Favorite Tips About Increase In Trade Receivables Cash Flow

For example, an increase in the levels of inventory and receivables will not impact profit before tax but will have had an adverse impact on the cash flow of the business.

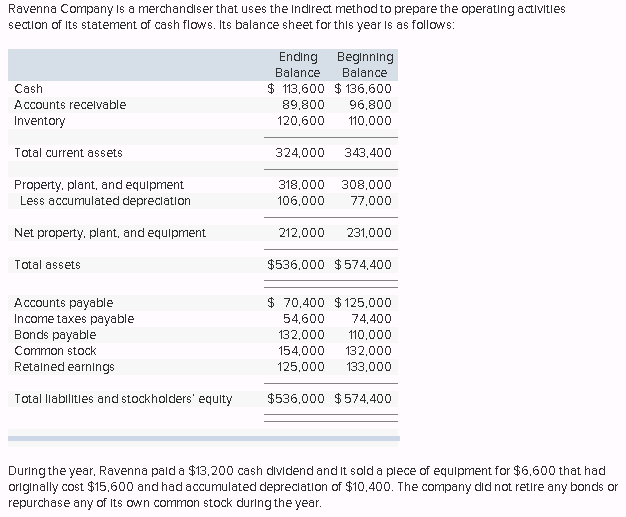

Increase in trade receivables cash flow. Understanding how trade receivables work is key to keeping your business running smooth. A decrease in accounts payable occurs when a business makes a payment to its creditors for its outstanding balance. Conversely, a negative number indicates a cash flow increase of the same amount.

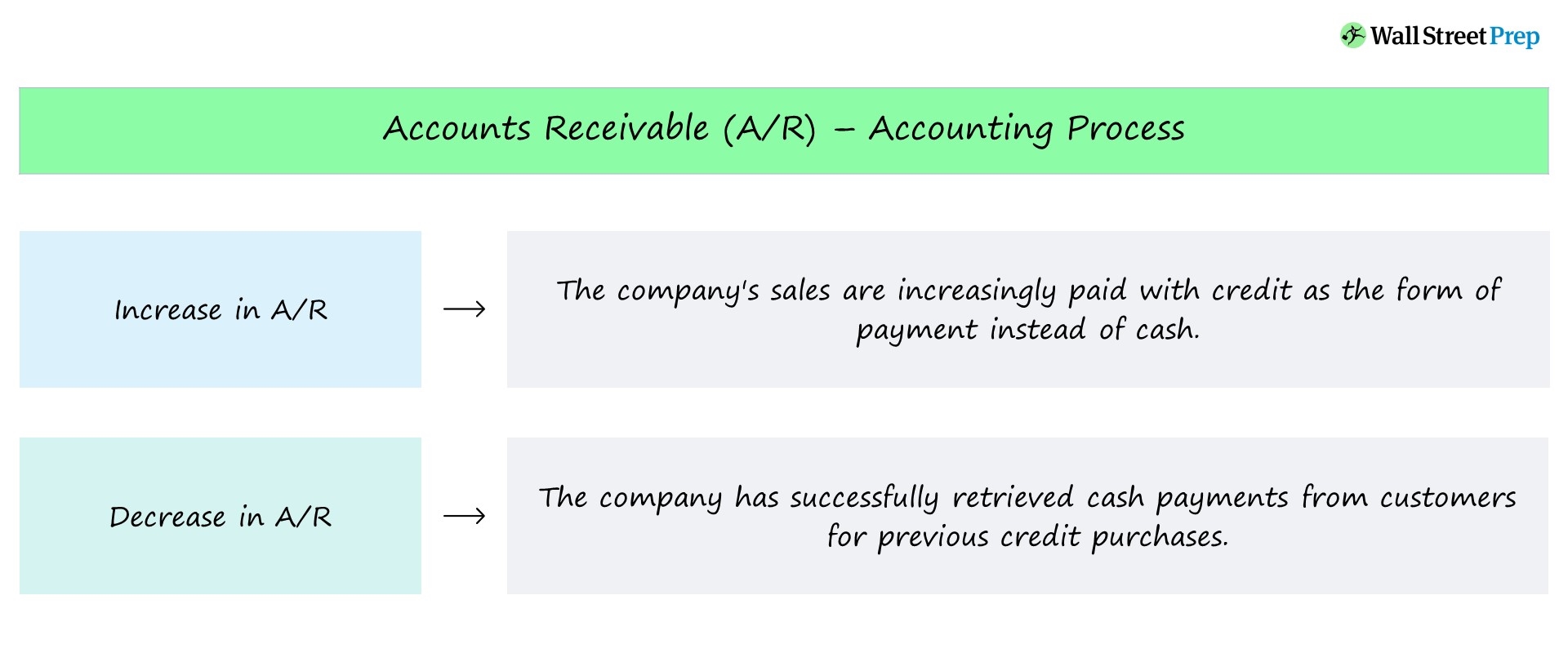

Trade receivables arise when a business makes sales or provides a service on credit. Decrease in accounts receivable (a/r) → the company has successfully retrieved cash payments for credit purchases. Remember, good trade receivable habits can boost cash flow and cut down bad debt risk.

Interest paid (12 000) tax paid (40 000) net cash flow from operations. Use clear credit terms and stay on top of invoices to manage money well. How does accounts payable decrease?

Decrease in accounts receivable => add the decreased amount to. That means that company abc expects to receive $200m that it is owed by customers. Robit estimates that, in 2024, net sales will increase and comparable ebit profitability in euros will improve compared to 2023.

Students of financial reporting papers will need to develop a sound understanding of the primary statement known as the ‘statement of cash flows’. Most b2b businesses offer goods and services to customers on credit. This entails selling your outstanding ar to a “factor,” which pays your company a percentage of the total value of.

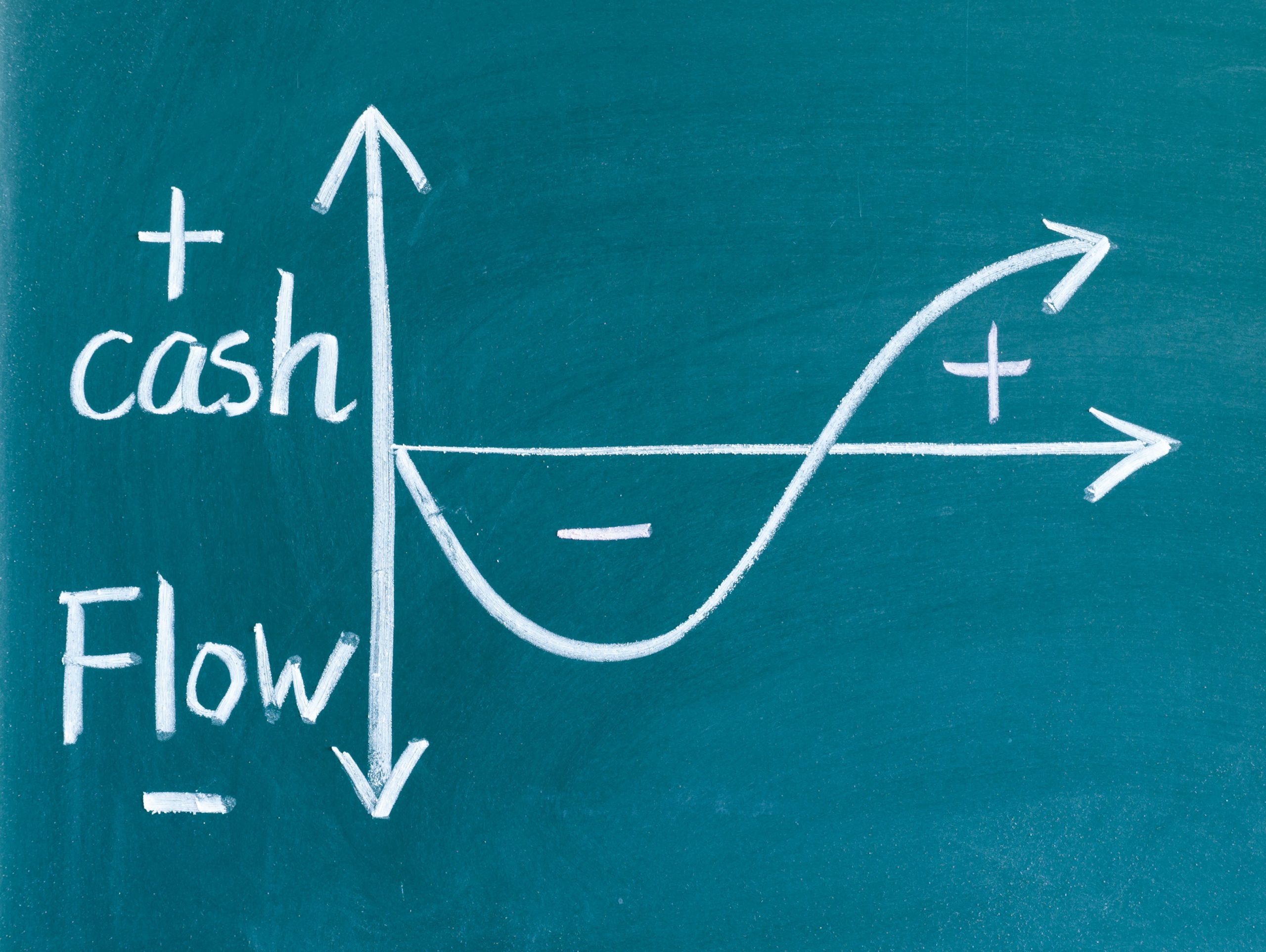

Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. When the indirect method of presenting the statement of cash flows is used, the net profit or loss for the period is adjusted for the following items: To reiterate, an increase in receivables represents a reduction in cash on the cash flow statement, and a decrease in it reflects an increase in cash.

What if the following year (2006), accounts receivable declined to a balance of $150m? Encouraging prompt payment/settlement sometimes, the entity may give a discount if a customer pays an invoice early. For example, if ben sells goods on credit to candar, candar will take delivery of the goods and receive an invoice from ben.

It is popularly called trade receivables and it is a current asset. The accounts receivable aging schedule can help you spot these problems in accounts receivable, and provide the necessary answers early enough to protect your business from cash flow problems. It’s not unusual for companies (especially those in cyclical markets) to switch from positive cash flow to negative cash flow.

Fundamental analysis tools 10 ways to improve cash flow by dan moskowitz updated september 10, 2022 reviewed by charlene rhinehart fact checked by kirsten rohrs schmitt if you own a business. This article is relevant for acca f7 and p2 plus aat and cima papers. Days sales outstanding (dso) the standard modeling convention is to tie ar to revenue to forecast accounts receivable, given how they are closely associated.

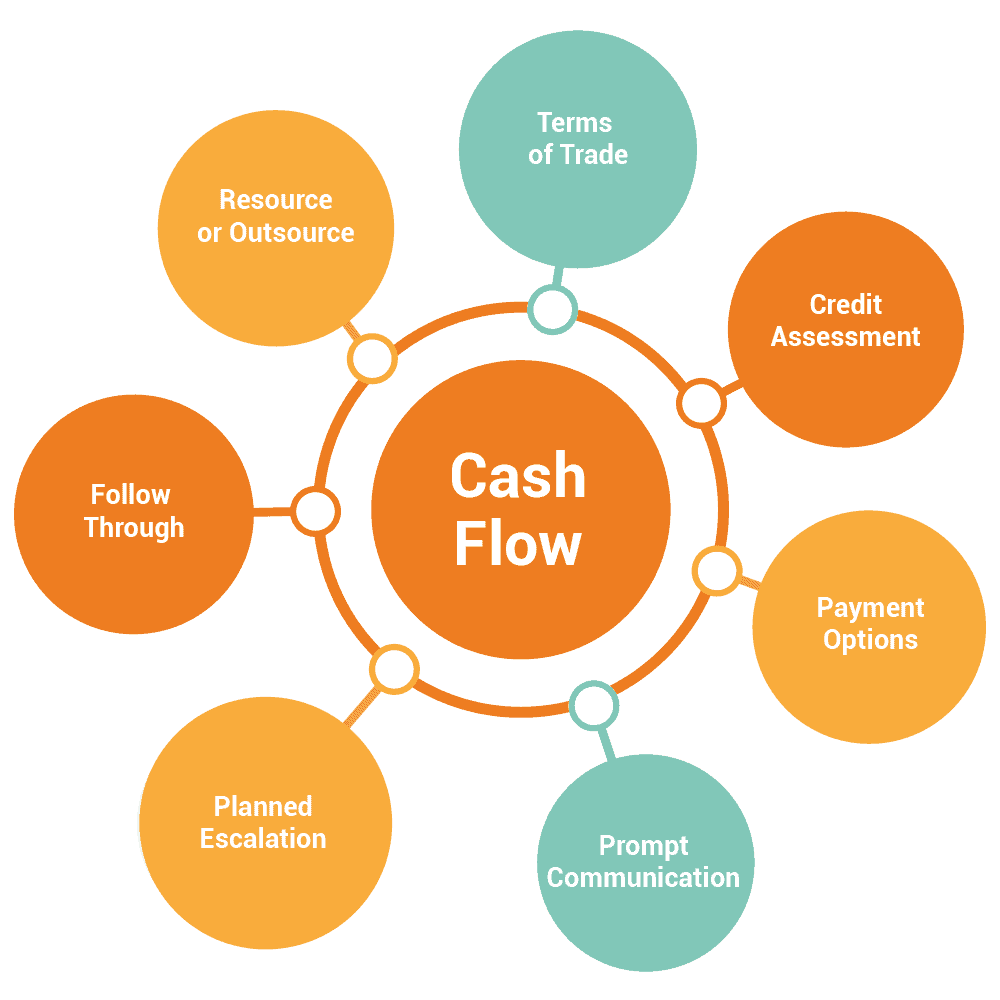

Then we’ll discuss why businesses need a cfs, how changes in ar affect the cfs, and how to calculate cash flow. Another fast source of cash to consider is ar factoring, also called invoice factoring. Therefore, in the reconciliation process, the increases in inventory and trade receivables are deducted from profit before tax.

/https:%2F%2Fblogs-images.forbes.com%2Fallbusiness%2Ffiles%2F2019%2F02%2Fcash-low-1200x840.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/GettyImages-490024232-ce77fc165c6147d2a4a6fa1c28824297.jpg)