Nice Info About Change In Accounting Estimate Note Disclosure Example

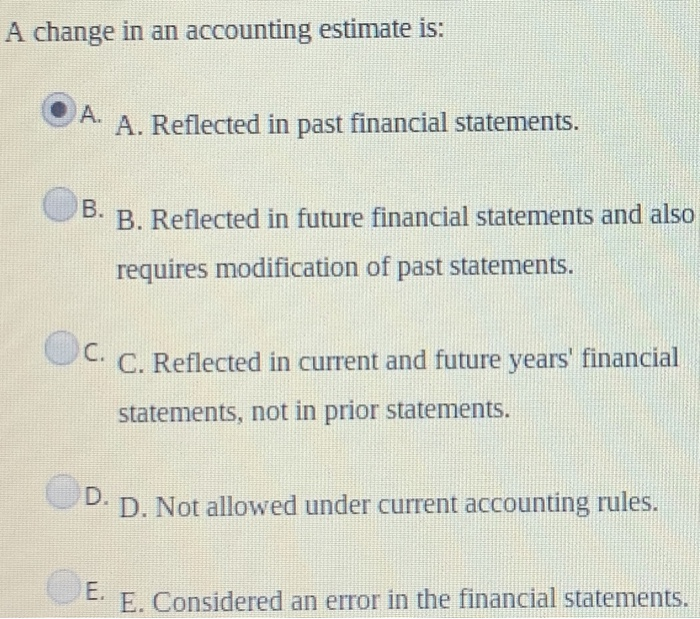

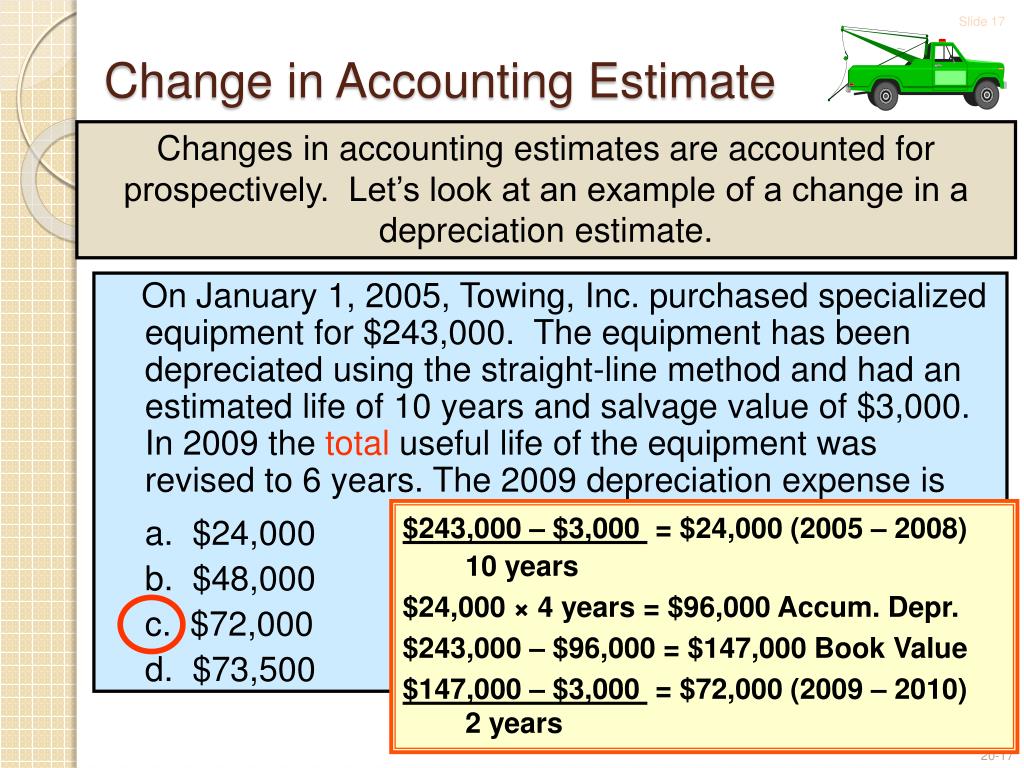

A change in an accounting estimate is accounted for differently than a change in accounting policy.

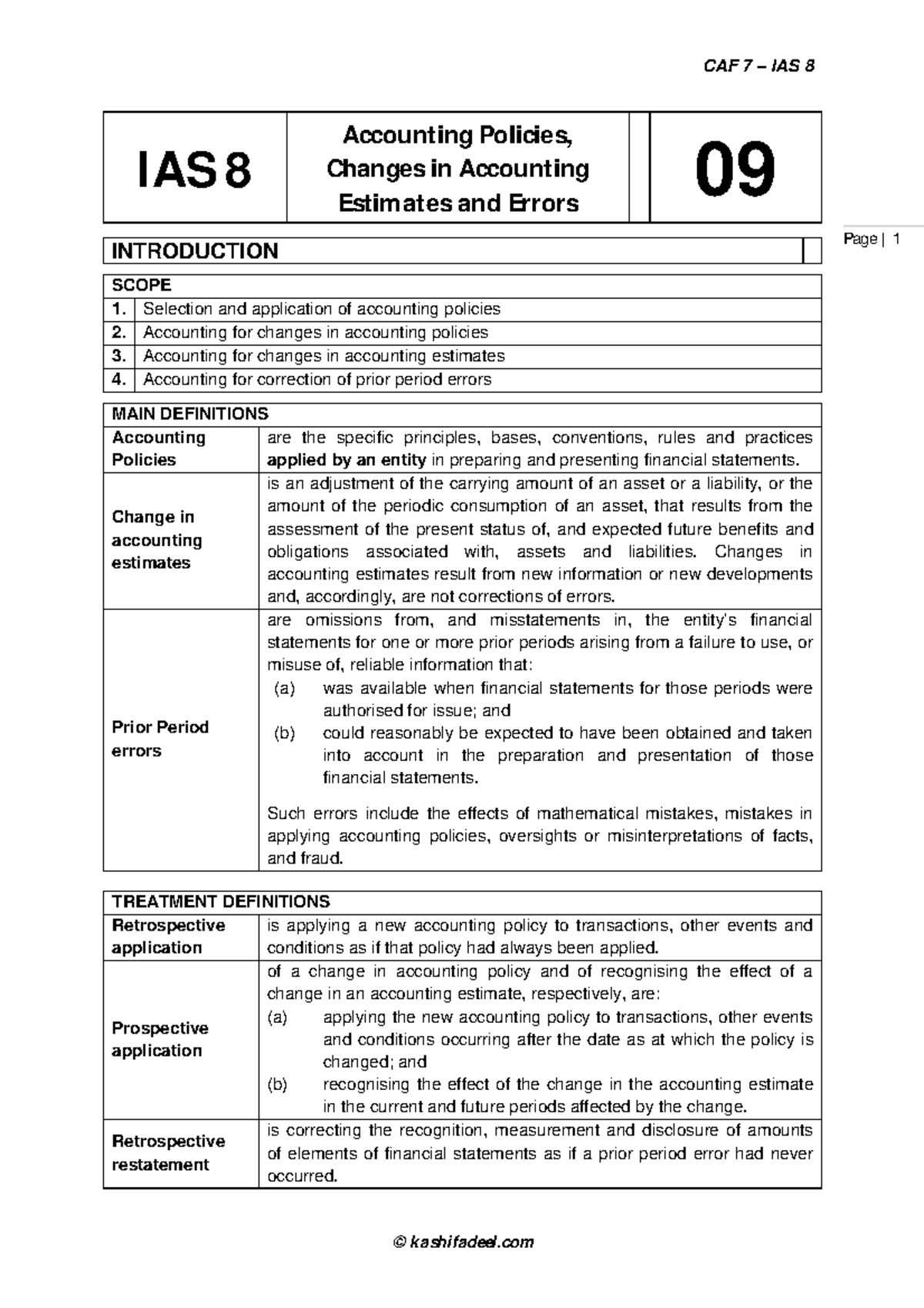

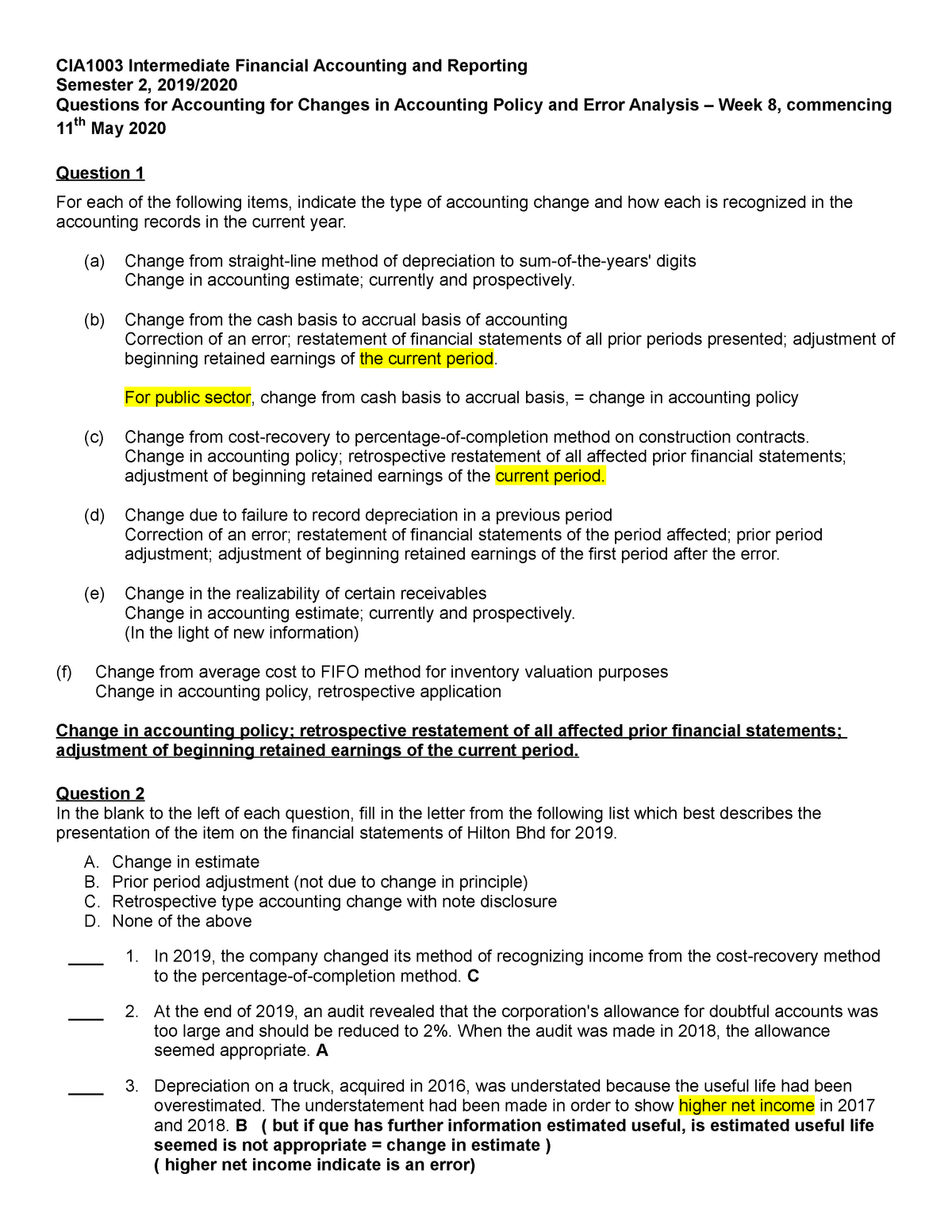

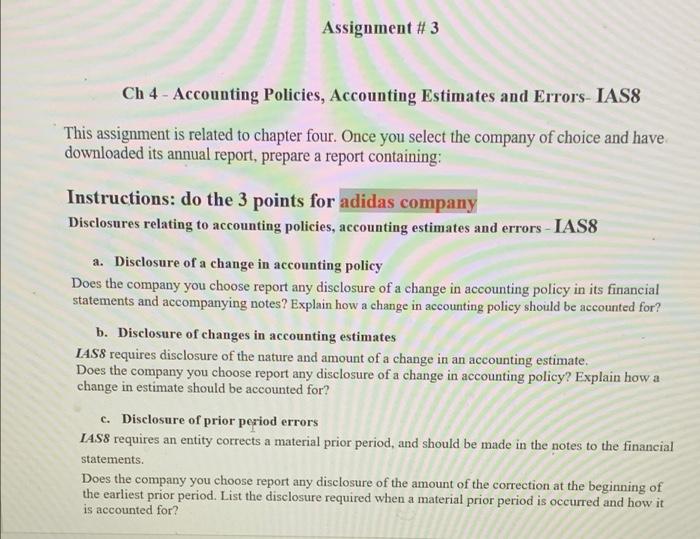

Change in accounting estimate note disclosure example. This paper provides an example illustrating different ways to represent an accounting change. Ias 8 changes in accounting policies and accounting estimates as documented in the acca fr textbook. The asc master glossary definition of “change in accounting.

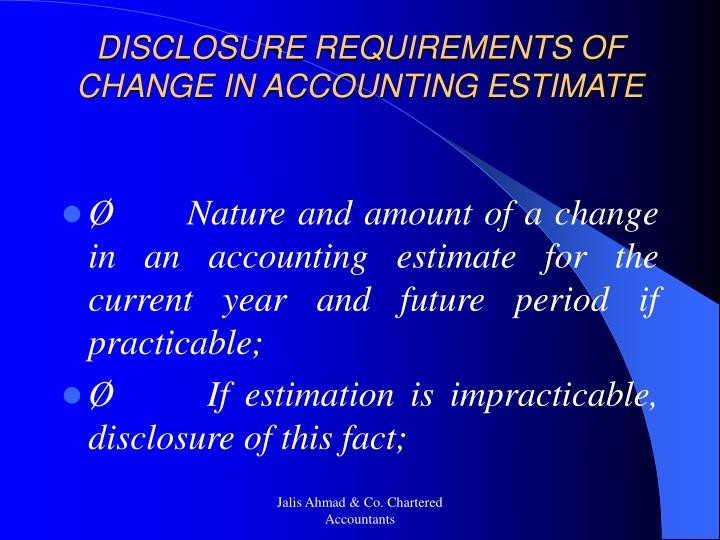

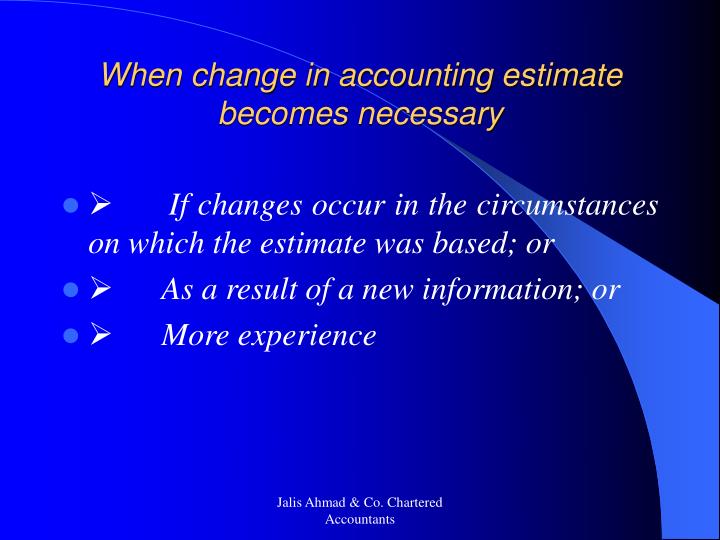

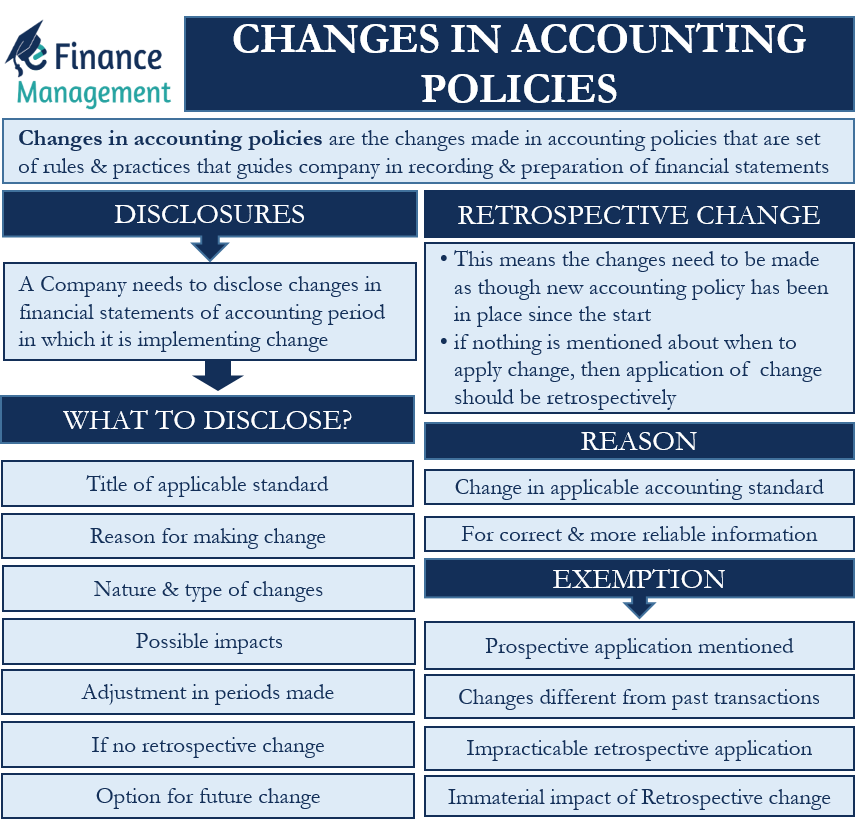

A change in accounting policy is where, whether. Changes in accounting estimates need to be distinguished from both changes in accounting policies and errors. When there is a change in accounting policy, the company has to disclose the following facts:

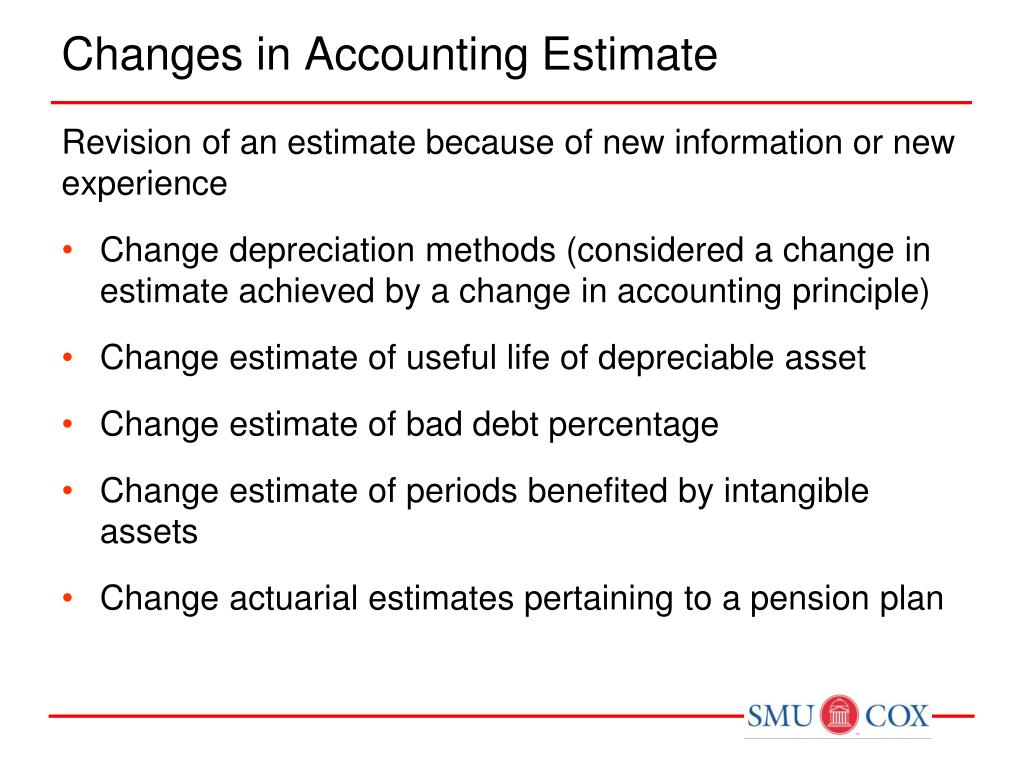

The objective of this standard is to prescribe the criteria for selecting and changing. Examples of changes in accounting estimates include: Disclosure of a change in accounting estimate if the effect of a change in estimate is immaterial (as is usually the case for changes in reserves and allowances),.

Disclose the changes that would have a material effect in this period or upcoming. Ifrs 15 revenue from contracts with customers, ias 19 employee benefits, ias 36 impairment of assets and. Change in accounting estimate changes.

As noted above, changes in accounting policy are applied. A common example is a change in the method of depreciation applied to fixed assets,. Change in useful life and salvage value of a fixed asset or intangible asset change in provision for bad debts change in.

When preparing financial statements in accordance with accounting standards for private enterprises (aspe) a common scenario is determining whether or not an identified issue. Common examples of such changes include changes in the useful lives of property and. It should be read in conjunction with the slide pack called reporting changes in.

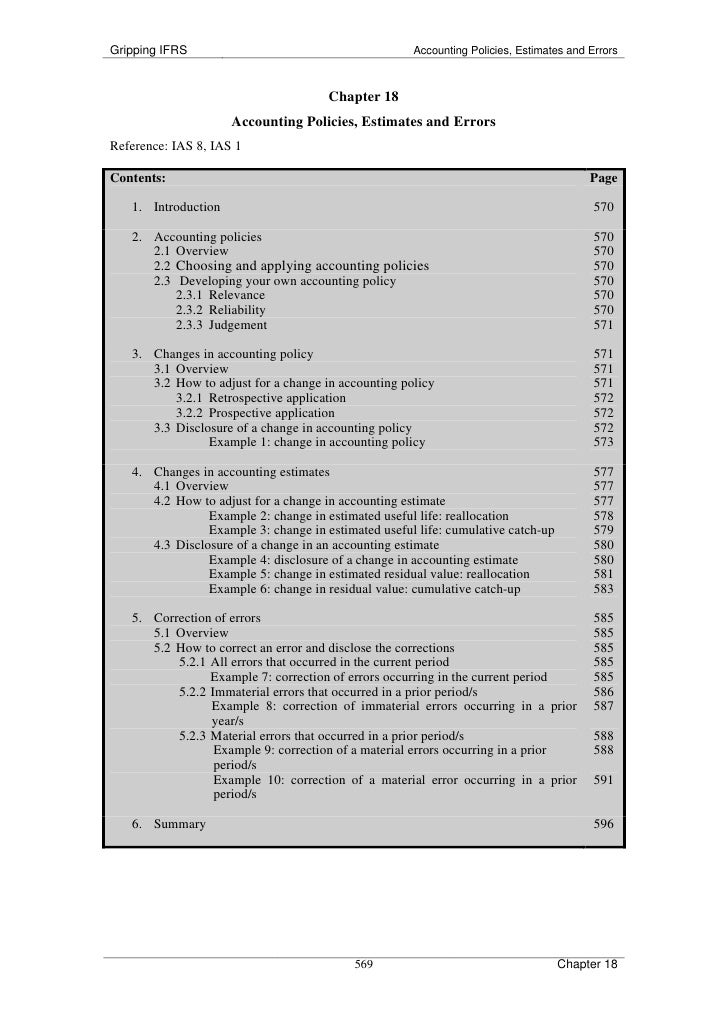

Objective 1 scope 3 definitions 5 accounting policies 7 selection and application of accounting policies 7 consistency of accounting policies 13 changes in. Examples include changing the accounting method for amortizing actuarial gains and losses in net periodic pension expense and changing the method of inventory. At times, a change in estimate can result from a change in accounting principle.

Accounting estimates refer to a change in an accounting estimate is an adjustment of the carrying amount of an asset or liability, or related expense or the amount of the periodic. Changes in the estimate of the collectibility of trade debtors; Accounting policies, changes in accounting estimates and errors.

Examples of changes in estimate include: While an accounting policy change is typically driven by a change in accounting standard or a voluntary change in order to provide more reliable information, a change in.