Supreme Tips About Trial Balance Closing Entries

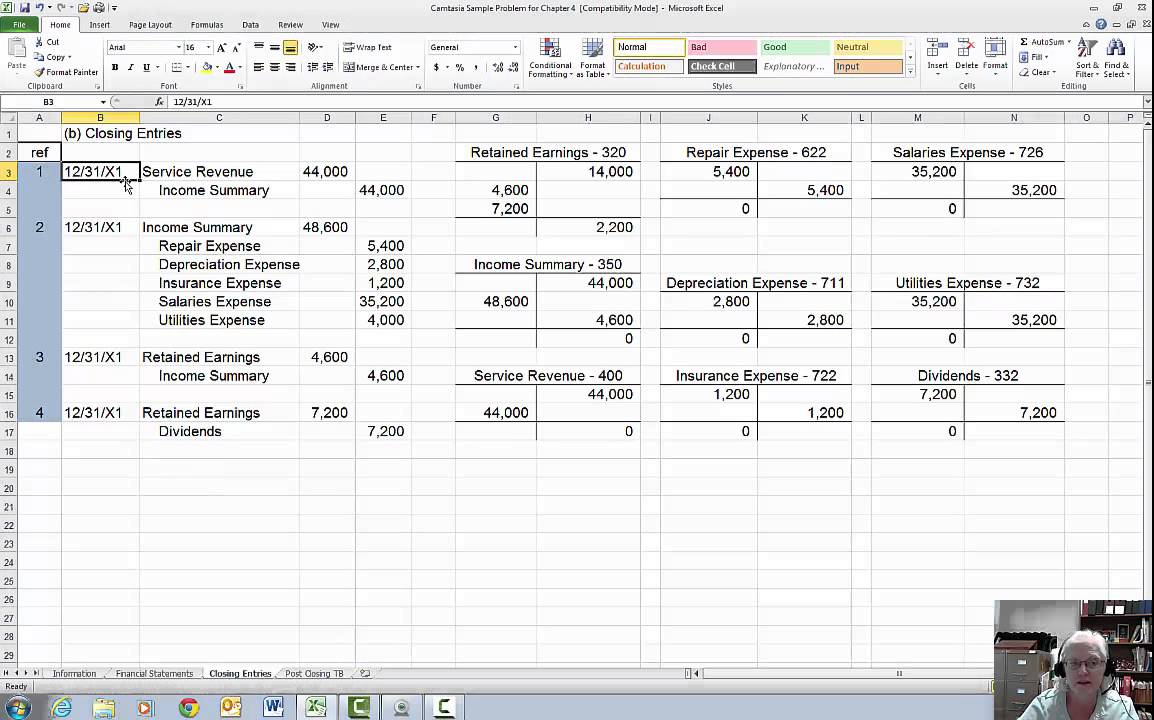

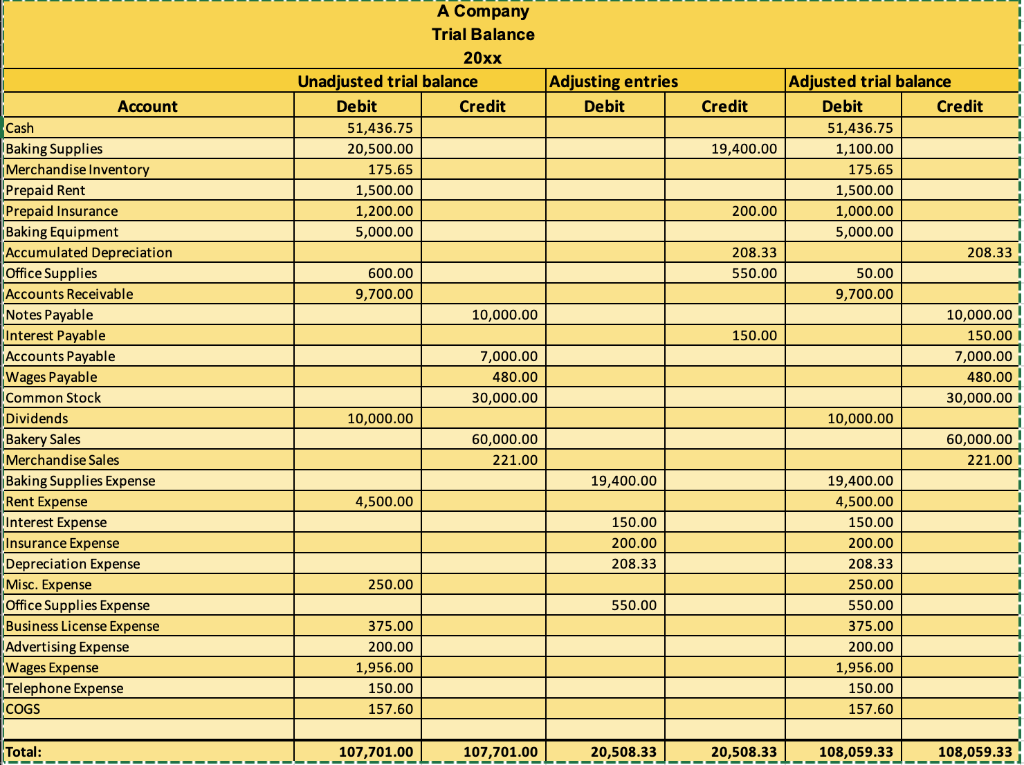

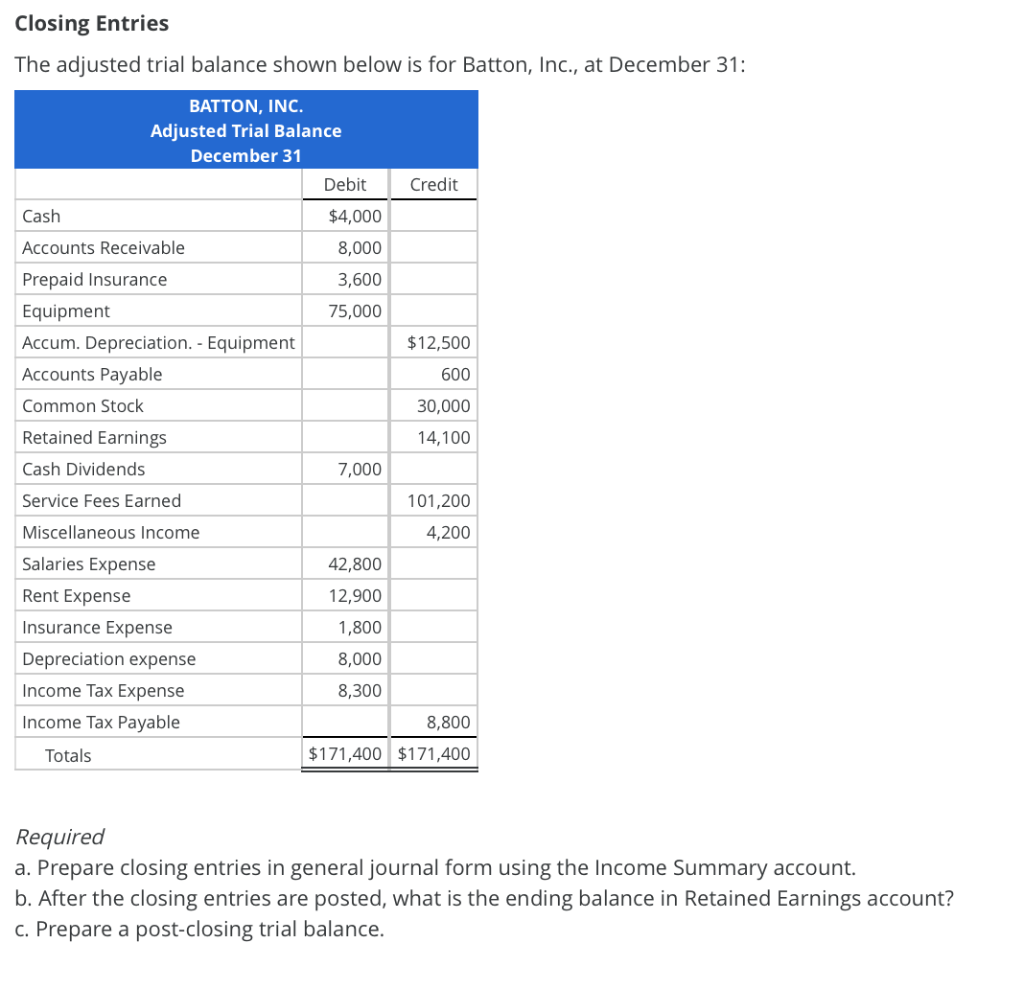

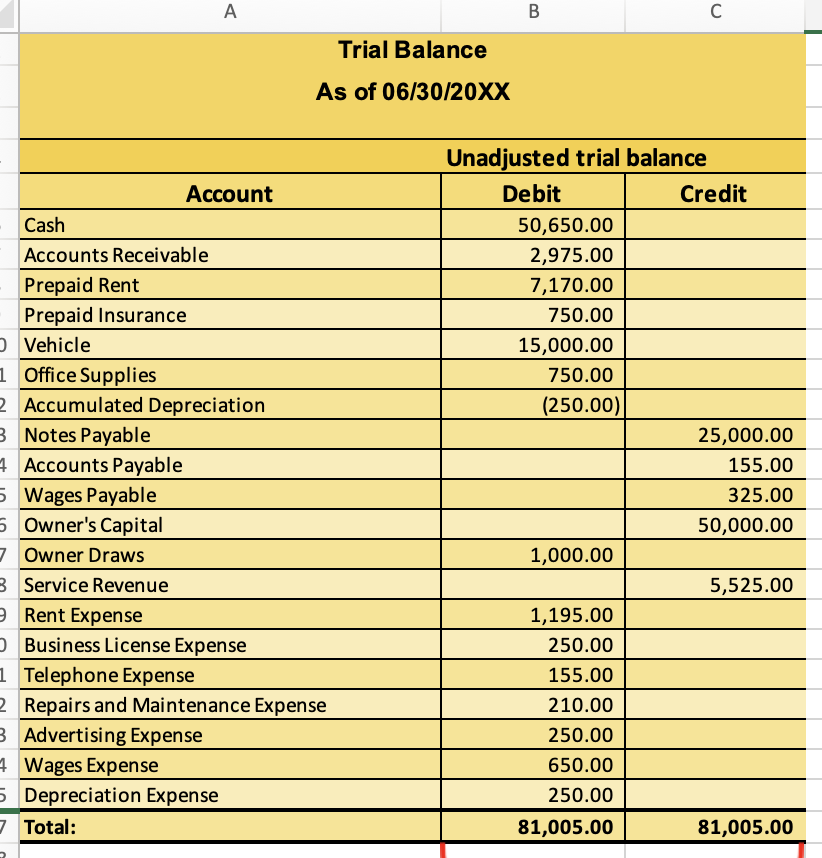

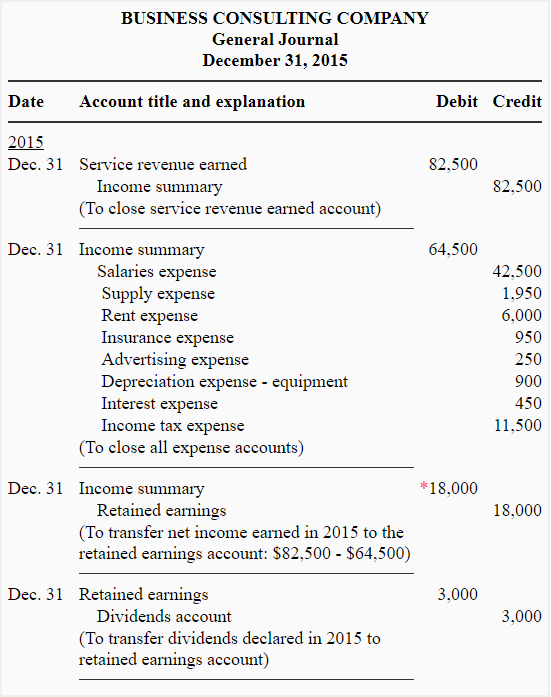

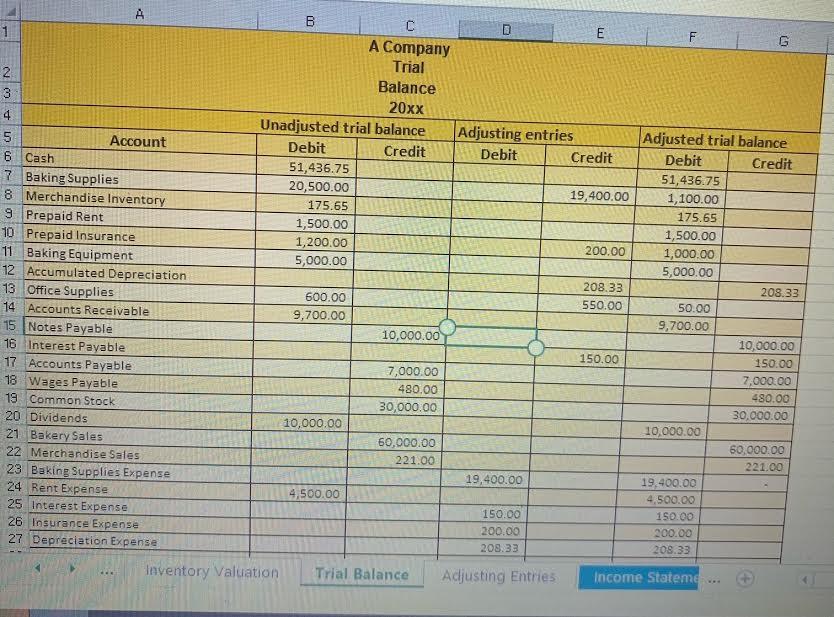

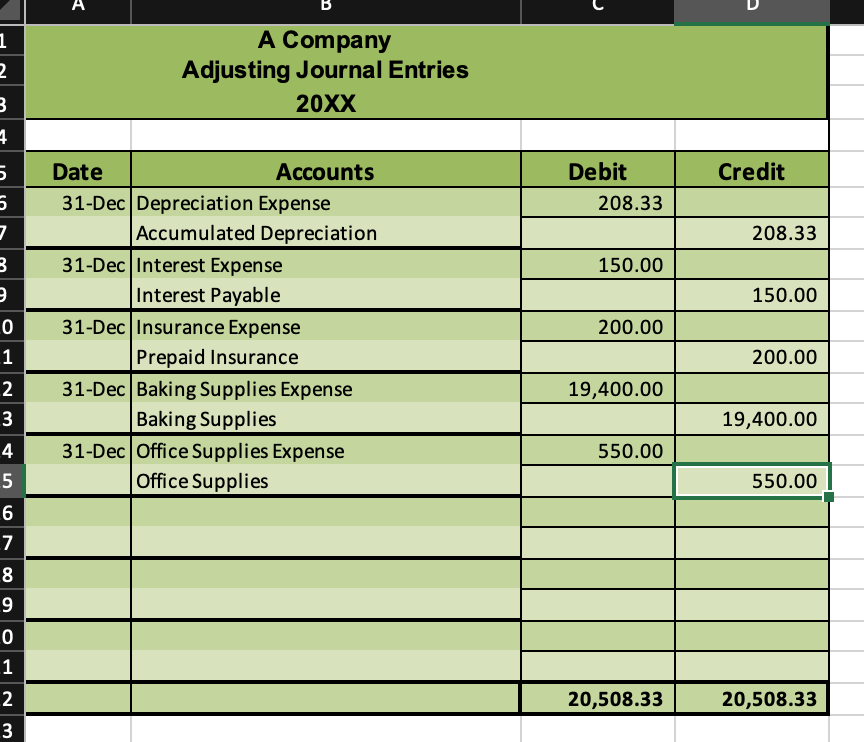

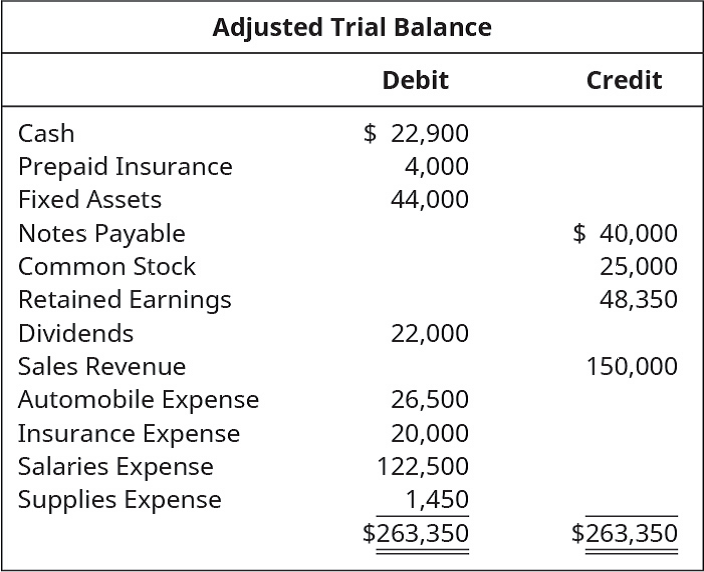

The information needed to prepare closing entries comes from the adjusted trial balance.

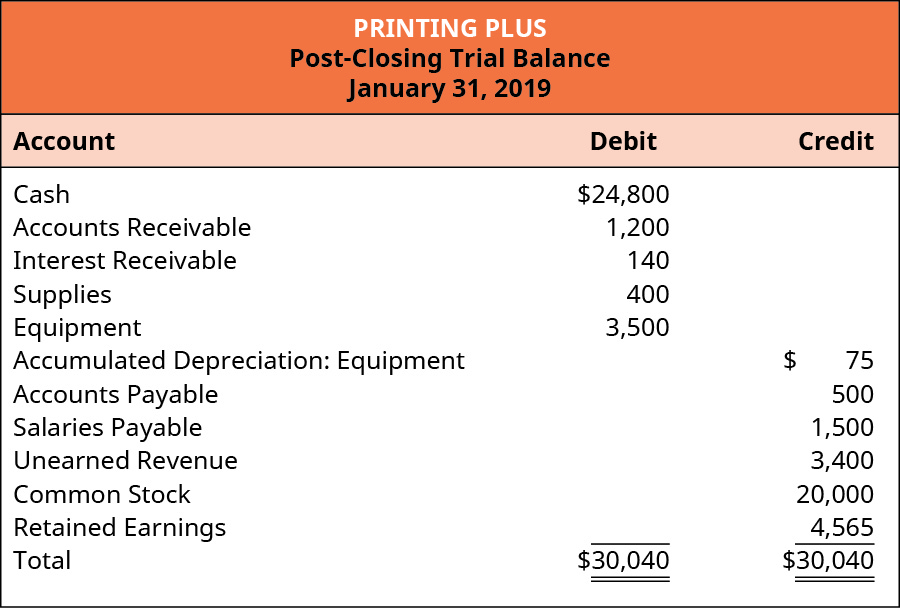

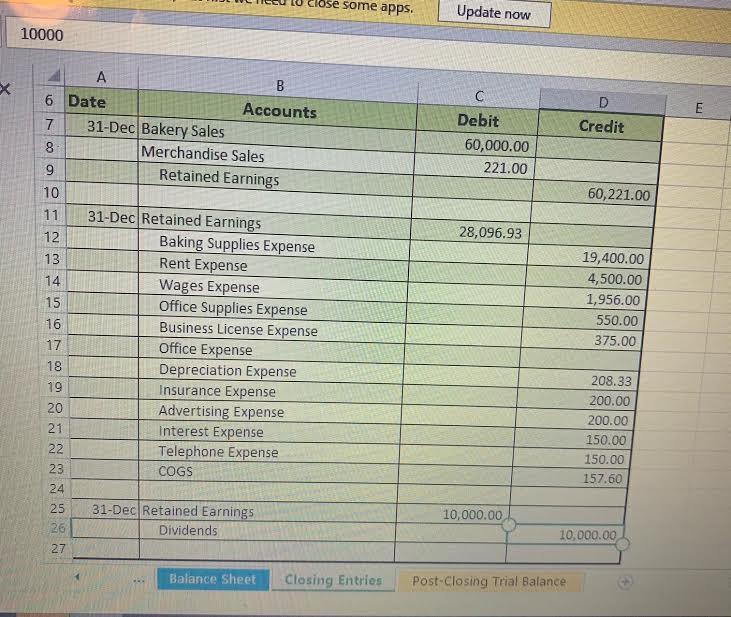

Trial balance closing entries. Let’s explore each entry in more detail using printing plus’s information from analyzing. The retained earnings account balance has now increased to 8,000, and forms part of the trial balance after the closing journal entries have been made. We see from the adjusted trial balance that our revenue accounts have a credit balance.

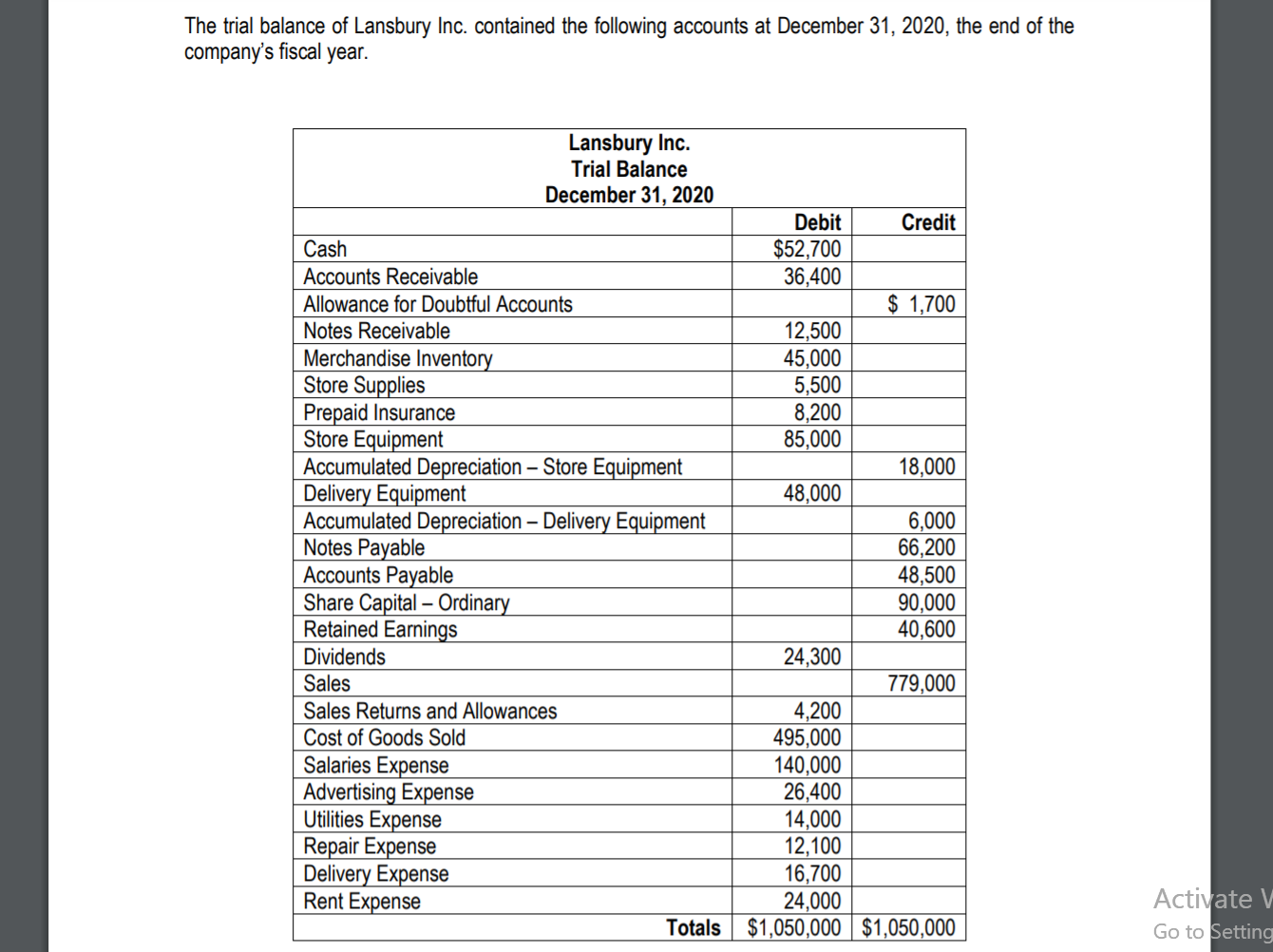

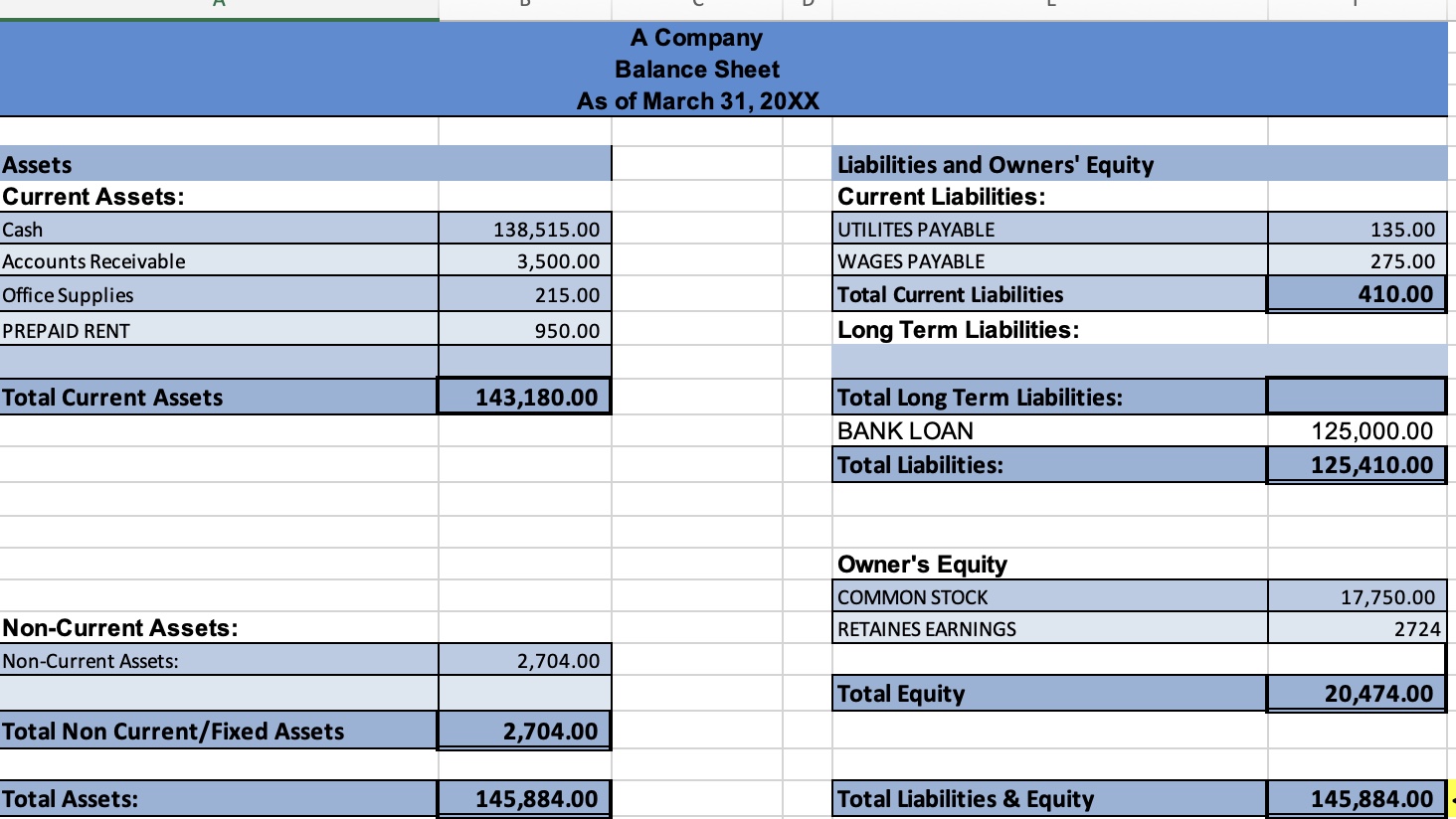

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. Closing entries are completed at the end of each accounting period after your adjusted trial balance has been run.

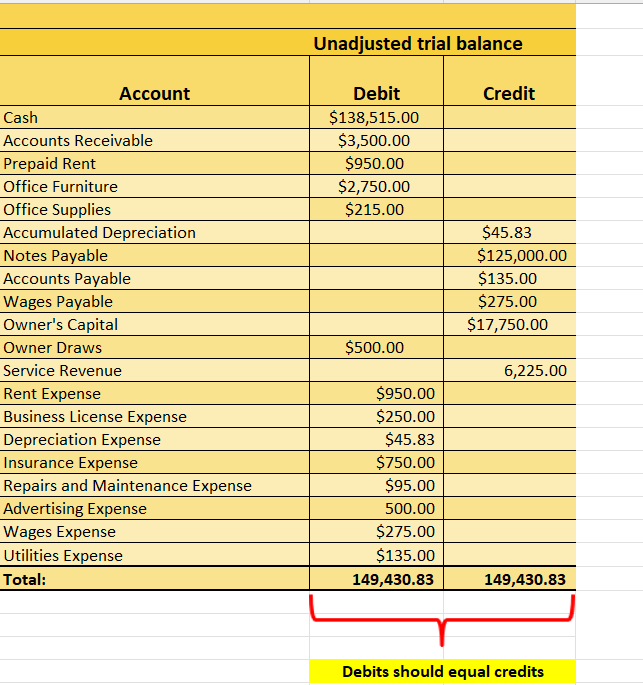

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. The information needed to prepare closing entries comes from the adjusted trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining.

In completing the accounting cycle, we continue our discussion of the accounting cycle, completing the last steps of journalizing and posting closing entries and preparing a. You are preparing a trial balance after the closing entries are complete. Close revenue accounts close means to make the balance zero.

This statement comprises two columns:. A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

Closing entries are journal entries posted at the end of an accounting period to reset temporary accounts to zero and transfer their balances to a permanent. Three types of trial balance 1. The main change from an adjusted trial balance is revenues, expenses, and.

Let’s explore each entry in more detail using printing plus’s information from analyzing. Written by cfi team what is a trial balance? You are preparing a trial balance after the closing entries are complete.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Closing entries are journal entries made at the end of an accounting period which transfer the balances of temporary accounts to permanent accounts.