Nice Info About P&l Cash Flow

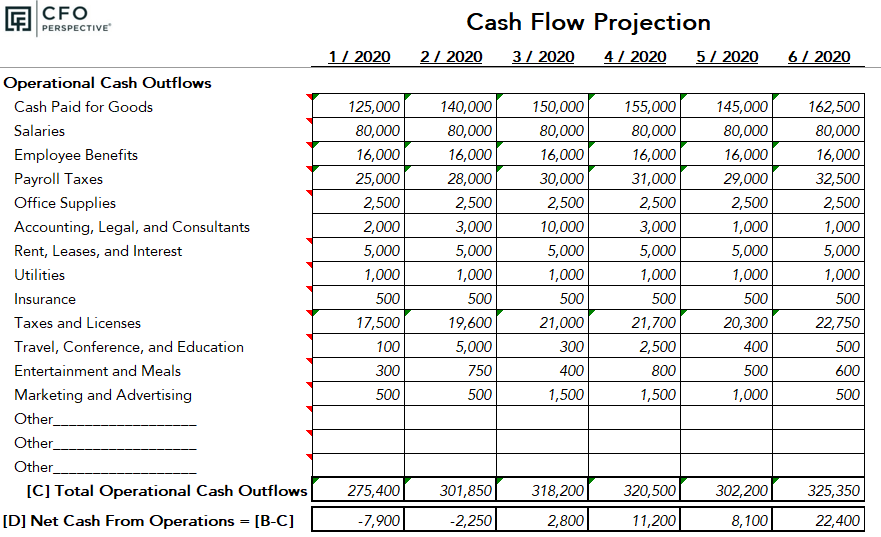

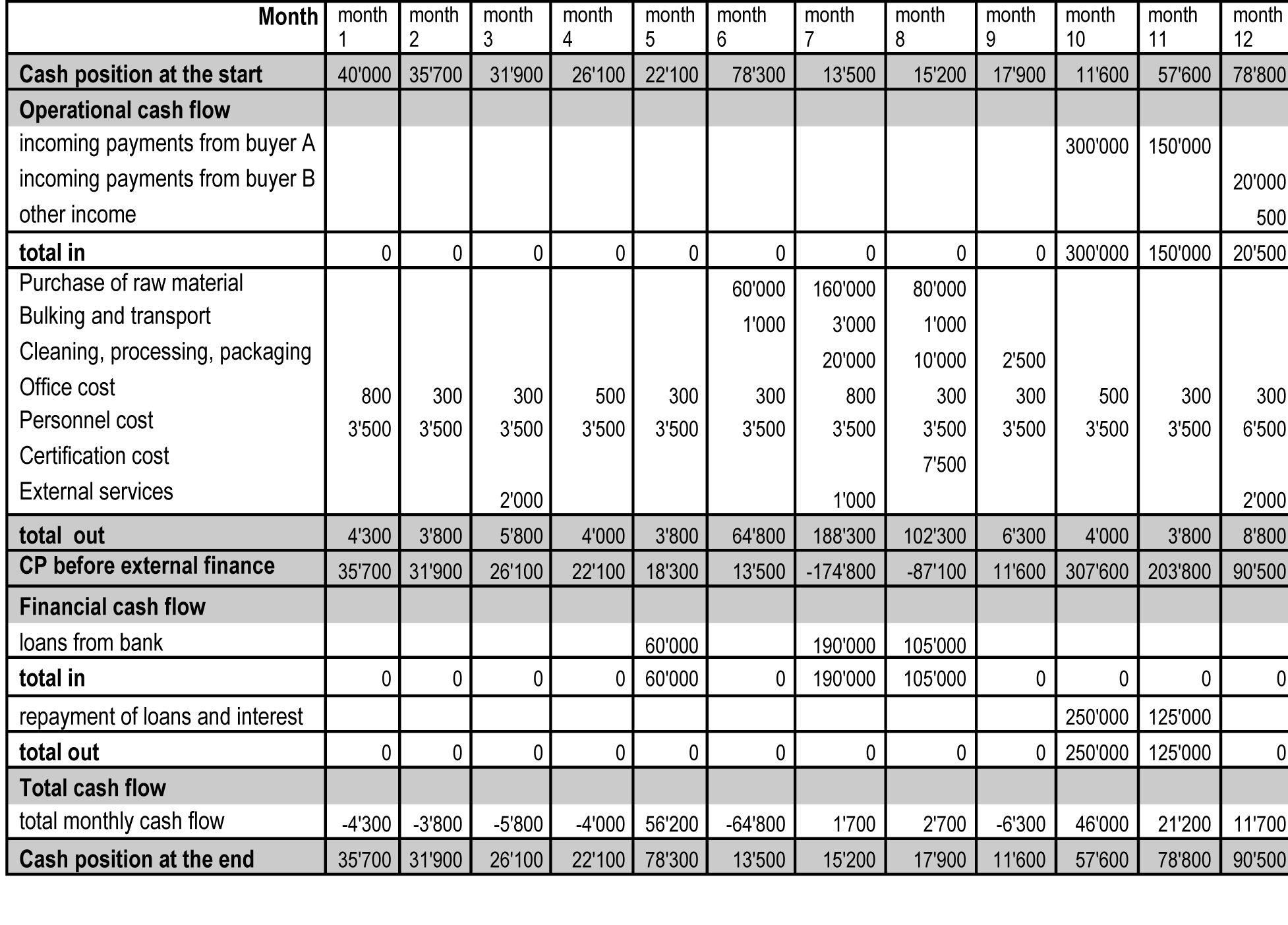

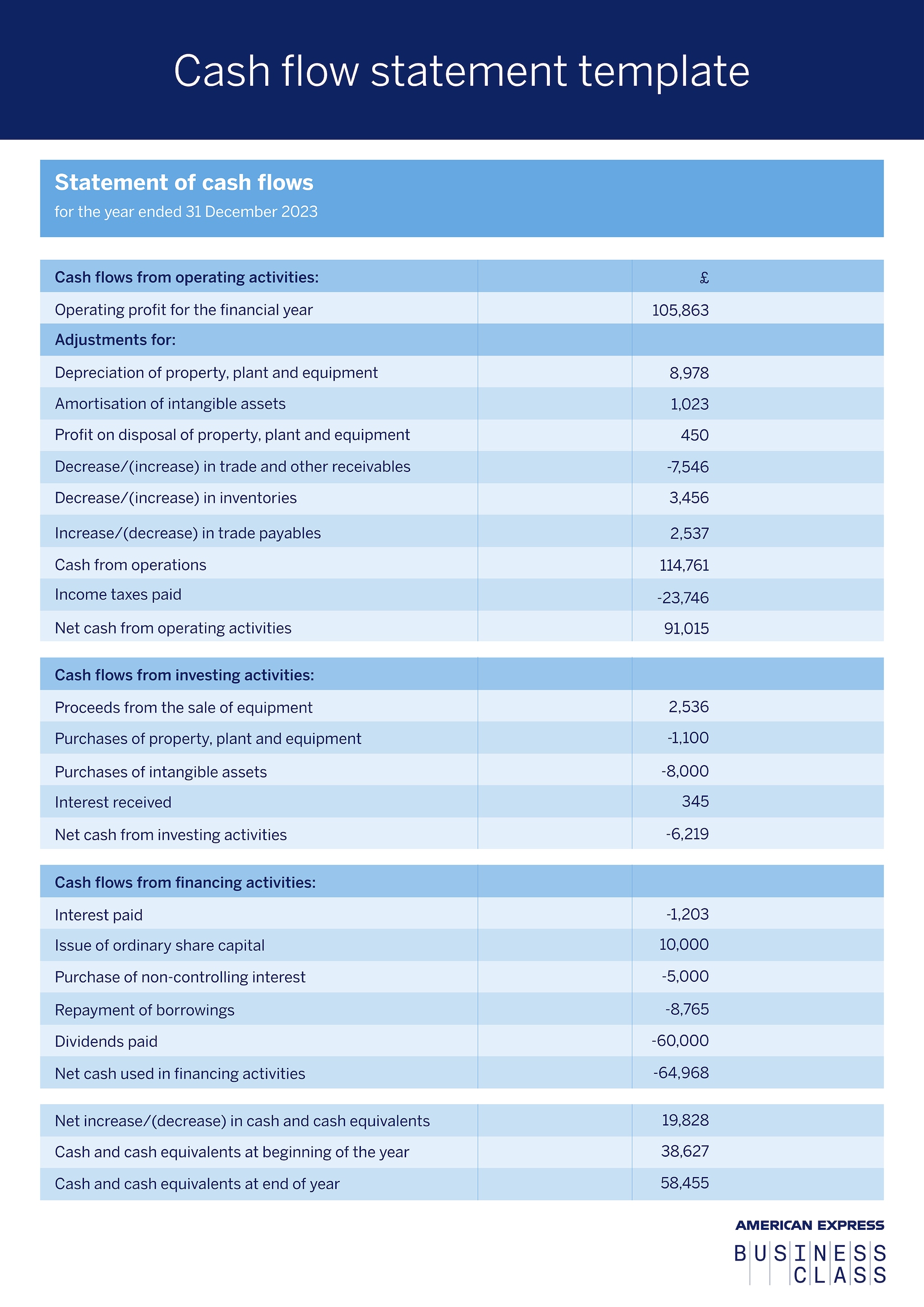

The cash flow statement details a company's cash inflows and cash outflows during that period.

P&l cash flow. Depreciation of the computer over three years of useful life, does. A p&l statement provides information about whether a company can. But the p&l statement details the financial concept of profits, which might not impact cash flow in the.

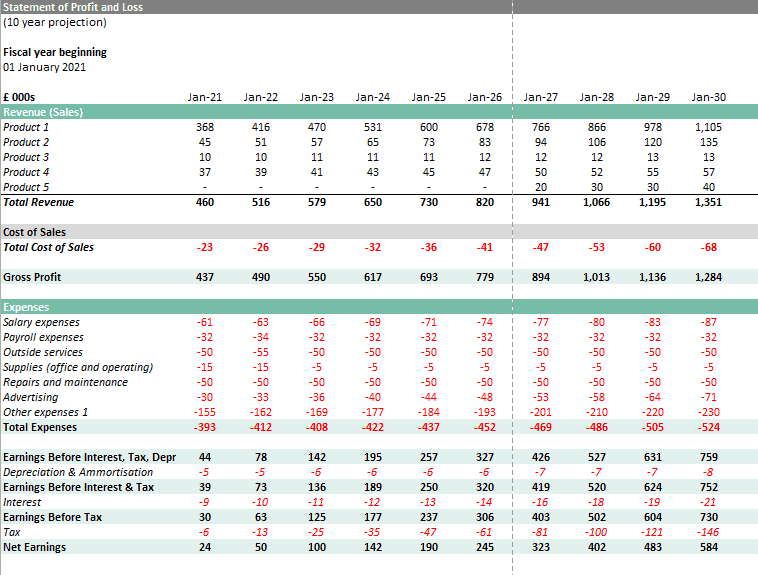

It is a video of the organization’s financial transactions. A profit and loss statement (p&l), also known as an income statement, is a critical financial document that provides a snapshot of a business's performance over a specific period. One of the most common reasons small businesses start producing profit and loss statements is to show banks and investors how profitable their business is.

The p&l statement is one of the three most important financial statements for business owners, along with the balance sheet and the cash flow statement (or statement of cash flows). The other two are the balance sheet and the cash flow statement. Taking into account the profit and cash generation in 2023, as well.

Cash flow statement. For example, payment to buy a new computer affects cash; The p&l statement is one of three financial.

In particular, the p&l statement shows the operating performance of the company as well as the costs and expenses that impact its profit margins. Revenue how much money the business makes in the form of cash or receivables. By running short on cash (also known as a cash crunch).

The p&l and cash flow statements for u.s. Companies, at least those that are publicly traded, are laid out in a mandatory quarterly filing to the securities and exchange commission called the form 10k. Download cfi’s free profit and loss template (p&l template) to easily create your own income statement.

Along with balance sheets and cash flow statements, p&l statements are one of the three main financial disclosures filed by public companies on a quarterly and annual basis. Essential items to look at under the p&l are; This tutorial demonstrates how we can use existing numbers in a profit & loss statement and balance sheet to construct a simple cash flow statement.

Your cash flow reveals your business’s liquidity. The downloadable excel file includes four templates. The outcome is either your final profit or loss.

The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. For example, growing profits on your p&l statement may provide the cash flow to purchase more assets that appear on your balance sheet. P&ls are prepared to reflect business activity in a given period, for example in a month, quarter, or year.

The profit and loss statement is used to record revenues, expenses and derives from that what the profit is. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. It breaks down all your company's financial activities every month, quarter, or year.