Painstaking Lessons Of Tips About Pro Forma Financials Meaning

When it comes to accounting, pro forma statements are financial reports for your business based on hypothetical scenarios.

Pro forma financials meaning. Growing just for the sake of growing doesn’t always yield favorable income for the firm. They can look forward or backward, revealing insights that standard financial statements. Pro forma financial statements present the complete future economic projection of a company or person.

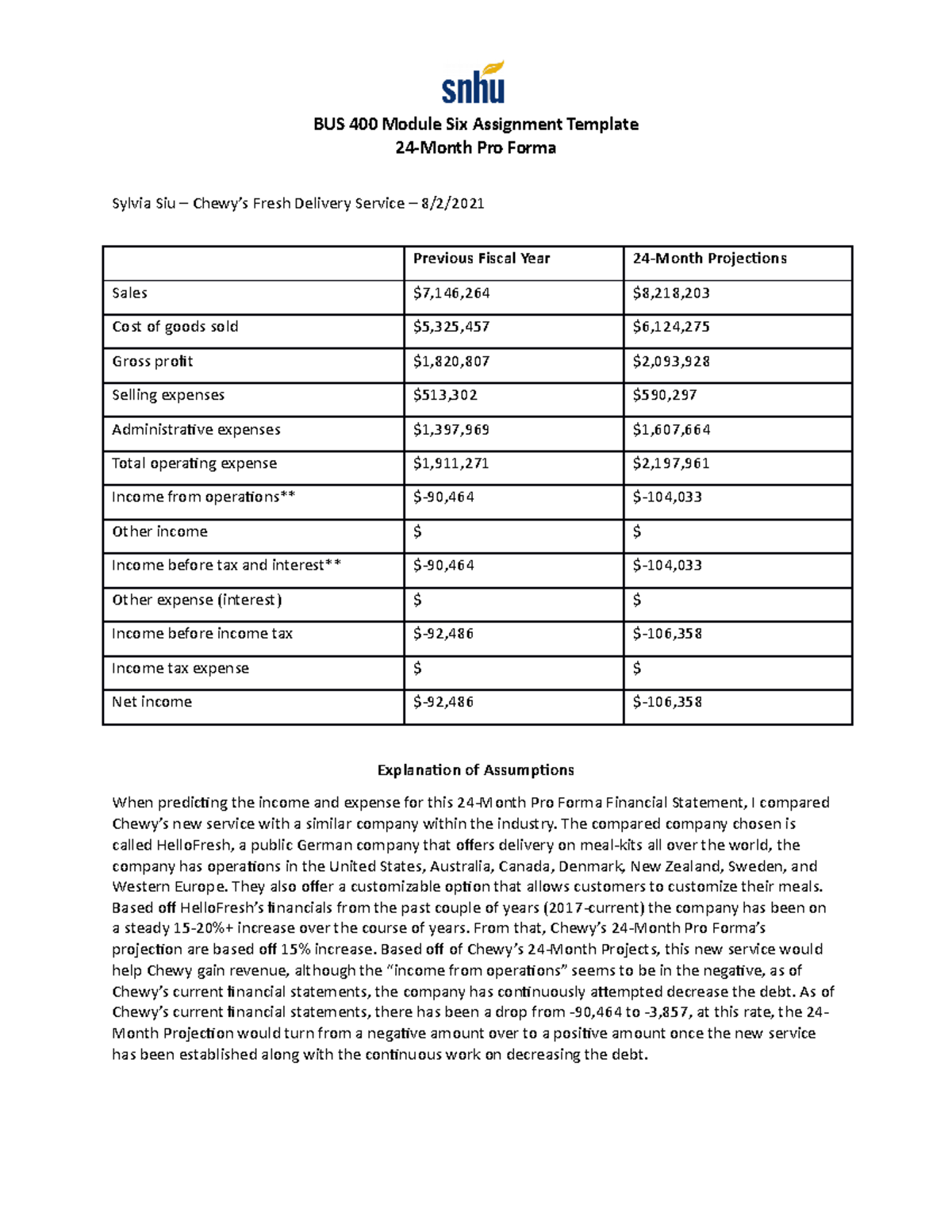

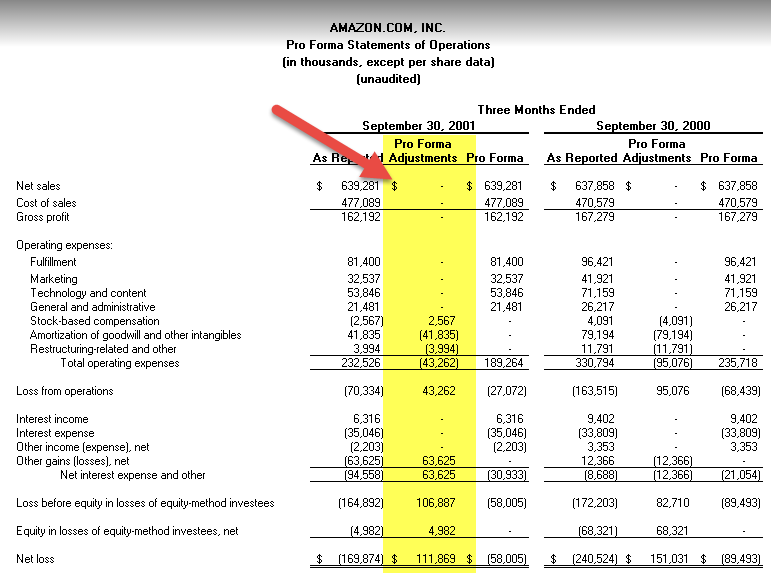

The pro forma models the anticipated results of the transaction, with particular emphasis on the projected cash flows, net revenues and taxes. Pro forma is a latin term that means “for the sake of form” or “as a matter of form,” but in modern parlance, it has come to mean a standard document, form, or financial statement. The definition and meaning of pro forma financial statements.

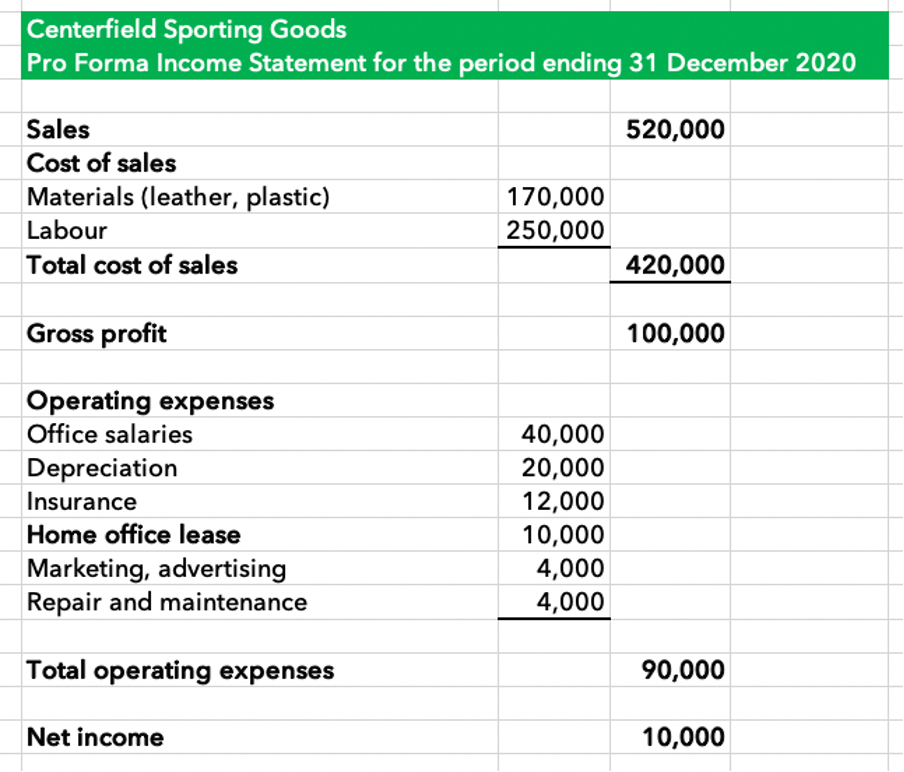

In accounting, pro forma refers to financial reports based on assumptions and hypothetical situations, not reality. Consequently, pro forma statements summarize the projected future status of a company, based on. Pro forma financial statements are a great tool for financial management, to assess your financial position in the current year, and for any future time period.

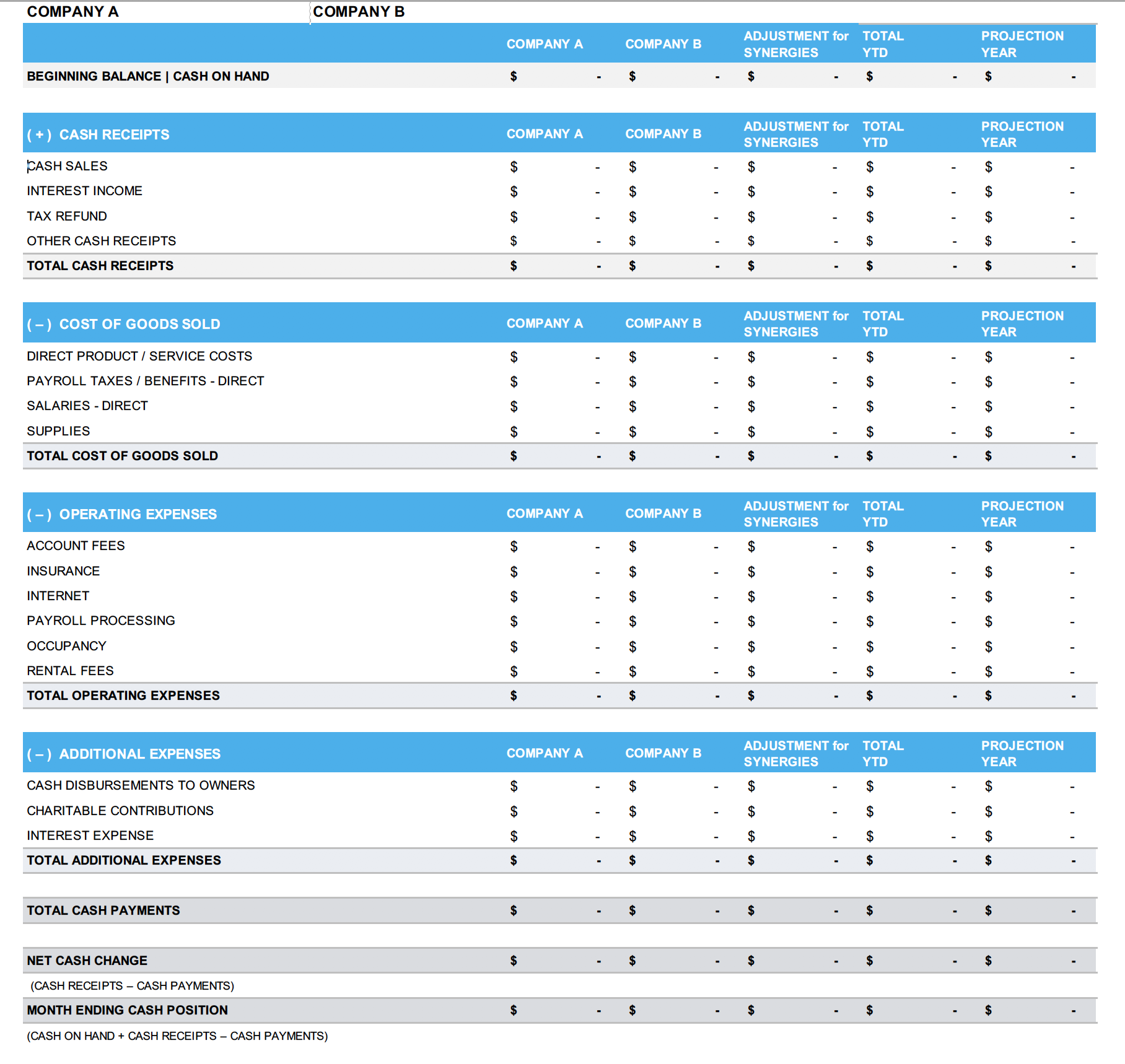

4 main types of pro forma statements. There are four main types of pro forma statements that you can use to manage your cash flows and the financial health of your business. Pro forma financial statements refer to reporting the company’s current or projected financial statements based on certain assumptions and hypothetical events that may have occurred or are likely to happen.

Pro forma is actually a latin term meaning “for form” (or today we might say “for the sake of form, as a matter of form”). What are pro forma financial statements? Key takeaways pro forma financial statements illustrate how a company’s financial position might change in the future.

Businesses use pro forma financial documents internally to aid in. These statements are used to present a view of corporate results to outsiders, perhaps.

We are pleased to present this publication, pro forma financial information: What are pro forma financial statements? A pro forma financial statement is a projection showing numbers that do not reflect the actual results from a company’s history.

Pro forma financial statements are a common type of forecast that can be useful in these situations. The documents are often used to express interest in business transactions or reveal the intended purpose and outcome of the transaction. Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future.

Pro forma financials may not be. The latin term pro forma, for “as a matter of form, has a procedure of calculating financial results uses certain projections oder presumptions. Pro forma documents, in any form, are essentially like letters of intent, expressing what an invoice or transaction is anticipated to look like after completion.

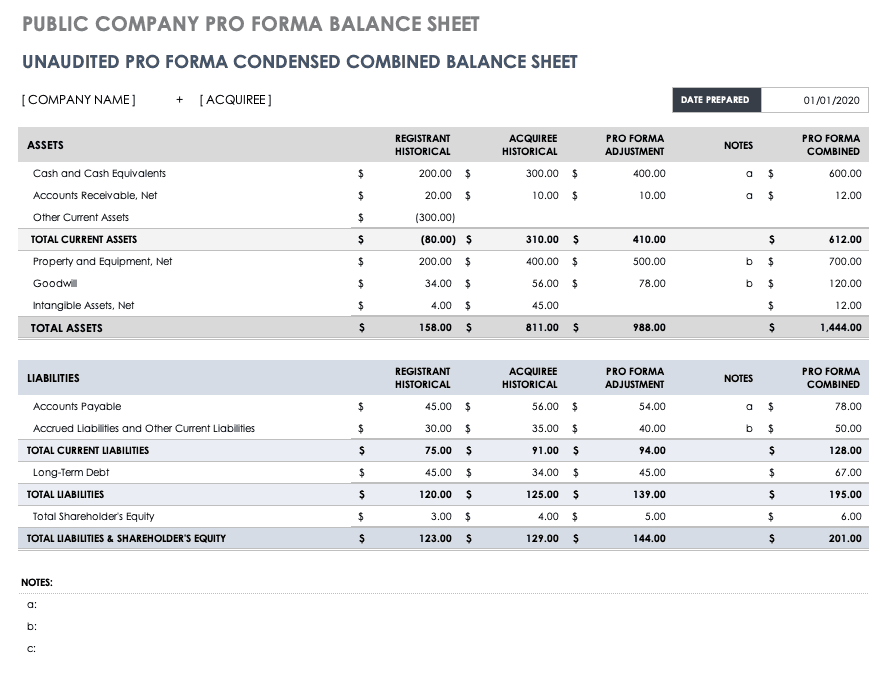

Accordingly, the company’s management can include or exclude line items that they feel may not accurately measure its estimates. This is similar to a traditional balance sheet as it shows the accounts receivable, your cash flow statements, and other pertinent financial. Pro forma financial information (pro formas) presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an earlier time.

:max_bytes(150000):strip_icc()/Pro-Forma-V2-c9d1a7bd7843405e8de36c734e910f44.jpg)