Inspirating Tips About On Balance Sheet Off

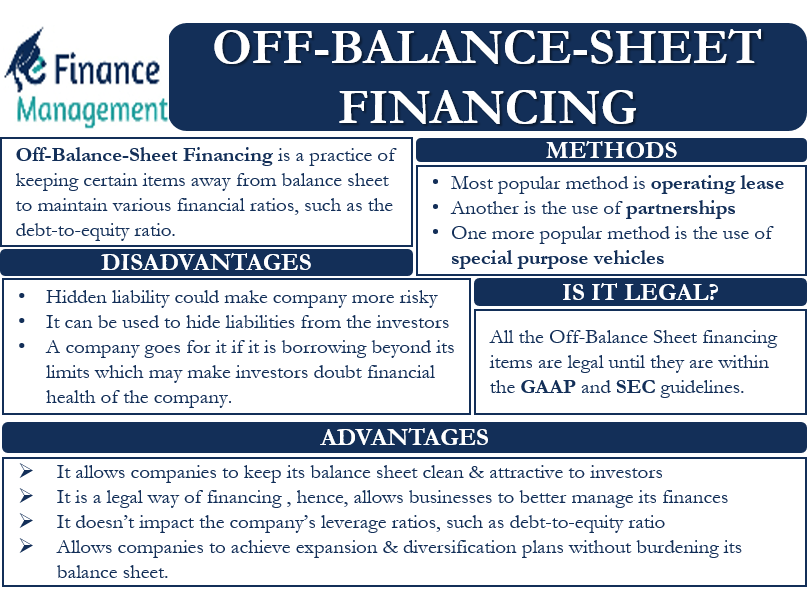

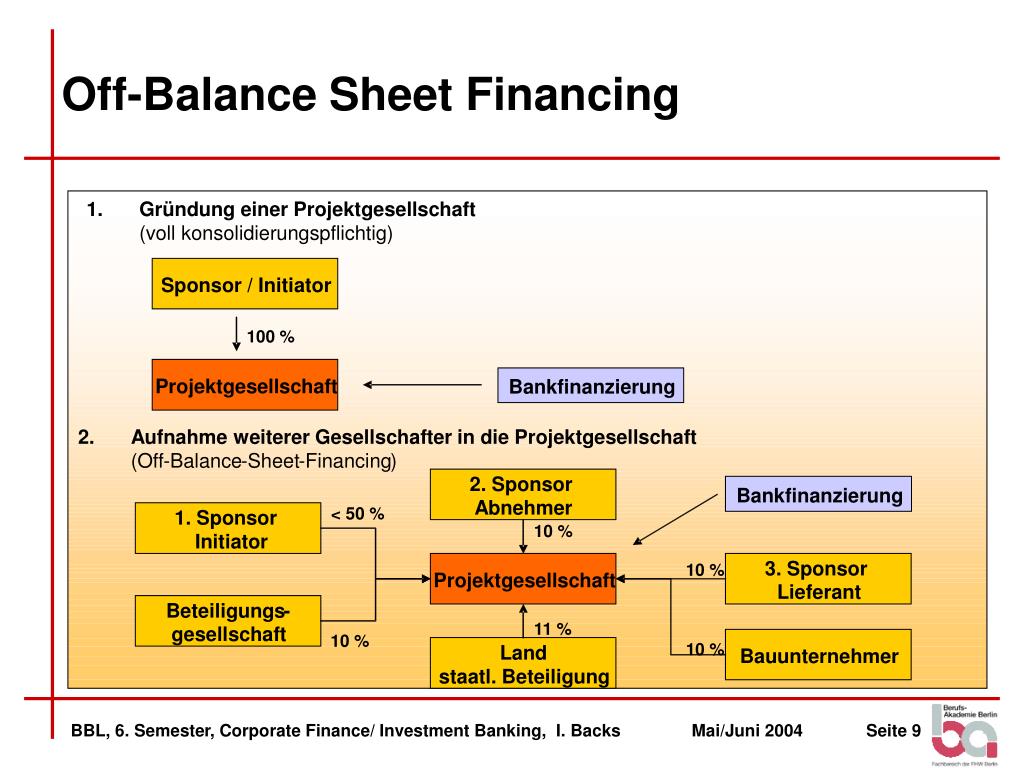

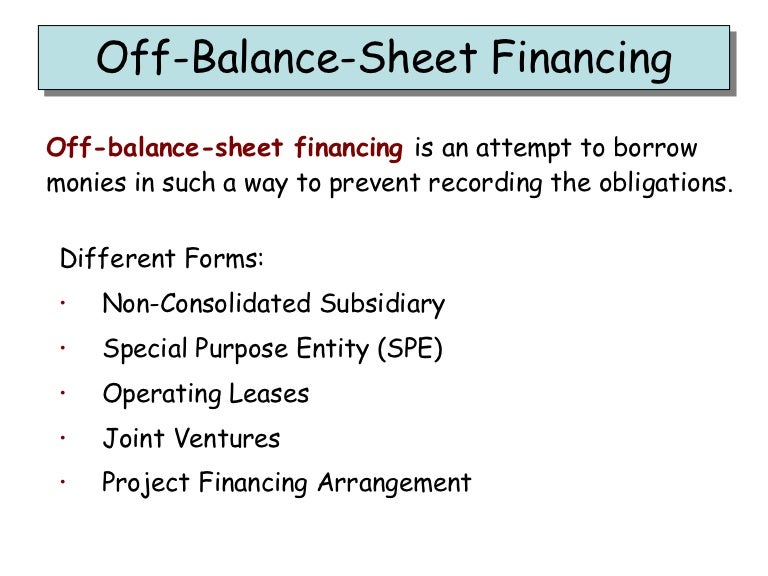

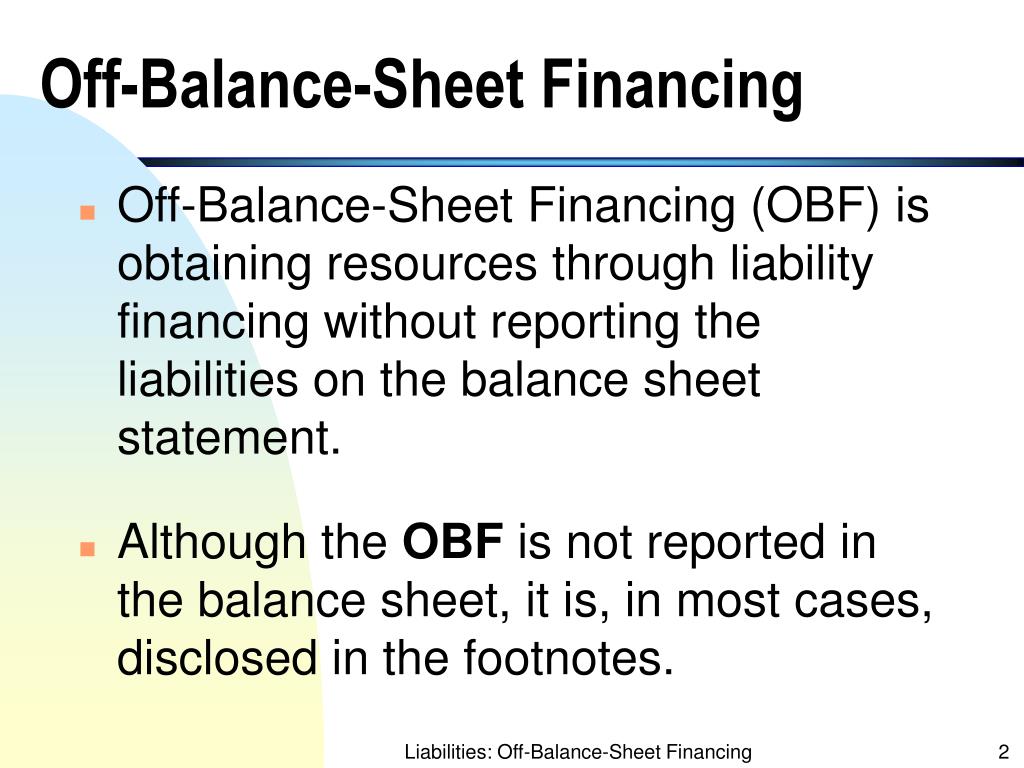

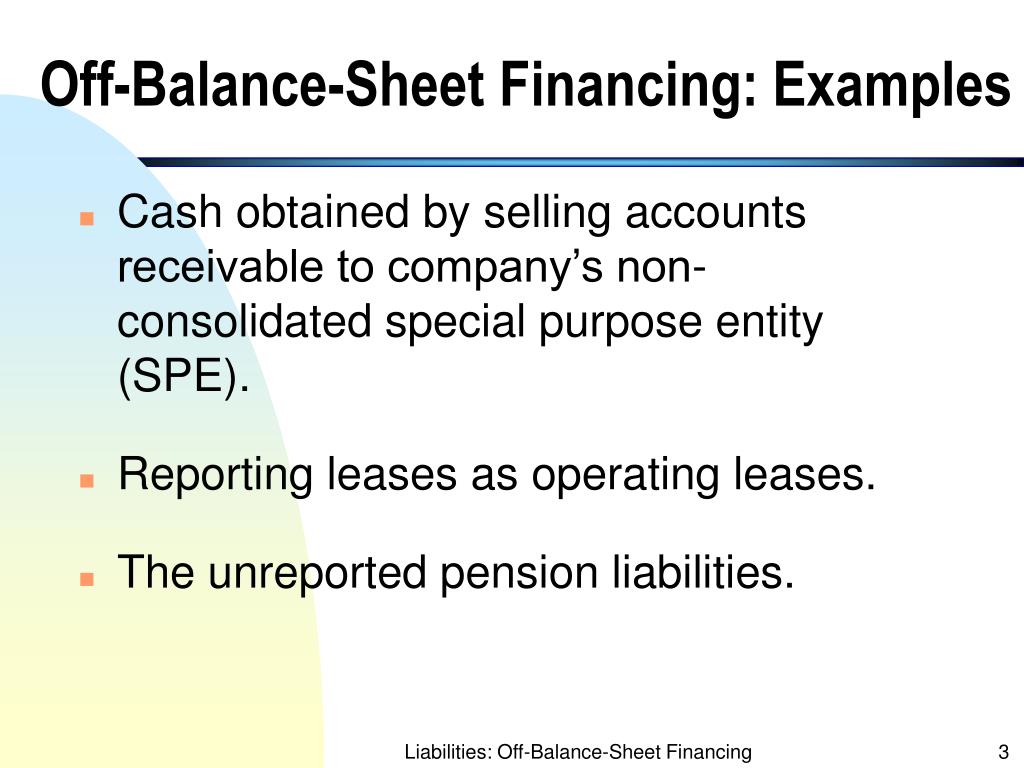

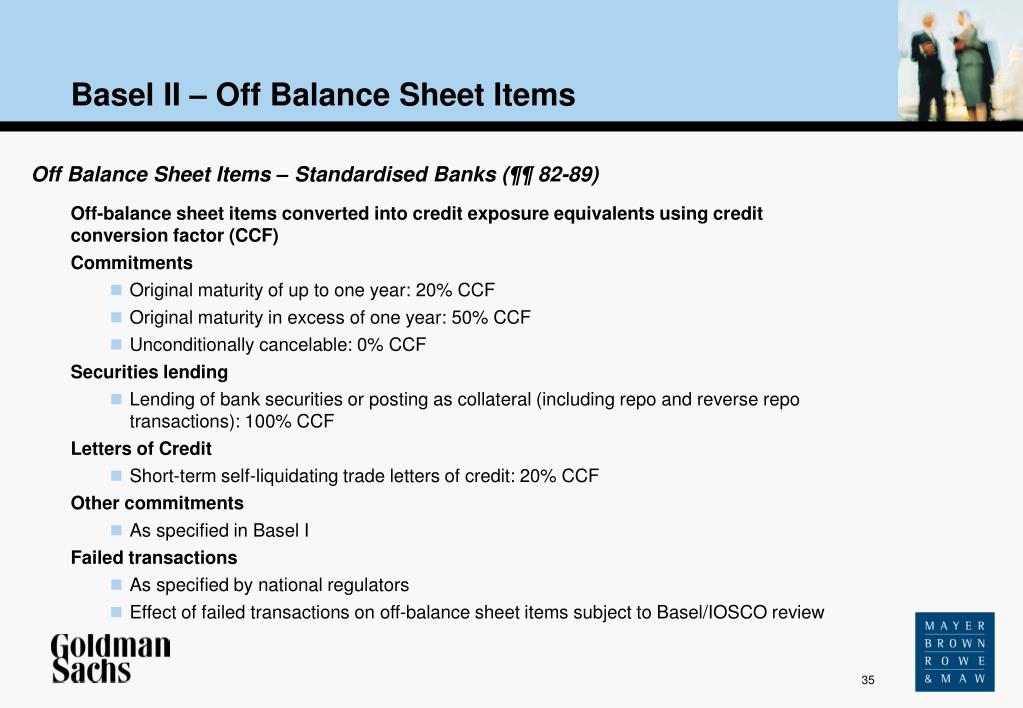

Off balance sheet financing is defined as the practice of not including certain assets or liabilities on a company’s balance sheet.¹ off balance sheet financing is also sometimes referred to as ‘incognito leverage’, as businesses can use the off balance sheet items as a type of leverage and show a company’s liquidity.² obsf meaning

On balance sheet off balance sheet. Under a leaseback agreement, a company can sell an asset, such as a piece of property, to another. The balance sheet is based on the fundamental equation: Off balance sheet refers to those activities of assets or debt or financing liabilities of the company that belongs to the company’s balance sheet but do not appear/present in the balance sheet i.e.

This is done without recording them on a company’s balance sheet. It is used to impact a company’s level of debt and. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

Balance sheets provide the basis for. These items are usually associated with the sharing of risk or they are financing transactions. Buzzfeed will keep hold of first we feast, maker of the popular video series hot ones.

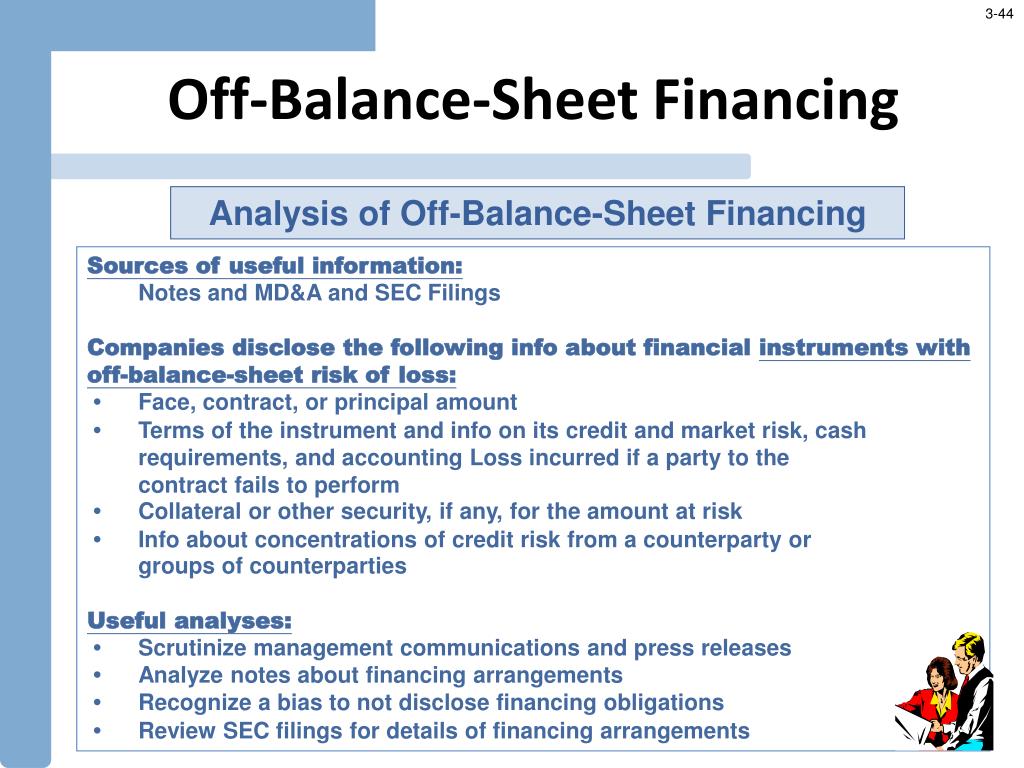

This type of financing differs from traditional forms in that it doesn’t show up on the balance sheet. As fixed assets age, they begin to lose their value. Securitizations securitization involves converting illiquid assets, like loans or receivables, into a security that can be sold on the market.

Off balance sheet refers to those assets and liabilities not appearing on an entity's balance sheet, but which nonetheless effectively belong to the enterprise. The bank will now report emissions linked to bonds capital raises on which it advices fossil fuel companies. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

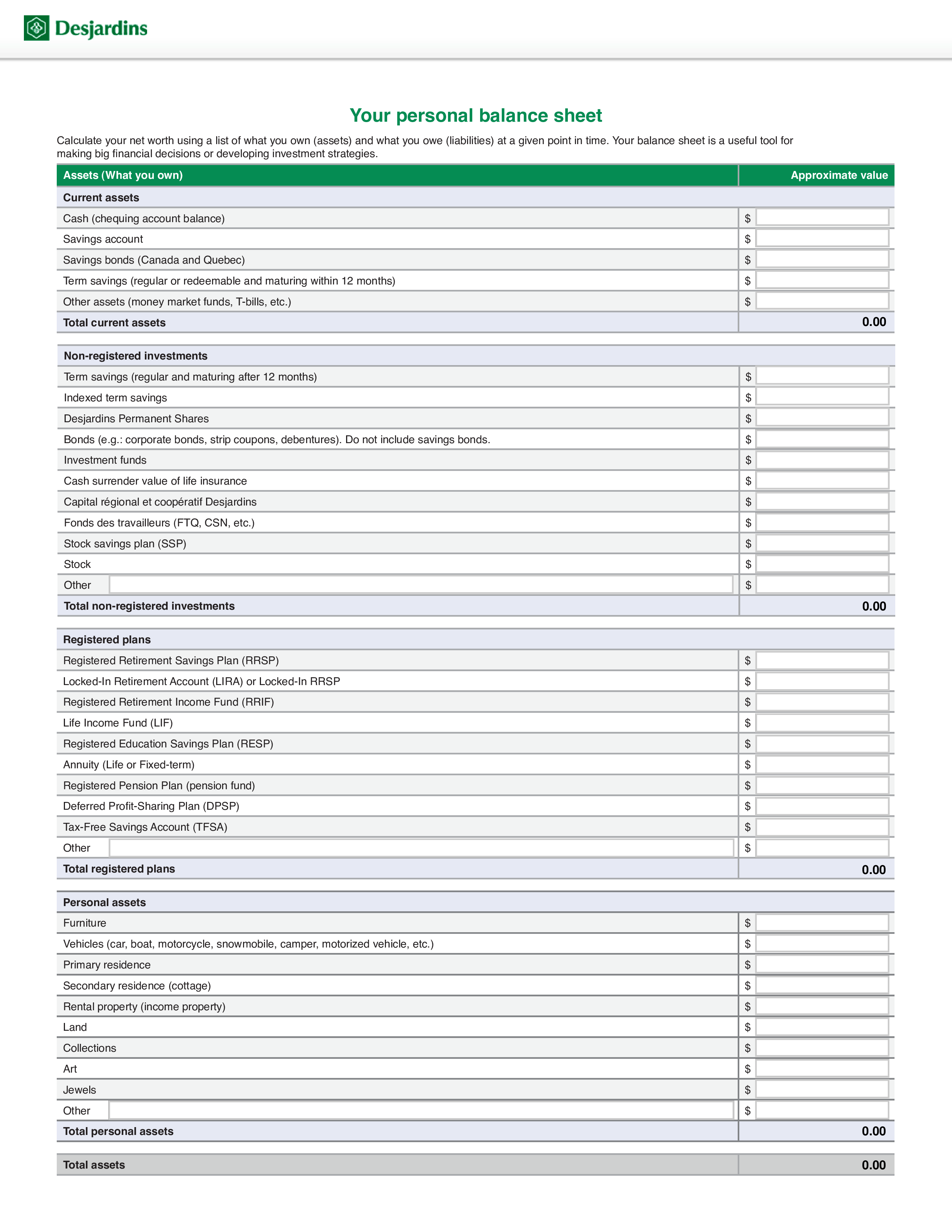

Balance sheet, financial statements. While there’s no official categories for the. Us financial statement presentation guide 23.7.

How does an off balance sheet work? The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. They are either a liability or an asset which are not shown on a company’s balance sheet as the business is not a legal owner of the respective item.

It can also be referred to as a statement of net worth or a statement of financial position. The company plans to use proceeds from the sale to strengthen its balance. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

The activities that are not recorded in the balance sheet but the company has the rights and obligations for those activities and has the. Assets = liabilities + equity. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan.

Off balance sheet refers to items that are effectively assets or liabilities of a company but do not appear on a company's balance sheet. Balance sheets are typically prepared and distributed monthly or quarterly depending on the. Check out our blog on everything small business owners need to know about balance sheets.