Fabulous Info About Monthly P&l Statement

What we’re referring to is the profit and loss statement (p&l), which gives you insight into how well your business is doing.

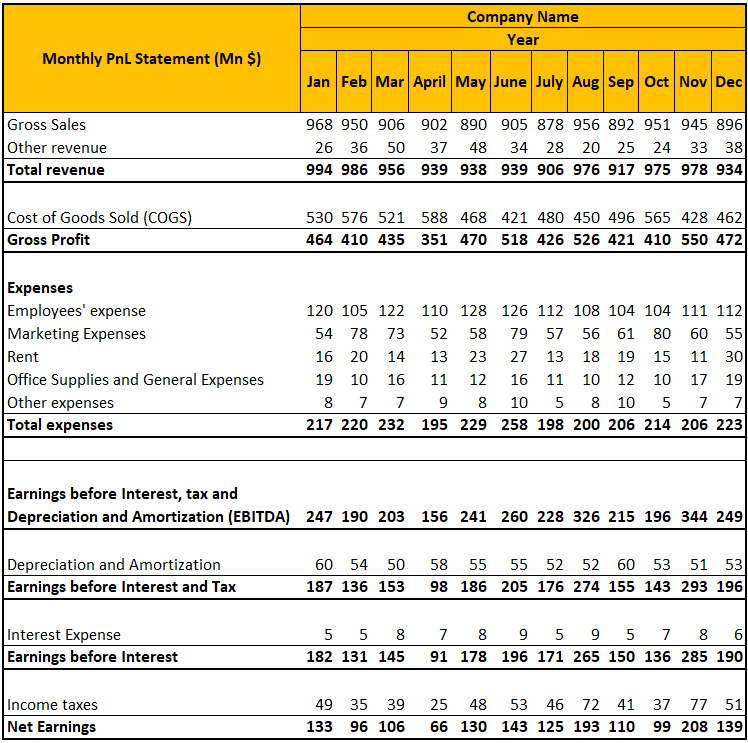

Monthly p&l statement. A p&l statement compares company revenue against expenses to determine the net income of the business. If you are using accounting software, you can set the system to generate a p&l statement automatically on a monthly basis. According to investopedia, “a profit and loss statement is a financial statement that summarizes the revenues, costs and expenses incurred during a specific period of time, usually a fiscal quarter or year.”

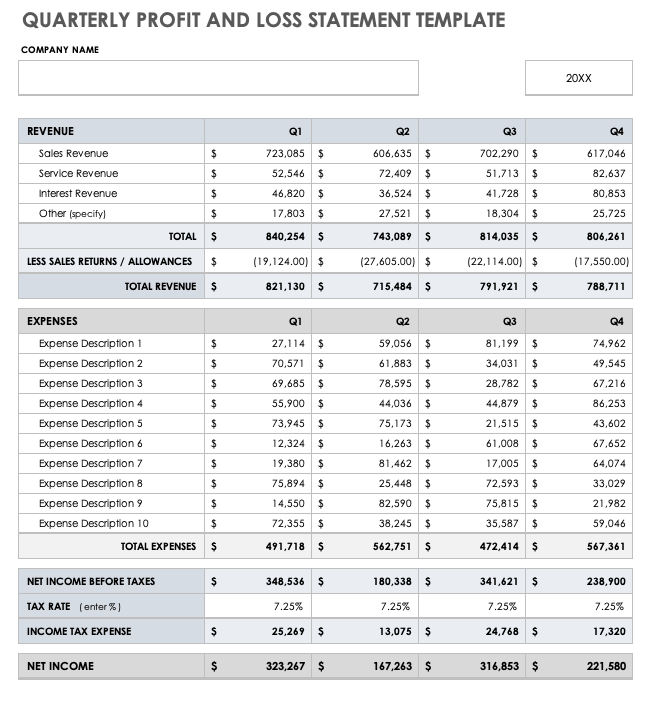

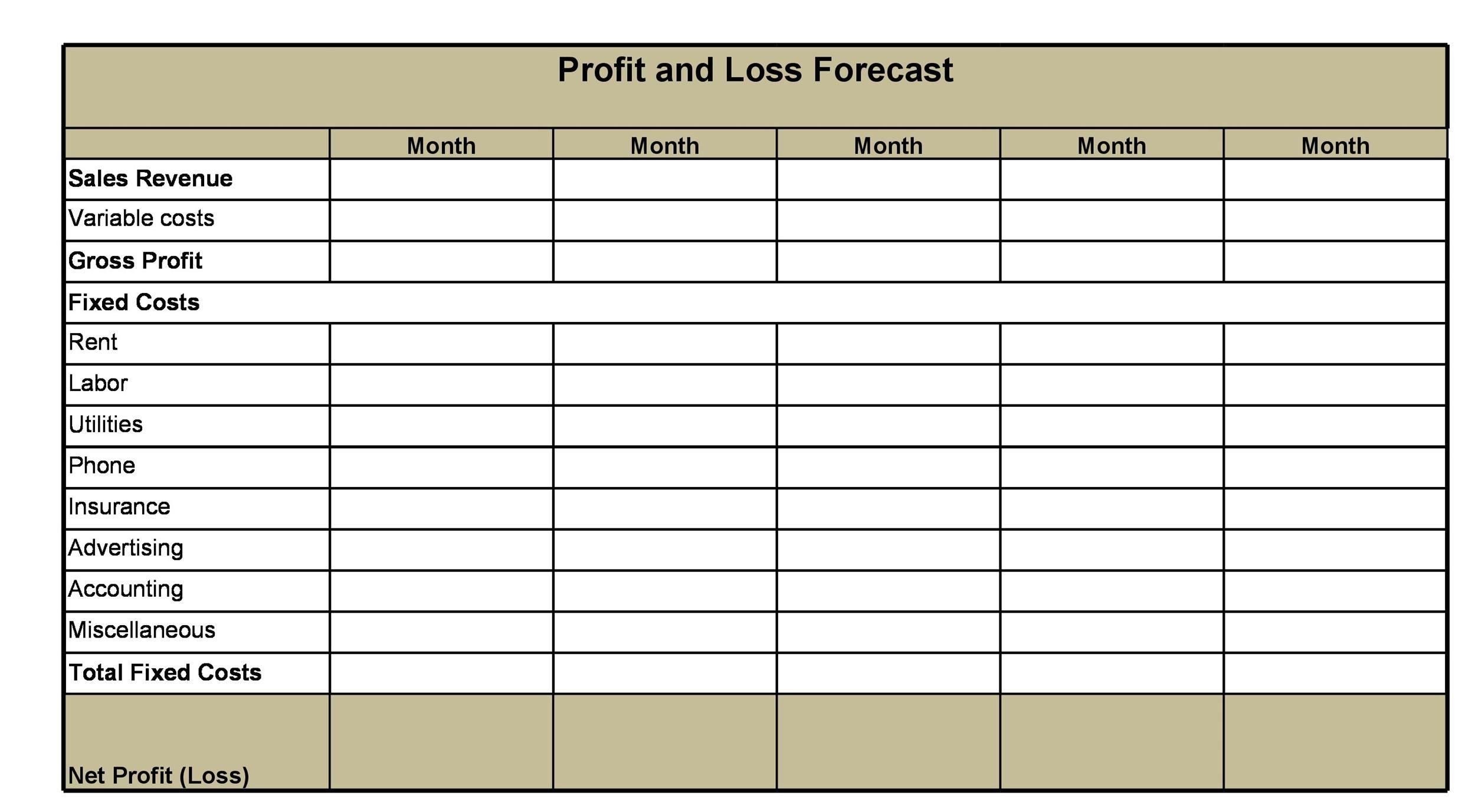

The time allocated for the p&l statement (weekly, monthly, quarterly, annually, etc.). It shows your revenue, minus expenses and losses. A p&l statement provides information about whether a company can.

Or how badly, for that matter. Quickbooks our range of simple, smart accounting software solutions can help you take your business to the next level. If revenues are higher than total business expenses, you’re making a profit.

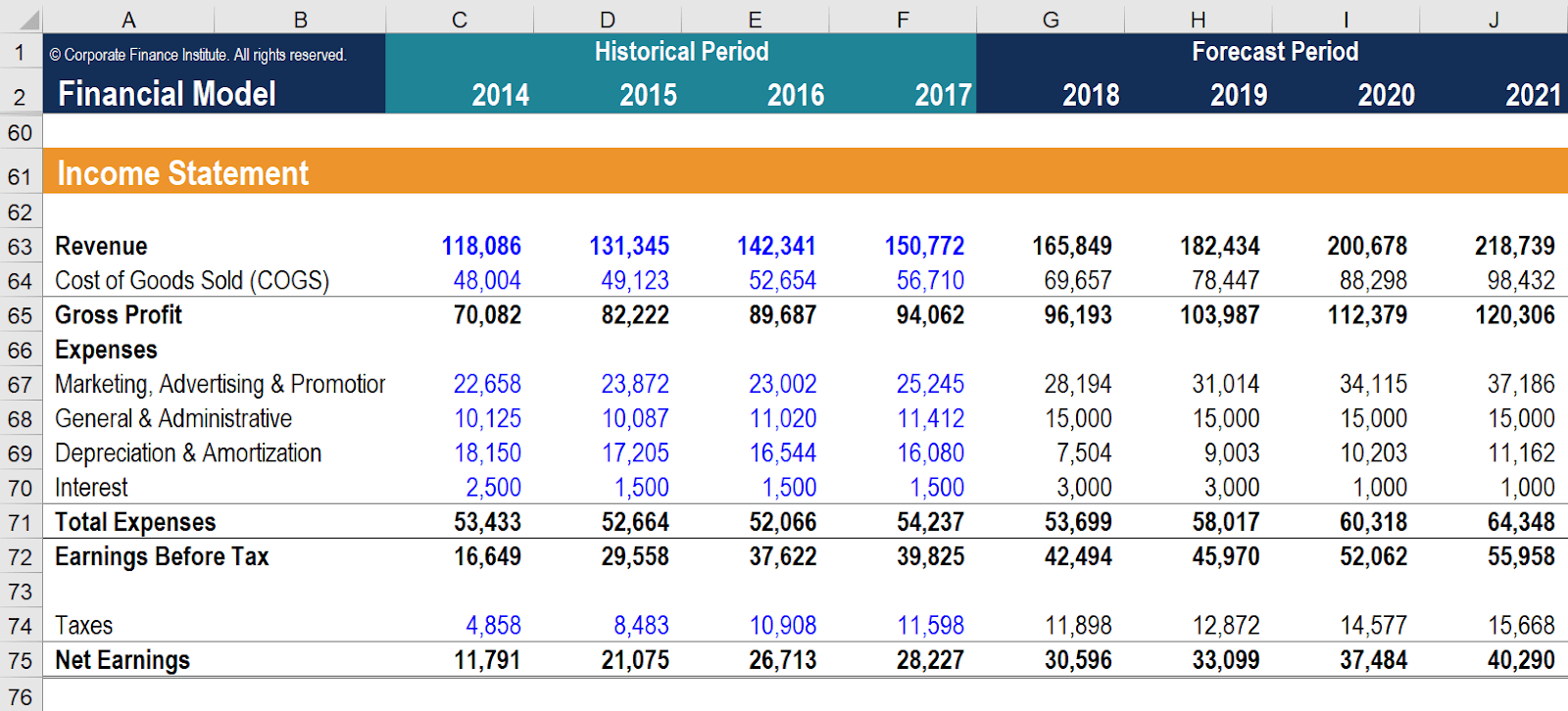

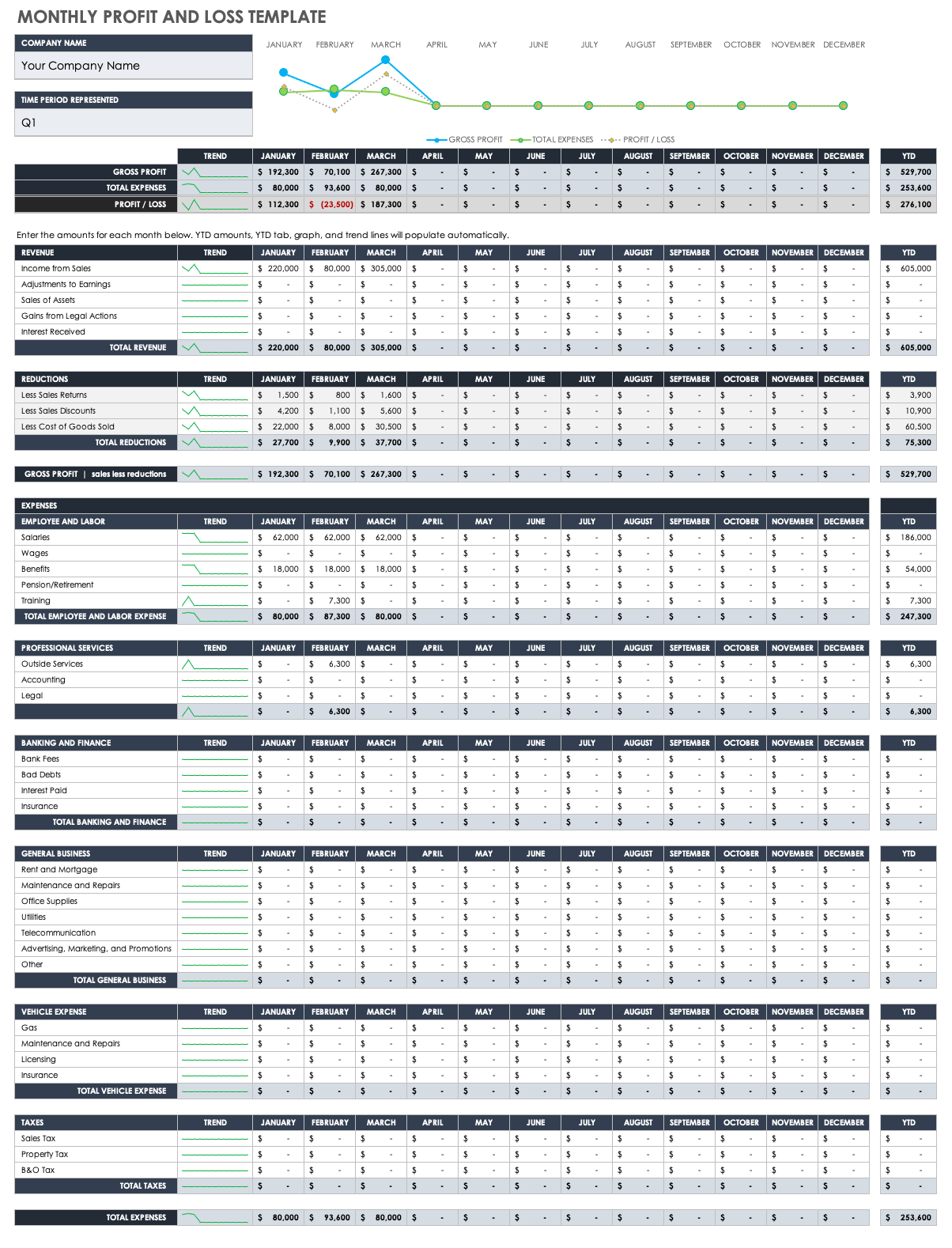

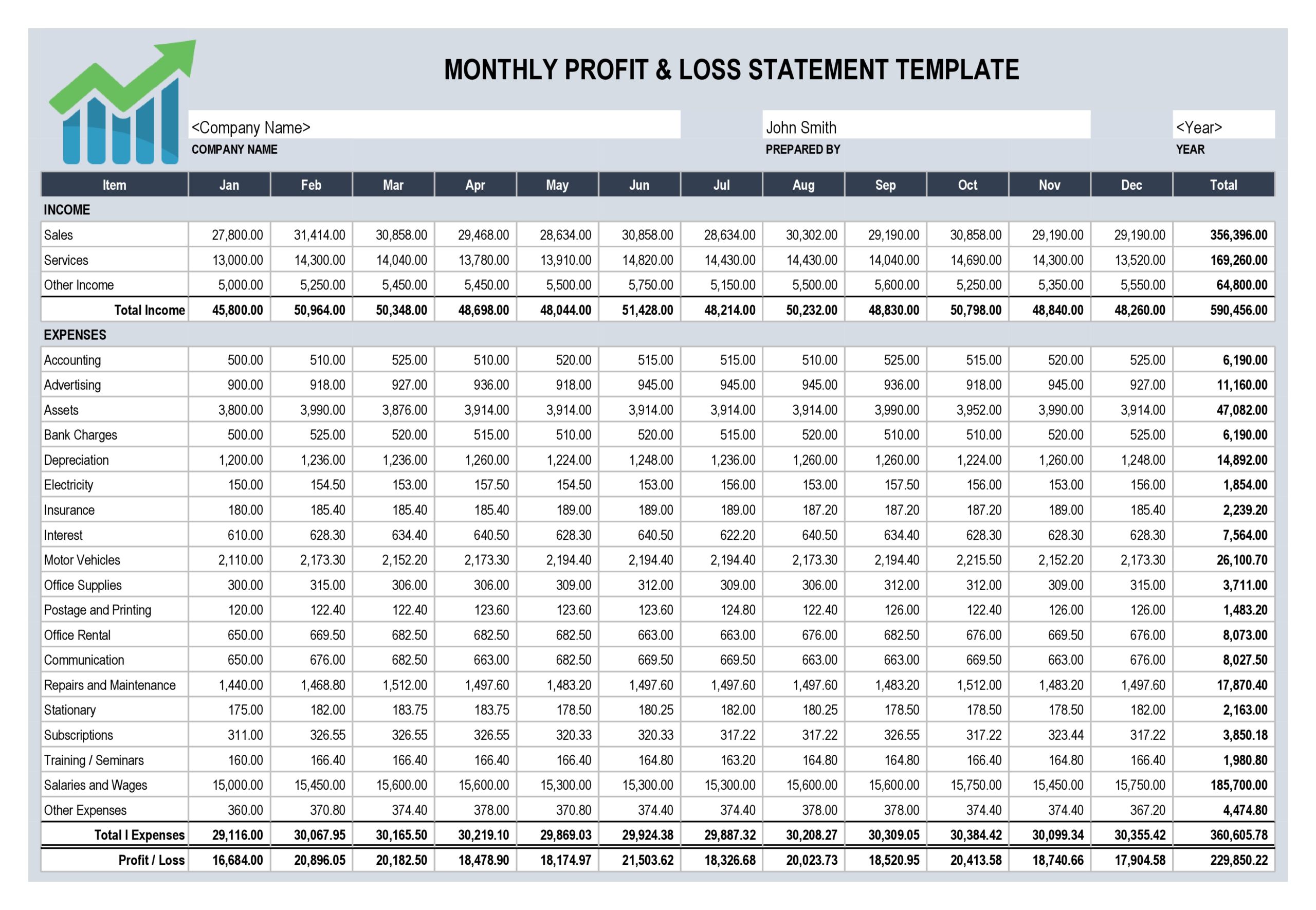

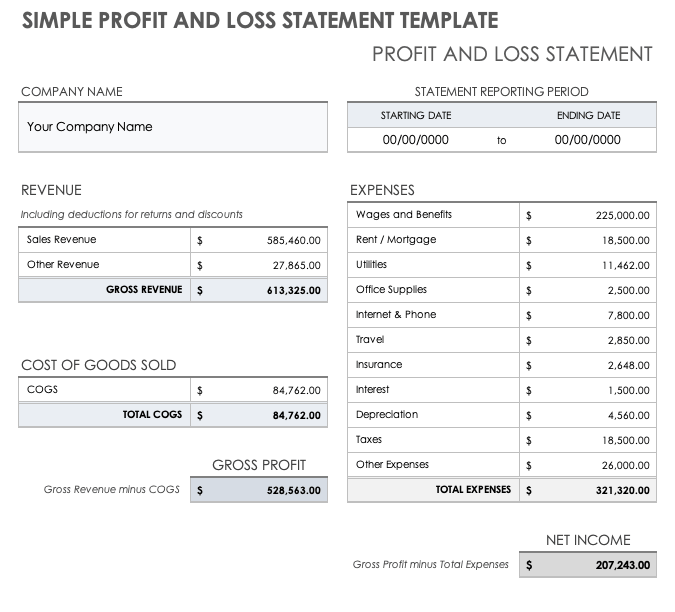

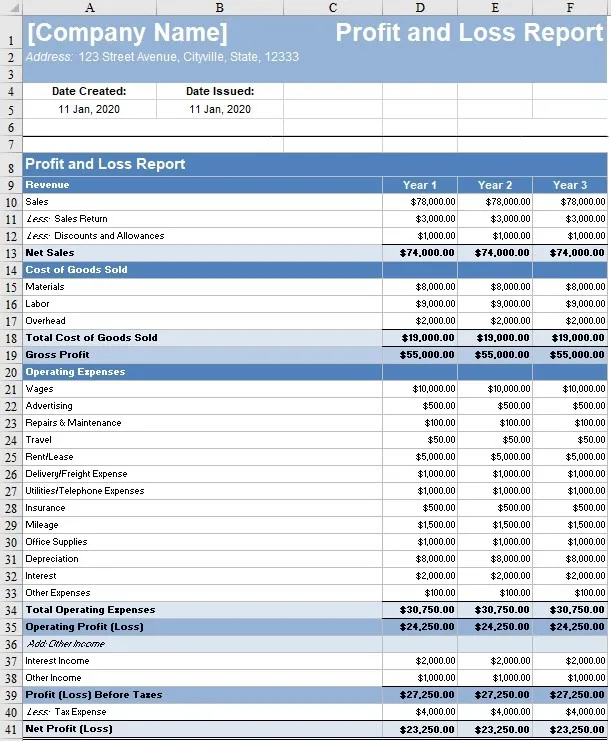

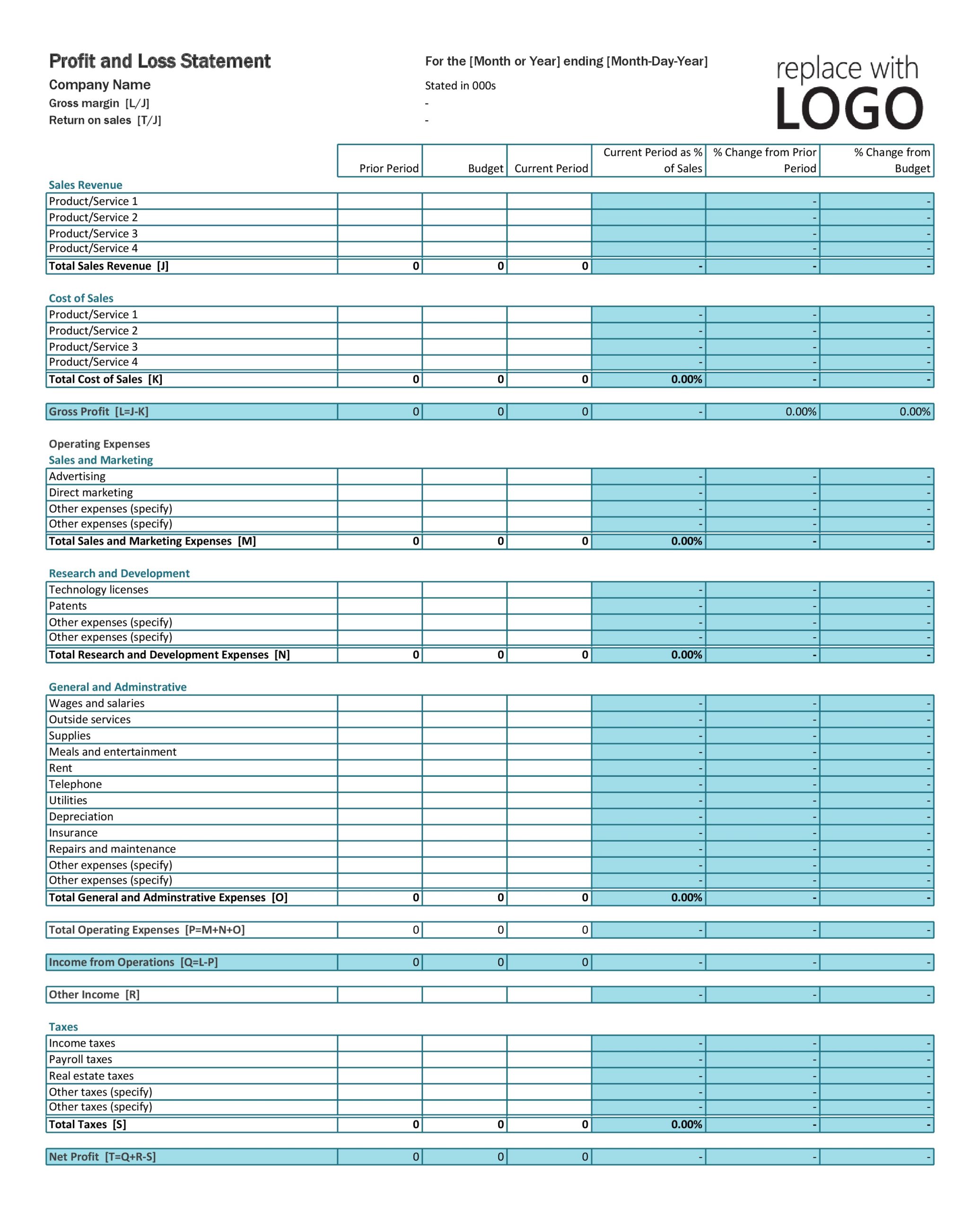

Revenue (or sales) cost of goods sold (or cost of sales) selling, general & administrative (sg&a) expenses marketing and advertising technology /research & development What is a monthly p&l statement? Below is a screenshot of the p&l statement template:

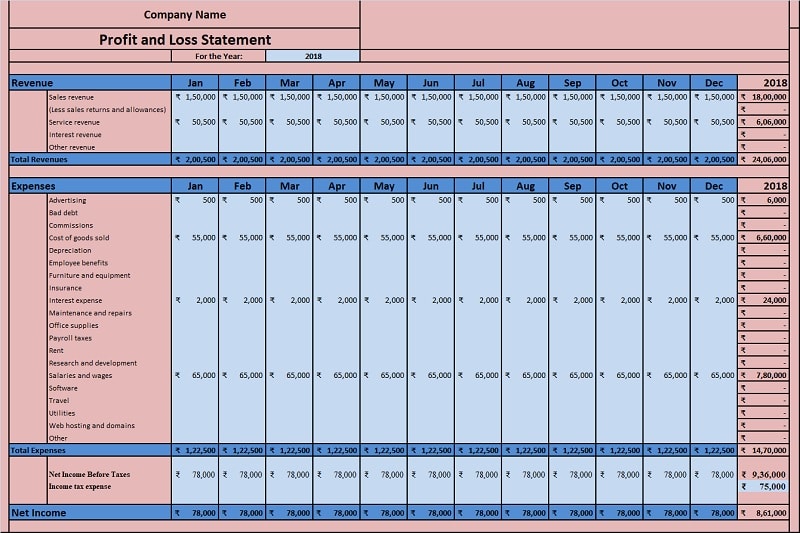

(such as sales, dividends, interest, etc.) together with the corresponding dollar amounts. Read more is one of. A monthly profit and loss (p&l) statement is a financial report that summarizes the revenues, costs, and expenses incurred during a specific month.

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The main categories that can be found on the p&l include: The profit and loss statement or the income statement income statementthe income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity over time based on user requirements.

Use this simple p&l statement template to calculate your organization’s total revenue compared to your costs and expenses. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. It provides a clear picture of a business’s financial performance, helping business owners and managers understand if the business is operating at a profit or loss.

This fully customizable template prompts you to note your statement reporting period date range, enter revenues (including any deductions for returns and discounts) and cost of goods sold (cogs), to determine. Visit site the basic formula for a profit and loss statement is: The result is either your final profit (if things went well) or loss.

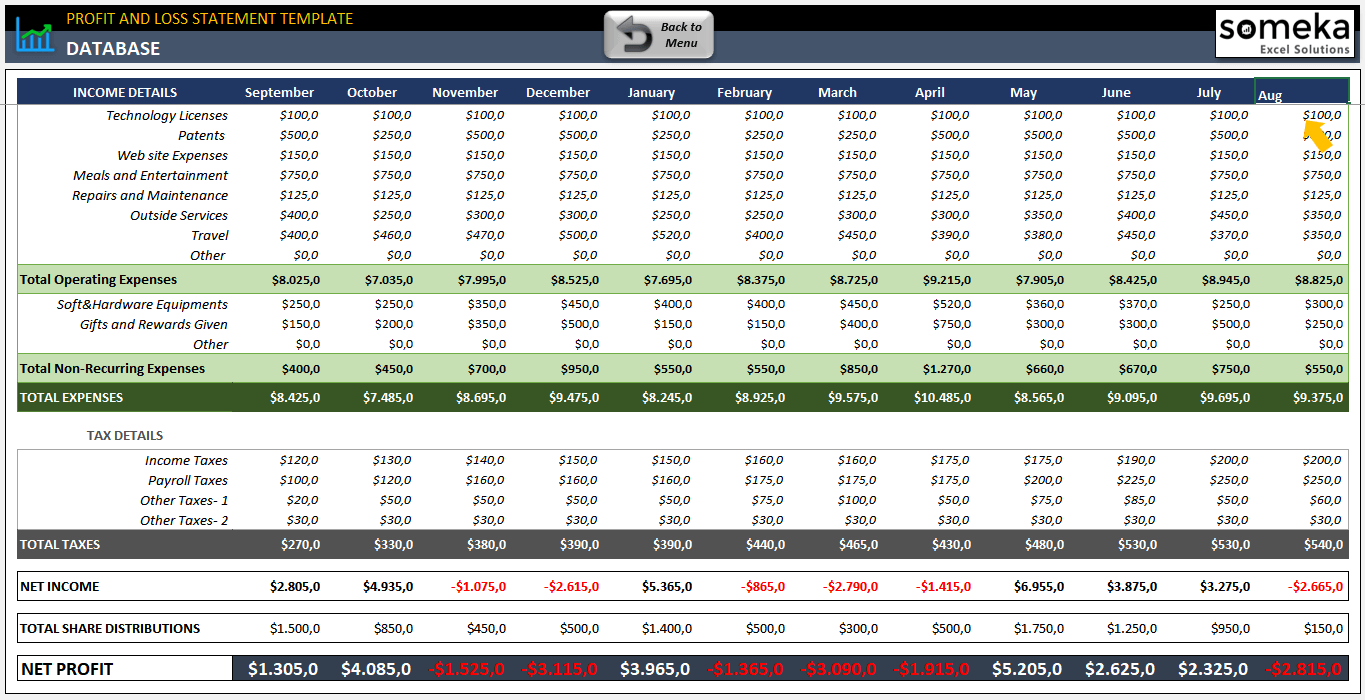

Once you've chosen your plan, there's no hidden fees or charges. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Start generating your income statement automatically

The p&l statement is one of three. This includes specified gross monthly income in detail. Updating your profit and loss statement helps you check in on the health of your business.

![Restaurant Profit and Loss Complete Guide [Free template]](https://sharpsheets.io/wp-content/uploads/2022/12/Screenshot-2022-12-16-at-17.10.04.png)