Matchless Tips About Understanding Company Financial Statements

How to read an income statement an income statement, also known as a profit and loss (p&l) statement, summarizes the.

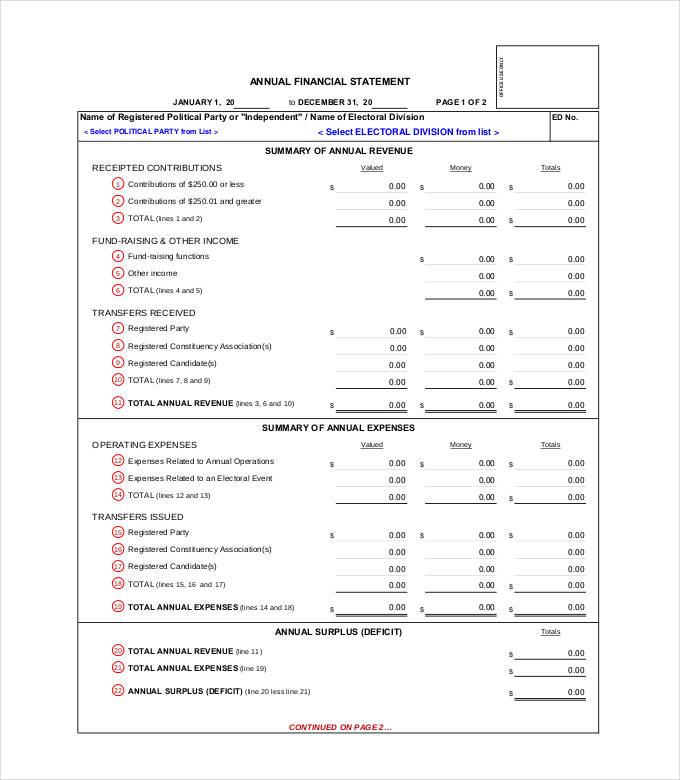

Understanding company financial statements. The balance sheet, the income statement, the cash flow. Balance sheets breakdown a company’s assets, liabilities, and equity. Balance sheets show what a company owns and what it owes at a fixed point in time.

While financial statements can be complex and technical, with a little practice and understanding of key concepts, you can master this. And (4) statements of shareholders’ equity.

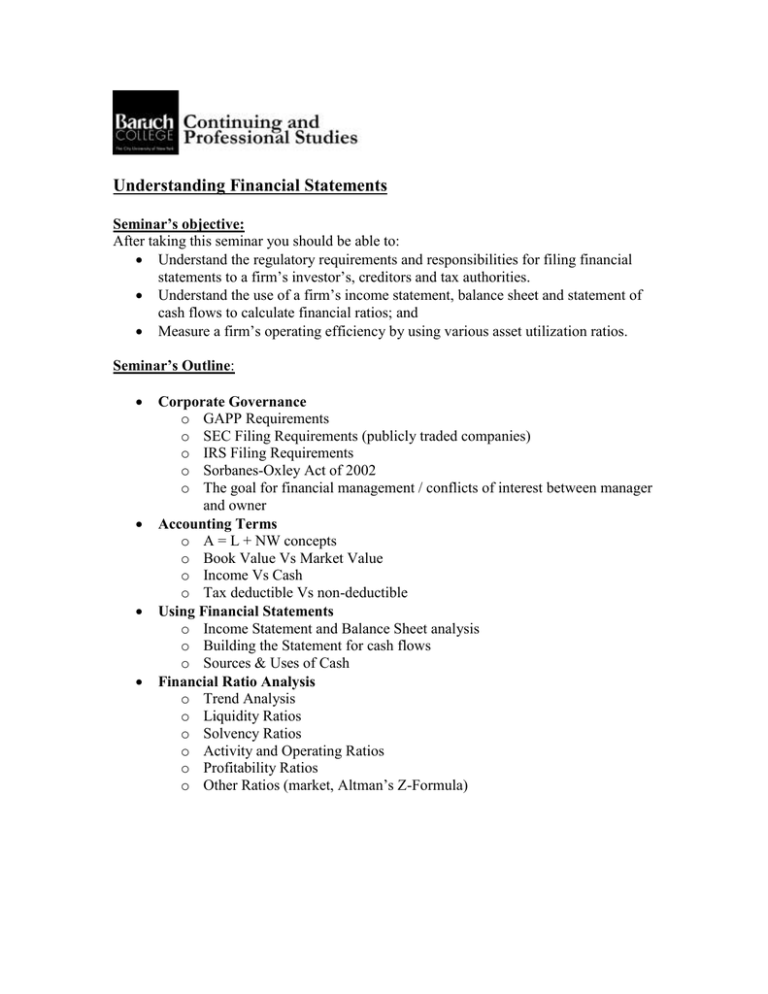

Corporate finance financial statements financial statements financial statements are essentially the report cards for businesses. Financial statements are written records that convey the financial activities of a company. These statements are vital for understanding a company's financial situation, performance, and cash flow.

It allows you to see what. They include information about a company’s assets, liabilities, equity, revenue, expenses, and cash flow. A financial analysis of a company's financial statements—along with the footnotes in the annual report—is essential for any serious investor seeking to understand and value a company properly.

There are four main financial statements. Financial statements are documents containing summarised data that describe an organisation’s financial activities, such as income, expenses, assets, liabilities, net worth, etc. Jackson enroll for free starts feb 18 financial aid available 69,067 already enrolled included with • learn more about.

And income statements serve to analyze a company’s revenue and expenses (profit and loss) over a certain period of time. How to read a cash flow. Understanding financial statements.

There are four sections to a company's financial statements: How to read a balance sheet a balance sheet conveys the “book value” of a company. Intuitively, this is usually the first thing we think about with a business… we often ask questions such as, “how much revenue does it have?” “is it profitable?” and “what are the margins like?”

Income statement analysis most analysts start their financial statement analysis with the income statement. Understanding financial statements 1. Prudent investors might also want to review a.

Financial statements are often audited by government agencies and accountants to ensure. Understanding company financial statements. The balance sheet, income statement, and cash flow statement.

They tell the story, in numbers, about the financial. On the top half you have the company’s assets and on the bottom half its liabilities and shareholders’ equity (or net worth). Financial statement are written records that convey the business activities and the financial performance of a company.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)