The Secret Of Info About 199a Safe Harbor Statement Example Monthly Balance Sheet Template

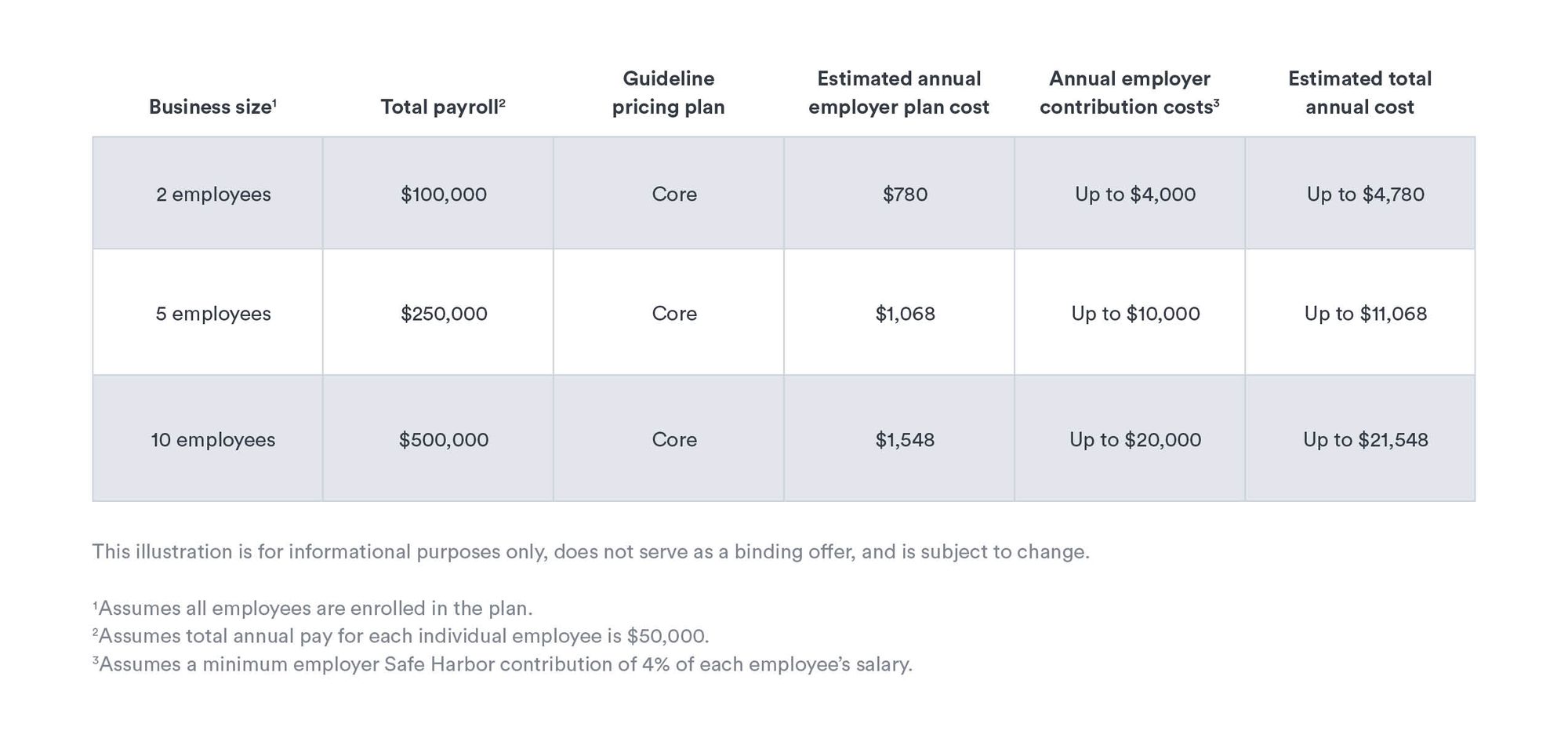

Separate books and records for each.

199a safe harbor statement example monthly balance sheet template. 199a qualified business income (qbi): 199a rental real estate safe harbor. (parker tax publishing september 2019) dear client:

A taxpayer who is over the applicable taxable income threshold has qbi of $100 each from two trades or businesses a and b. Rental real estate enterprises (code sec. (parker tax publishing september 2019) for the tax year ending [insert tax year],.

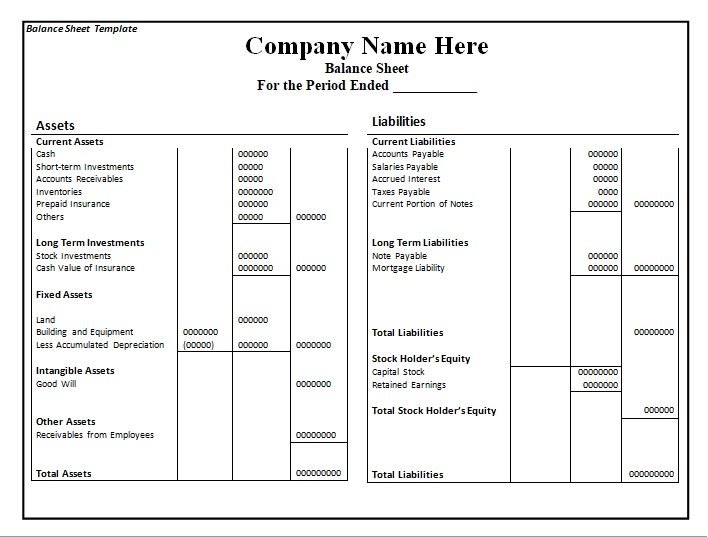

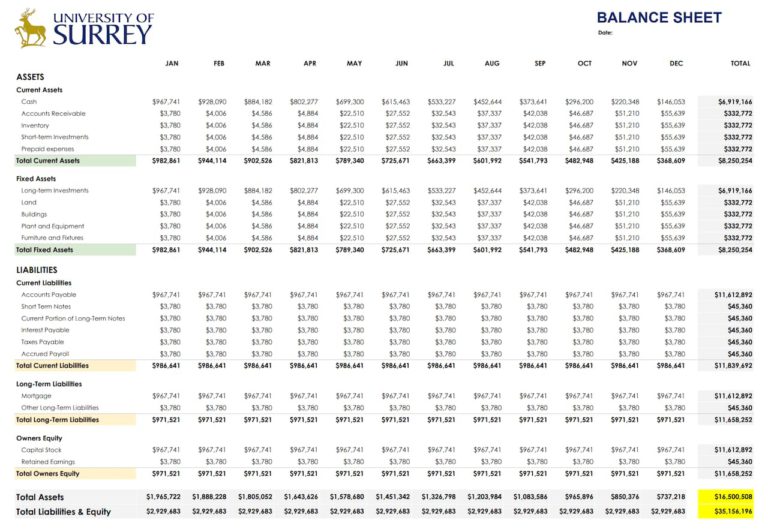

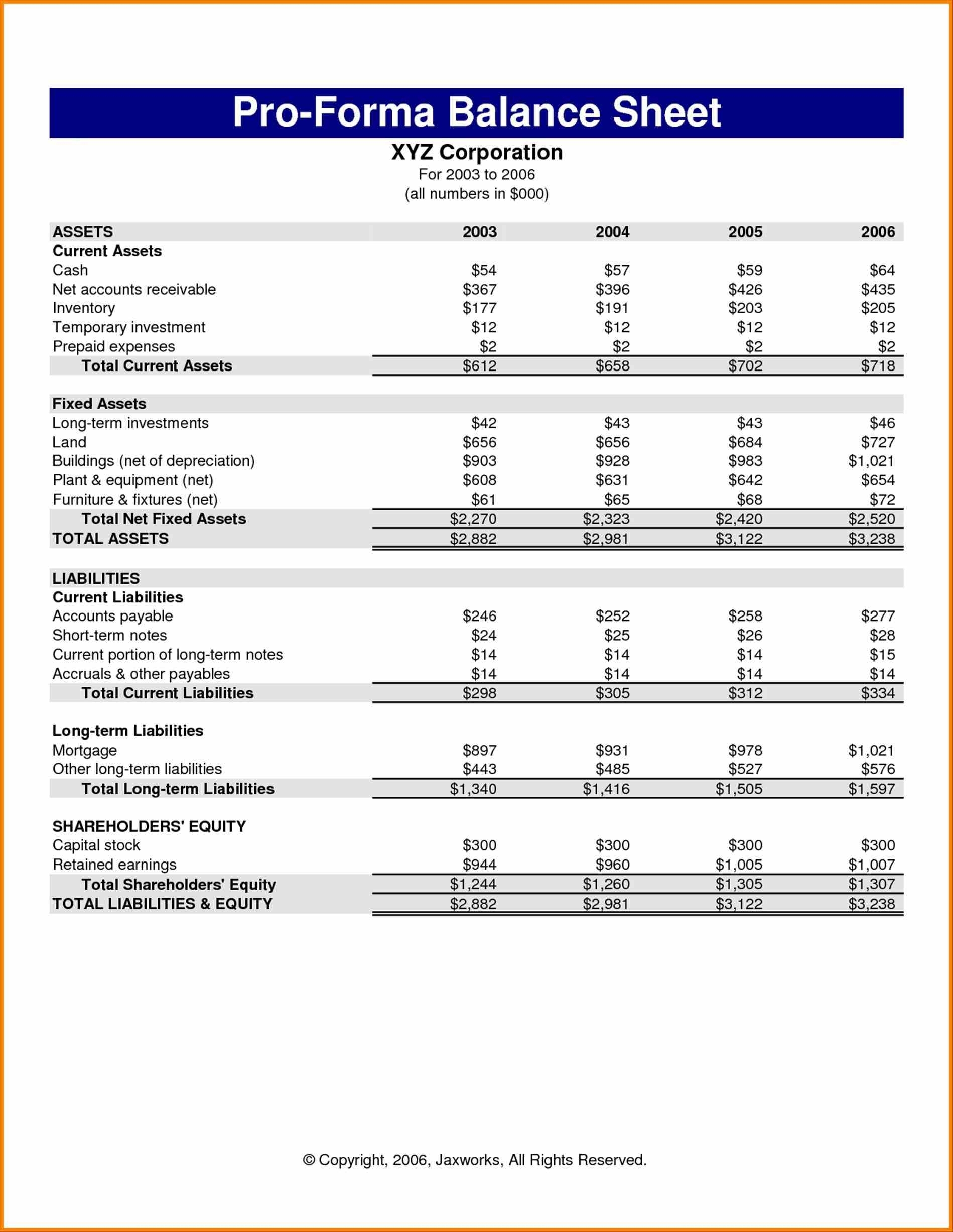

We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. On september 24, 2019, irs issued rev. The broad reach of the economic substance doctrine.

For the purposes of section 199a, each rental real estate enterprise will be treated as a single trade or. A taxpayer or rpe must include a statement attached to the return on which it claims the section 199a deduction or passes through the 199a information. Short answer is, you can't create 1 safe harbor statement for multiple schedule e rental properties.

The determination to use this safe harbor must be made annually. Lacerte will create a safe harbor statement for each. Get expert tax advice and tips.

Unmodified box method, modified box method and tracking method. This safe harbor is available for taxpayers who seek to claim the section 199a deduction with respect to a rental real estate enterprise. solely for purposes of. Discover how to document the sec.

The revenue procedure's safe harbor attempts to mitigate uncertainty about whether an interest in rental real estate rises to the level of a trade or business for purposes of irc. Abby owns two commercial buildings that she. The following example illustrates the application of the safe harbor:

Sample safe harbor election statement: This revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated as a trade or business for purposes of section 199a of the internal.