Have A Info About Calculate Free Cash Flow From Income Statement

It is the leftover money after accounting for your capital expenditure and other operating expenses.

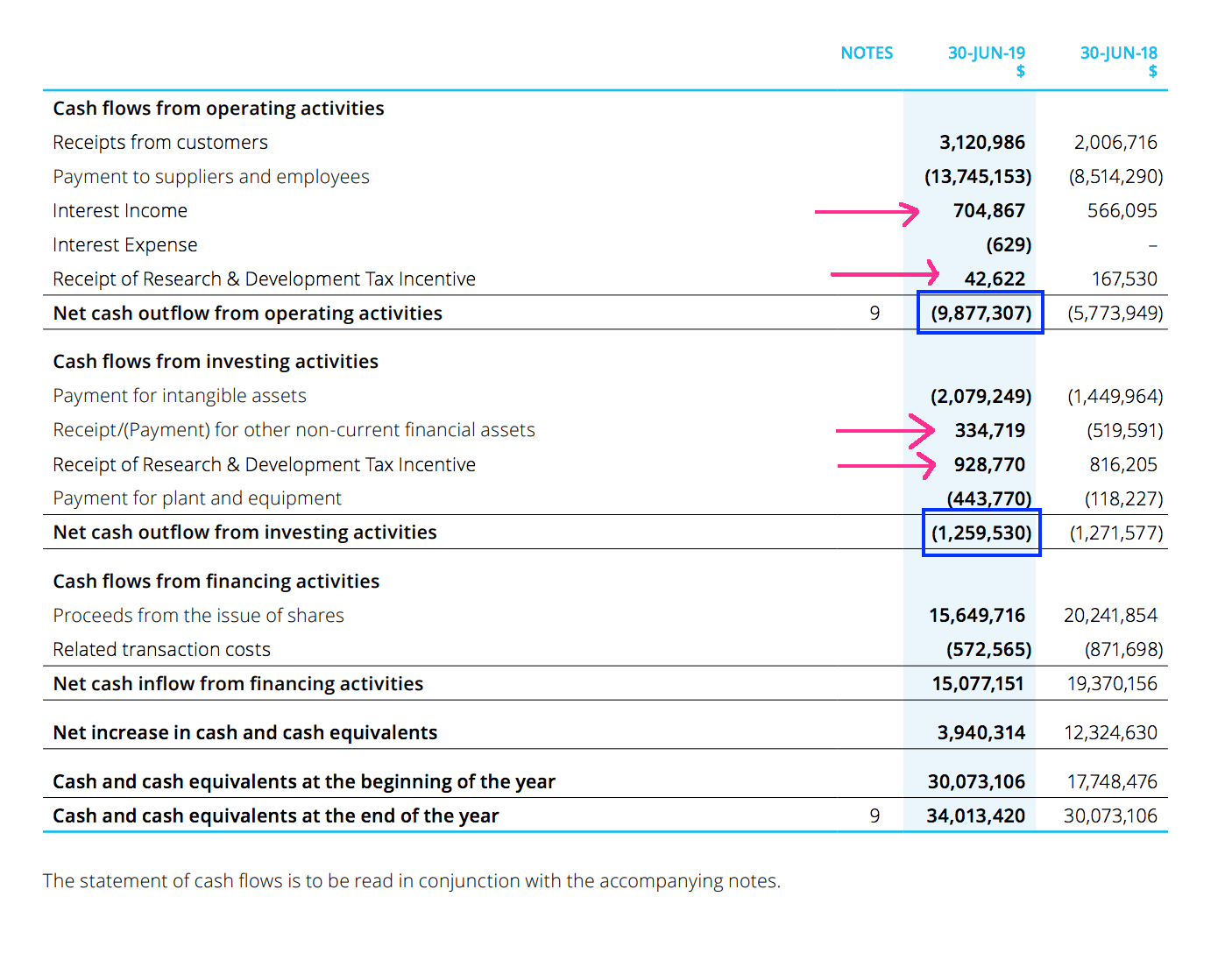

Calculate free cash flow from income statement. To calculate fcf from your cash flow statement, you’ll need to identify your operating cash flow and capital expenditure. How to prepare a cash flow statement. Determine the current period for analysis, whether it's monthly, quarterly, or annually.

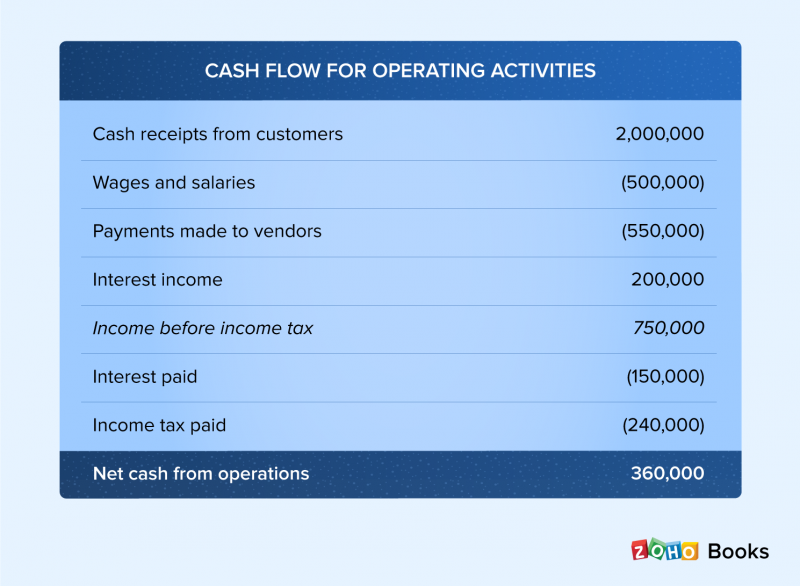

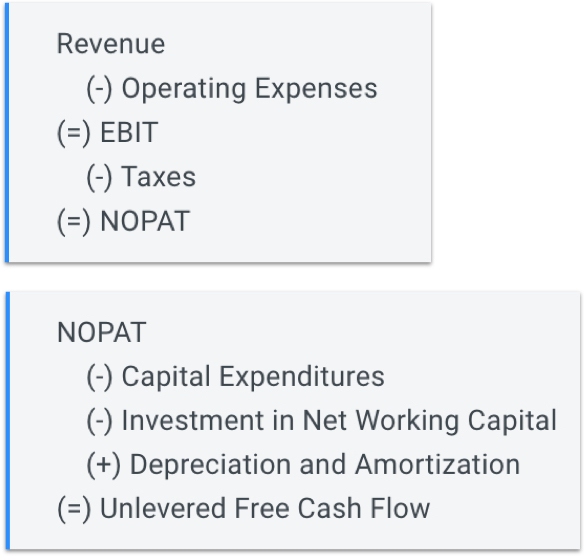

Get your free cash flow statement template operating cash flow refers to any money generated through the normal operation of the business, minus any taxes paid. Free cash flow to the firm (fcff) represents the amount of cash flow from operations available for distribution after accounting for depreciation expenses, taxes, working capital, and investments. While a cash flow statement shows the cash inflow and outflow of a business, free cash flow is a company’s disposable income or cash at hand.

Calculation of free cash flow. Income statement and free cash flow. Make adjustments for non cash transactions step 4:

Determine the starting point identify the starting point for calculating the free cash flow. One can calculate the fcff by using cash flow from operations or by using the company’s net income. So, the calculation of free cash flow will be:

* constant currency (c.c.) adjusts prior year for movements in currencies. Fcf gets its name from the fact that it’s the amount of cash flow “free” (available) for discretionary spending by management/shareholders. This figure is also referred to as ‘operating cash.' then subtract capital expenditure, which is money required to sustain business operations, from its value.

Example of free cash flow calculation Fcff means the ability of the business to generate cash, netting all its capital expenditures. April 27, 2022 free cash flow (fcf) is what metric business owners and investors use to measure a company’s financial health.

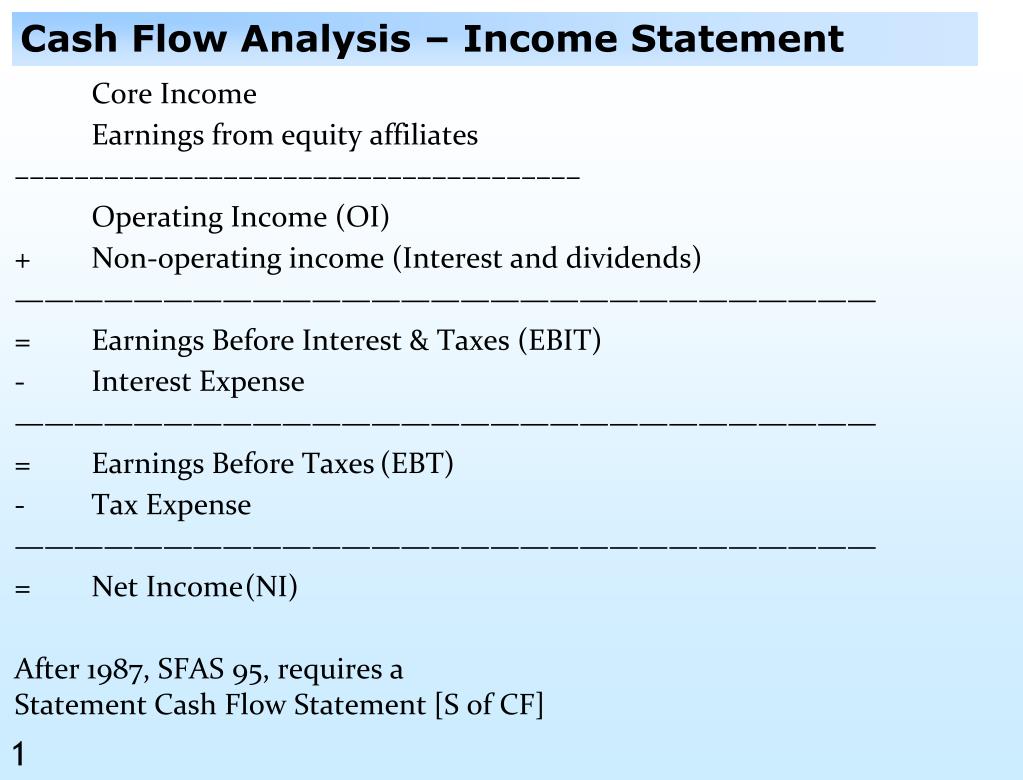

If you would like to p. Example of a free cash flow. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements.

The formulas to calculate free cash flow to the firm (fcff): How to calculate fcfe from net income. Here's what you need to know about calculating free cash flow and other components of a cash flow statement:

Find the cash and cash equivalent at the beginning and end of the reporting period step 3: Free cash flow helps companies to plan their expenses and. Balance sheet the cash flow statement measures the performance of a company over a period of time.

Free cash flow can be easily derived from the statement of cash flows by taking operating cash flow and deducting capital expenditures. Record adjusted ebitda margin fourth. It is the amount of cash generated by a company that can be potentially distributed to the company’s shareholders.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)