Spectacular Info About Cash Flow Reconciliation

Lyft said incorrectly that a key margin metric was expected to rise by 500 basis points this year, but brewer later corrected that forecast to an increase of 50 basis points.

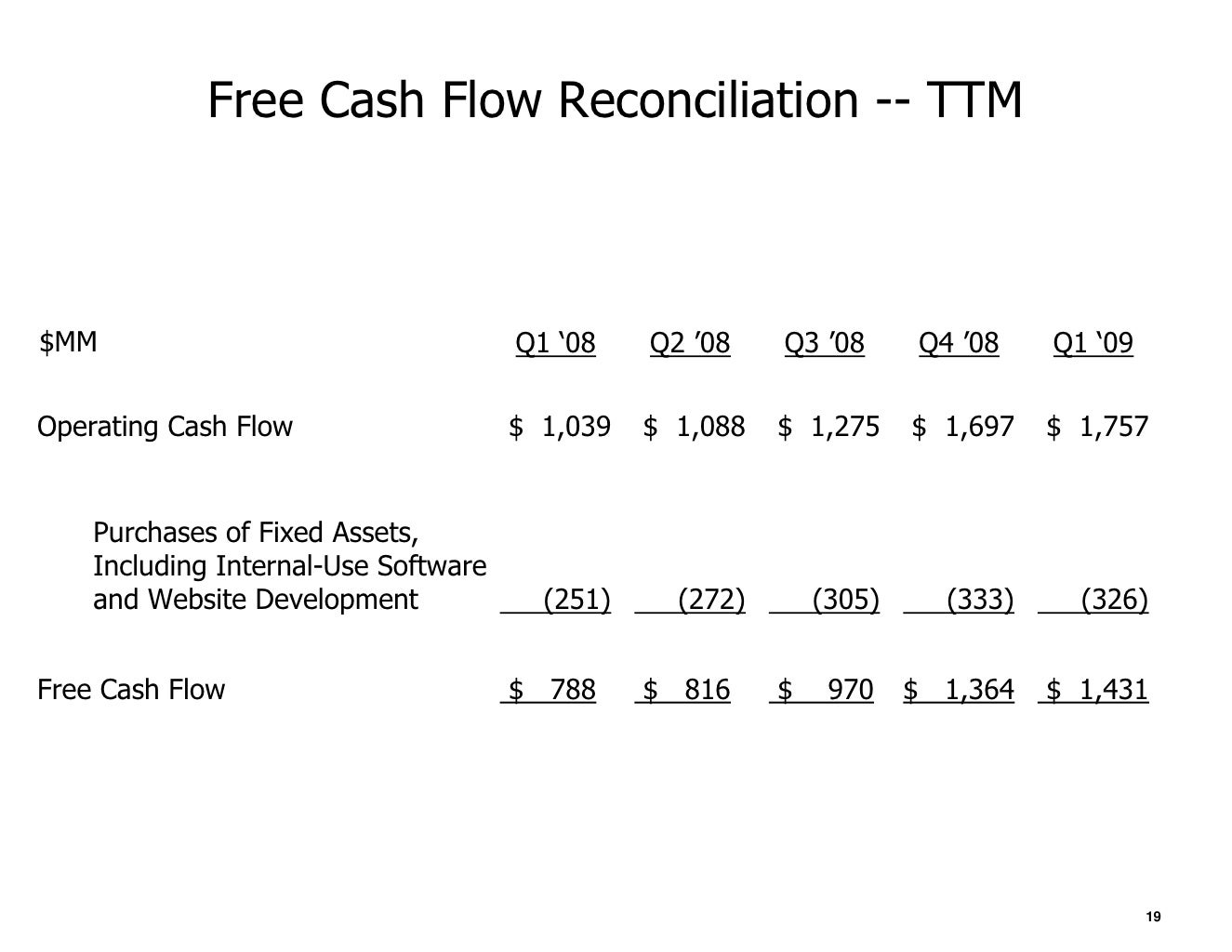

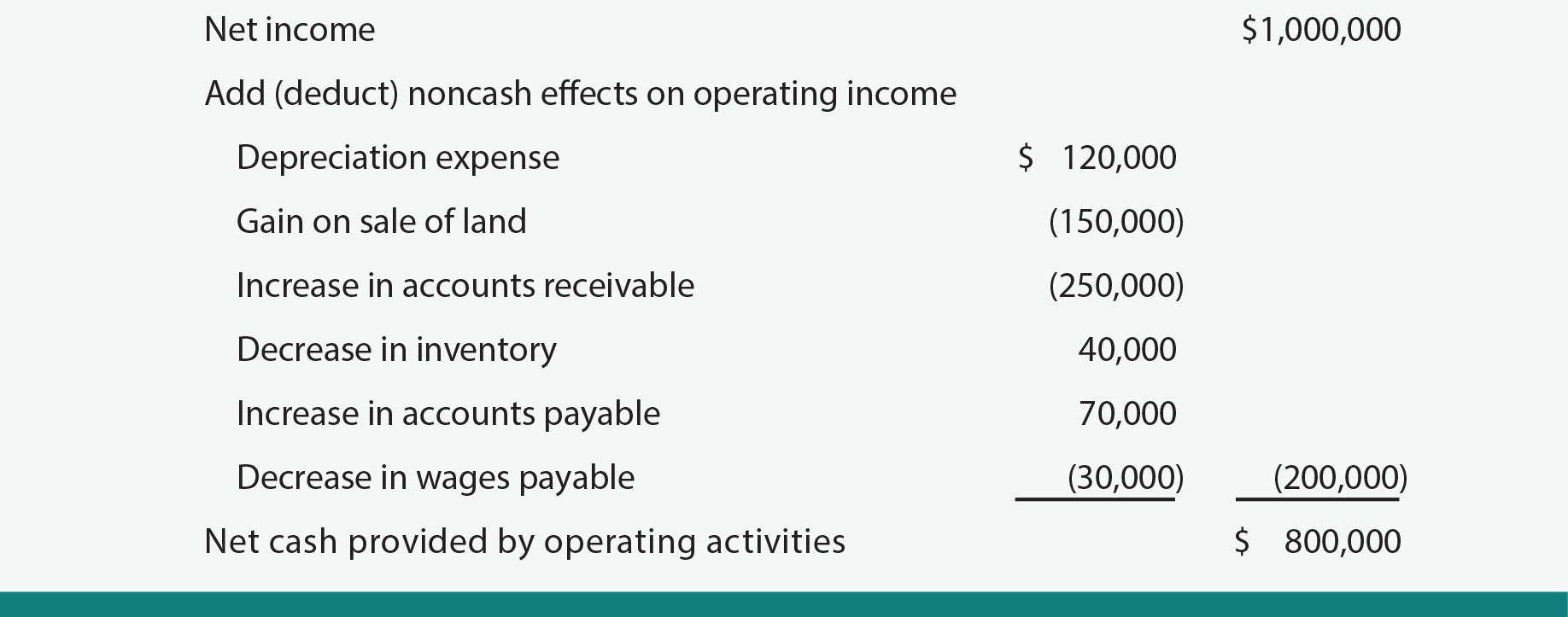

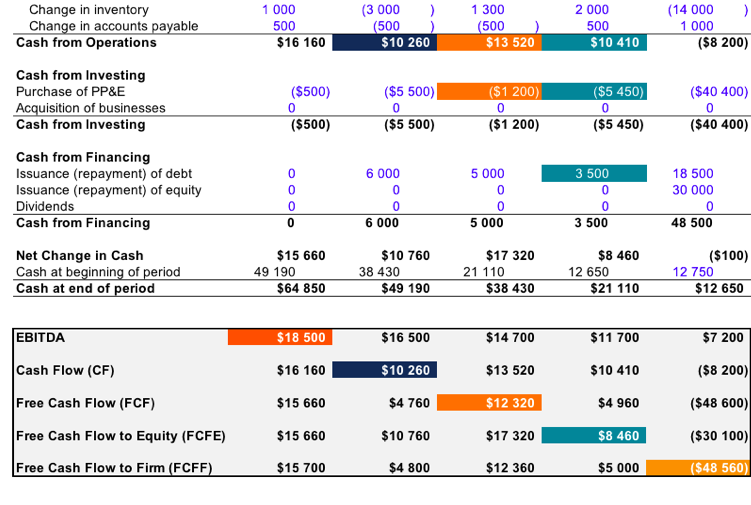

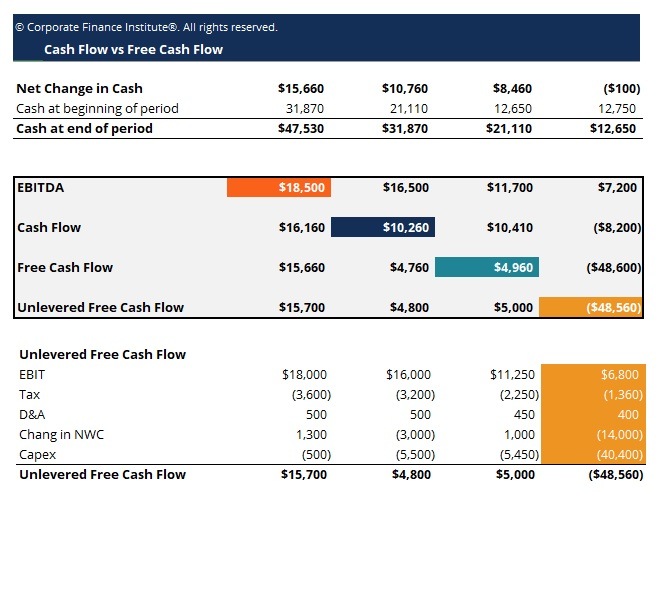

Cash flow reconciliation. This is the ultimate cash flow guide to understanding the differences between ebitda, cash flow from operations (cf), free cash flow (fcf), unlevered free cash flow, and free cash flow to firm (fcff). Reconciliation is an accounting procedure that compares two sets of records to check that the figures are correct and in agreement. To reconcile net income to cash flow from operating activities, these noncash items must be added back, because no cash was expended relating to that expense.

For example, cash flow statements can reveal what phase a business is in: 76% reimbursable prospect pipeline 15x ending backlog with opportunities across all three segments revamped capital structure lowers interest expense while supporting future growth anticipate improved cash flow. Written by jeff schmidt what is the statement of cash flows?

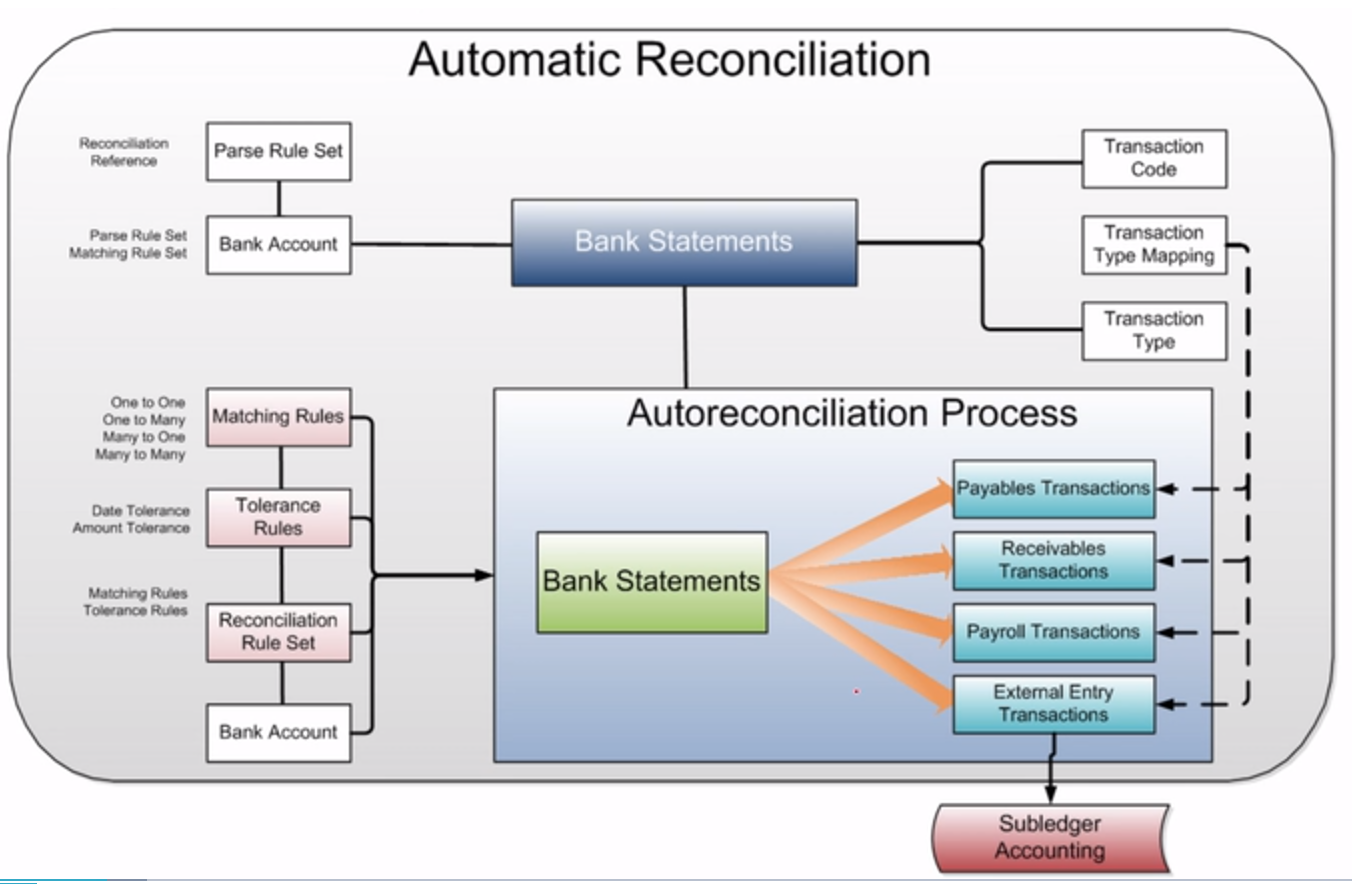

Configuration for one exposure from operations. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Configuration guide for sap s/4hana finance for cash management.

So how can we reconcile the fact that it looks like we made $200 in income, but we lost $200 in cash? Flow follows the global x u.s. Below is a preview of the cash flow reconciliation template:

And a reconciliation presented to amounts reported in the statement of financial position [ias 7.45] This cash flow reconciliation template will help you differentiate between ebitda, cf, fcf, and fcff. It ensures that businesses only pay for what they have ordered and received.

The balancing figure is the cash spent to buy new ppe. You'll need to make three types of adjustments to reach operating cash flow. Operating activities dividends from joint ventures and associates returns on investments and servicing of finance taxation

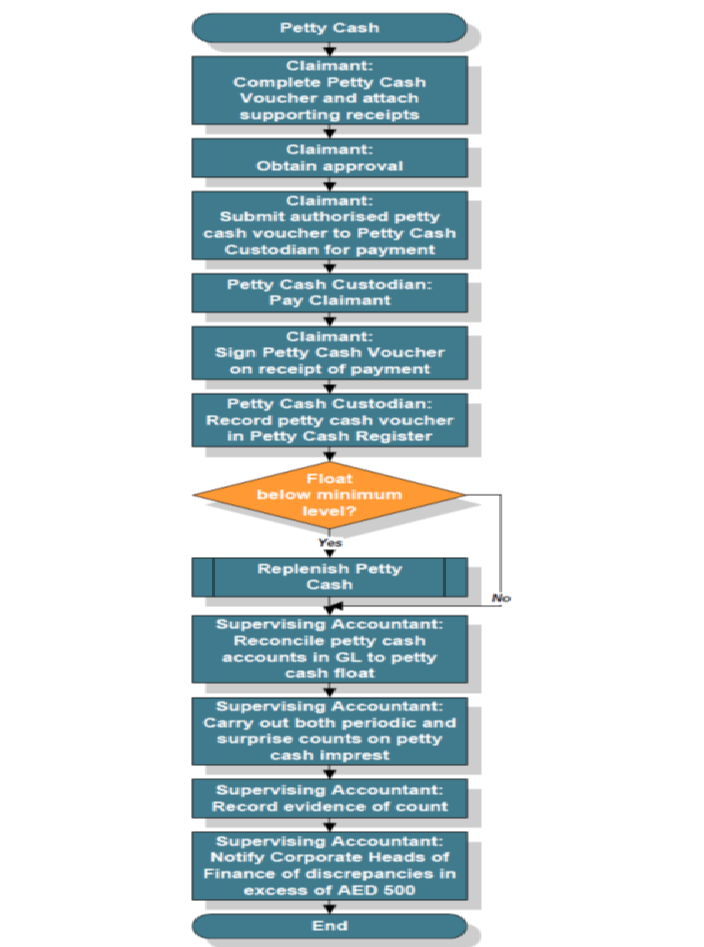

Proper invoice reconciliation helps manage cash flow by avoiding overpayments and unexpected liabilities. Cash reconciliation is a fundamental accounting practice designed to ensure the amounts recorded from sales transactions accurately reflect the cash, checks, and other payment forms collected through a point of sale (pos) system. On propensity’s statement of cash flows, this.

How to perform a cash reconciliation step 1: Compare internal cash register to the bank statement the first step is to compare transactions in the internal register and the bank account to see if the payment and deposit transactions match in both records. This divergence between share price and.

Cash flow reconciliation template. Download reports from financial systems. It can also reveal whether a company is going through transition or in a state of decline.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Cash flow reconciliation is the process of comparing your cash flow forecast with your actual cash flow statement, which records the historical movements of cash in and out of your. Determine the accounting period that is being reconciled.