Unique Tips About Is Accounts Receivable On Income Statement

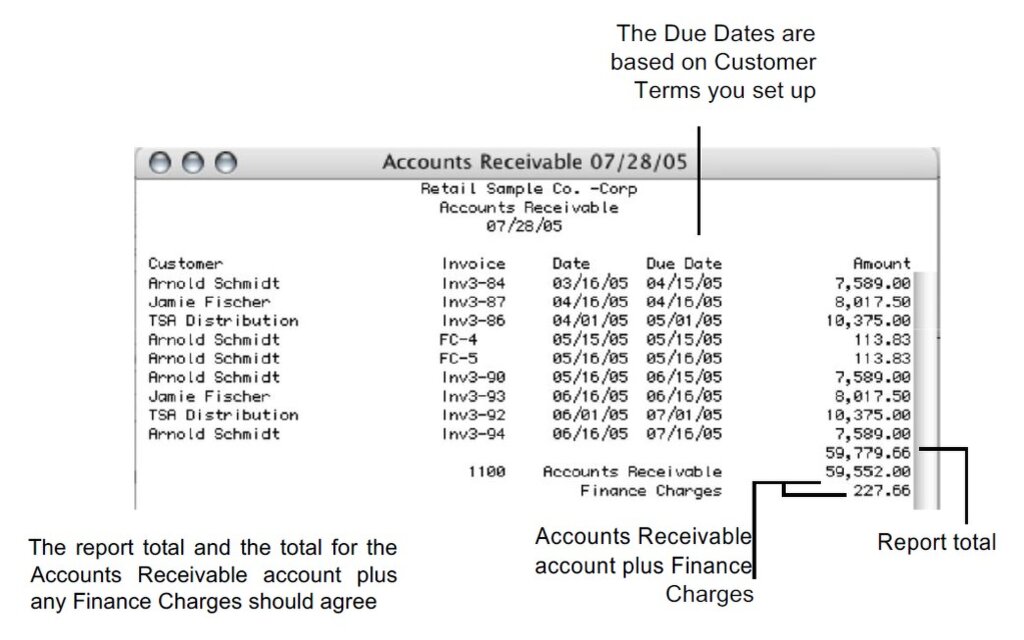

Accounts receivable is a current asset account that keeps track of money that third parties owe to you.

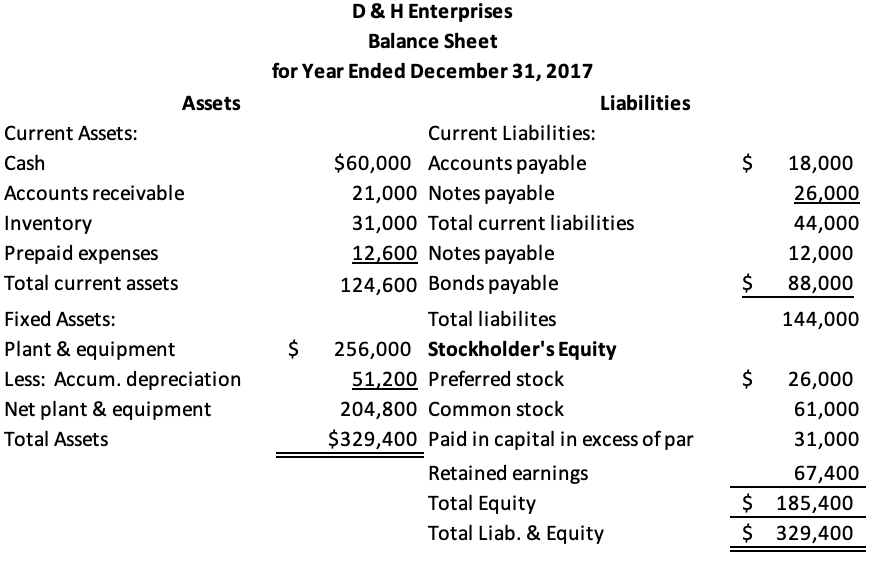

Is accounts receivable on income statement. Yes, accounts receivable should be listed as an asset on the balance sheet. The amount that direct delivery will incur. Therefore, it becomes a part of the balance sheet and falls under assets.

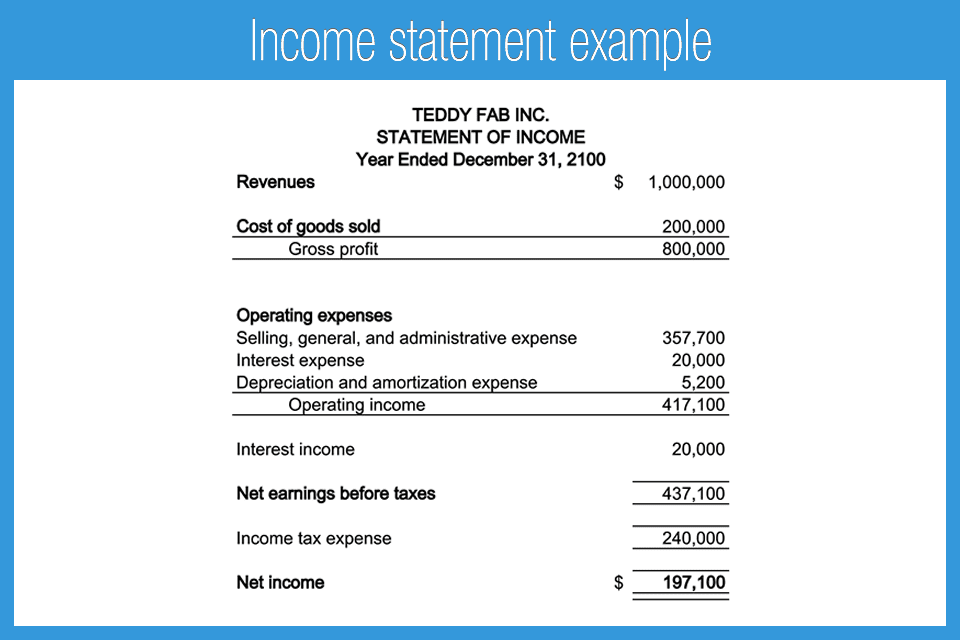

No, accounts payable is a liability on the balance sheet. Your accounts payable is accounts receivable for the other company. If joe is preparing monthly income statements, joe should report one month of interest expense on each month's income statement.

Written by cfi team what is the accounts receivable turnover ratio? Public accounts committee sitting. Accounts payable (a/p) are invoices you owe to other companies.

Increase in accounts receivable is recorded as a $20,000 growth in accounts receivable on the income statement. This money is typically collected after a. Book a free demo find out more is accounts receivable on income statement?

Again, these third parties can be banks, companies, or even people who. Bookkeeping guidebook how to audit receivables new controller guidebook how to analyze accounts receivable anyone analyzing the results of a. Accounts receivable offsets the amount listed on the income statement.

If a company has delivered products or. The answer is yes! Income statements and balance sheets are two of three financial reports companies.

Are you wondering where accounts receivable fits into an income statement? Accounts receivable is a financial term that refers to the amount of money owed to a company by its customers or clients for goods and services sold on credit. Is accounts payable an asset?

Accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Including accounts receivable on the income statement can provide several benefits. The accounts receivable does not go on the income statement on its own.

As a business owner, it’s crucial to understand how this important financial metric impacts your overall financial health. The amount is a balance rather than a transaction. What are the benefits of including accounts receivable on the income statement?

The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio. Go back to the table of contents. Accounts receivable (a/r) reflects the total of credit payments owed to your business by your customers and that should be received within the next year.

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)