Can’t-Miss Takeaways Of Tips About Flow Of Accounts Into Financial Statements

What’s the difference between a cash flow statement and an income statement?

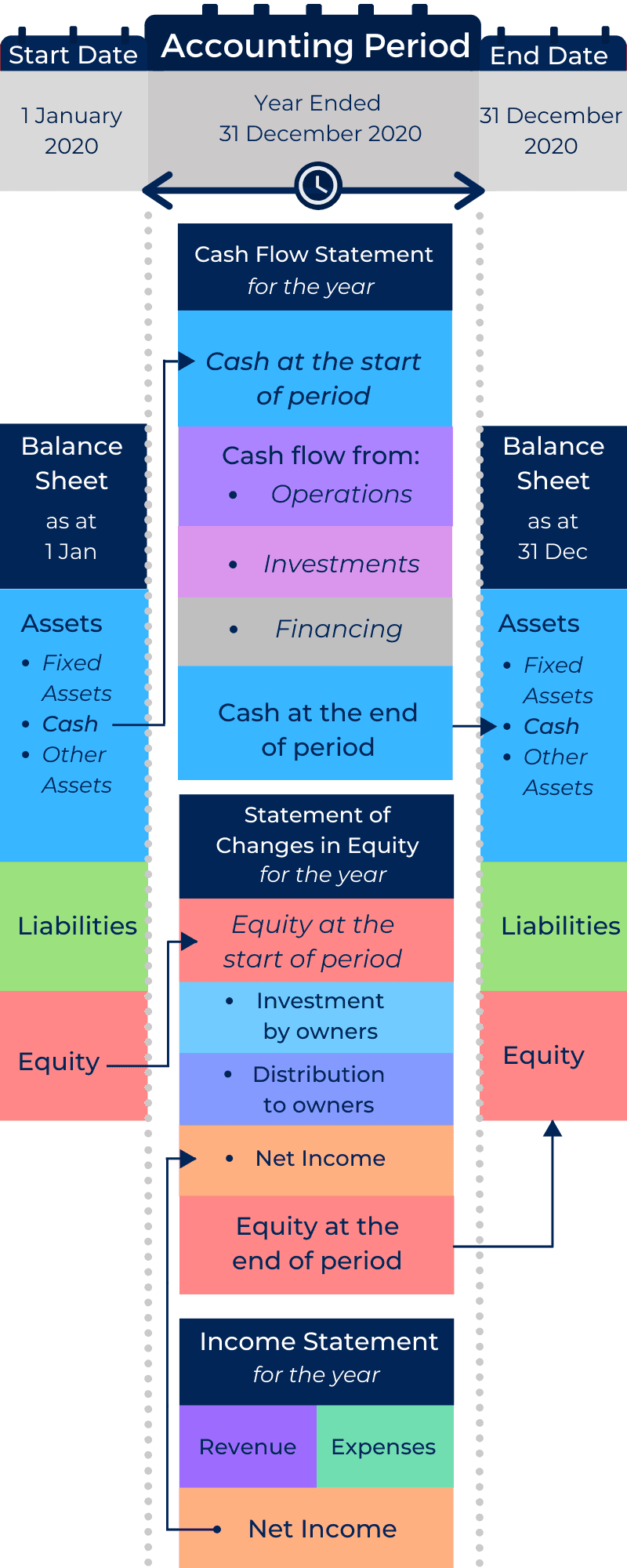

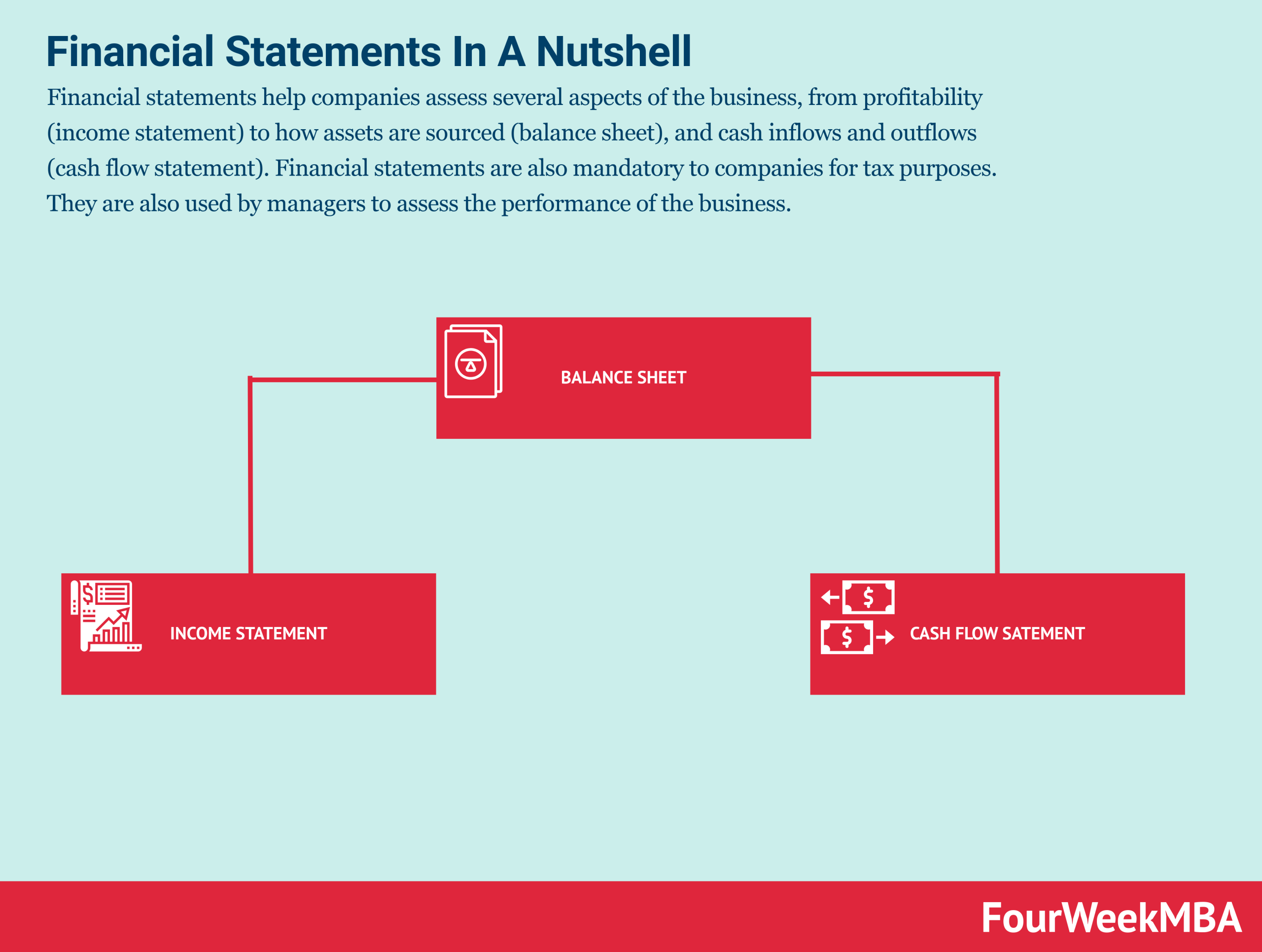

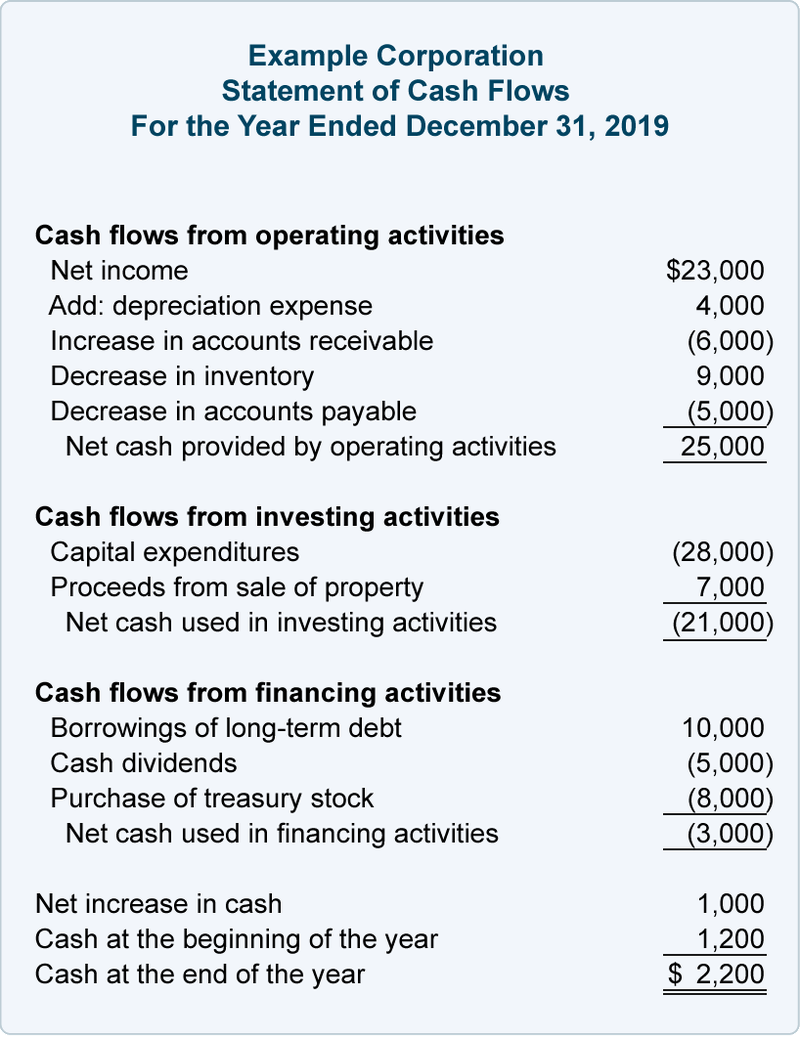

Flow of accounts into financial statements. Let's break down the classification of each account into the appropriate financial statement: On the balance sheet, it feeds into retained earnings and on the cash flow statement, it is the starting point for. A statement of cash flows.

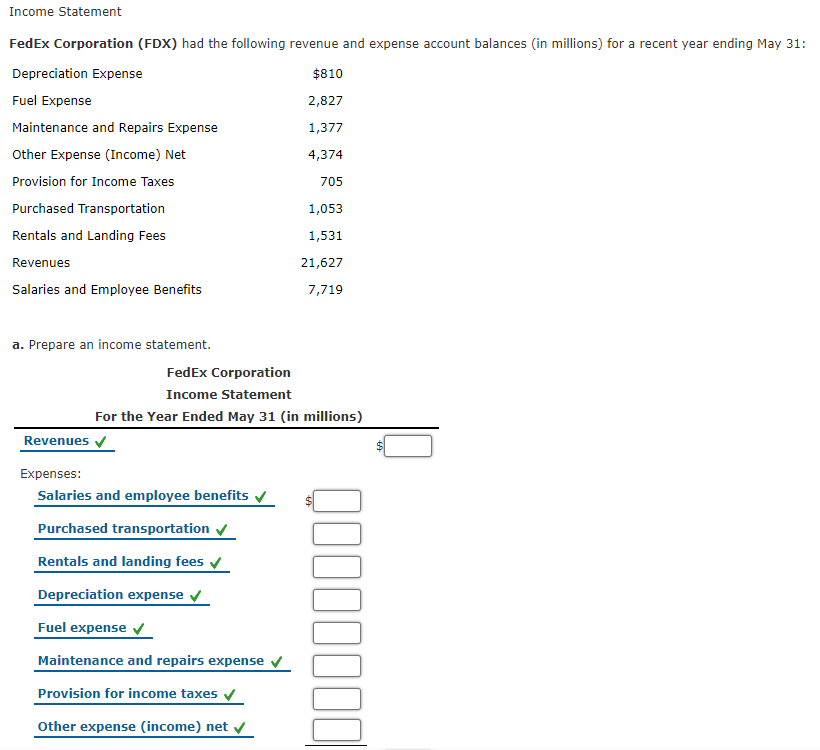

The balance sheet, income statement, and cash flow statements form the core of financial reporting. External stakeholders use it to understand the overall health of an. An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows.

Purposes and alternative names for the balance sheet and income statement are presented below. Balance sheets, income statements, cash flow statements, and annual reports. Results for a period are shown on the income statement and the cash flow statement.

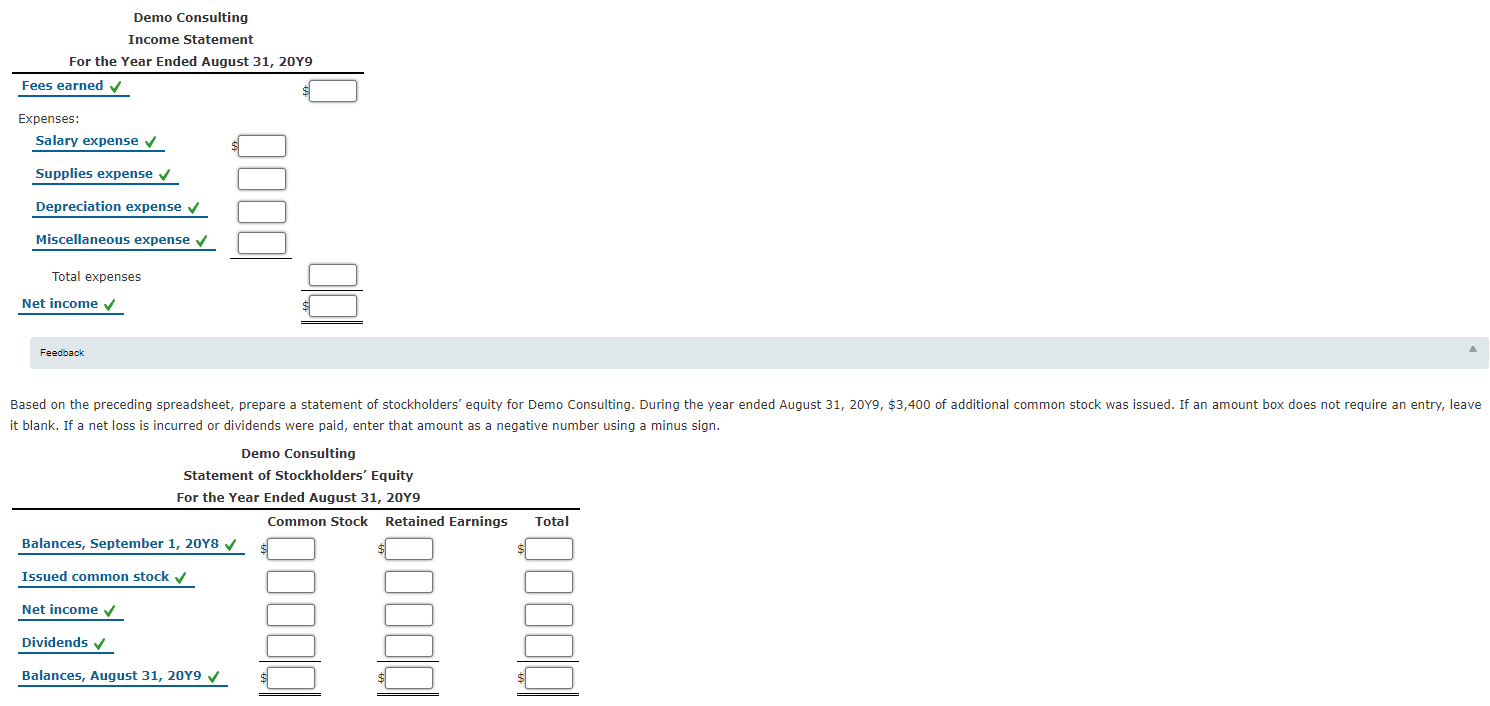

The income statement, statement of retained earnings, balance sheet, and statement of cash flows, among other financial information, can be analyzed. This teaching note covers two of the four statements: Income statement analysis most analysts start their financial statement analysis with the income statement.

Overview of the three financial statements 1. Executive minute on the joint committee of public accounts and audit report no. The income statement, balance sheet, and cash flow statement.

To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: Why do shareholders need financial statements? Financial statement analysis reviews financial information found on financial statements to make informed decisions about the business.

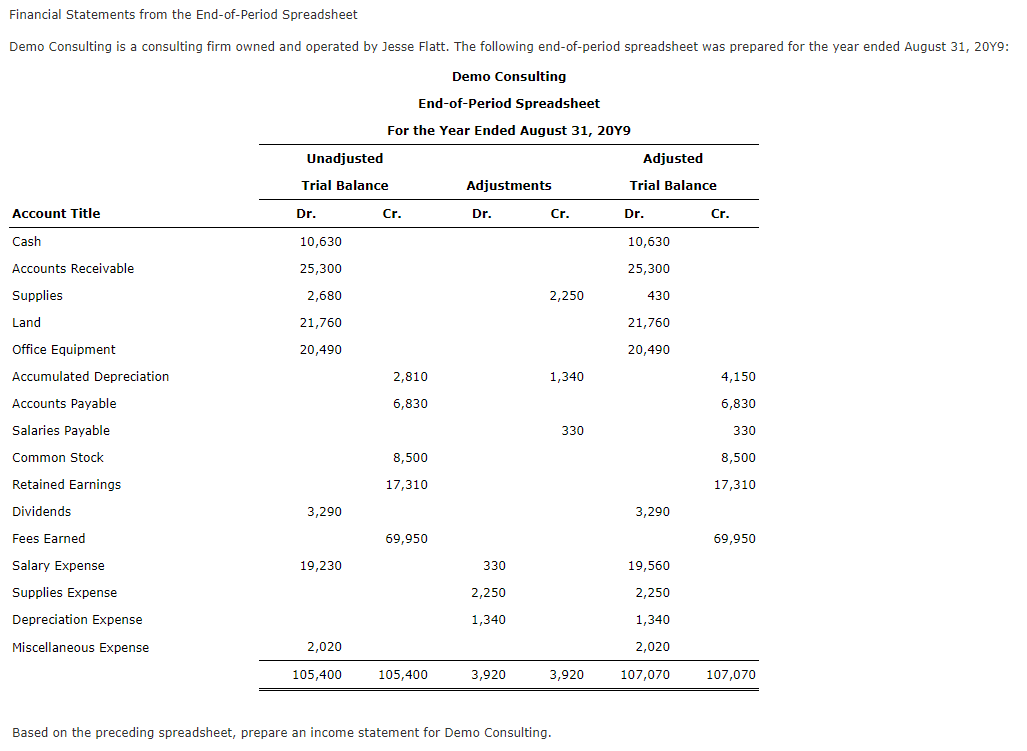

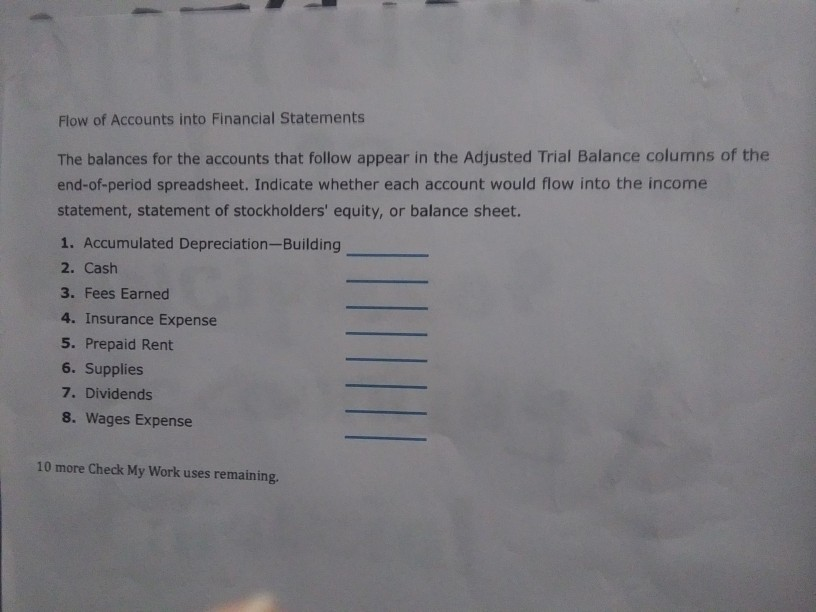

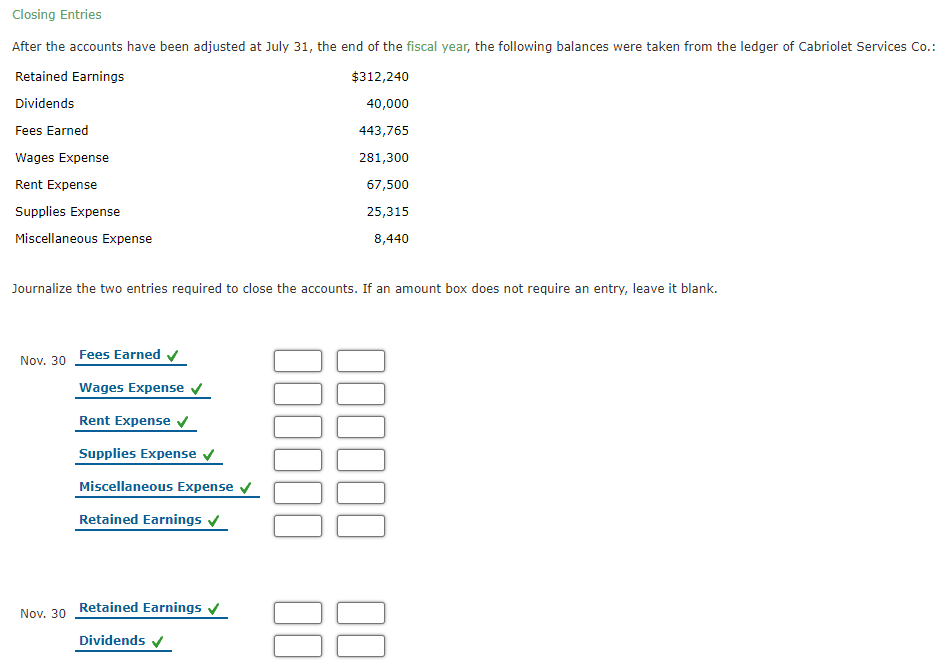

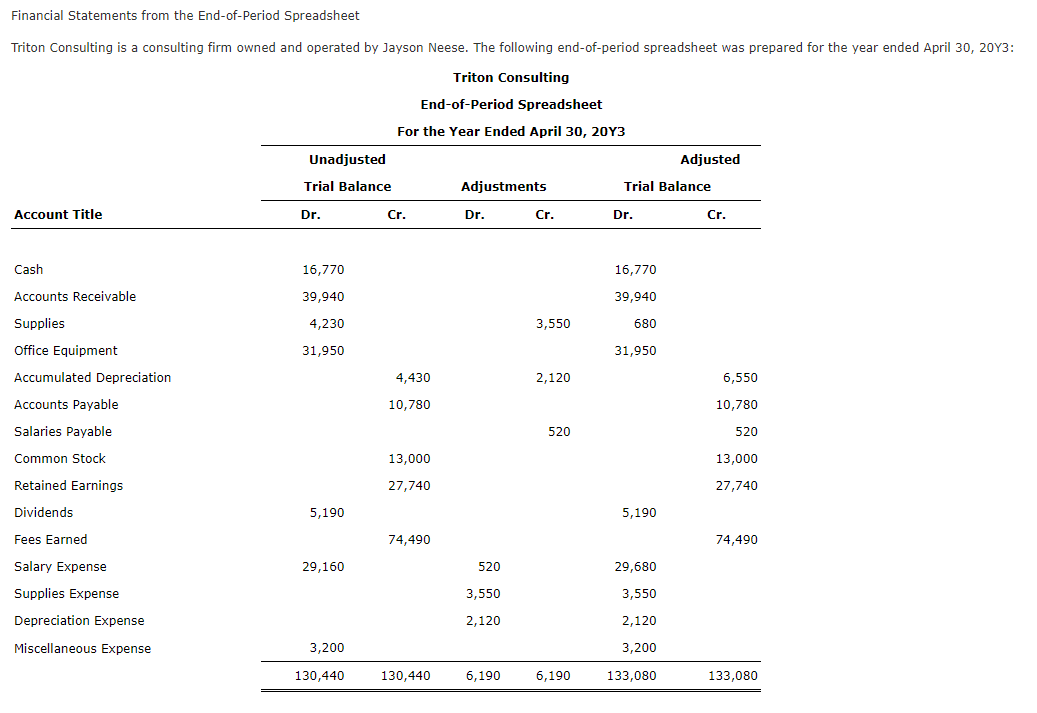

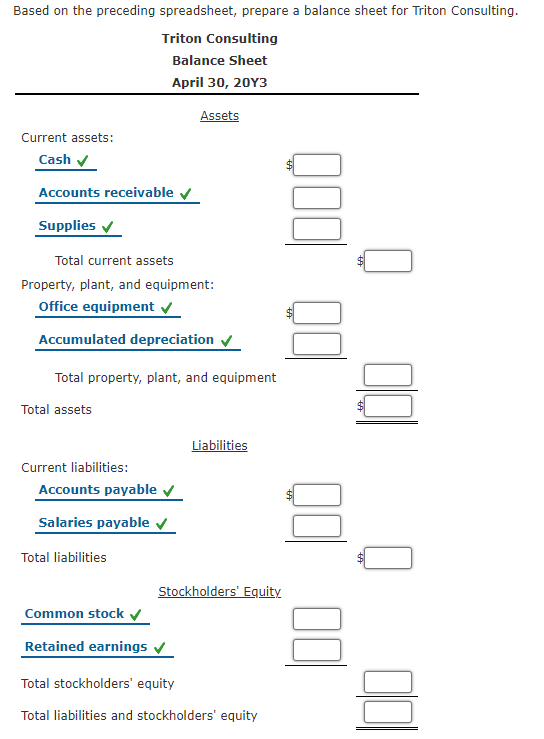

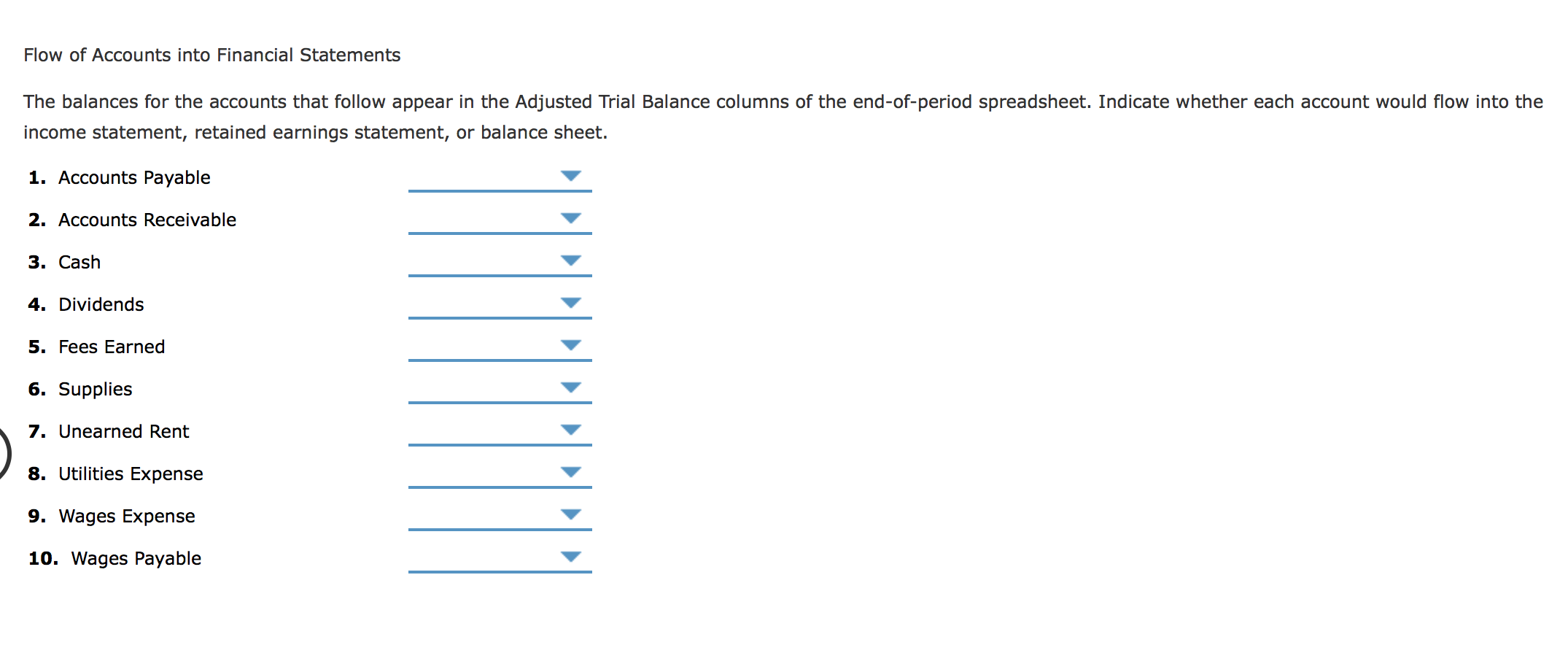

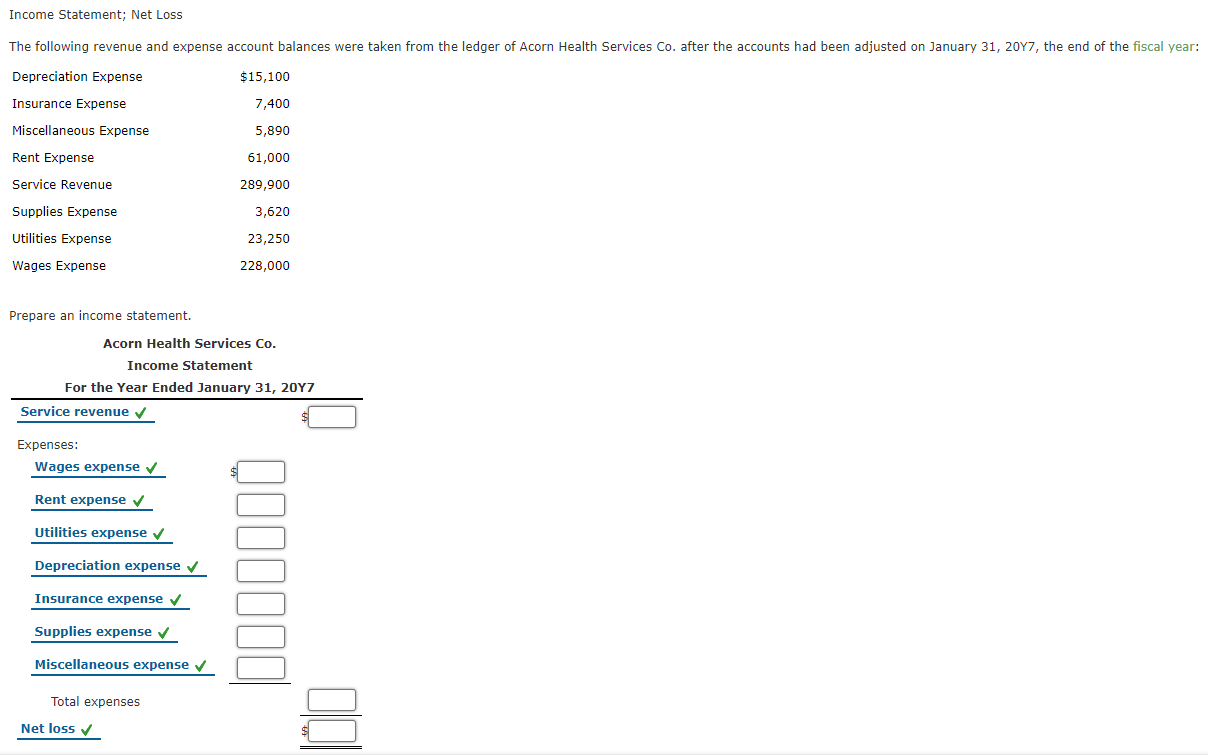

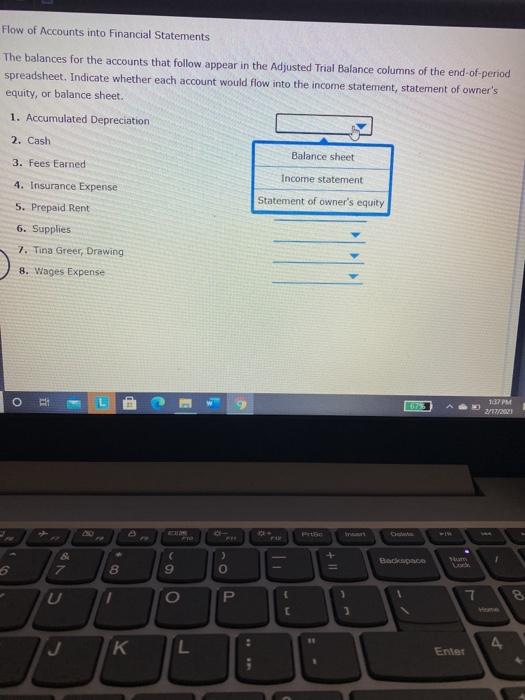

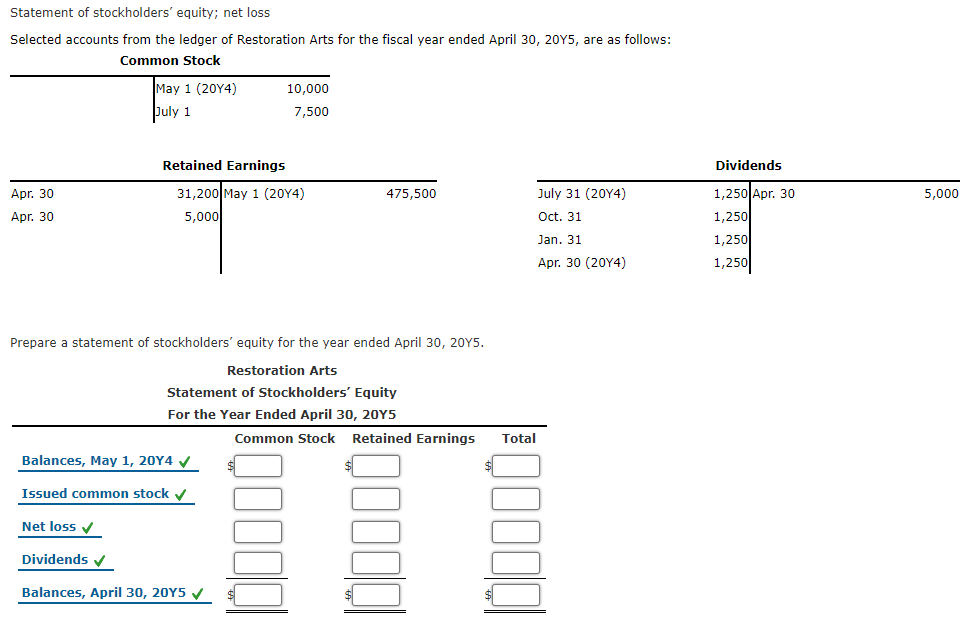

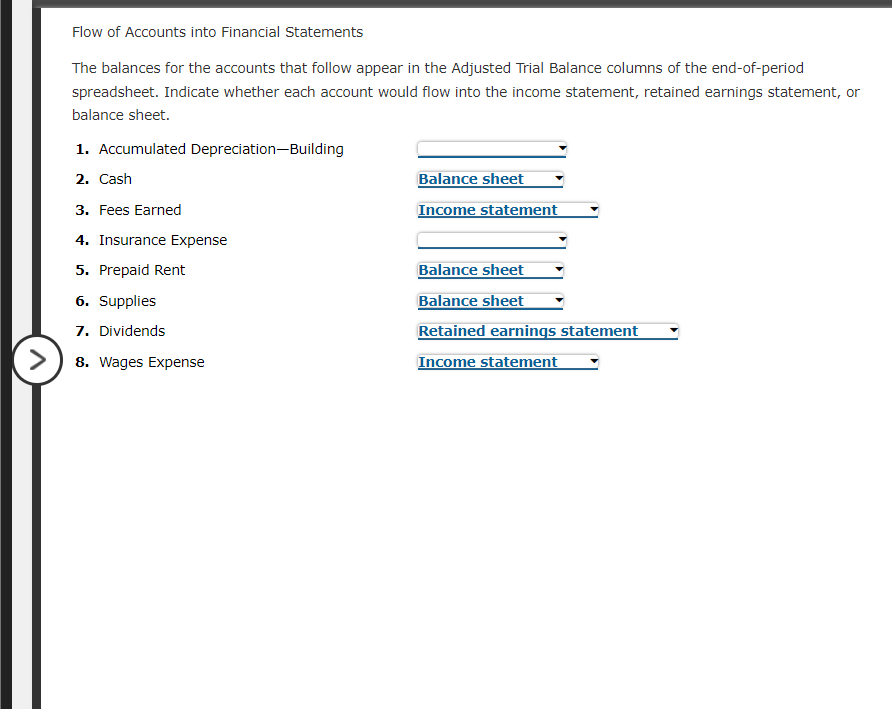

This reports a company's financial performance over a specific. Indicate whether each account would flow into the income statement, statement of owner's equity, or balance sheet. In doing so, the spreadsheet illustrates the impact of the adjustments on the financial statements.

The value of these documents lies in the story they tell when reviewed together. Does the balance sheet always. Intuitively, this is usually the first thing we think about with a business… we often ask questions such as, “how much revenue does it have?” “is it profitable?” and “what are the margins like?”

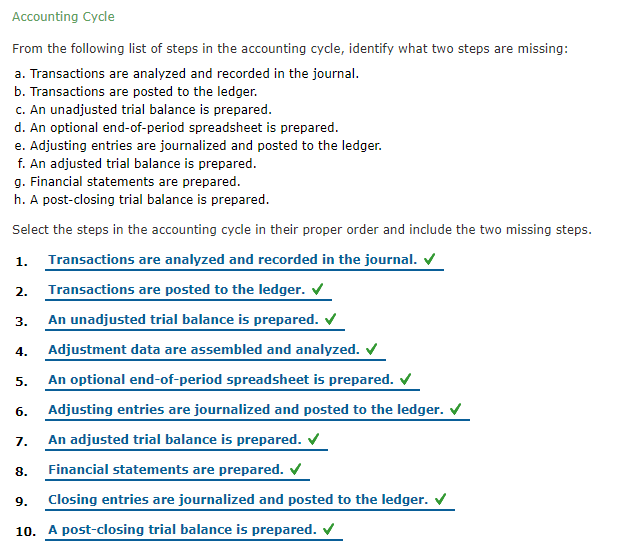

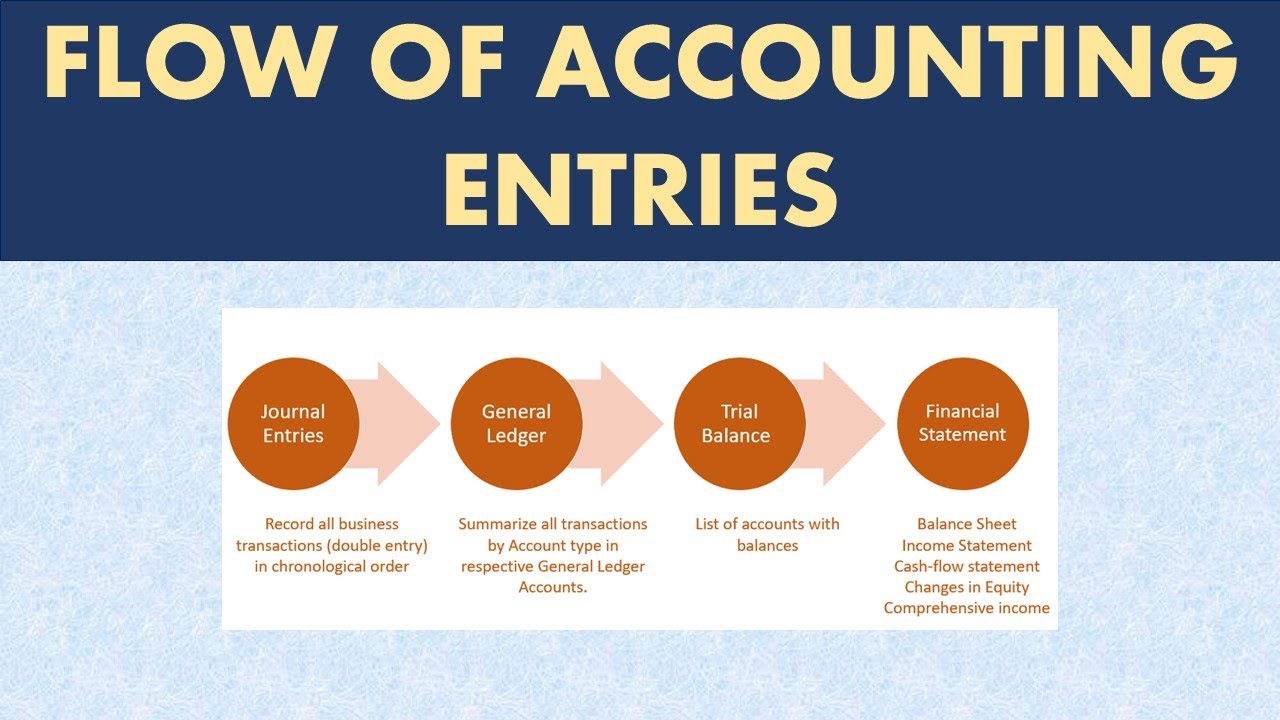

The 8 steps of the accounting cycle Analyzing these three financial statements is one of the key steps when creating a financial model. Indicate whether each account would flow into the income statement, retained earnings statement, or balance sheet.

The balance sheet and the income statement. They show company assets, liabilities, profitability, and liquidity, empowering users to make informed choices. Preparing financial statements is the seventh step in the accounting cycle.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)