Peerless Tips About Profit And Loss Account Debit Balance

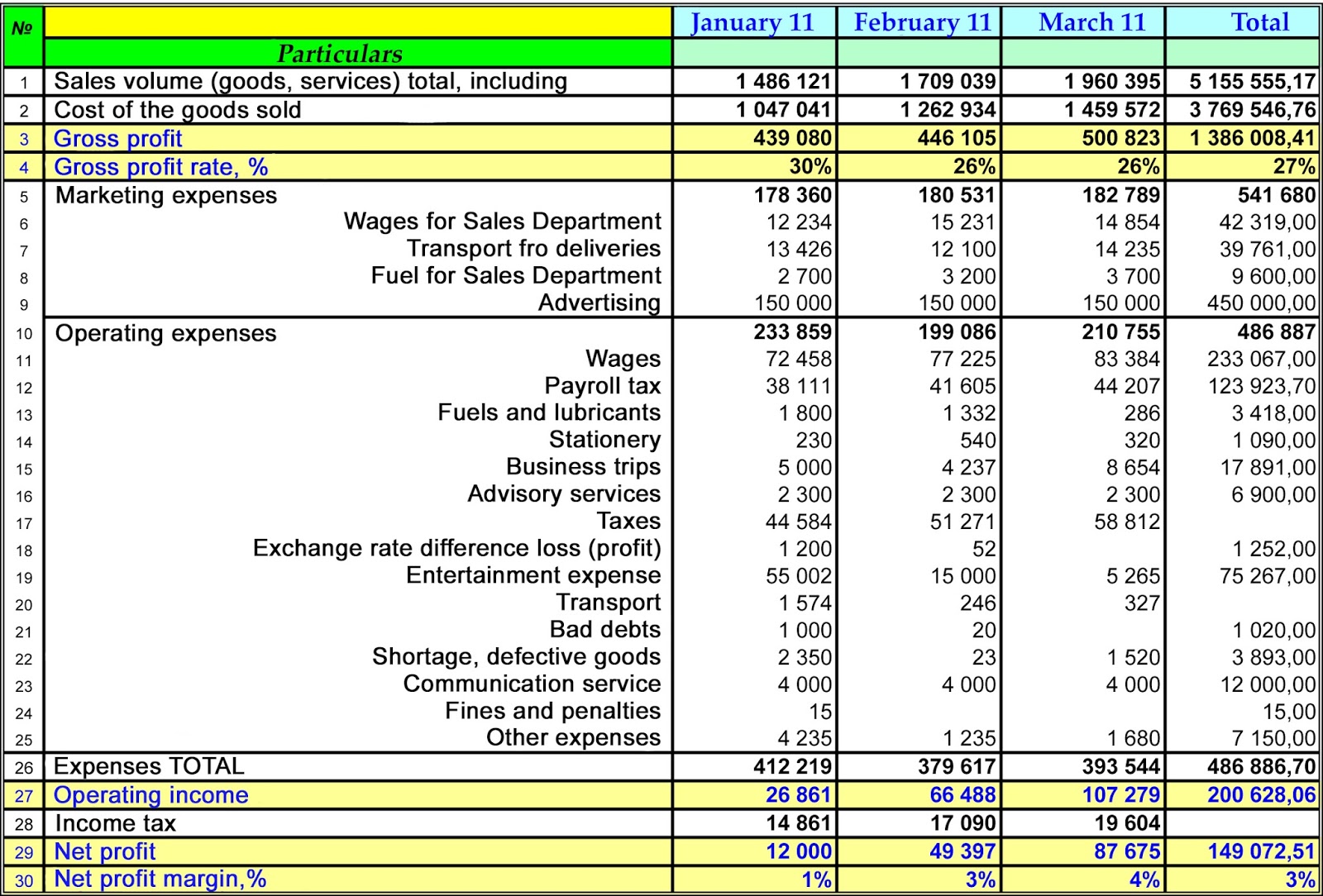

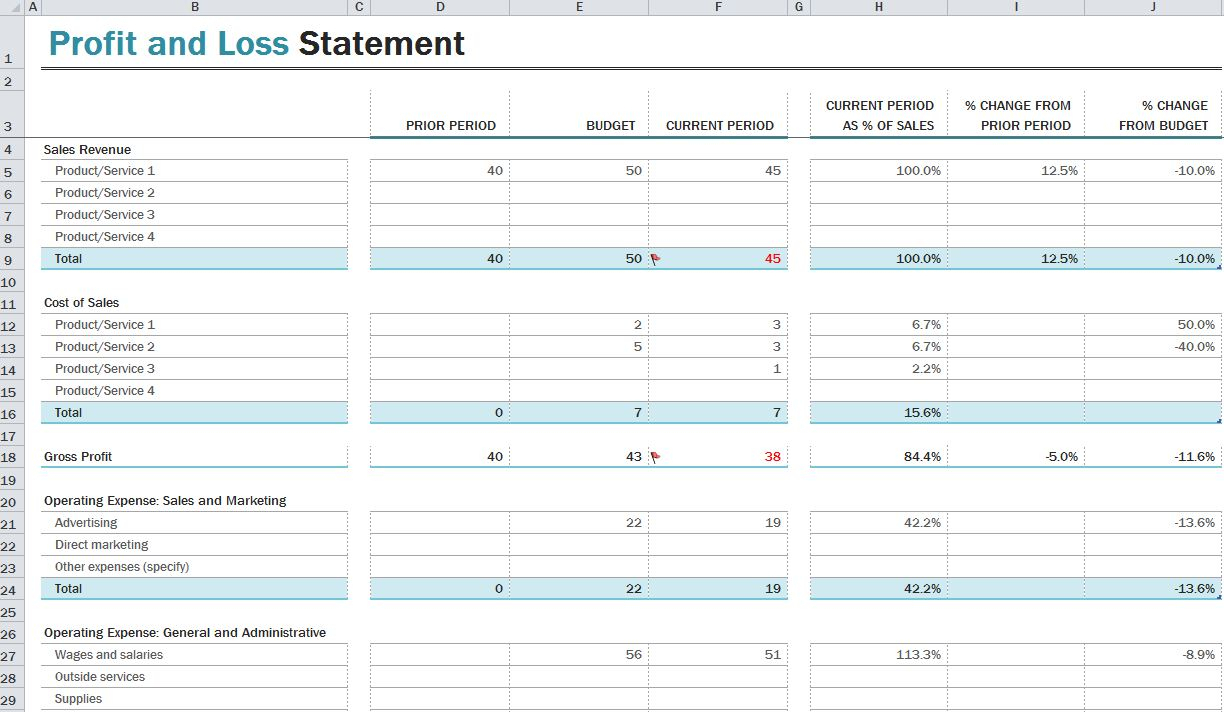

What is a profit and loss (p&l) statement?

Profit and loss account debit balance. In order to prepare the profit and loss account and the balance sheet, a business. This loss is what we call the debit balance of a. Understand the difference between generating cash and making a profit.

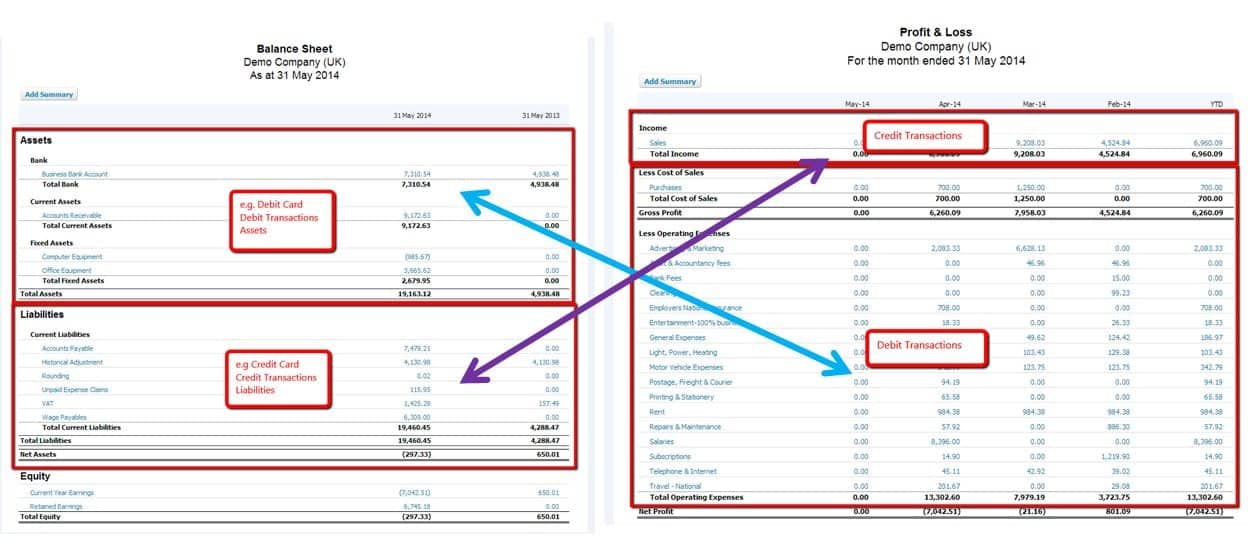

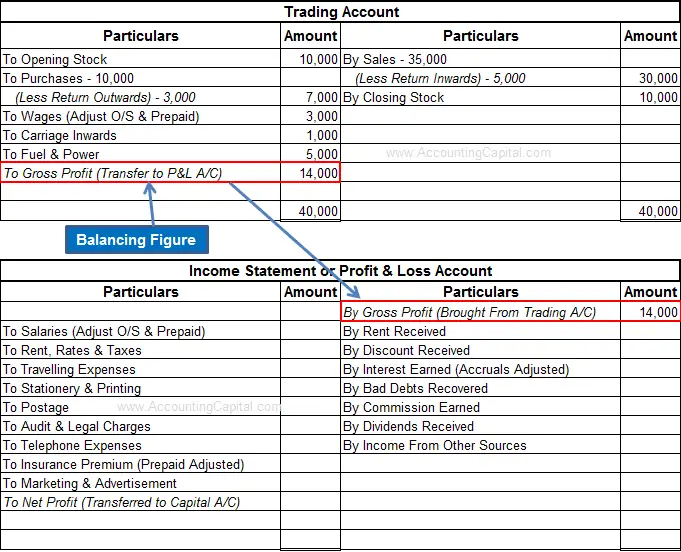

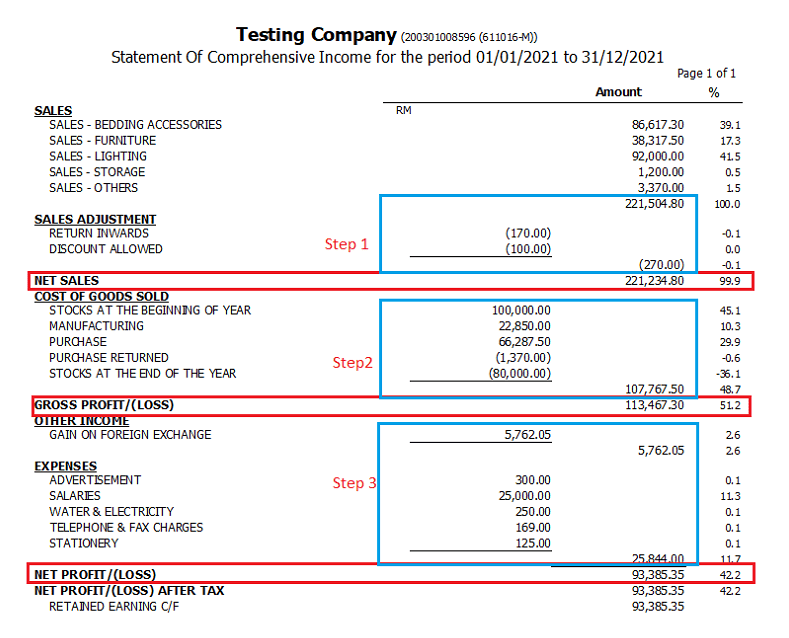

This value is obtained from the balance which is carried down. The income statement, often known as the balance sheet,. Profit loss account is prepared to find out gross profit or gross loss.

Gross profit or gross loss is transferred to. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues , costs, and. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date.

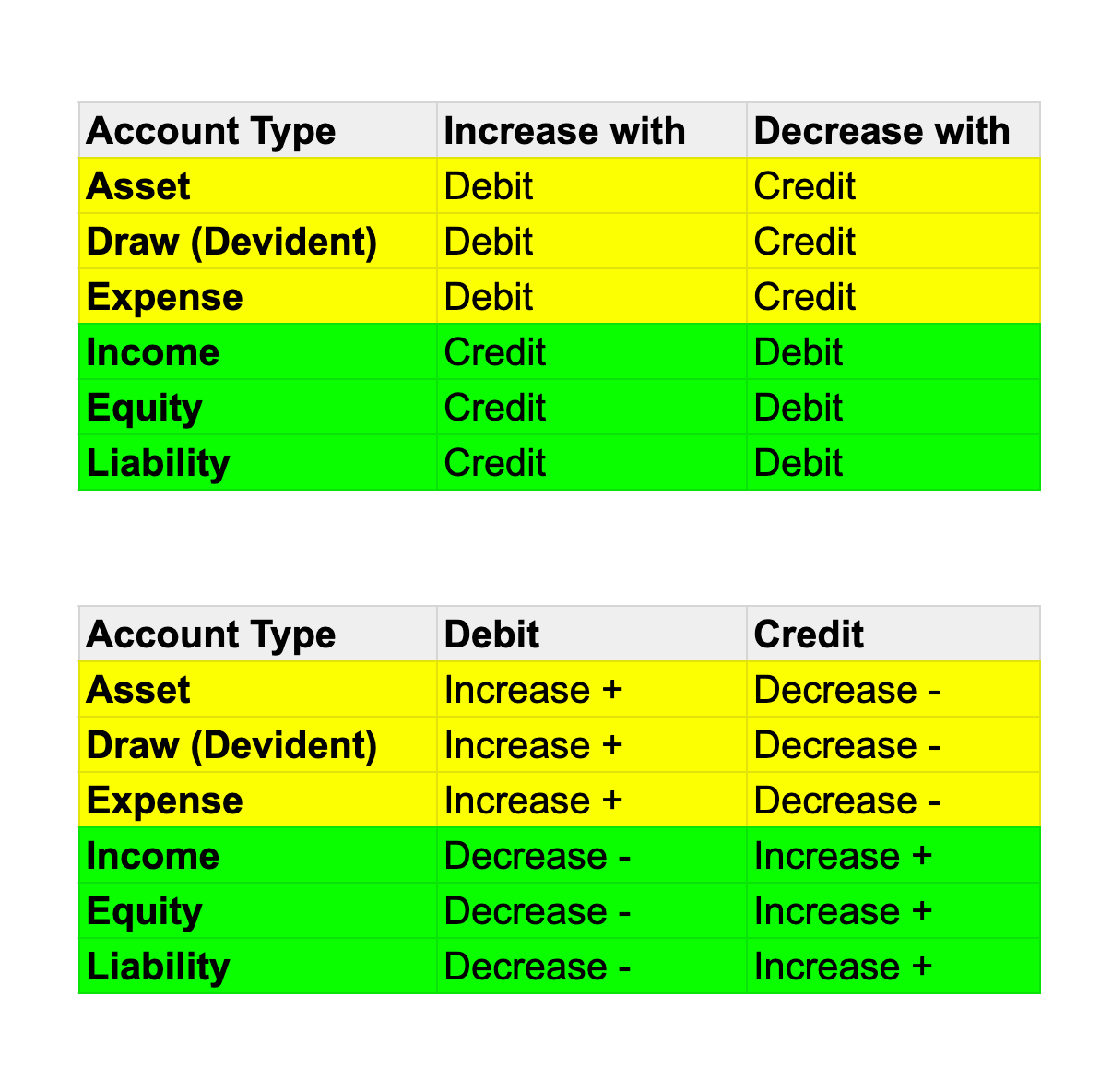

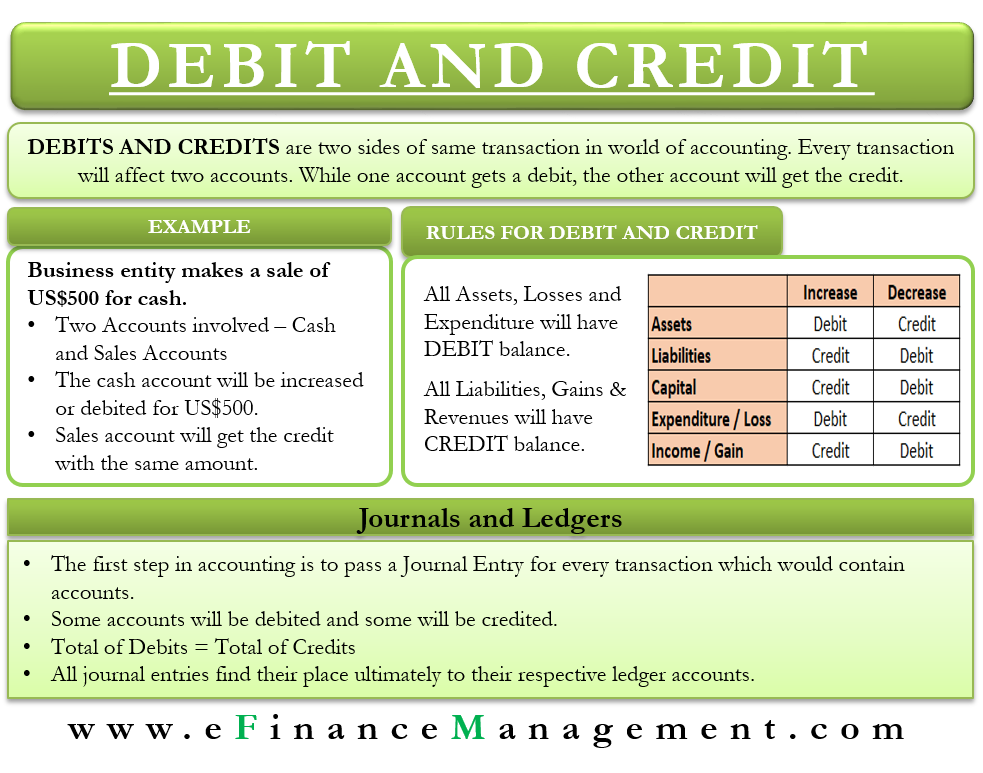

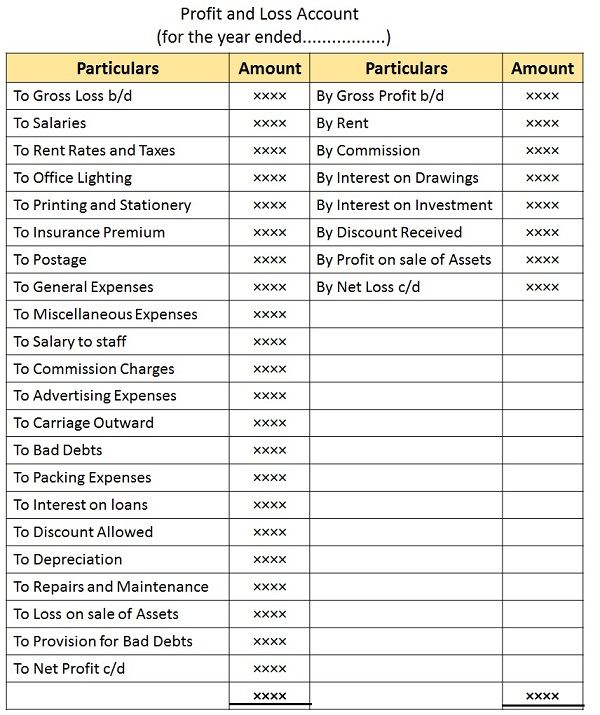

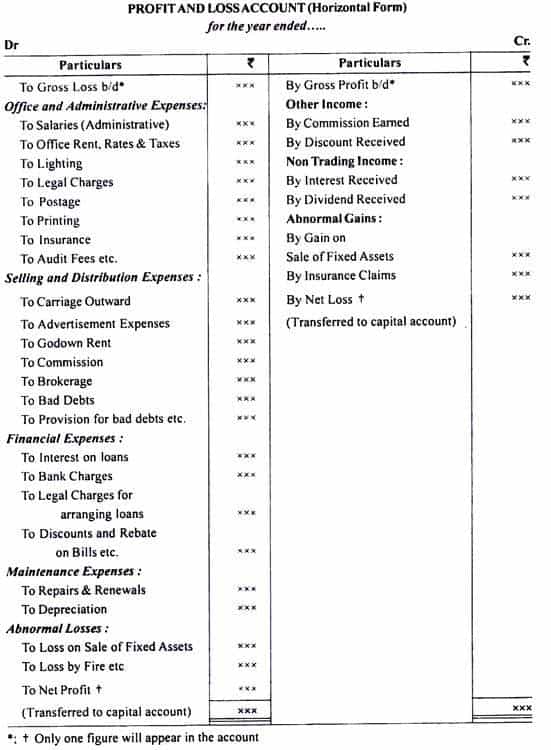

Understand how profit relates to owner's capital in the balance sheet and the accounting equation. Understand the concept of trading account here in detail. In a p&l account, when the expenses (debit) are greater than the incomes (credit), the business is said to be in a net loss.

From profit and loss accounts to balance sheets and annual financial statements. The profit and loss statement is an apt snapshot of a company's financial health during a specified time. From april 1, 2017, they decided to share.

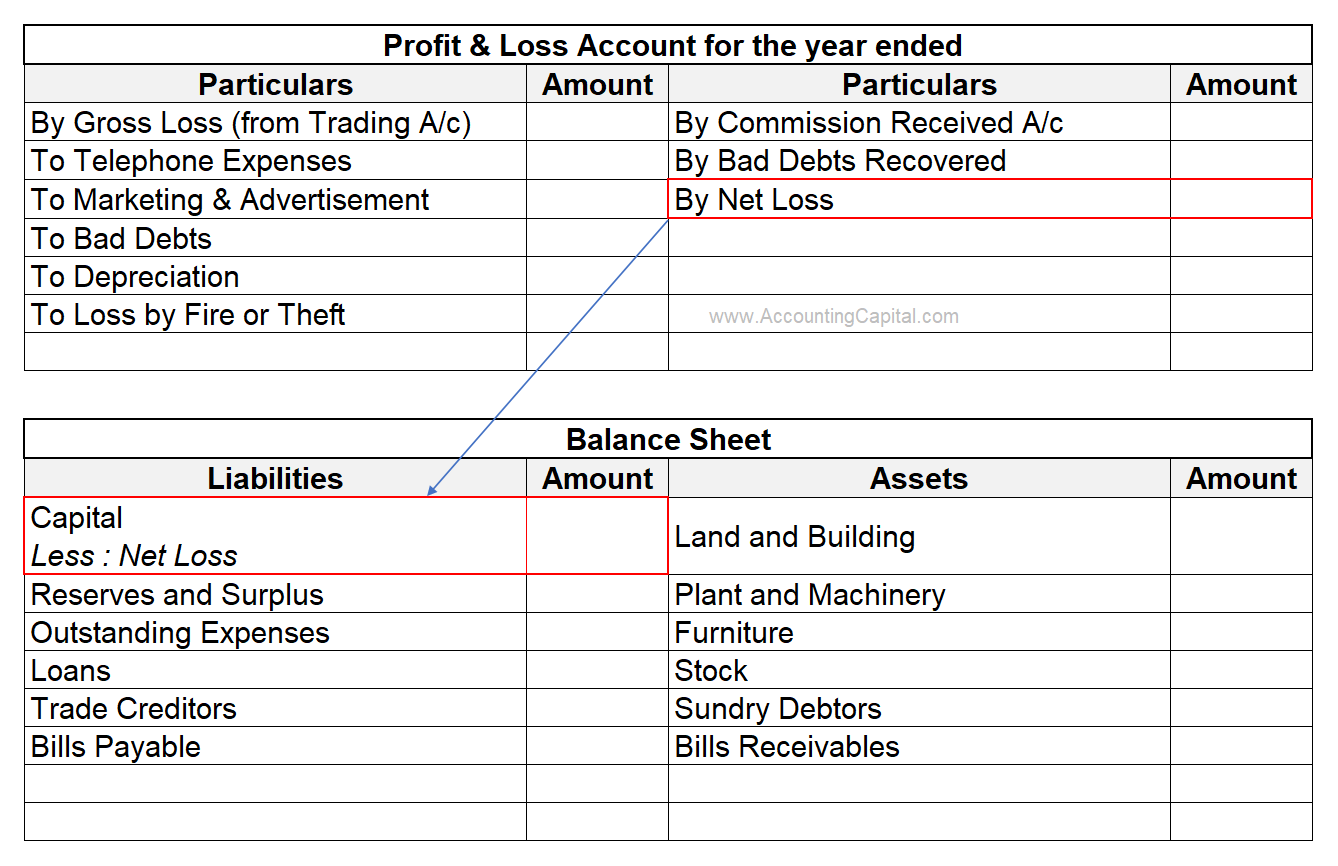

The credit balance of a profit and loss account means “ net profit ” for the business, whereas a debit balance of a profit and loss account indicates a net loss. Both the profit and loss account and the balance sheet are drawn from the trial balance. Trading account is a part of profit & loss account.

You may approach paytm payments bank or use its banking app to close your wallet and transfer the balance to an account maintained with another bank. This reduction in equity signifies that. Jun 6th, 2023 | 17 min read contents [ show] every business wants to know the incomes earned and expenses incurred during a particular period, usually at the end.

At the end of a financial year, the net loss is transferred to the balance sheet and shown as a deduction from capital. This indicates that the company has not made enough money to cover its costs. A profit and loss account is an account.

The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. Profit and loss account get initiated by entering the gross loss on the debit side or gross profit on the credit side. A and b are partners sharing profits and losses in the ratio of 2:1.

Considering the formula for ascertaining the profit or loss, profit = (sum of balances in nominal accounts with a credit balance) − (sum of balances in nominal accounts. The profit and loss account (p&l account) is central to this accounting concept, as it splits expenses from income (nominal accounts) with the aid of two. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.