Nice Tips About Charity Accounts Audit

An independent accountant should prepare them.

Charity accounts audit. Learn when and why your nonprofit may need to have an independent audit, and how to manage it effectively. Appoint a suitable person to carry out the independent examination, and 3. The widow of the late founder of suicide prevention charity console has been fined €1,500 after she pleaded guilty to a charge of failing to keep the books of account.

For a charity registered with the charity commission for england and wales (ccew) and complying with charities. Prepare for the independent examination the trustees of all. On this page you can access a.

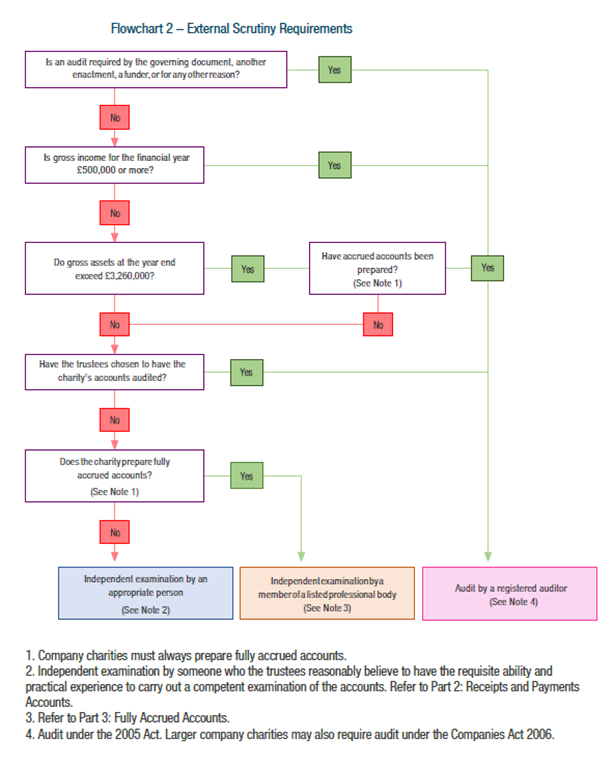

Does your charity need an audit? In general, an audit must take place when: This guidance gives trustees the information they need to:

Auditor is required to provide an opinion on whether a charity’s accounts give a ‘true and fair view’. There are two main types of external scrutiny to which charities’ accounts are subject: How to prepare and audit charity accounts | accountancy daily.

Claiming too much in deductions. The auditor is required to plan their work to identify material fraud or to plan to. Your return could become flagged if you claim more deductions than is typical or if.

The charities accounts (scotland) regulations 2006 set out the format and scrutiny requirements for charity accounts. There have been a number of small updates to the. If examination is written into your constitution you have to comply regardless of legal thresholds.

Optional below £25k, unless condition of governing. These form part of the annual. The assets of the charity are more than £3.26 million.

When does your charity need an audit? If your charity has an income of more. The gross income in the financial year is £500,000 or more;

Audited financial statements provide important information about a charity’s financial accountability and accuracy. Who has to be examined or audited? Charities with a gross annual income between £25,000 and £250,000 must have their annual accounts independently examined or audited.

The audit requirements for charities that are not companies and for companies that claim audit exemption under the companies act 2006 are set out in: Registered and excepted charities with income > £25k must have an ie unless the accounts are audited. Audit an audit provides reasonable.