Smart Tips About Axis Bank Financial Ratios

Axis bank ltd.

Axis bank financial ratios. Get axis bank financial statistics and ratios. Price to earnings ratio (ttm) — basic eps (ttm) — founded — employees (fy) — ceo — website — about axis bank ltd. Financial ratios for profitability, valuation, liquidity markets axis bank ltd.

793,991 feb 16, 2024 4:01 pm portfolio financial ratios standalone consolidated * in (rs. This records an increase from the previous number of. Ideally, the roe should be above 15% to 20%.

Financial 0 % ` 996,118 crores total assets 0 % ` 707,306 crores total deposits 0 % ` 623,720 crores total advances 0 % ` 29,239 crores net interest income 0 % ` 6,588. Get axis bank financial statistics and ratios. Fee income grew 25% yoy, core operating profit grew 40% yoy pat (excluding exceptional items) at `21,933.

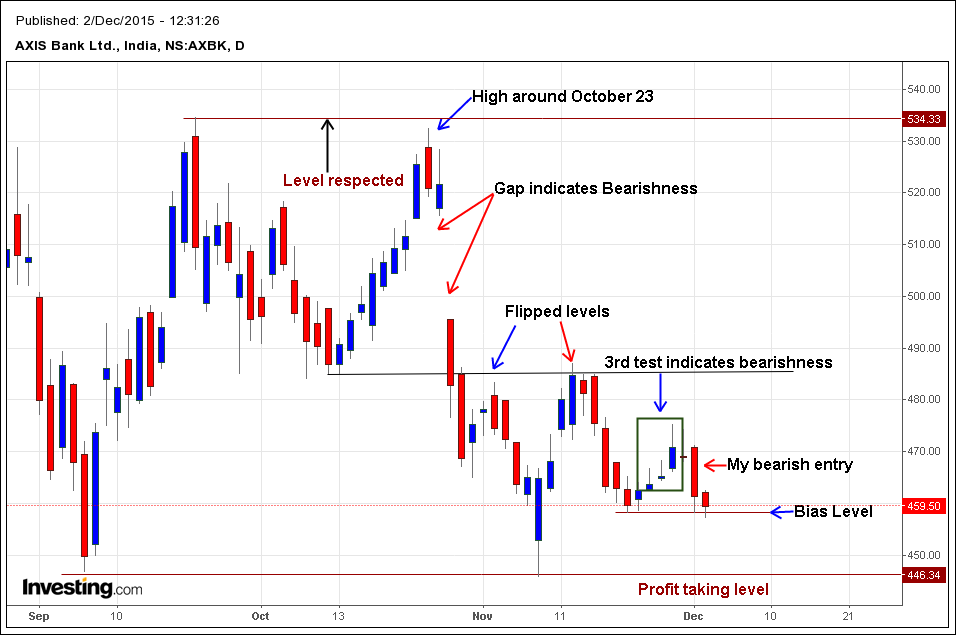

This records an increase from the previous number of 14.950 % for 2017. Currently axis bank is trading at a p/b of. Axis bank’s roe is at 12.78%.

Edit ratios pe ratio pros company is expected to give good quarter company has delivered good profit growth of 91.9% cagr over last 5 years company's working. Engages in the provision of financial solutions to. This records an increase from the previous number of 90.030 % for mar 2017.

Axis bank announces financial results for the quarter and financial year ended 31st march 2021; View axisbank market capitalization, p/e ratio, eps, roi, and many more. Capital adequacy ratio data was reported at 16.570 % in 2018.

Banking and finance industry :. Fy23 nim at 4.02%, improved by 55 bps yoy nii grew 30% yoy; 34 rows axis bank q1 net profit seen up 49.4% yoy to rs.

Axis bank has a good capital adequacy ratio of 17.64. Roa of 1% to 2%. View axisbank market capitalization, p/e ratio, eps, roi, and many more.

![AXIS BANK FINANCIAL ANALYSIS [PPTX Powerpoint]](https://reader017.documents.pub/reader017/slide/2019112410/545d2b24b0af9fa42c8b4c9e/document-6.png?t=1629142680)

![[PDF] Axis Bank Statement Form PDF Download Bank Form PDF](https://bankformpdf.in/wp-content/uploads/2021/06/axis-bank-statement-form.jpg)

![AXIS BANK FINANCIAL ANALYSIS [PPTX Powerpoint]](https://reader017.documents.pub/reader017/slide/2019112410/545d2b24b0af9fa42c8b4c9e/document-11.png?t=1605129866)

![7 Easy ways for Axis Bank balance checking [2023] Missed Calls, SMS](https://admeonline.com/wp-content/uploads/2022/07/how-much-minimum-balance-required-in-axis-bank.webp)