Spectacular Tips About Understanding Trial Balance

Running a trial balance helps you detect any possible errors.

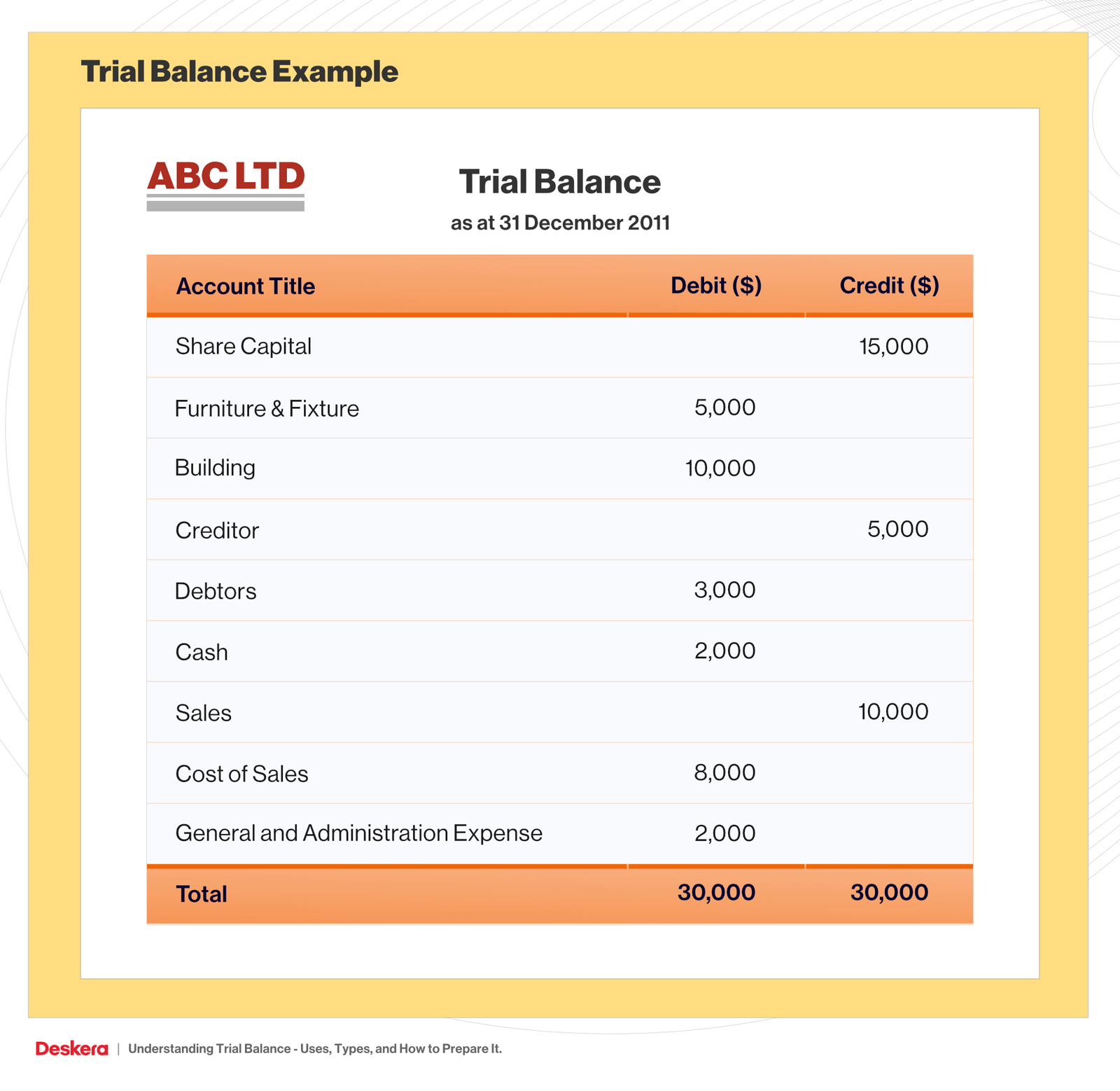

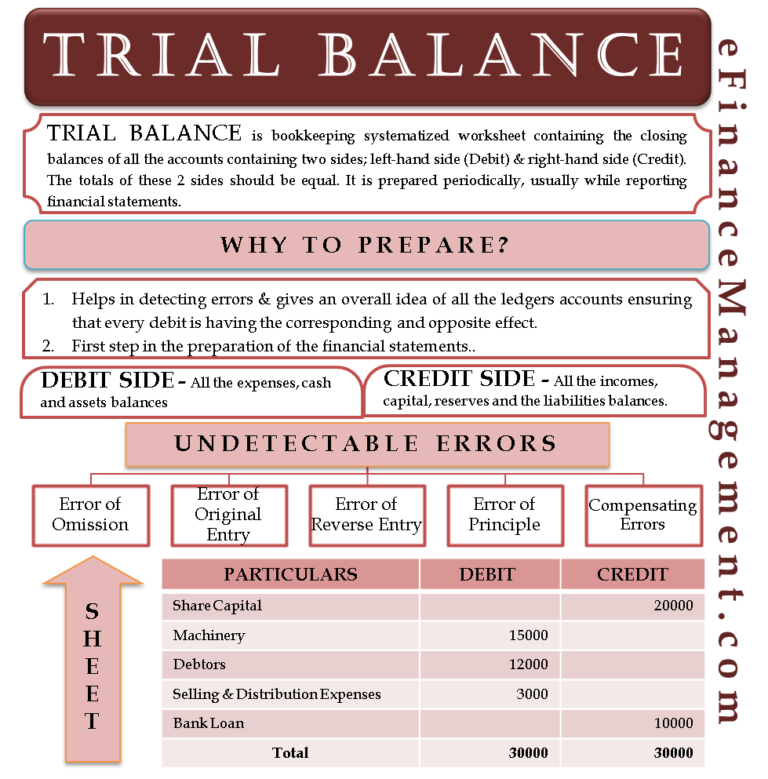

Understanding trial balance. Understanding the concept of a trial balance is fundamental in the significance of a trial balance in accounting cannot be overstated. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

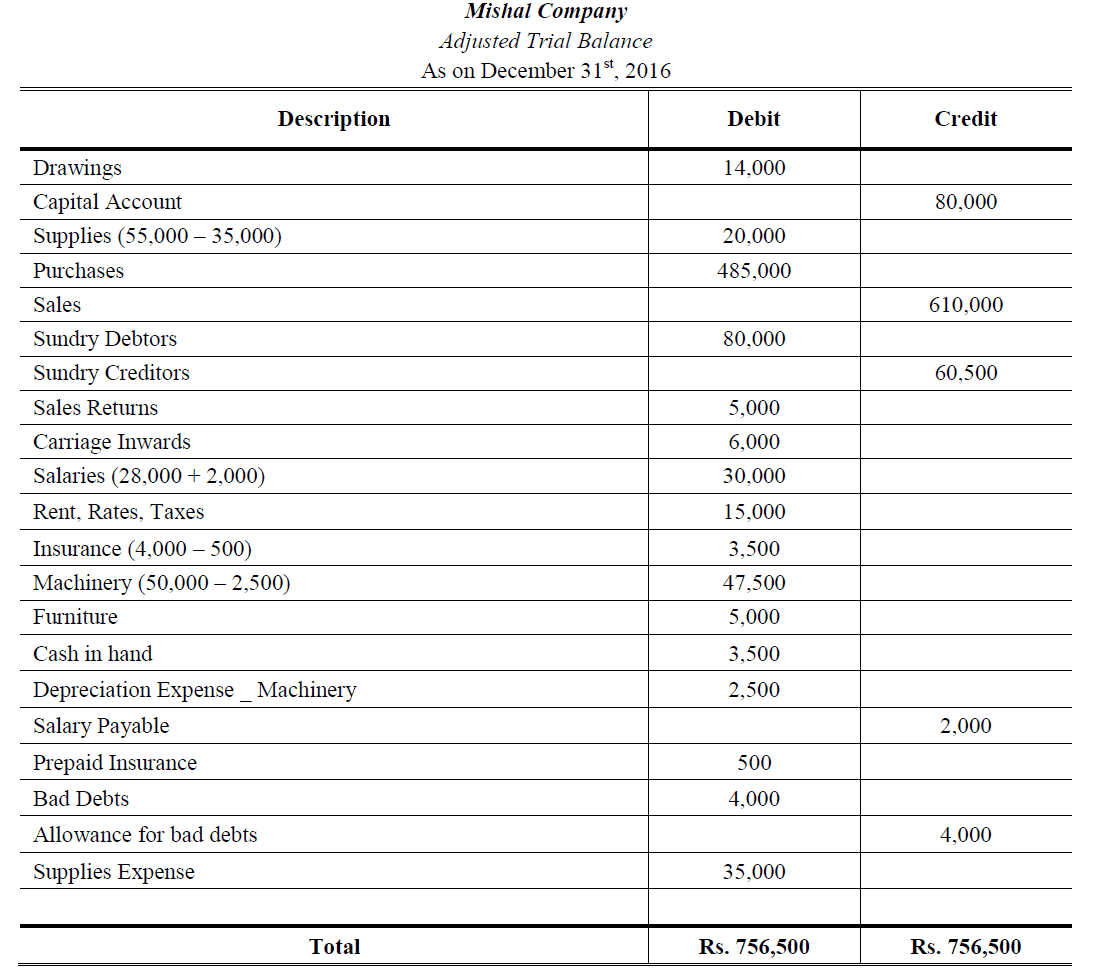

It is not just a precursor to preparing significant financial statements such as the income statement and components of a trial balance If the sum of all credits does not equal the sum of all debits, then there is an error in one of the accounts. By listing all the ledger accounts and their respective debit or credit balances, it provides a snapshot of the accounting equation’s current standing, where assets must equal liabilities.

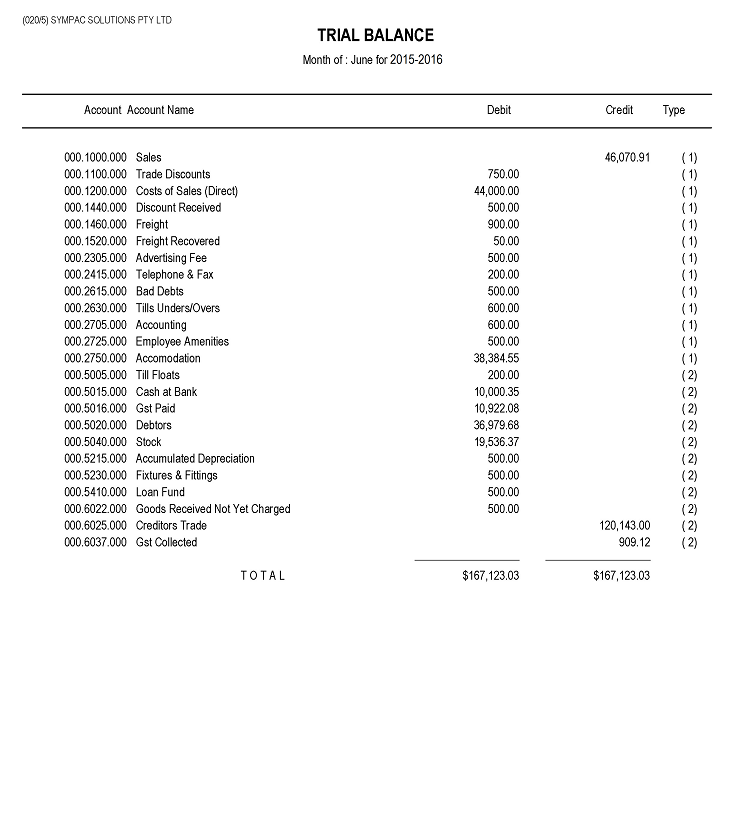

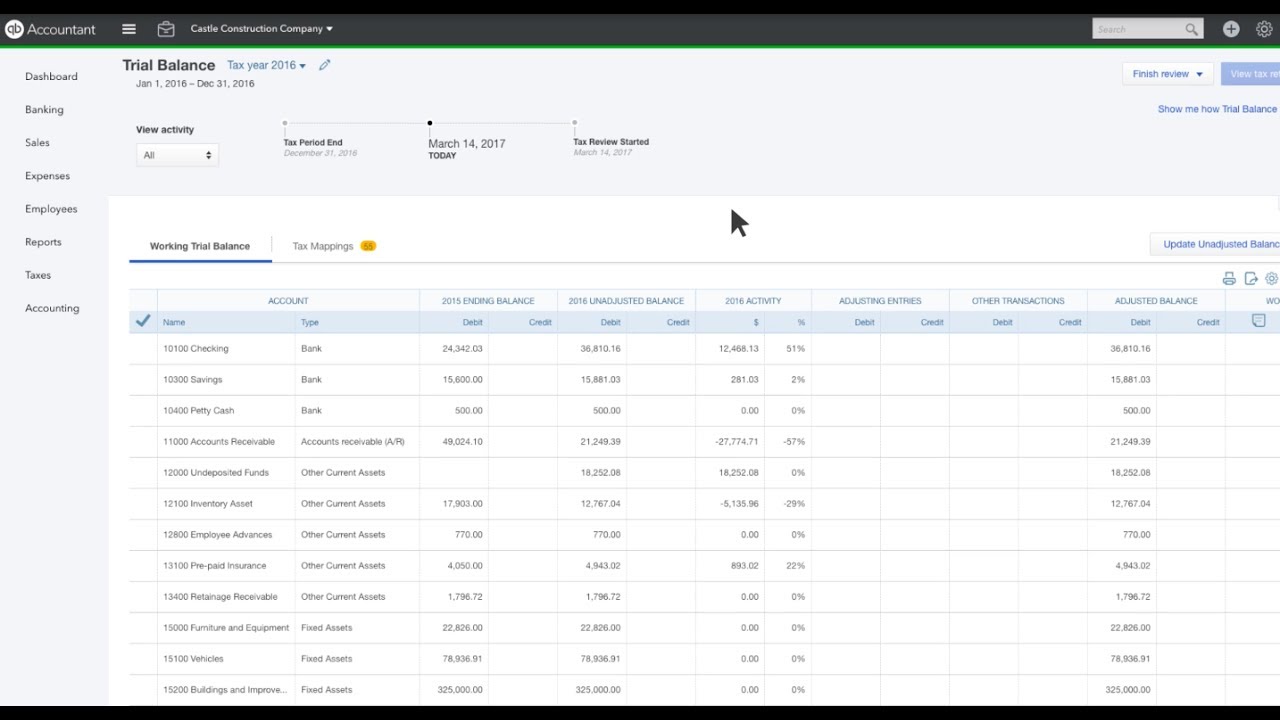

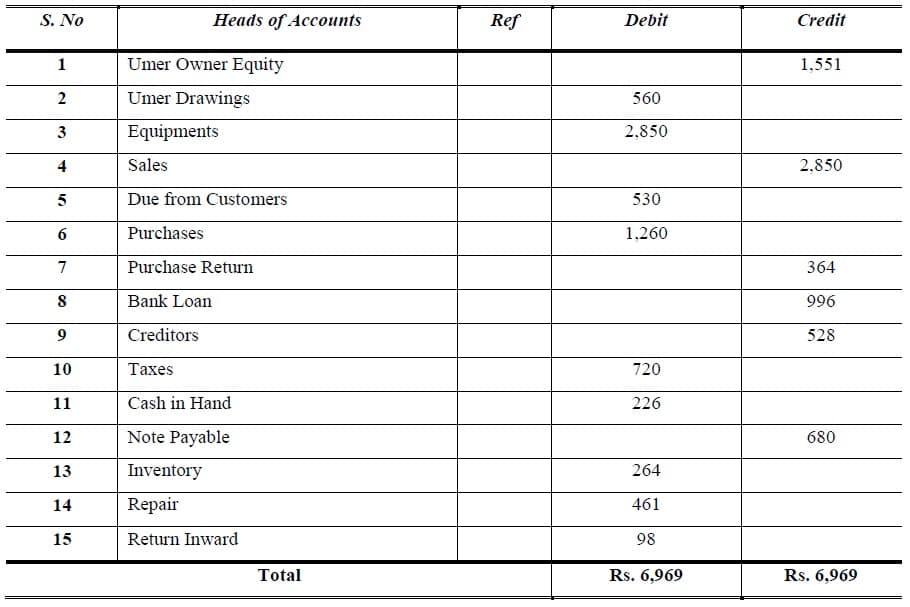

The trial balance includes balance sheet and income statement accounts. Trial balance is a statement that lists the balances of all general ledger accounts used in an organization. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

A trial balance is used in bookkeeping to list all the balances in your business’s general ledger accounts. (often the accounts with zero balances will not be listed.) the debit balance amounts are. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

This statement comprises two columns: Understanding trial balance what are the uses of a trial balance? Why have a trial balance?

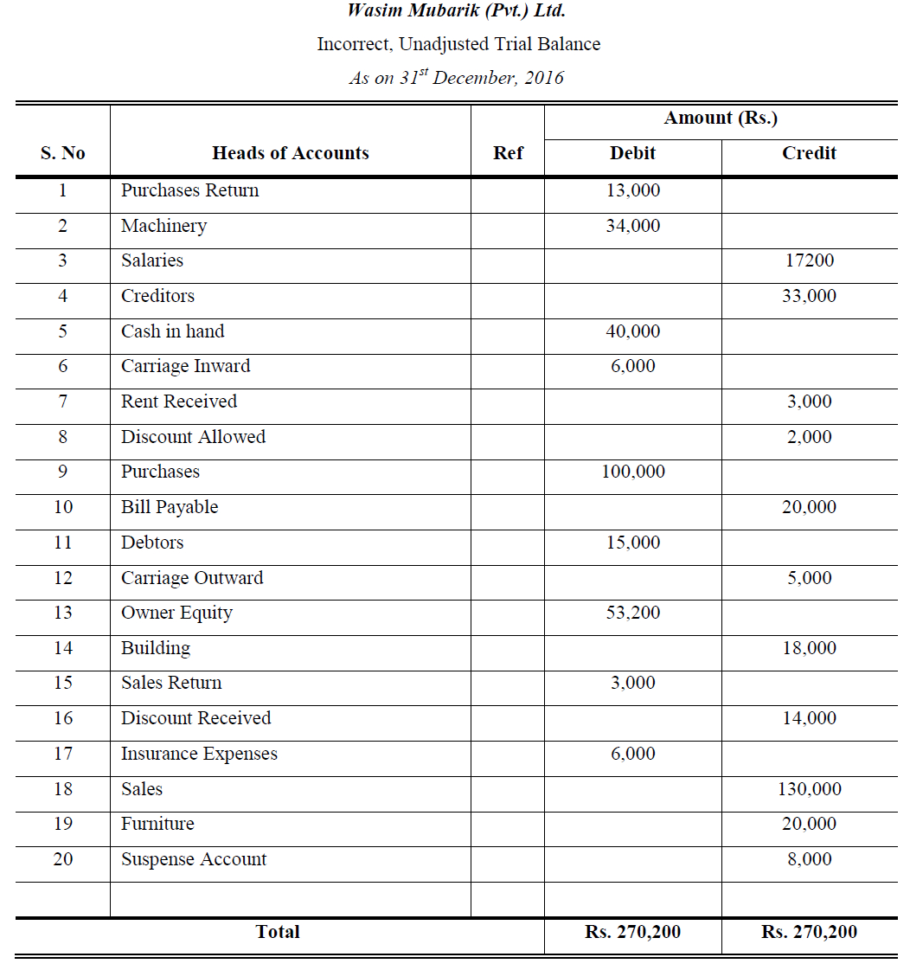

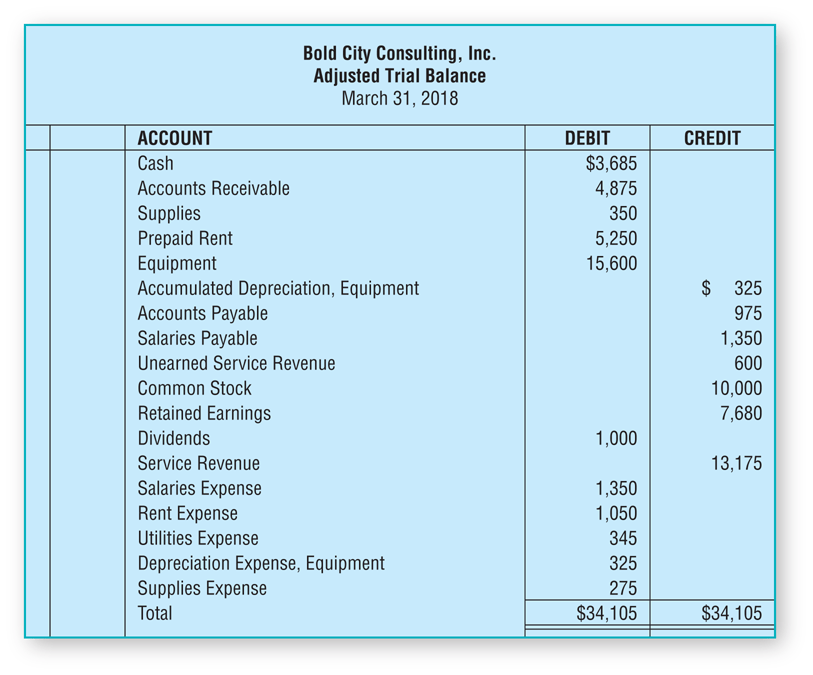

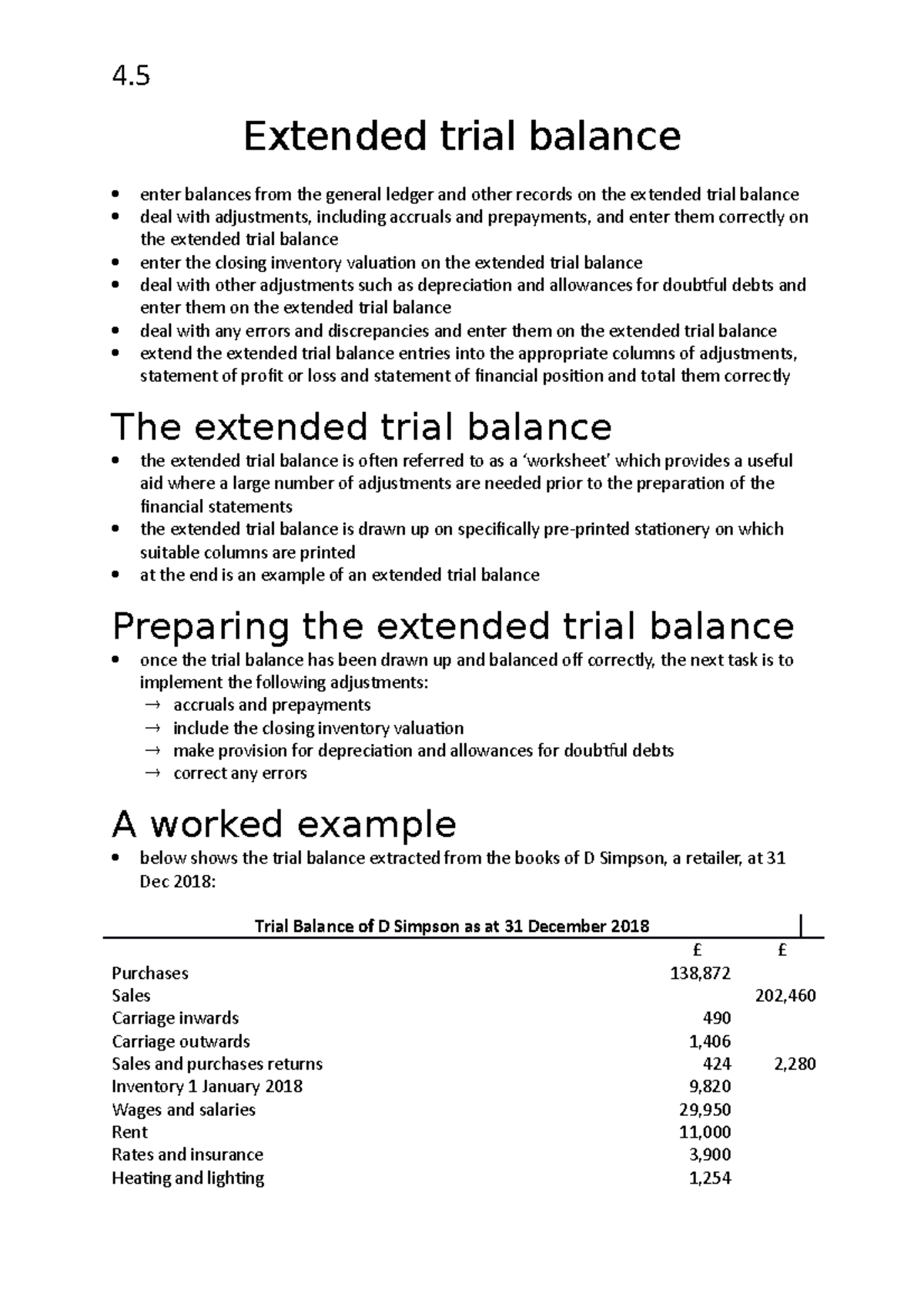

Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses , gains, and. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Ledger balances are segregated into debit balances and credit balances.

What adjustments do accountants make? A trial balance is an indispensable financial tool for business owners, helping them identify errors, prepare financial statements, and assess their company's financial health. If the total of all debit values equals the total of all credit values, then the accounts are correct—at least as far as the trial balance can tell.

It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. Account descriptions help users recognize the type of account (e.g., asset, liability, revenue, expense) and its role in the financial statements. They offer additional context and understanding of the accounts listed.

It compiles all ledger accounts and details their balances as either debits or credits by following the core principle that. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)