Brilliant Tips About Cash Flow Statement Indirect Method In Tally

Another item that is often overlooked is the amount of interest and income taxes paid when using the indirect method of reporting the statement of cash flows.

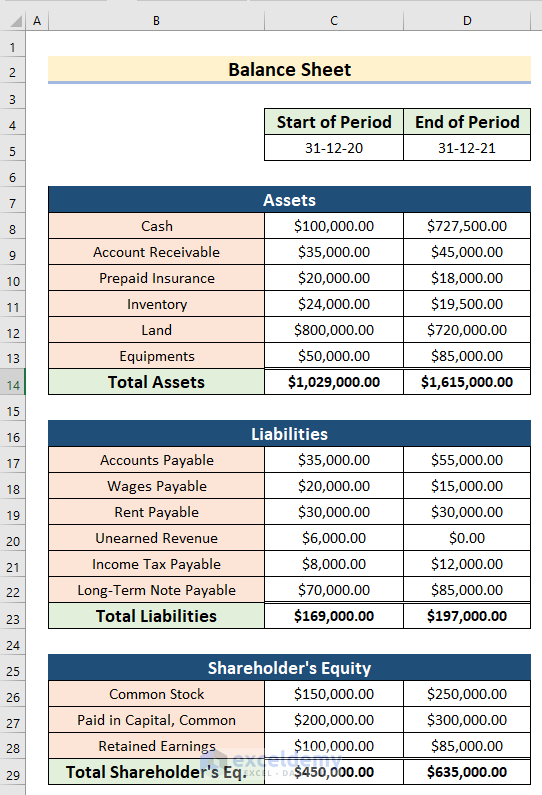

Cash flow statement indirect method in tally. There are two widespread ways to build a cash flow statement. A cash flow statement concentrates. If the company is following a different.

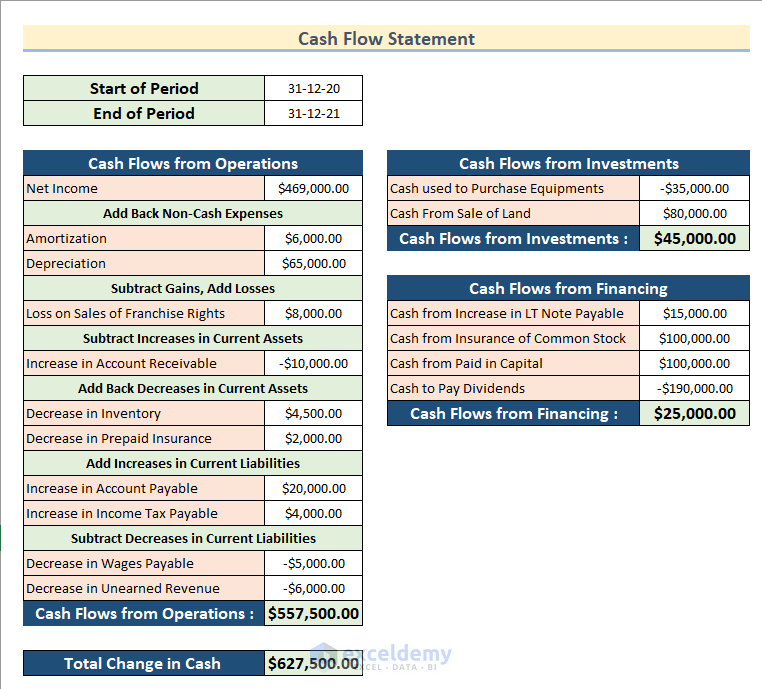

The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions. What is the cash flow statement indirect method? Using the indirect method, operating net cash flow is calculated as follows:

With this app, you can create the cashflow statement based on the indirect calculation method. The direct method uses actual cash inflows and outflows from the. With this method, you can determine precisely how much money you’ve spent and brought in,.

The cash flow statement is. How to prepare a cash flow statement. In cash flow statements screen, indirect method will be displayed as the default method used for generation of cash flow statement.

This app enables you to create a cash flow statement based on the indirect calculation method. What is the cash flow statement indirect method? Cashflow = cash flow from.

It starts with a business’s net income. Gateway of tally > display > statutory reports > mca reports > list of accounts > cash flow statement tally.erp 9, allows the user to prepare the cash flow statements using direct method or indirect method. The cash flow statement indirect method presents data regarding the sums of money that a company.

The cash flow indirect method makes sure to automatically. The indirect method for the preparation of the statement of cash flows involves the adjustment of net. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the.

Add back noncash expenses, such as depreciation,. A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. One way is to use the indirect method of cash flow statements.

Go to gateway of tally > display > cash/funds flow > cash flow. The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. Statement of cash flow indirect method.

In will be displayed as the default method used for. This step adjusts income statement. The direct method only takes the cash transactions into account and produces the cash flow from operations.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)