Unbelievable Info About Interfund Transfer Governmental Accounting

Amounts transferred from other funds by individual major fund, nonmajor governmental funds in.

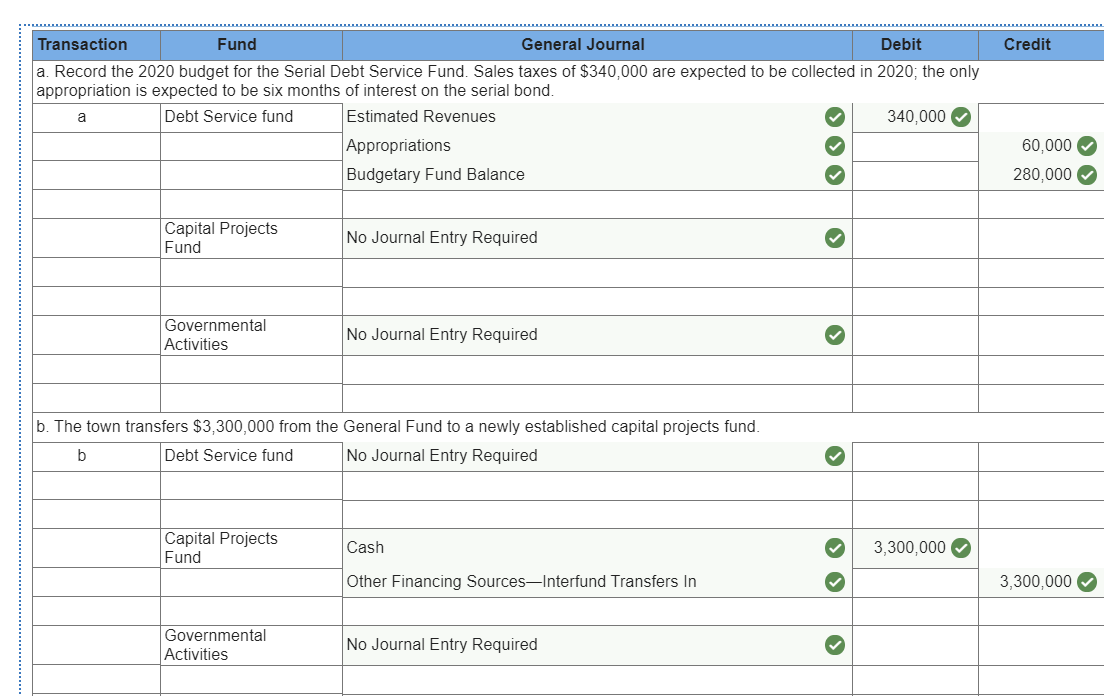

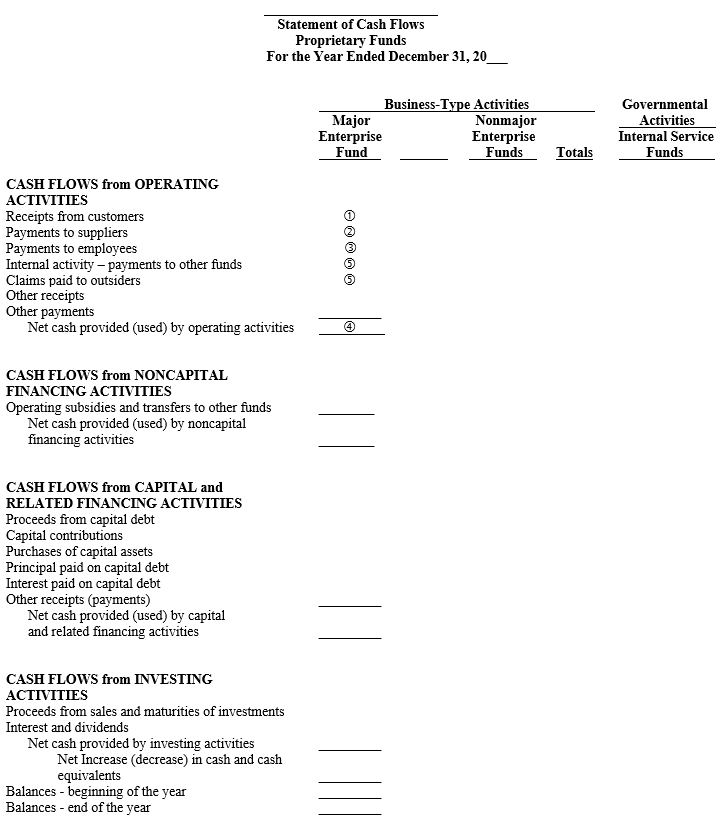

Interfund transfer governmental accounting. This course steps through the different categories and types of funds with an overview of the basics of each fund then presents interfund activity and balances as well as interfund. The general fund incurred $3,000,000 for utilities provided to the various municipal buildings by the utility enterprise fund. Interfund services provided and used.

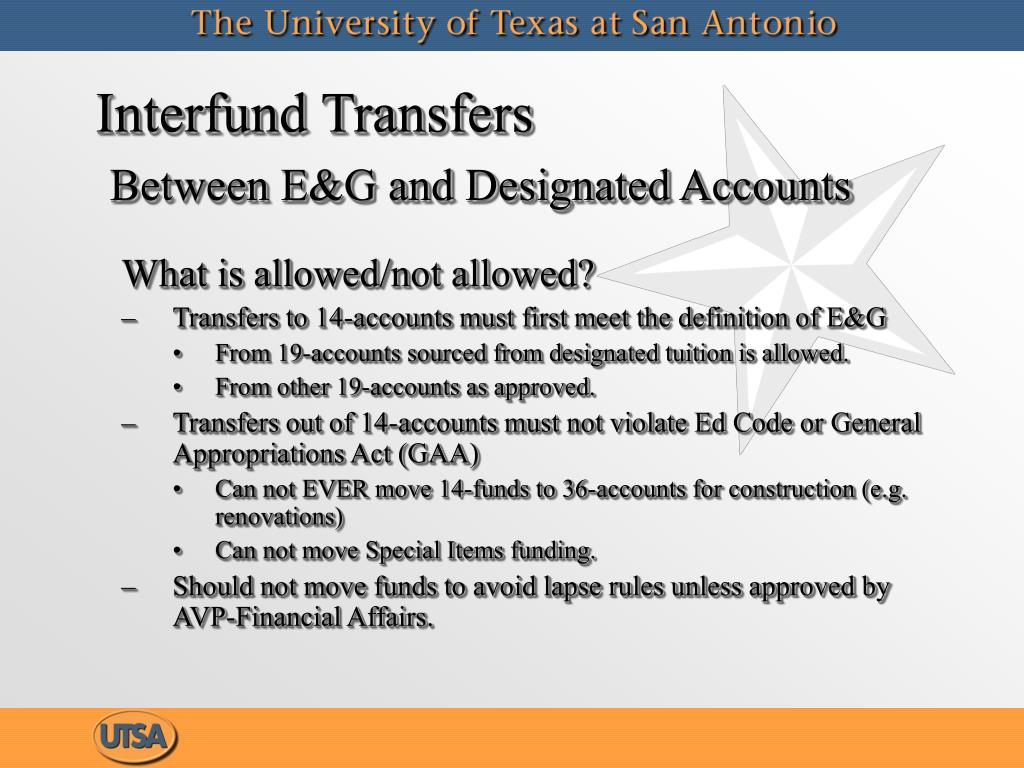

Since the general fund is a municipality's largest. Gaap divides interfund activities into two main categories with various subcategories: Governmental accountants and accounting paraprofessionals need to know the differences between the types of interfund transactions and how to.

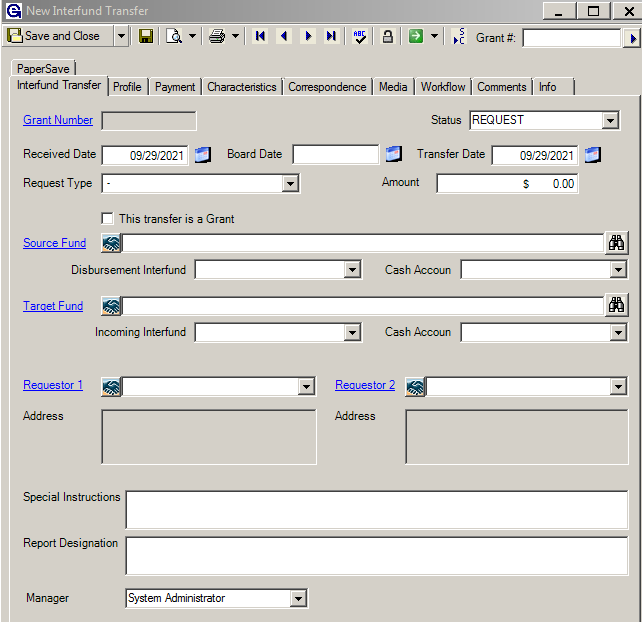

Xvi.4.r interfund transactions and transfers. Interfund transfers are flows of assets between funds without equivalent flows of assets in return and without a requirement for repayment. Are you a cpa candidate or accounting.

Lessons including basic accounting theory,. Learn the elements of financial reports and generally accepted accounting principles (gaap) for state and local governments. One fund gives (or receives) value without receiving (or giving) value in return.

Interfund transfers are not used to. Report transfers of cash that occur between different gaap fund types, different funds or different agencies as transfers in or out as follows: Download citation | interfund, internal, and intra‐entity activity and balances | this chapter describes primary standards for accounting for and reporting interfund,.

As discussed in chapter 21, all caps are used to indicate accounts used. Details about interfund transfers reported in the fund financial statements: It paid $2,550,000 in cash before the end of the.

Residual equity transfers should be reported as additions to or. Governmental accounting literature has affirmed the importance of signaling a balanced condition between revenues and expenditures. Governmental accounting research system (gars) pronouncements.

In governmental funds, report transfers as: Interfund transfers should be distinguished from revenues, expenses, or expenditures in financial statements. Interfund transfers should be distinguished from revenues, expenses, or expenditures in financial statements transfers should be reported in the “other financing sources.