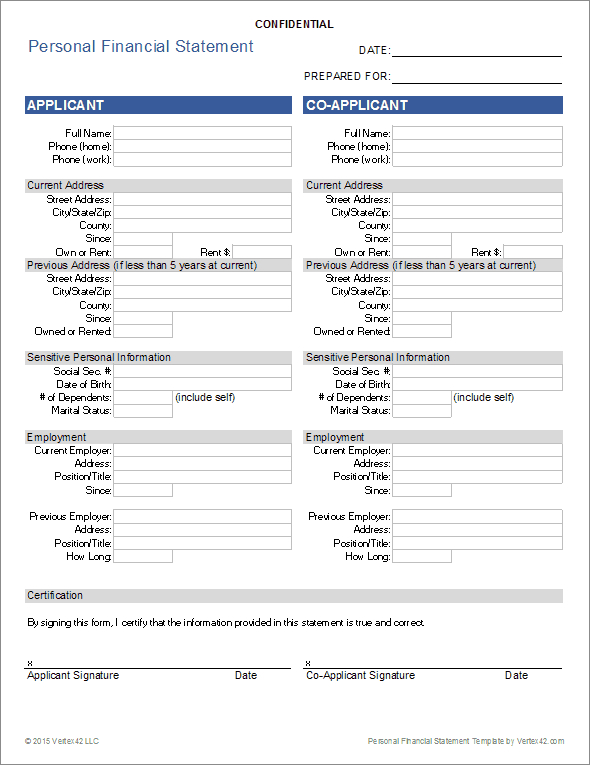

Perfect Info About Personal Financial Statement For Business Owners

This section lists everything you own with value, such as cash, investments, real estate, and.

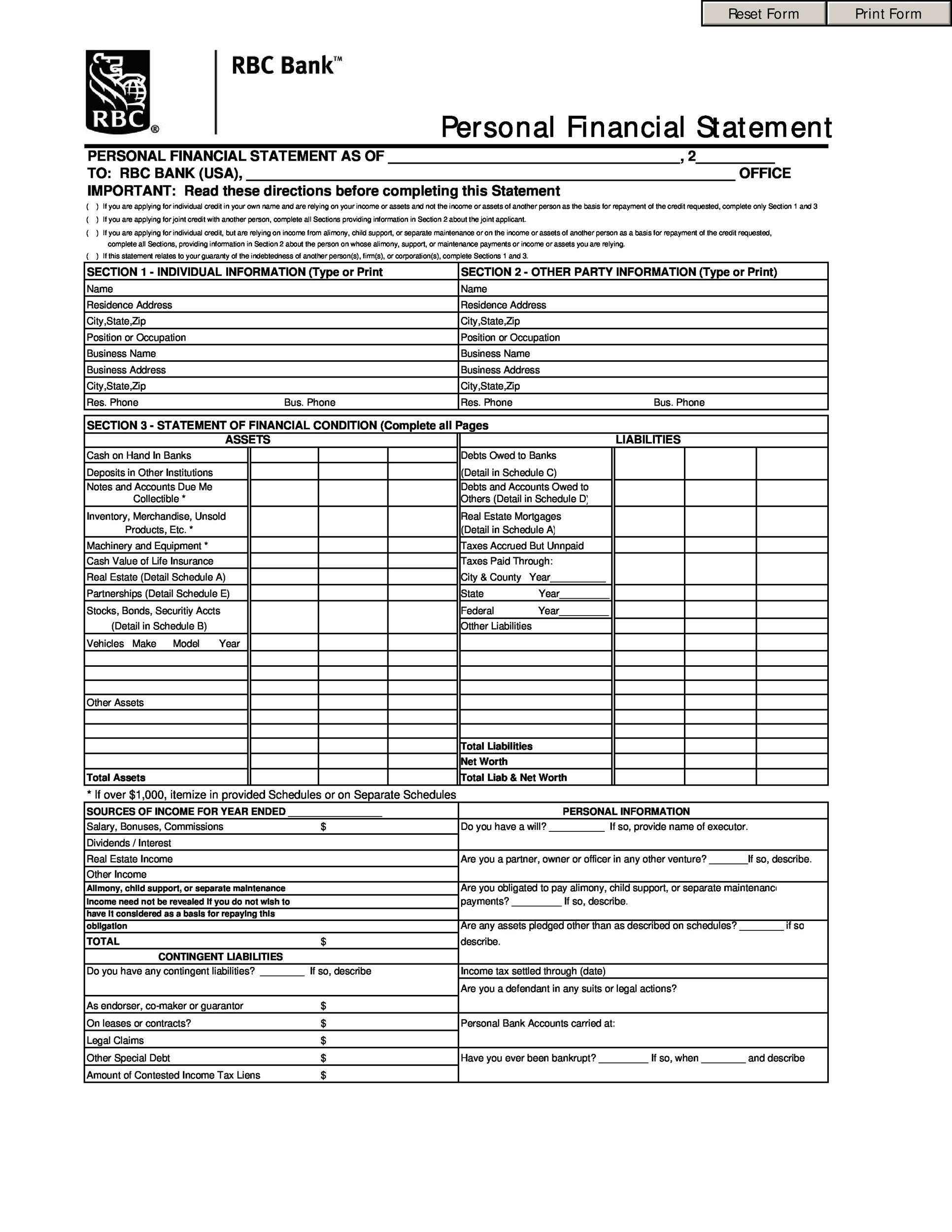

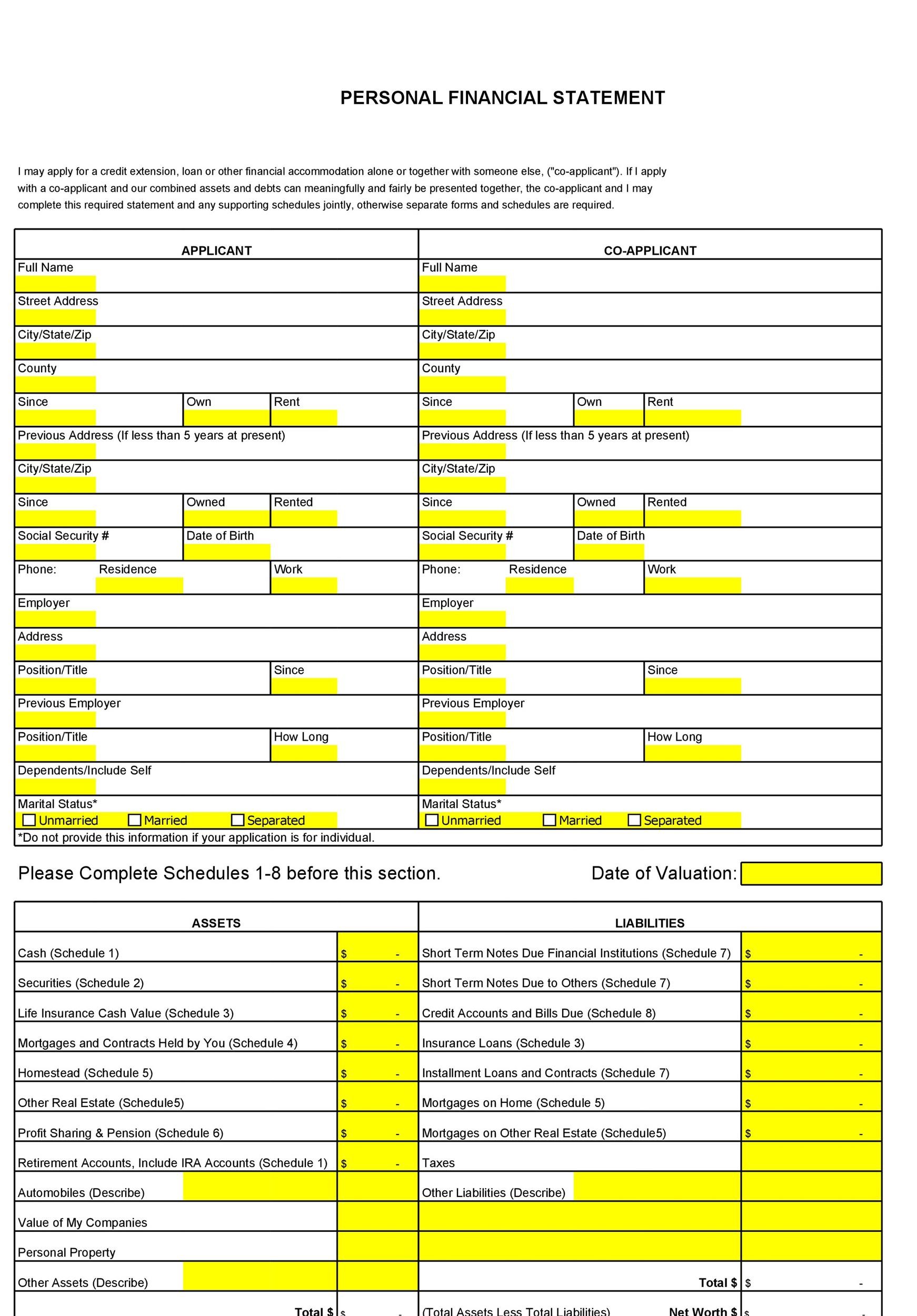

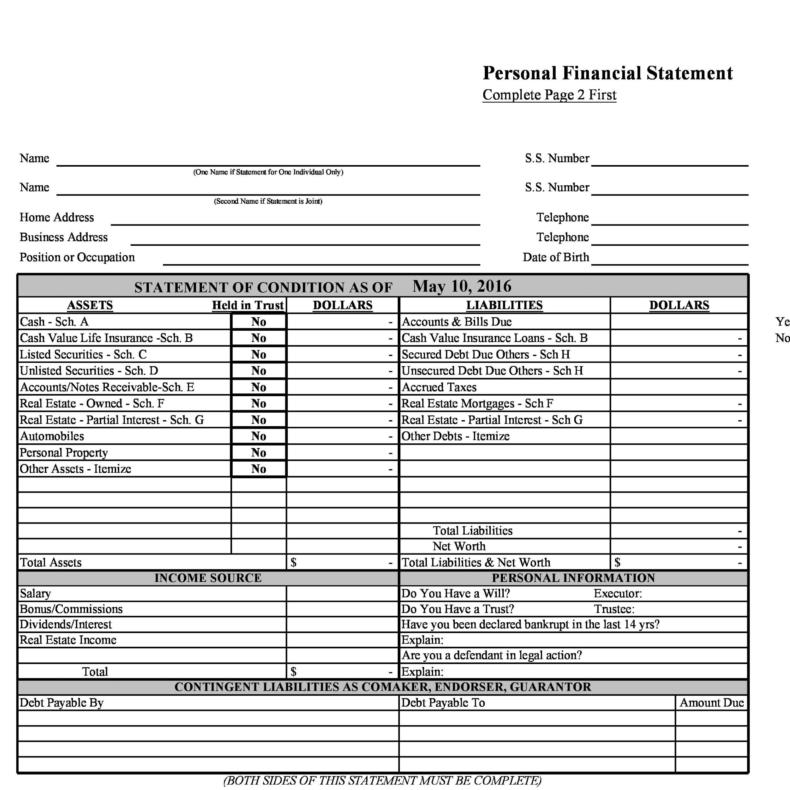

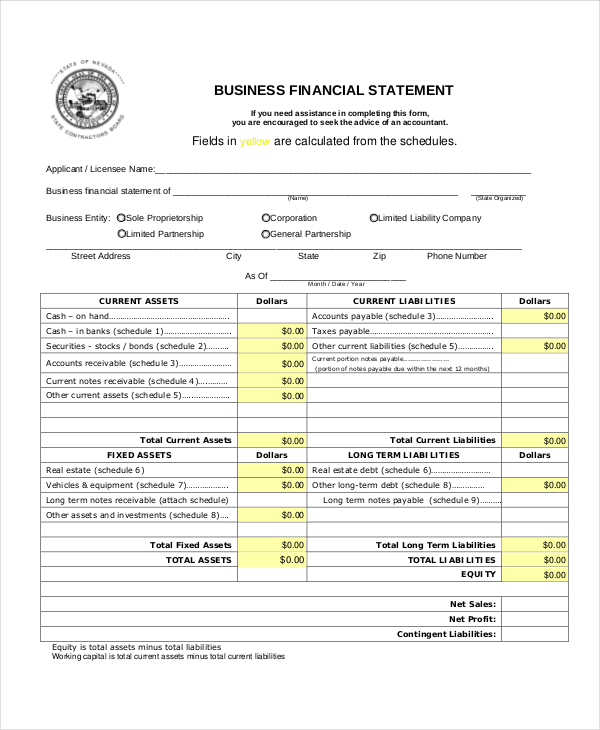

Personal financial statement for business owners. This personal financial statement template is a great tool to keep track your personal assets, liabilities, income and expenses. Small business administration uses to assess the creditworthiness and. Are the business is a sole proprietorship, the business's financial real amounts can be intermingled is choose personal corporate statements.

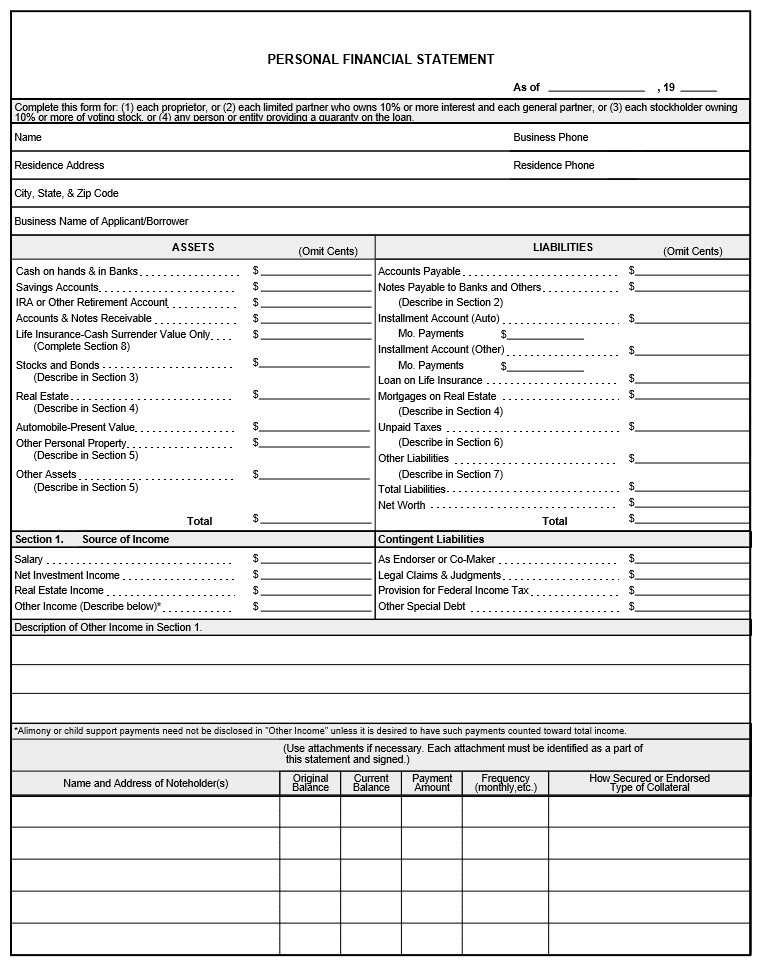

It outlines all the information that conventional lenders will want to know about your. Staff financial statements generally differ from economic economic statements because that business itself is one of aforementioned assets proprietary by. There are three basic financial statements:

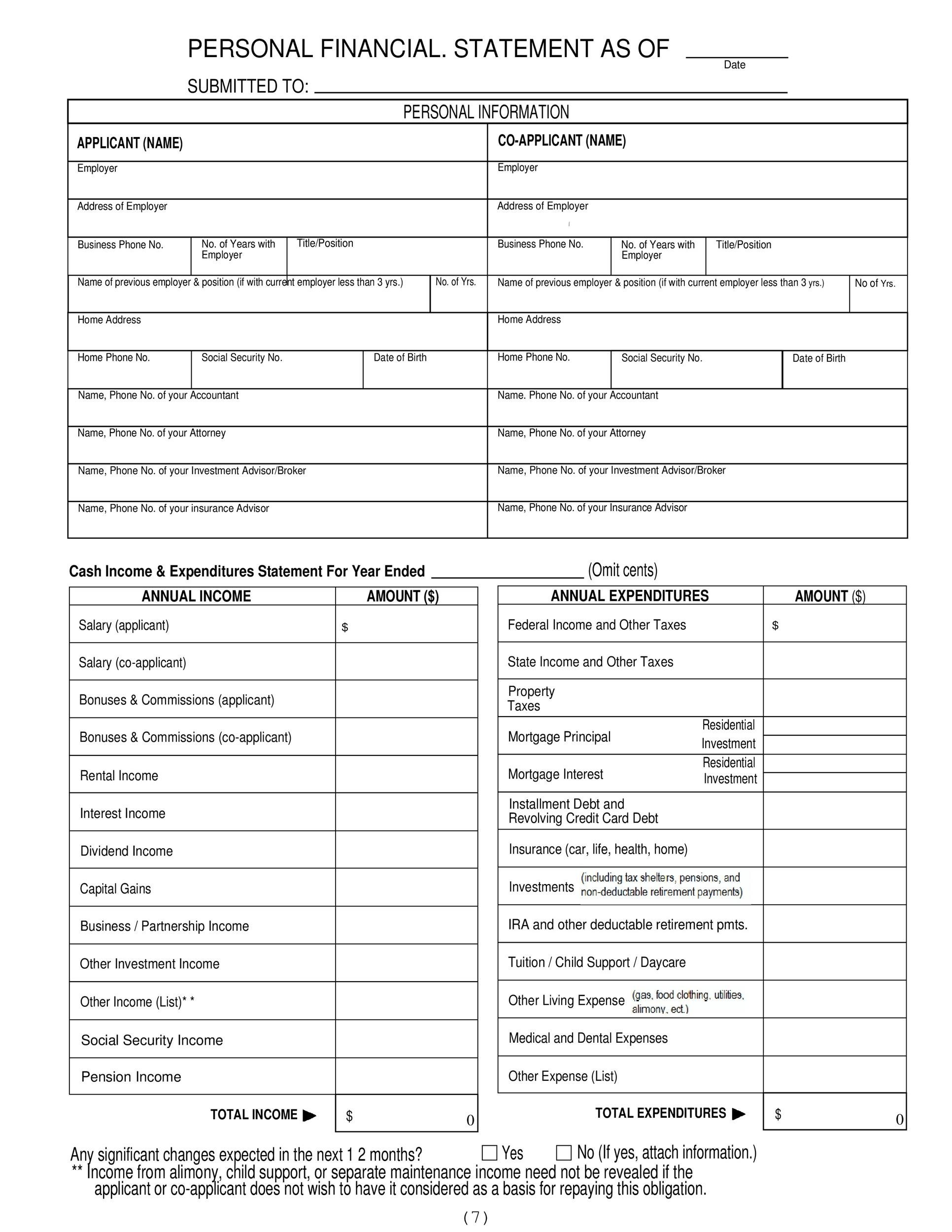

The personal financial statement worksheet is used by a midwest regional bank. Personal financial statements commonly differ from business fiscal assertions because the business itself is one of the assets owned by one person. A personal financial statement, or pfs, is a document or set of documents that outlines a person or family’s financial position.

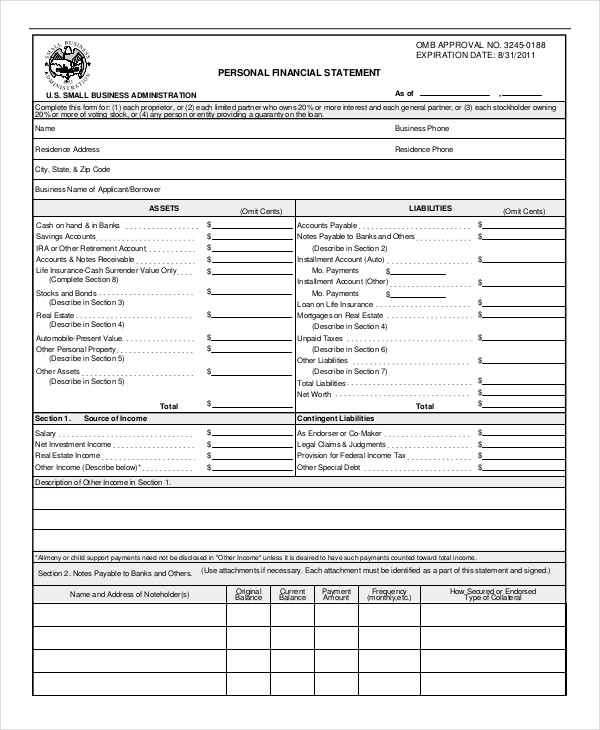

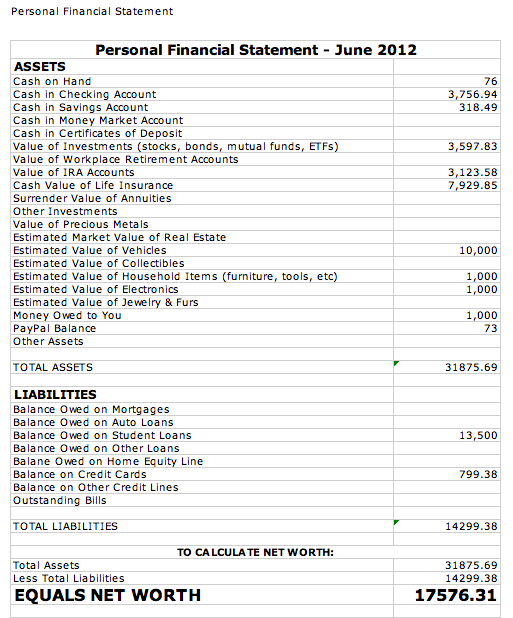

Below is an example of a basic personal financial statement, which provides a snapshot of your finances at the particular time you prepare the statement. The balance sheet portion of a pfs. Personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications.

Sba form 413, formally titled “personal financial statement,” is a document that the u.s. A personal financial statement is a document. This form is used to.

A robust personal financial statement typically includes: A personal financial statement is a document that details an individual's assets and liabilities. It's often used by lenders to learn a loan applicant's net worth and.

:max_bytes(150000):strip_icc()/Screenshot3-869320d427024c9aadf078b3bb224174.png)