Who Else Wants Info About Cash Flow Statement Is Related To

A cash flow statement is a financial statement that presents total data.

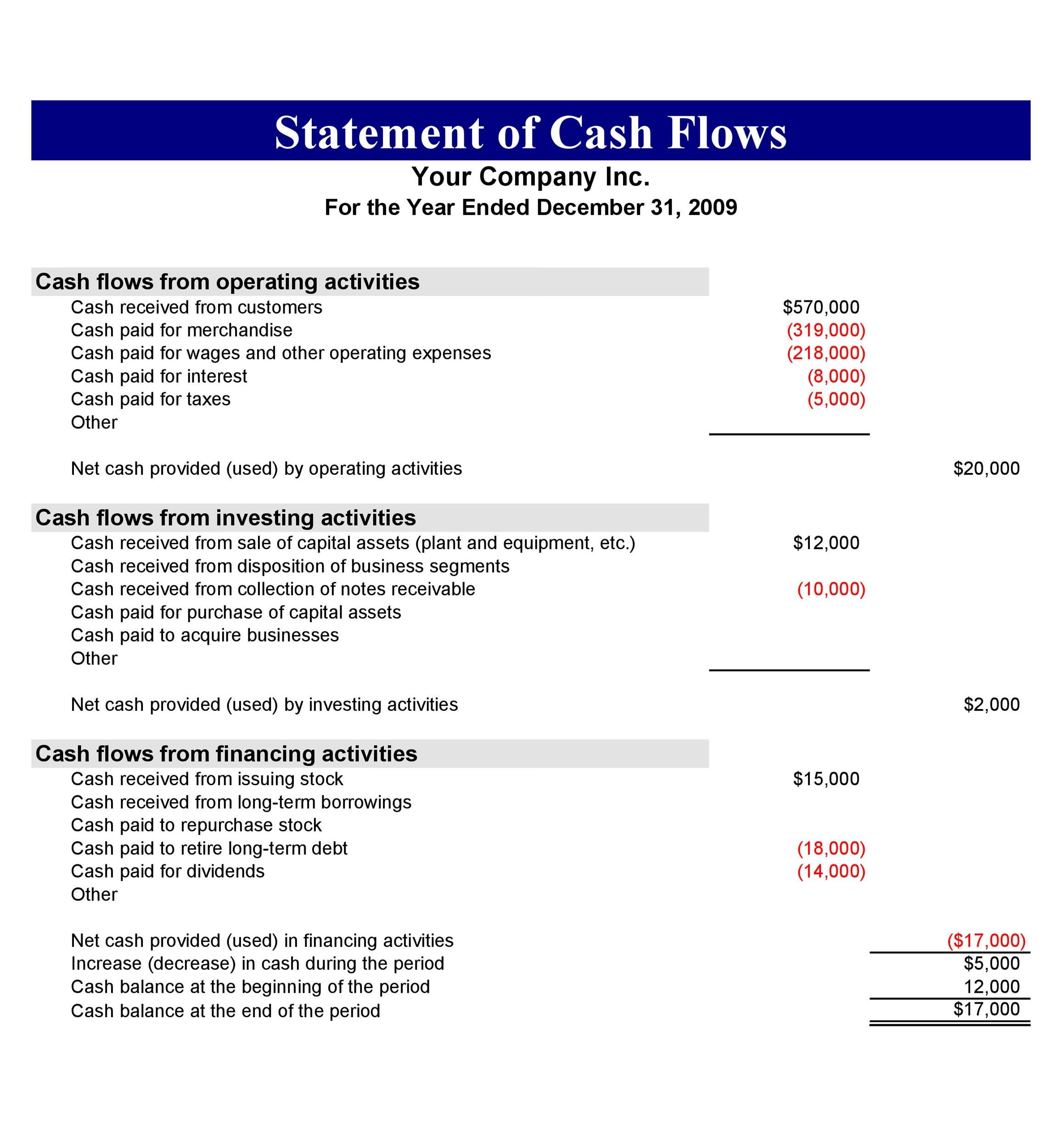

Cash flow statement is related to. The cash flow statement is broken into three sections covering the fundamental components of every business: The income statement is the most common financial statement and shows a. Let’s look at what each section is showing.

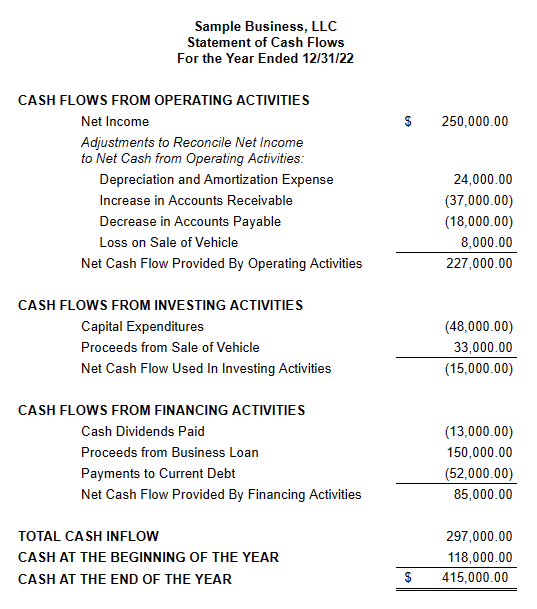

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Following is an example of what a cash flow statement looks like. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

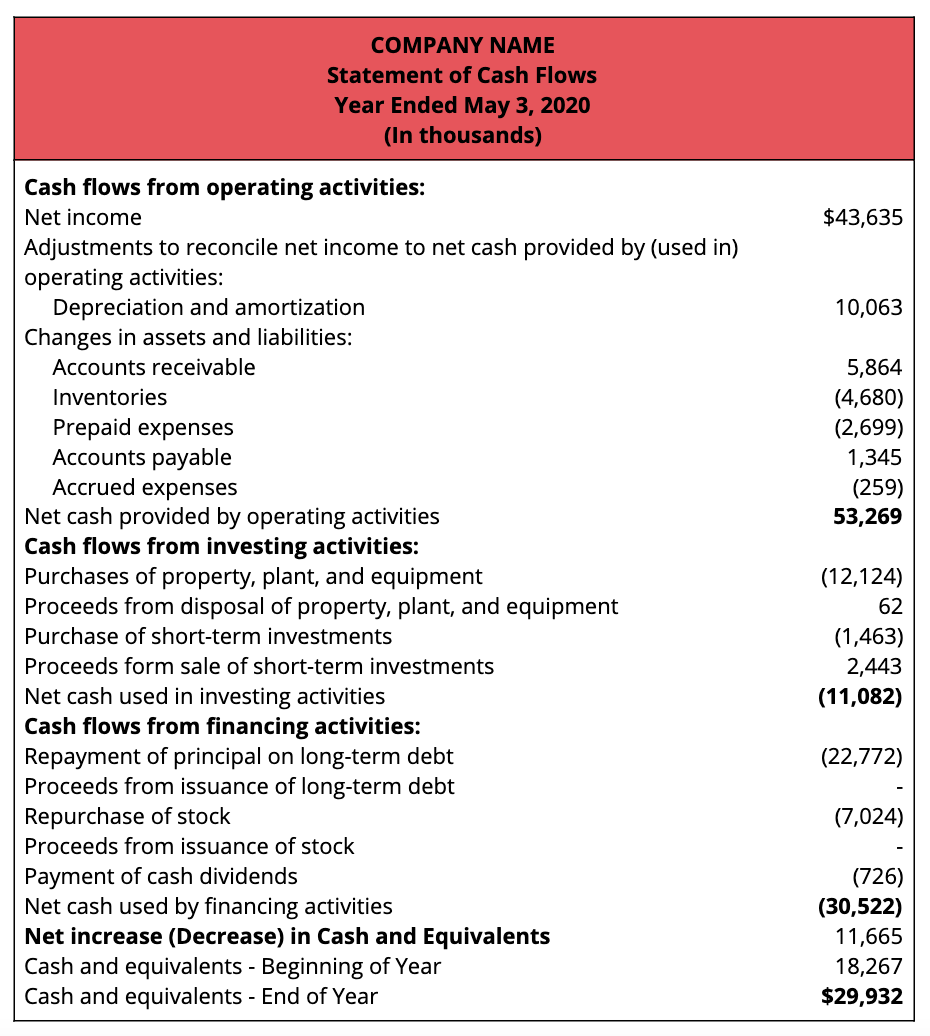

The main components of the cash flow statement are: A cash flow statement is a way to summarize cash flow activity and analyze trends. This includes cash flows from both debt and equity financing—cash flows associated with raising cash and.

Cash flows related to financing activities typically represent cash from investors or banks, issuing and buying back shares, and dividend payments. The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet. Whether you are raising a loan, paying interest to service debt, or distributing dividends, all of these transactions fall under the financing activities section in the cash flow statement.

A cash flow statement is one of three key documents used to determine a company's financial health. The third section of the cash flow statement examines cash inflows and outflows related to financing activities. A cash flow statement is a crucial financial document that details all your sources of cash over a given period of time.

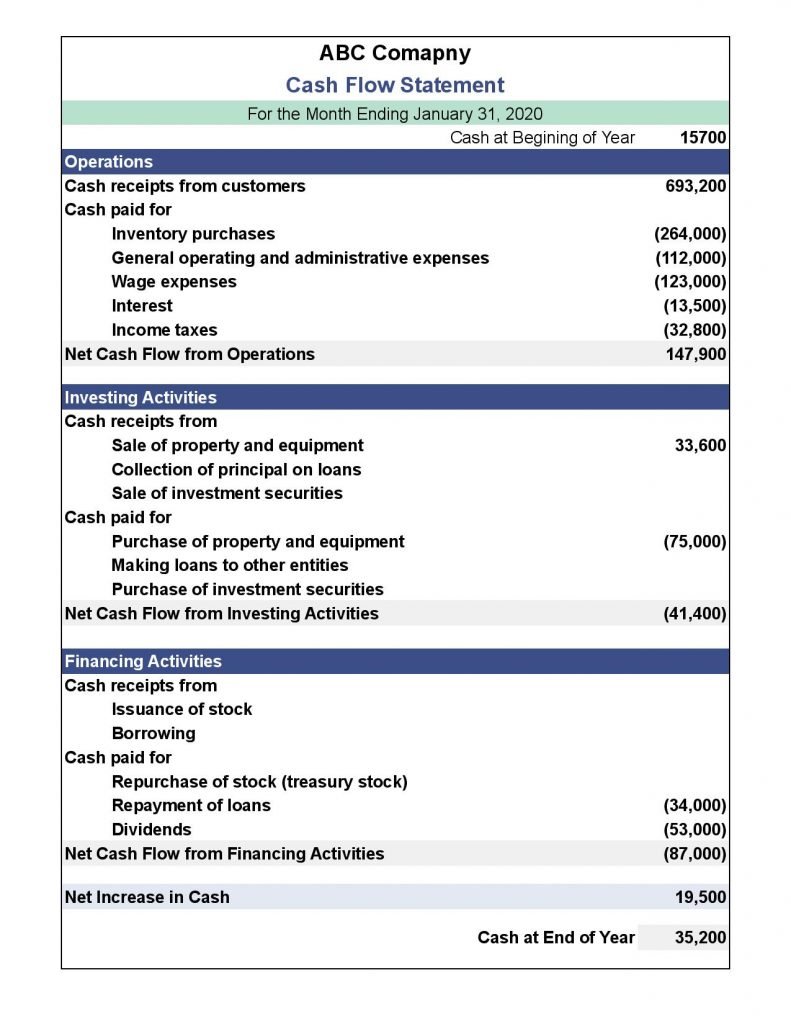

The cash flow statement is the third main financial statement, together with income statement and the balance sheet. Key takeaways cash flow is the movement of money in and out of a company. This is the cash flow statement for xyz company at the end of financial year (fy) 2018.

Your cash flow statement is one of your business’s most important financial statements. Cash flow statement example. It provides valuable information about the liquidity, solvency, and overall financial health of a company.

If you’re an investor, cash flow statements can offer insight into a company’s financials to help you decide whether it belongs in. December 13, 2023 what is a statement of cash flows? Many companies sit on piles of cash, even when rates of return suggest they shouldn’t.

Cost of goods sold related to the project is estimated to be roughly $400 per unit in year one and will increase each year after that by 4% in line with expert inflation forecasts over the project period. A cash flow statement (cfs) is a financial statement that shows the inflow and outflow of cash in a company over a specified period. Utrecht, 22 february 2024 highlightsrevenue eur 3,324 million;

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. The company's operations manager has considered various locations where product manufacturing might take place.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)