First Class Info About Cash Flow From Operating Activities Indirect Method Format

Common cash flow calculations include the tax paid (which is an operating activity cash outflow), the payment to buy property, plant and equipment (ppe) (which is an investing activity cash outflow), and dividends paid (which is a financing activity cash outflow).

Cash flow from operating activities indirect method format. Cash flows from (used for) operating activities: Cash flows from operating activities. Companies, whereby the starting line item is net income.

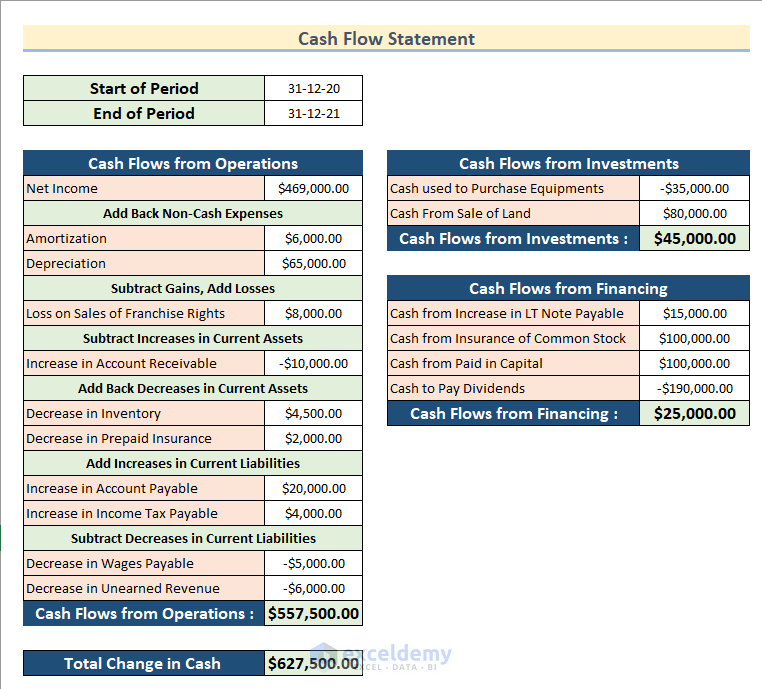

What is the cash flow statement indirect method. Cash flows from financing activities. $81,750.00 loss on disposal of equipment:

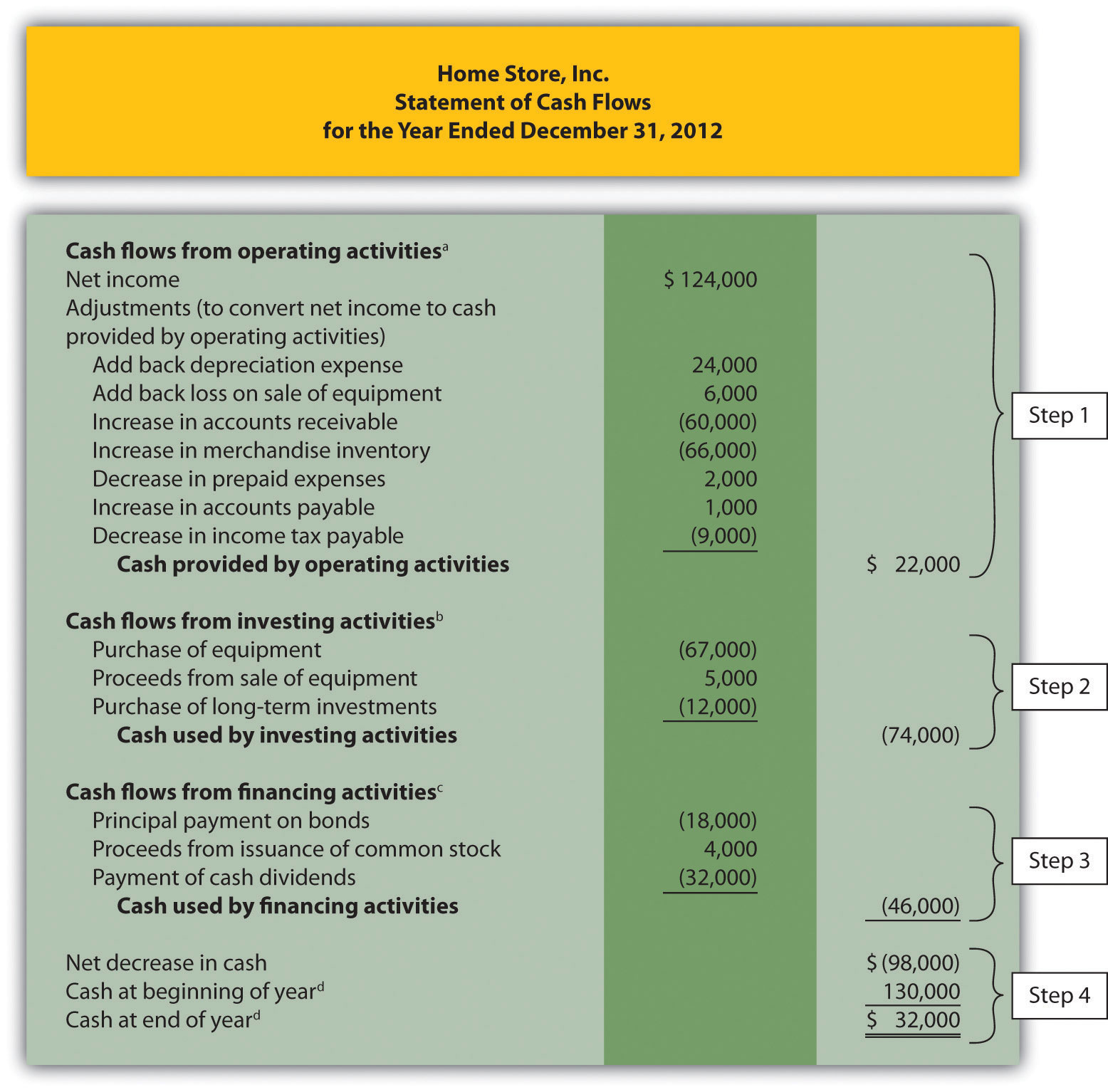

Cash flow is calculated using the direct (drawing on income statement data using cash receipts and disbursements from operating activities) or the indirect method (starts with net income. The following example shows the format of the cash flows from operating activities section of cash flows statement prepared using indirect method: Home store, inc., had net income of $124,000 in 2012.

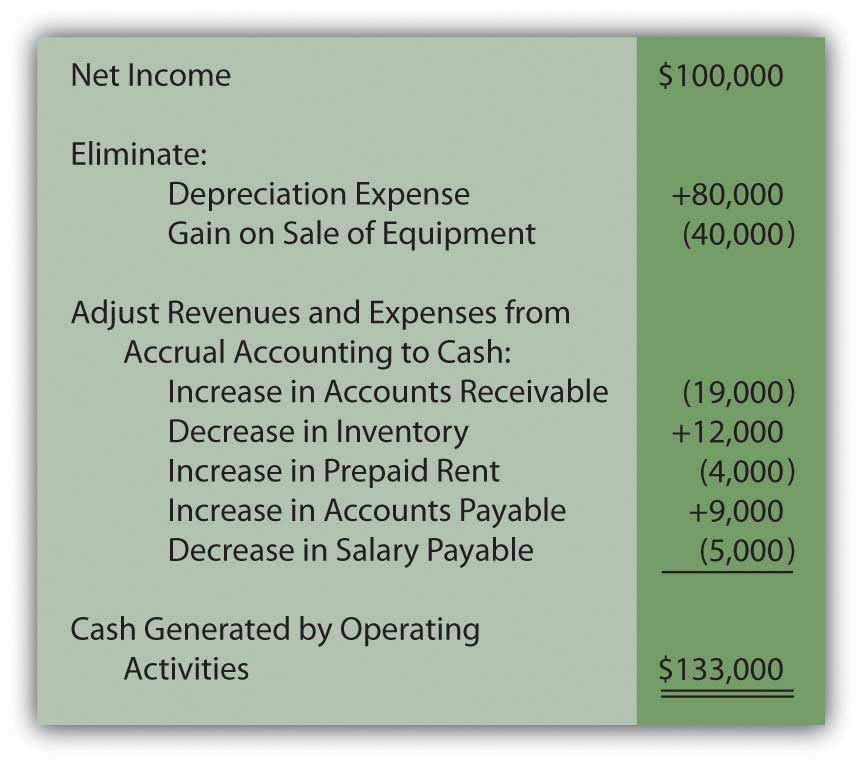

Cash flow from operating activities may be reported in either presentation format: Using the indirect method, operating net cash flow is calculated as follows: In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to.

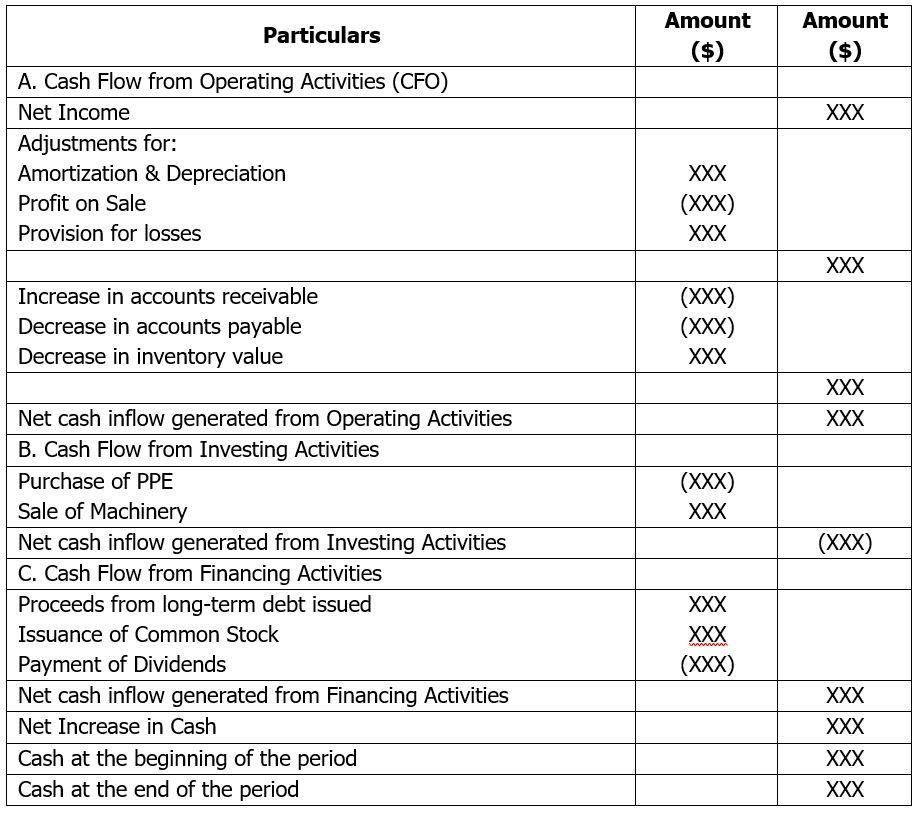

Operating cash flow = net income + depreciation and amortisation + accounts receivables + inventory + accounts payables 2. You can gather this information from the company’s balance sheet and income statement. It starts with a business’s net income and then lists cash flows, both received and paid, for various activities (i.e., the three cash flow categories:

Depreciation loss or gain on sale of fixed assets miscellaneous expenses written off investment income interest dividend operating. How to calculate net cash flow from operating activities. Cash flows from investing activities.

Cash flow from operations overview. When the indirect method of presenting the statement of cash flows is used, the net profit or loss for the period is adjusted for the following items: The direct method is intuitive as it means the statement of cash flow starts with the source of operating cash flows.

In this method, you begin with the net income and adjust it to calculate the company’s operating cash flow. This is the cash receipts from customers. The cash flow statement indirect method is one way to present a company’s total cash flow.

Under the direct method, the information contained in the company's accounting records is used to. Example of indirect method of operating activities section Cash flow from operating activities formula the “cash flow from operations” is the first section of the cash flow statement, with net income from the income statement flowing in as the first.

Both ifrs and us gaap encourage the use of the direct method but will allow either method to be used. In this article, we look at the indirect method of preparing a statement of cash flows. In the presentation format, cash flows are divided into the following general classifications:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)