Perfect Tips About To View 26as

Here’s how to see form 26as:

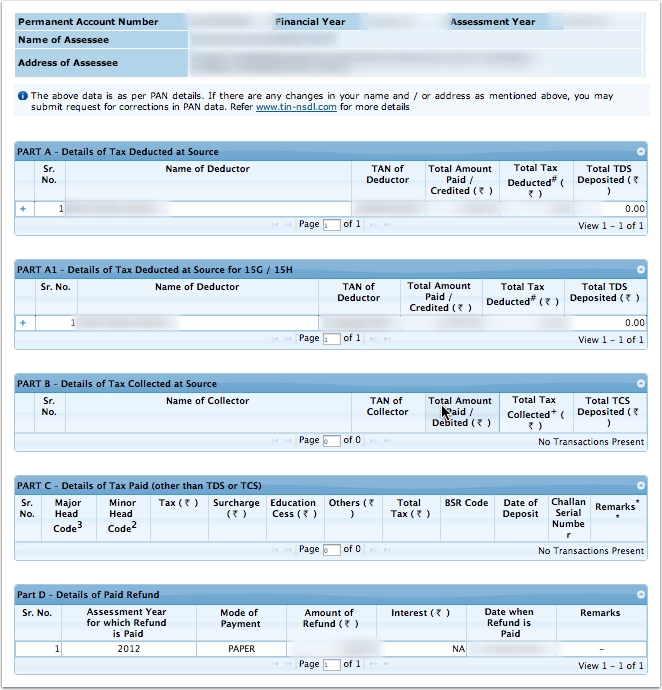

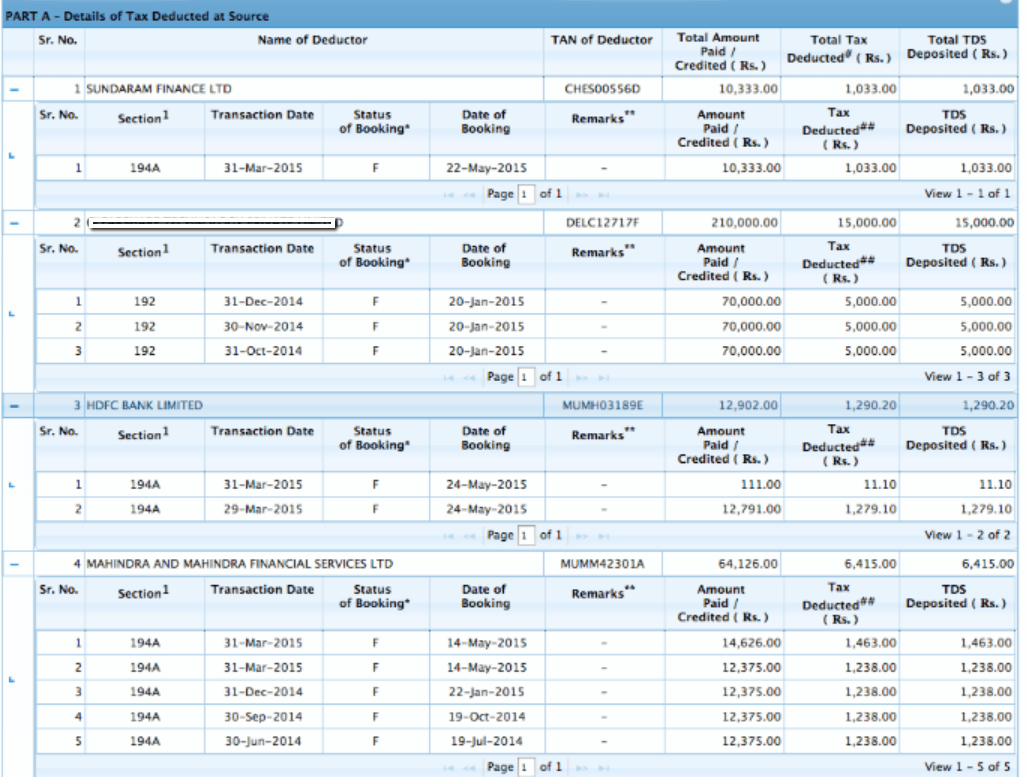

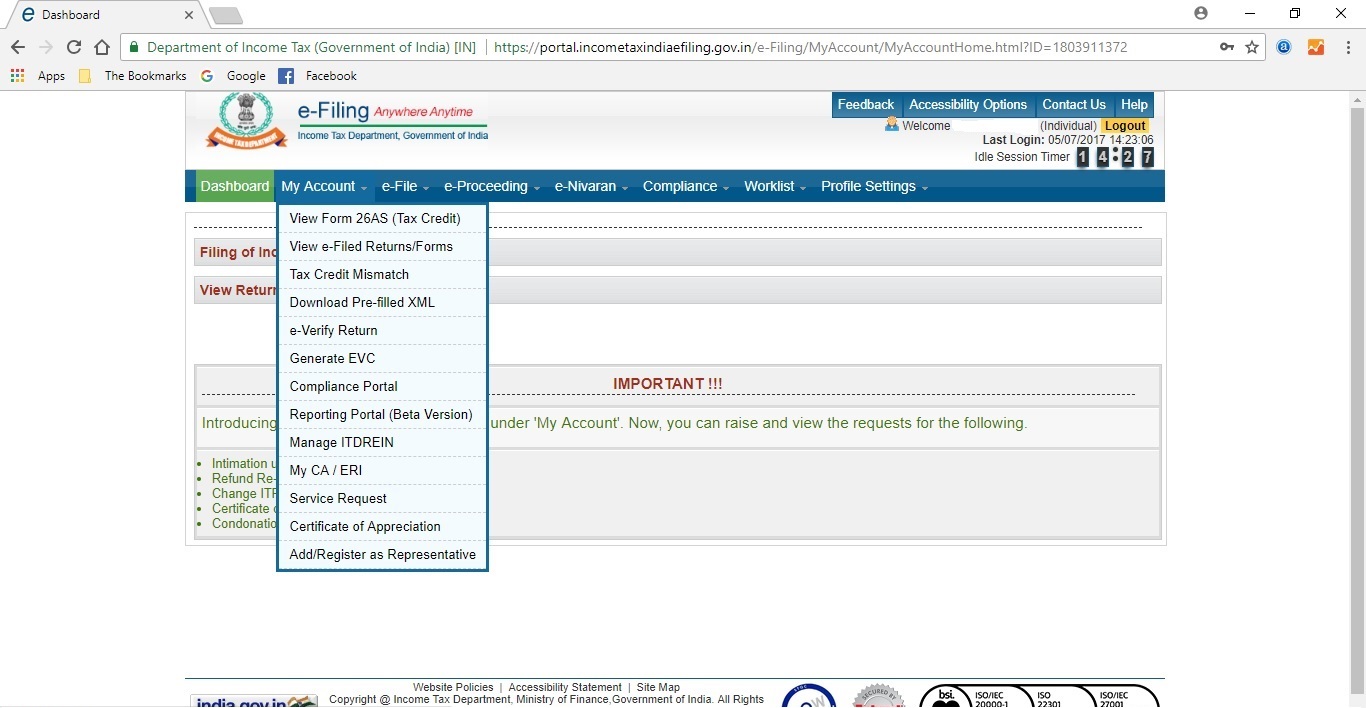

To view 26as. Users having pan number registered with their home branch can avail the facility of. Go to 'my account' > 'view form 26as (tax credit)'. Form 26as is a consolidated tax statement issued by the income tax department of india containing the details of all tax deducted on behalf of a taxpayer and.

You can now view and download form 26as. Users of retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login : Click on the link at the bottom of the page that says 'view tax credit (form 26as)' to access your form 26as.

Go to new income tax portal www.incometax.gov.in and. You can save the form on your desktop. The website provides access to the pan holders to view the details of tax credits in form 26as.

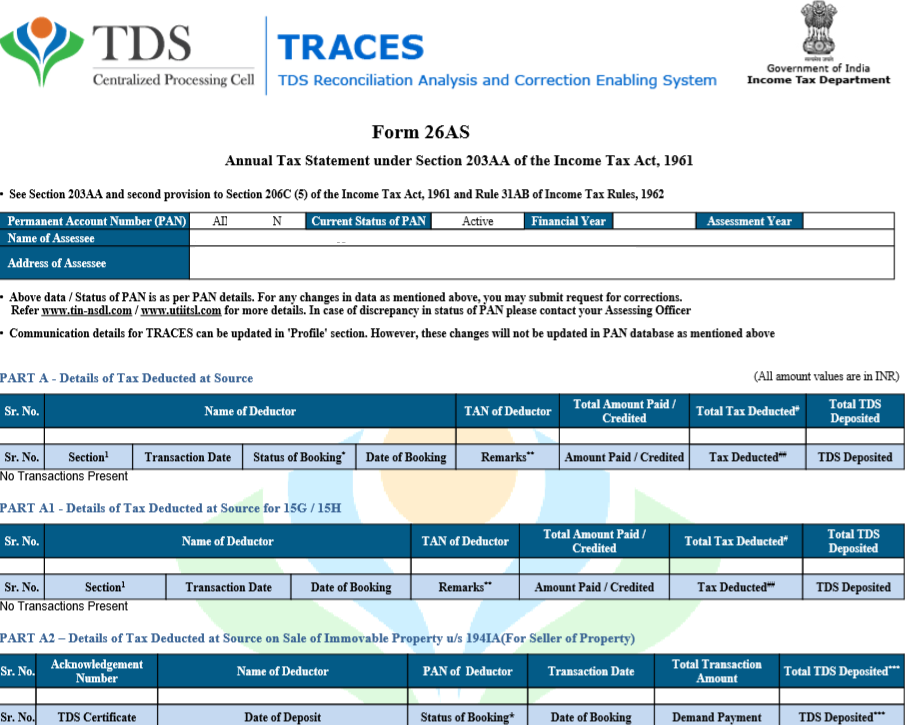

Form 26as, or tax credit statement, is one of the most important documents when filing taxes. What is form 26as ? If you are not registered with traces, please refer to our e.

Now, in the dropdown menu, click on ‘view form 26as’. Form26as is an important tax document in india, that every tax payer. How to view and download form 26as?

Instructions to view form 26as through traces portal 5.1 related 1. There are three ways to view and download form 26as. Here is how to get form 26as:

Select 'view tax credit', choose 'assessment year', 'view type' as. Every taxpayer can access their form 26as via the income tax department’s official website by using their permanent account number or pan. Form 26as can be accessed by a taxpayer from the income tax portal using the pan.

Here are the steps to follow: Form 26as, or the annual statement or tax credit statement, is a consolidated statement issued by the income tax department of india. Read disclaimers and click 'confirm'.

How to view form 26as? You may view form 26as by pan no. Choose the assessment year and the.

On the tds reconciliation analysis and correction enabling system (traces) portal.