One Of The Best Tips About Use Of Financial Statements Example Current Liabilities On Balance Sheet

This reading is organized as follows:

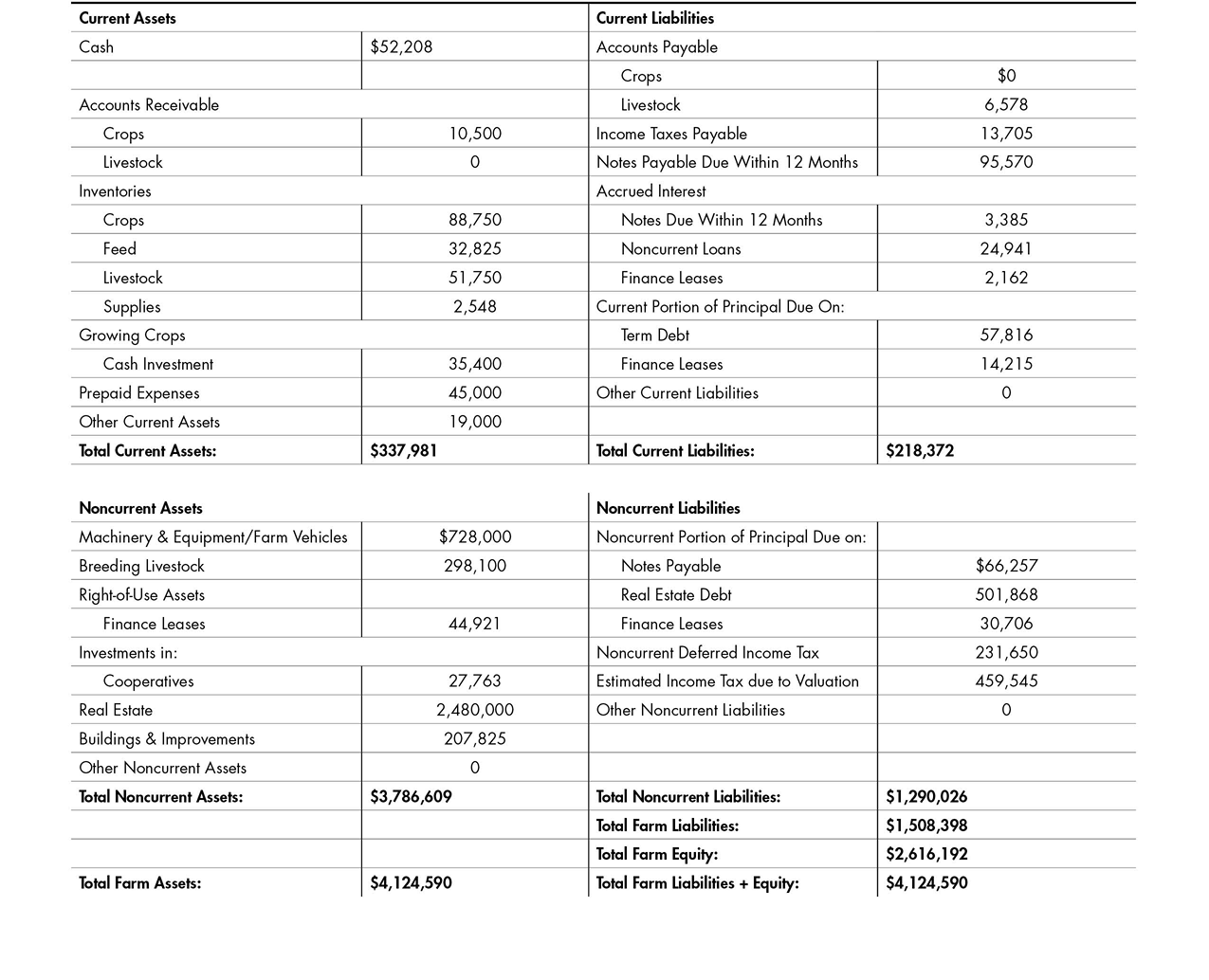

Use of financial statements example of current liabilities on balance sheet. To calculate your company’s current liability balance, add all the liabilities up. It provides a snapshot of financial health. The requirement for an entity to have the right to defer settlement of the liability for at least 12 months after the reporting period.

That’s because your business has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from you, the owner (issuing shareholder equity). Therefore, this equation should always be true. The amount owed to vendors and suppliers based on their invoices.

Section 4 focuses on assets, and section 5 focuses on liabilities. It can also be referred to as a statement of net worth or a statement of financial position. David kindness of all the financial statements issued by companies, the balance sheet is one of the most effective tools in evaluating financial health at a specific point in time.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The statement must always balance, hence the name. Let’s look into each section of the balance sheet in more detail.

This chapter looks at a government's balance sheet, showing the various types of assets and liabilities it contains. The sheet then explains how those assets are financed, either through liabilities (debts), equity (the sale of stocks and bonds), or a mix of both. Current liabilities examples are accounts payable, taxes payable, salaries, loans, and other existing debts.

A balance sheet has two sides: Examples of the descriptions used to report a company's current liabilities include: Current liabilities are the items a company owes in the next year, and can include things like unpaid supplier invoices, or upcoming repayments for debts you’ve committed to like business loans.

Section 3 discusses current assets and current liabilities. You can expect to include items like these: Current liabilities are reported on the classified balance sheet, listed before noncurrent liabilities.

Recall that current assets and current liabilities are amounts generally settled in one year or less. Current liabilities are those that are expected to be settled within one year, or one operating cycle―whichever is longer. Assets = liabilities + equity.

The balance sheet is one of the three core financial statements that are. Hence, the balance sheet is often used interchangeably with the term “statement of financial position”. Changes in current liabilities from the beginning of an accounting period to the end are reported on the statement of cash flows as part of.

Assets on one and liabilities and equity. The amount from prepaid revenues, such as gift cards, that is yet to be recorded on the balance sheet. A balance sheet is a financial statement that shows a company’s assets for a given period, such as a quarter or fiscal year.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)