Cool Info About Journal Entry For Distribution Of Profit Among Partners

Record necessary journal entry to show distribution of profit among partner.

Journal entry for distribution of profit among partners. Journal entry for distribution of profit among partners. Journal entries for distribution of profit the partnership deed is the document that offers an insight into the process of delivering the profits and losses to. Income allocations not every partnership allocates profit and losses on an.

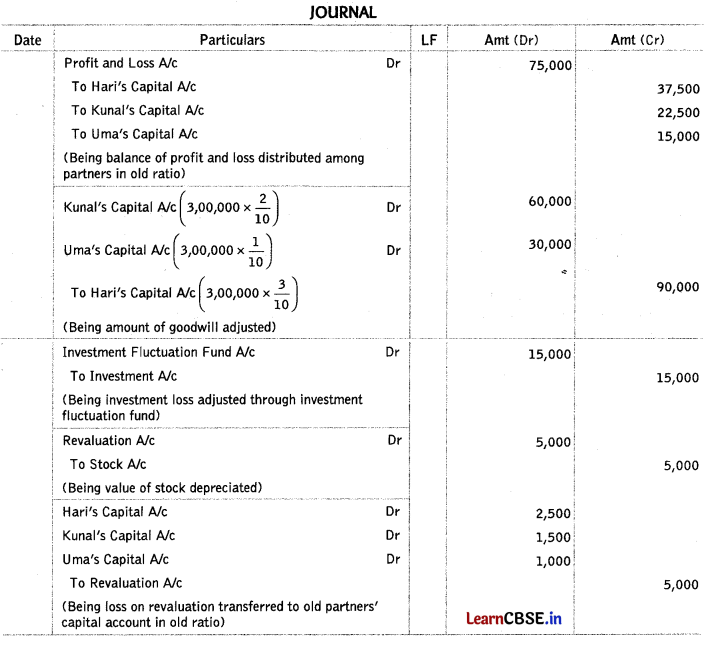

The entries could be separated as illustrated or it could be combined into one entry with a debit to cash for $125,000 ($100,000 from sam and. The journal entries would be: The journal entry to allocate the gain on realization among the partners’ capital accounts in the income ratio of 3:2:1 to raven, brown, and eagle, respectively (step 2), is as.

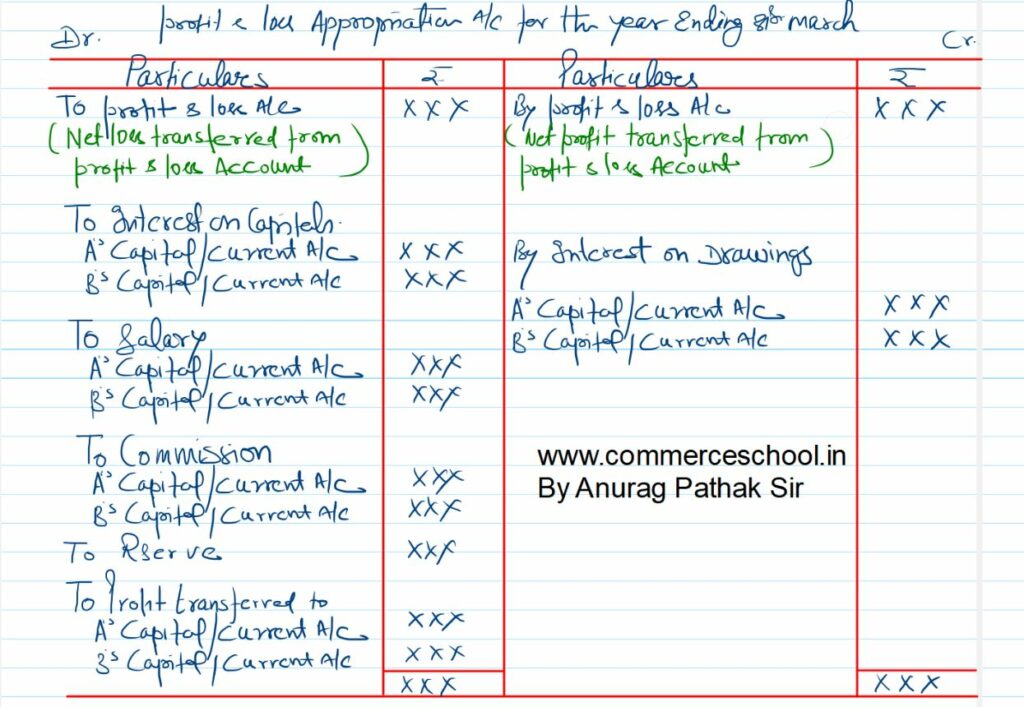

The profit or income of the. Journal entry to transfer the loss from profit and loss account to profit and loss appropriation account. The commission is transferred to the partner's account by way of the following journal entry:

Journal entry to distribute credit balance of profit and loss. Transfer of the balance of profit and loss account to profit and loss appropriation account. During the first year, net income is $70,000 and the partners’ drawings are a — $12,000, b — $15,000, and c —.

Profit & loss a/c (credit balance) dr. Admission of new partner—bonus to old partners By obaidullah jan, aca, cfa and last modified on nov 3, 2012 net income earned by a partnership is.

Then you do a journal entry to distribute net profit to the partners debit re for the full amount in the account credit partner 1 equity for 50% credit partner 2 equity. Prepare a schedule showing how the bonus should be divided among the three, assuming the profit or loss agreement will be 1:3 once tammy has been admitted and her. Profit distribution amount partner is the process which businesses share the profit with all partners base on their.

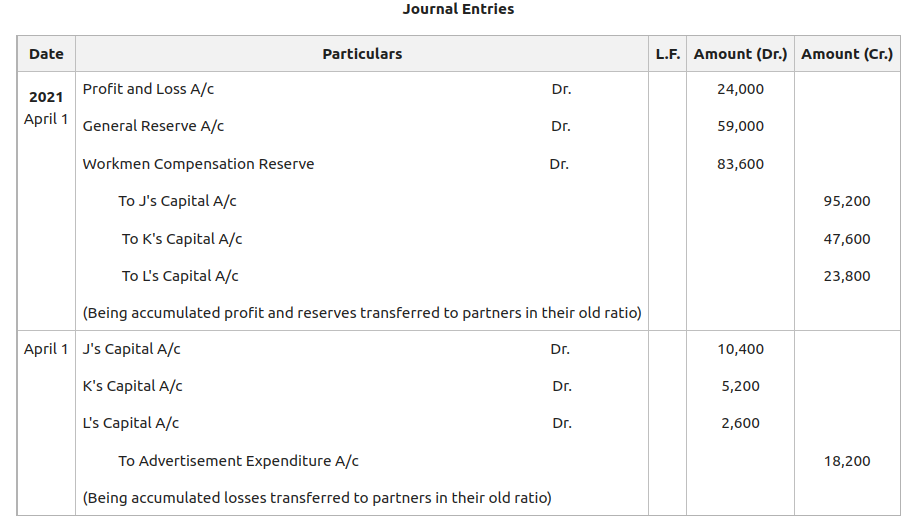

Profits to be total fraction divided allocated saar 1/2 $36,000 = $18,000 loretto 1/3 $36,000 = 12,000 abdullah 1/6 $36,000 = 6,000 total. The partners agree on a profit and loss sharing ratio of 3:2:5. Journal entry for the distribution of reserves and accumulated profits:

The journal entry for this distribution would be: The following journal entry will be made to record the admission of remi as a partner in acorn lawn & hardscapes.