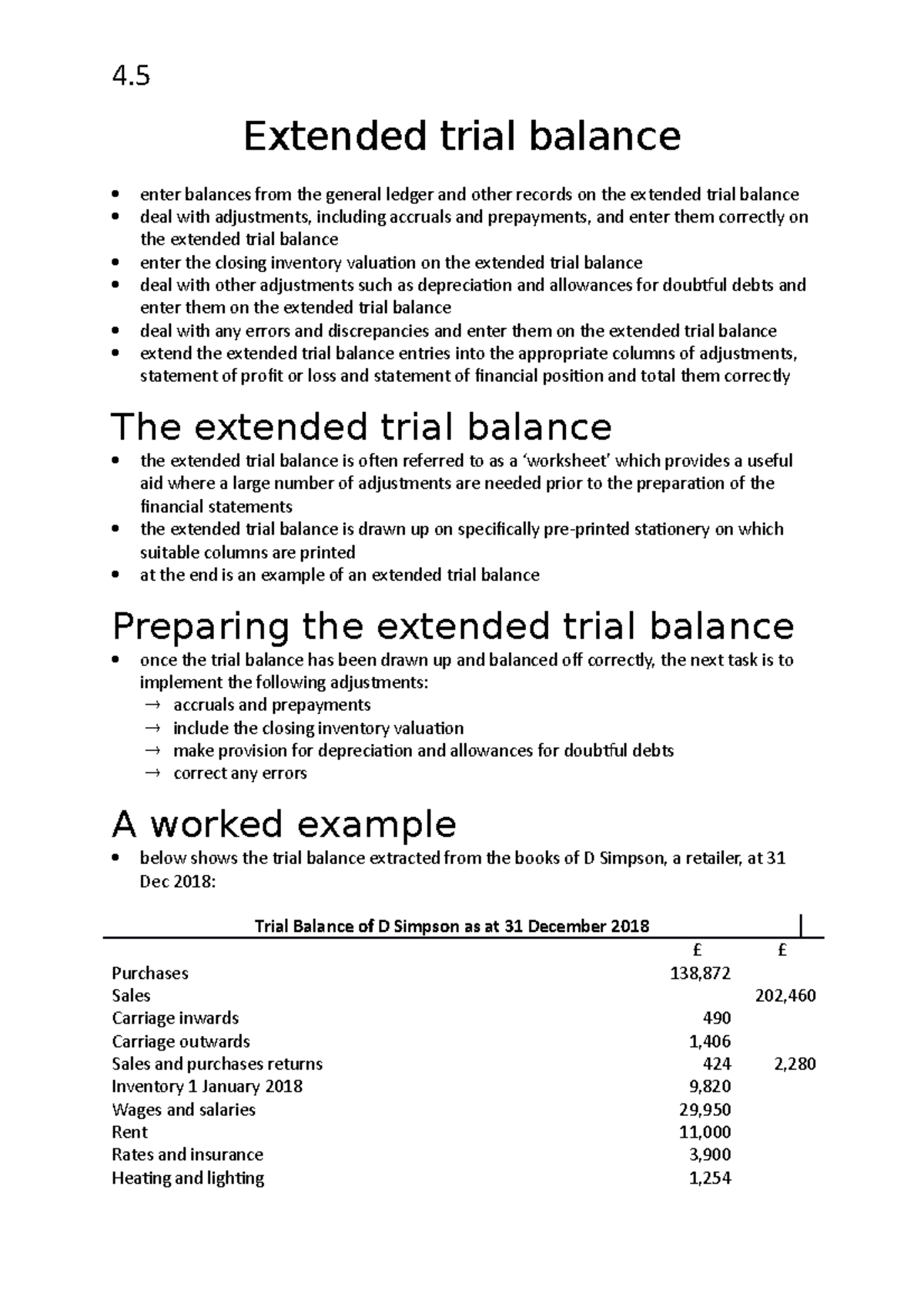

Net trial balance. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. The method 1 and 2 are described below:

The trial balance is an accounting report that lists the ending balance in each general ledger account. The general ledger accounts ' debit and credit column sums must equal one another to. In this method, the process of totalling the ledger accounts on both sides is followed by balancing the accounts.

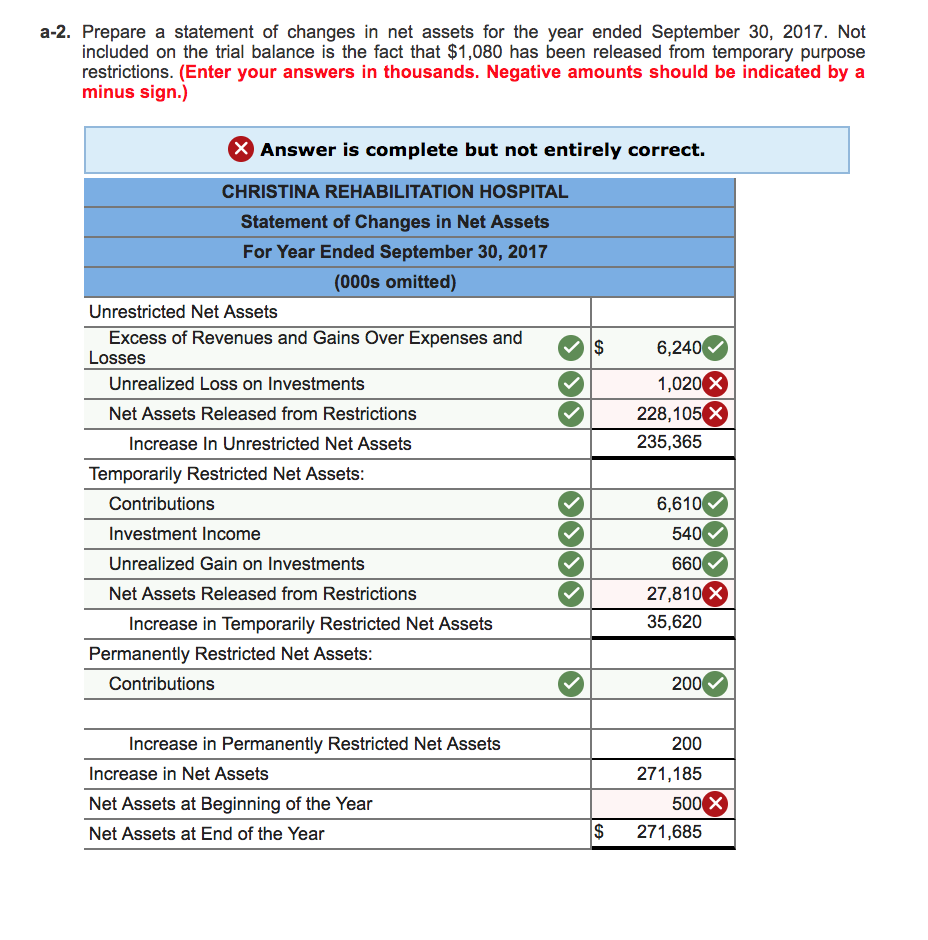

Trial balance vs balance sheet. 16, 2024 updated 7:25 p.m. To derive net income, first you adjust the balances for things such as deferred income.

One can also take a total of assets, or if only trial balance is available, then we need to add assets one by one and then have a grand total of assets. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. Note that for this step, we are considering our trial balance to be unadjusted.

Total or gross trial balance; How do you prepare a trial balance? Beginning retained earnings carry over from the previous period’s ending retained earnings balance.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. If the debits do not equal the credits, then. Net income information is taken from the income statement, and dividends information is taken from the adjusted trial balance as follows.

How does a trial balance work? A new york judge on friday handed donald j. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,.

Total or gross trial balance: A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Net income information is taken from the income statement, and dividends information is taken from the adjusted trial balance as follows.

The trial balance includes balance sheet and income statement accounts. The totals in your general ledger at the end of an accounting period are the unadjusted trial balance. Trump a crushing defeat in his civil fraud case, finding the former president liable for conspiring to manipulate.

What is a trial balance, and how does a trial balance work? Here are steps to make a balance sheet from trial balance. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new.