Ideal Info About Financial Statements Are Prepared By

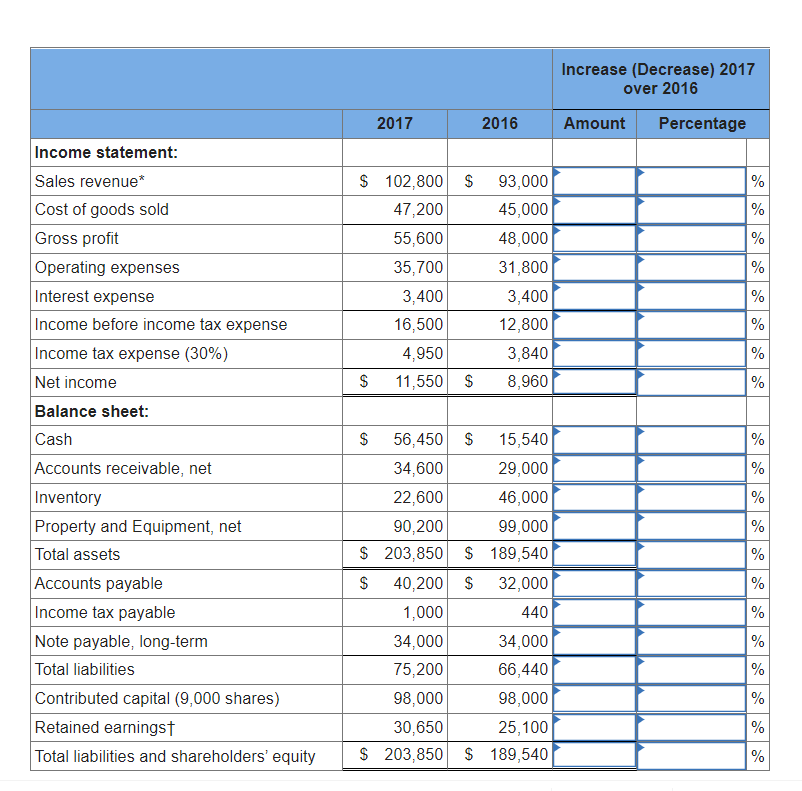

Each of the financial statements provides important financial information for both internal and external stakeholders of a company.

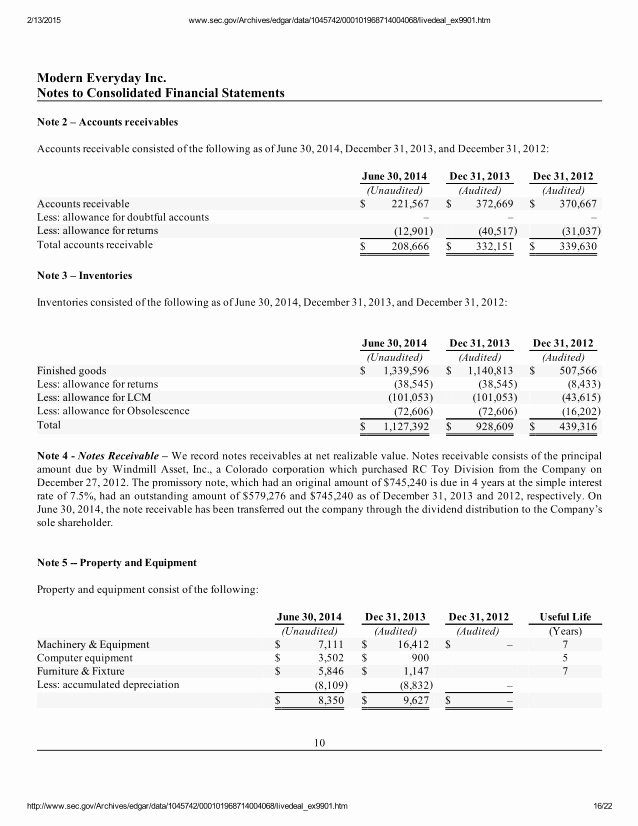

Financial statements are prepared by. $704 million in dividends and. The four general purpose financial statements include:. Let us discuss these statements in detail now.

We will discuss the financial statement form in the next section of the course. While the average deal size increased 14 percent, owing to a handful of large deals, the number of companies changing hands fell 27 percent from a year earlier. There are four main financial statements.

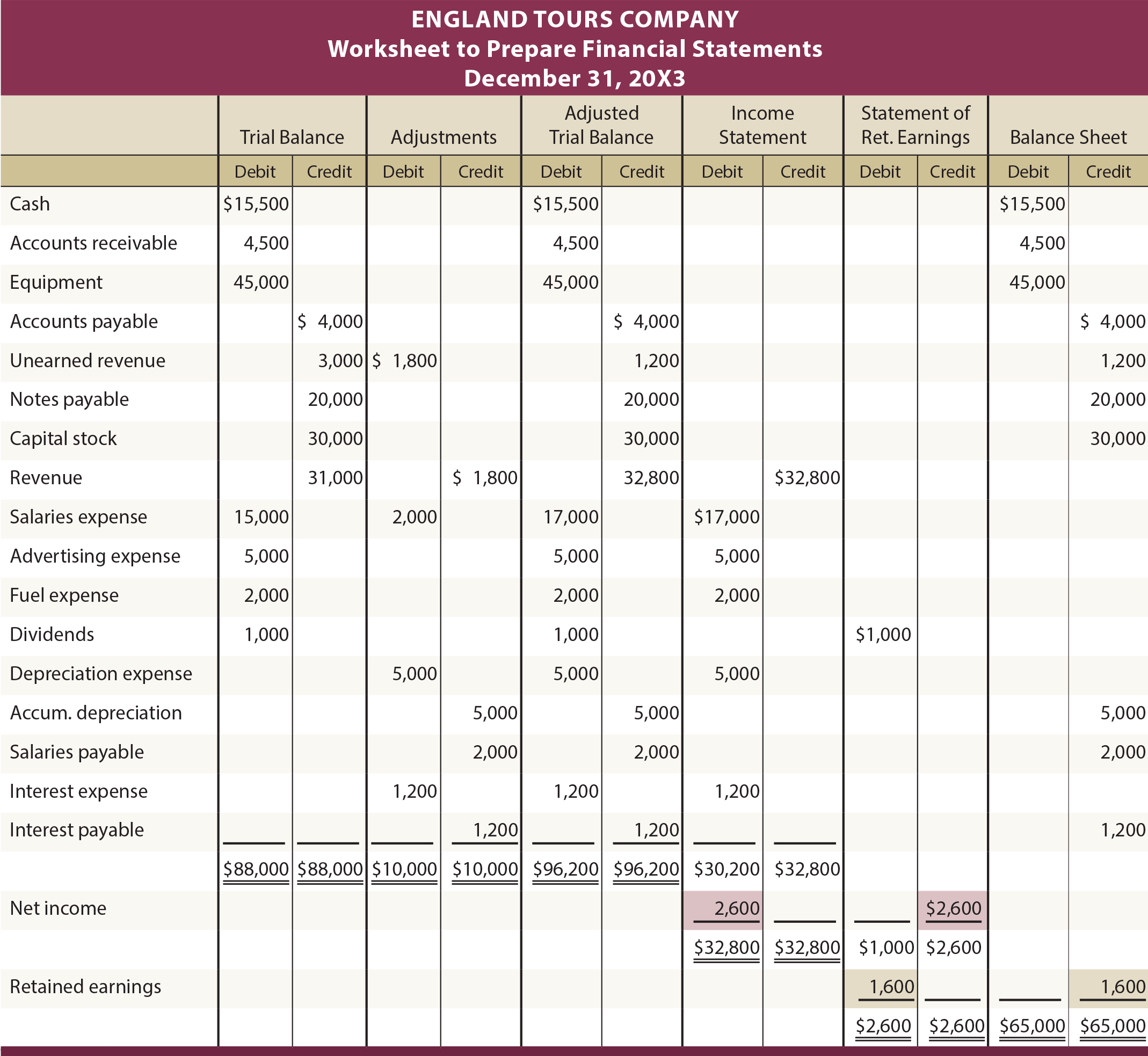

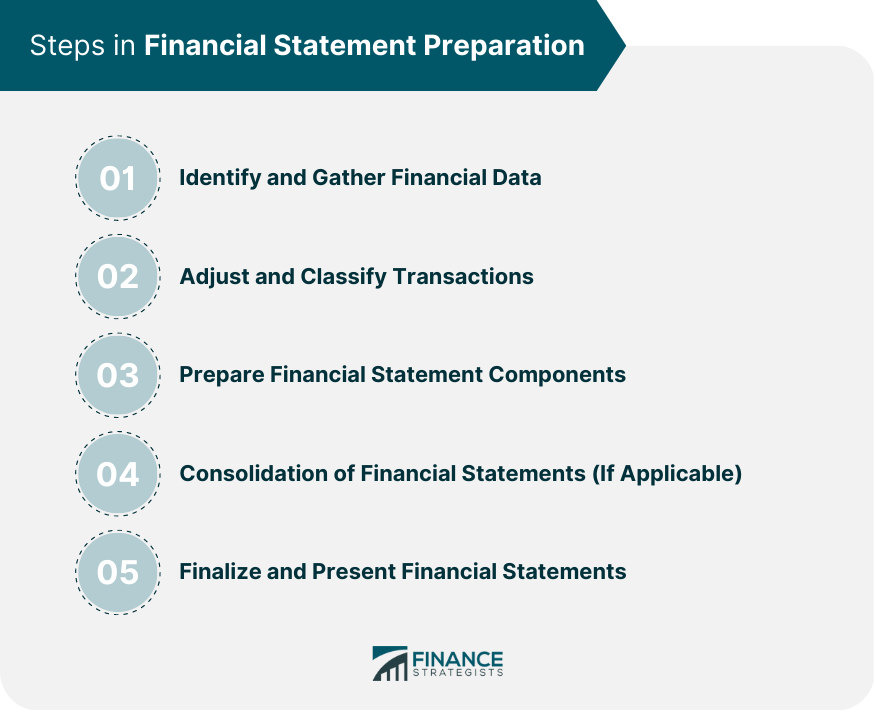

Financial statements are prepared by transferring the account balances on the adjusted trial balance to a set of financial statement templates. Many private companies with numerous shareholders often obtain audited statements and if your business is of. The balance sheet is a financial statement that provides a snapshot of the assets, liabilities, and shareholders’ equity.

Now, let us look at the types of financial statements below: Tdoc earnings call for the period ending december 31, 2023. Finance is about the pricing and allocation of money and risk throughout the economy.

Keeping financial statements updated on a regular clip helps businesses develop, prepare for the future, and better identify their capital needs. All publically held companies are required to have audited statements by the securities and exchange commission. The accountant prepares financial statements separately from a tax return (e.g., the accountant might prepare a tax return that includes financial statements and then—at the client’s request—creates financial statements separately from the return)

External stakeholders use it to understand the overall health of an. Ias 27 (as amended in 2011) outlines the accounting and disclosure requirements for 'separate financial statements', which are financial statements prepared by a parent, or an investor in a joint venture or associate, where those investments are accounted for either at cost or in accordance with ias 39/ifrs 9. But usually, it comes with the balance sheet.

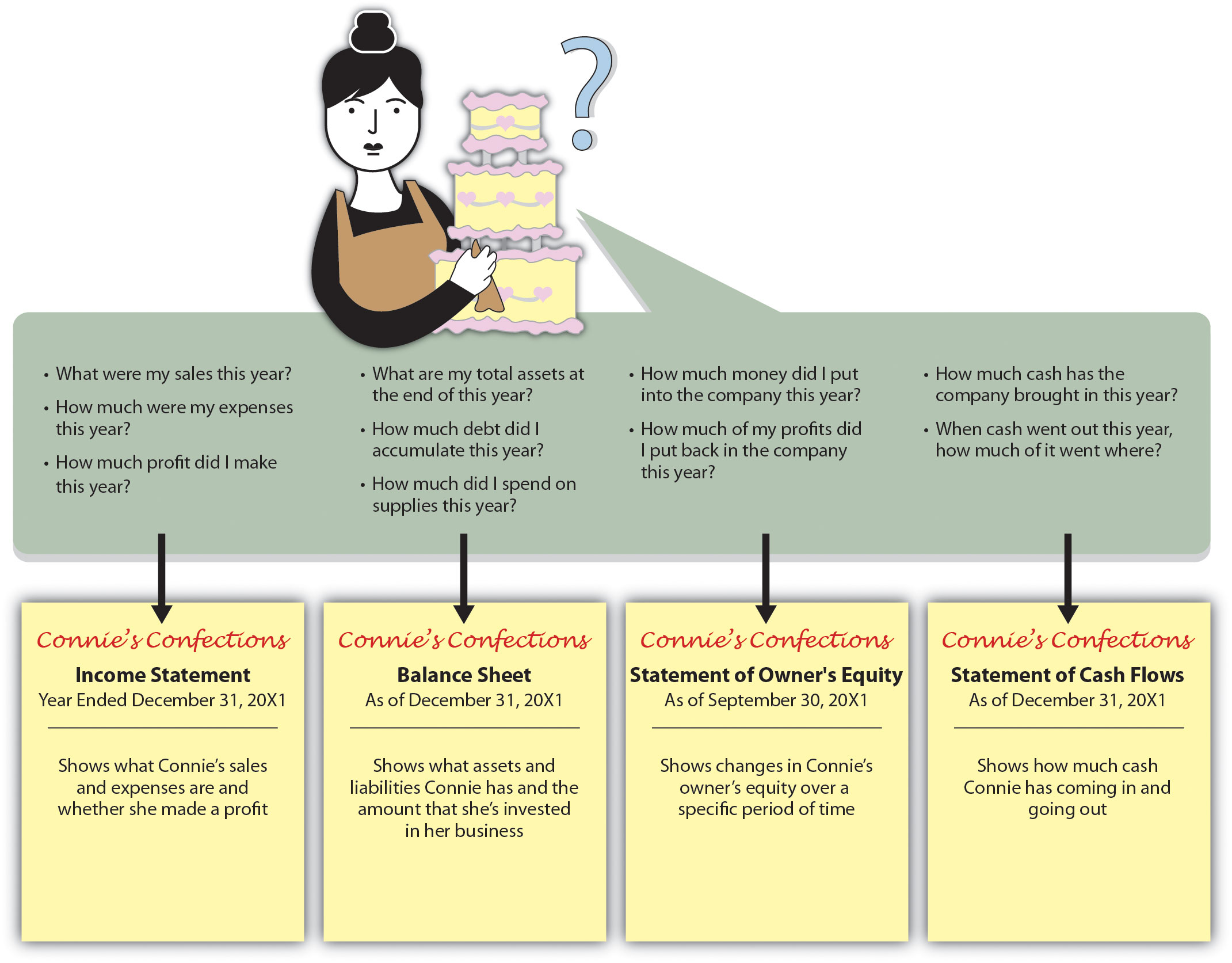

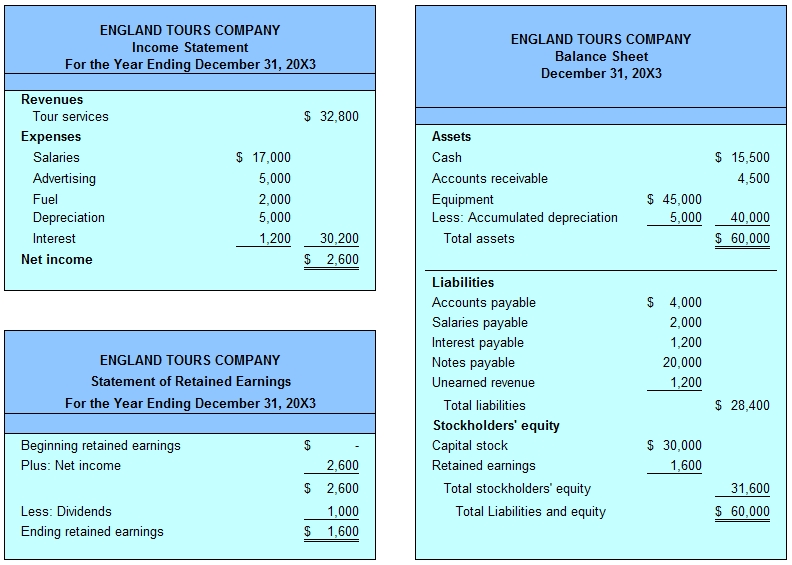

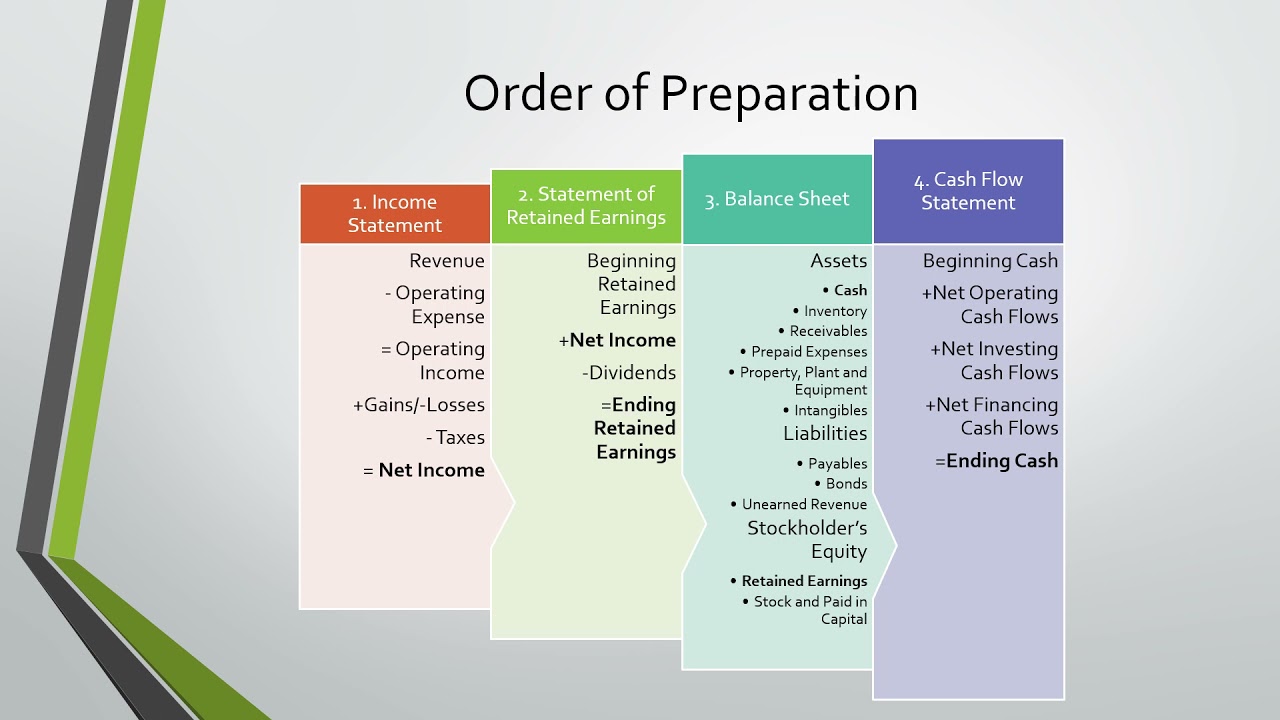

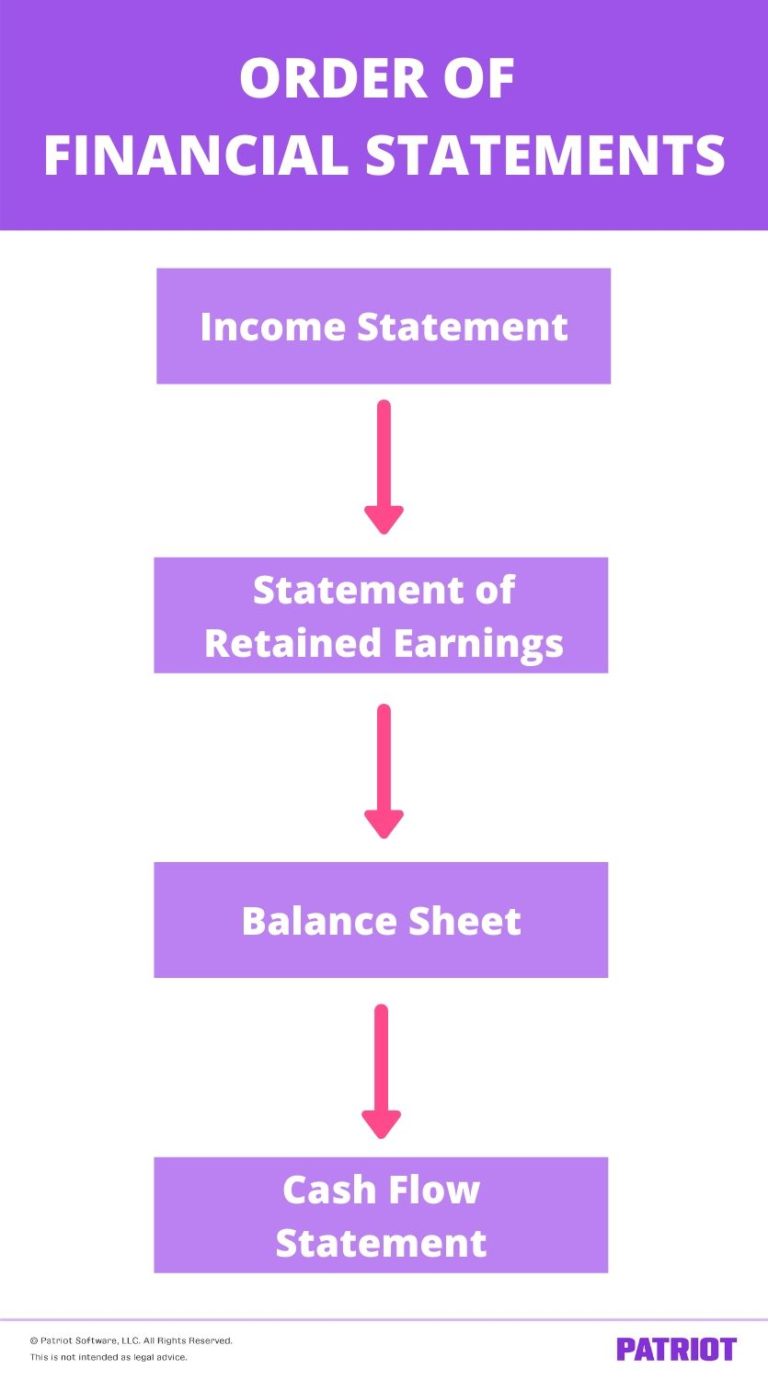

And (6) working with international partners. The income statement, statement of retained earnings, balance sheet, and statement of cash flows. The completed financial statements are then distributed to management, lenders , creditors , and investors , who use them to evaluate the performance, liquidity , and cash flows of a business.

(1) an income statement, recent standards now require a statement of comprehensive income, (2) a statement of changes in equity, (3) a balance sheet, also known as statement of financial position, (4) a statement of cash flows, and (5) notes to financial statements or supplementary notes. Fourth quarter highlights. For all of 2023, global m&a value fell 16 percent to $3.1 trillion—a showing even weaker than the pandemic year of 2020.

A financial statement is made up of four main documents: Income statement, balance sheet or statement of financial position, statement of cash flow, noted (disclosure) to financial statements. They include key data on what your company owns and owes and how much money it has made and spent.

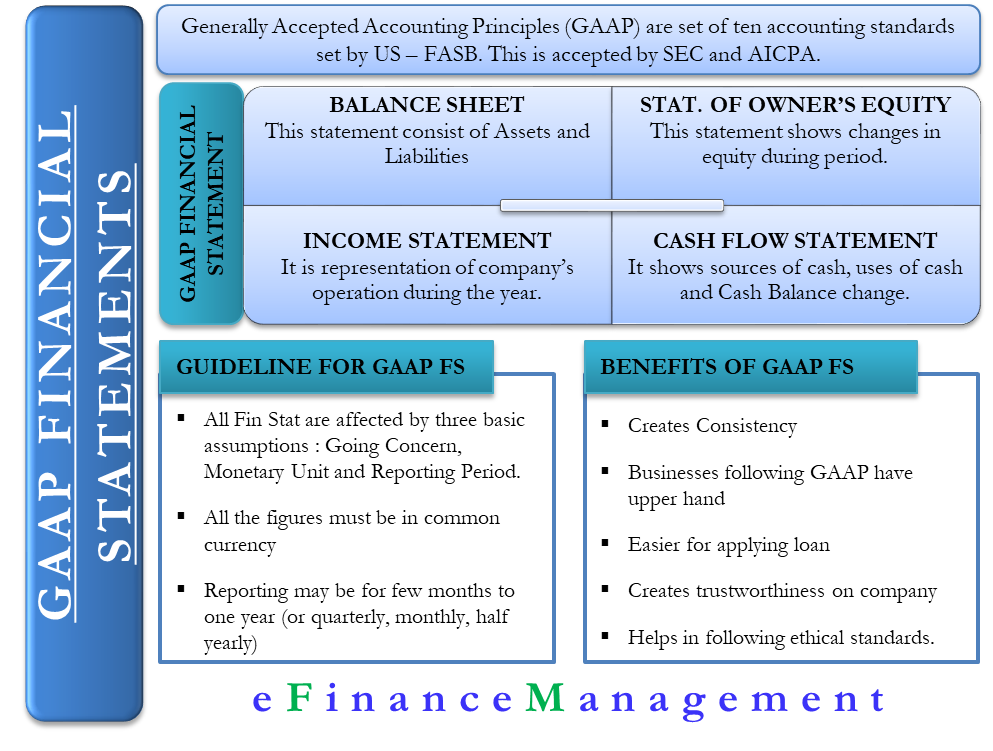

The three financial statements are: Financial statements are often audited by government agencies and accountants to ensure. Companies prepare their financial statements in accordance with a framework of generally accepted accounting principles (gaap) relevant to their country, also referred to broadly as accounting standards or financial reporting standards.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)