Favorite Info About Cash Used In Investing Activities

![[Solved] STATEMENT OF CASH FLOWS 1. The following is a balance sheet](https://media.geeksforgeeks.org/wp-content/uploads/20221103163653/Inv1.png)

Written by tim vipond what is cash flow from investing activities?

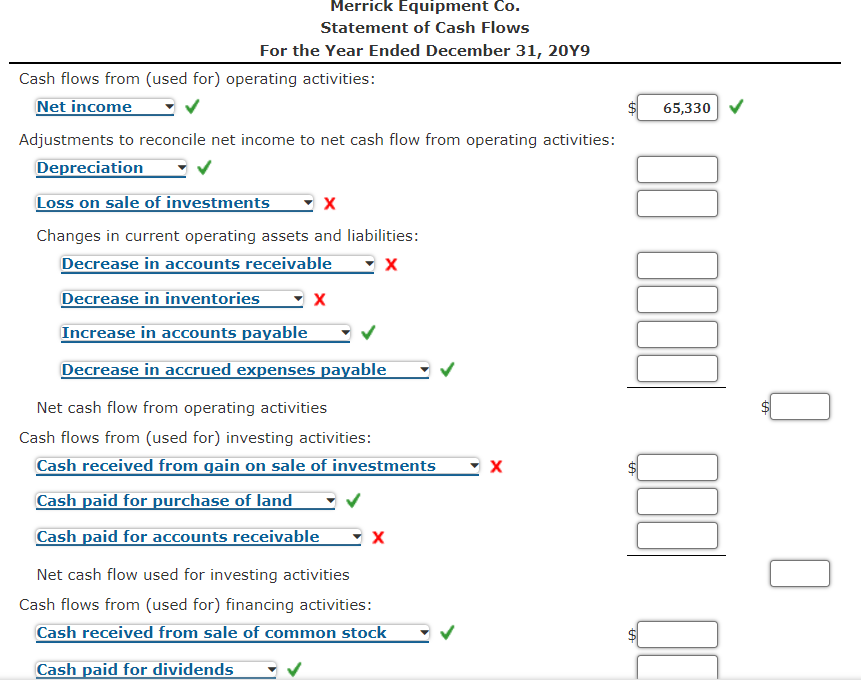

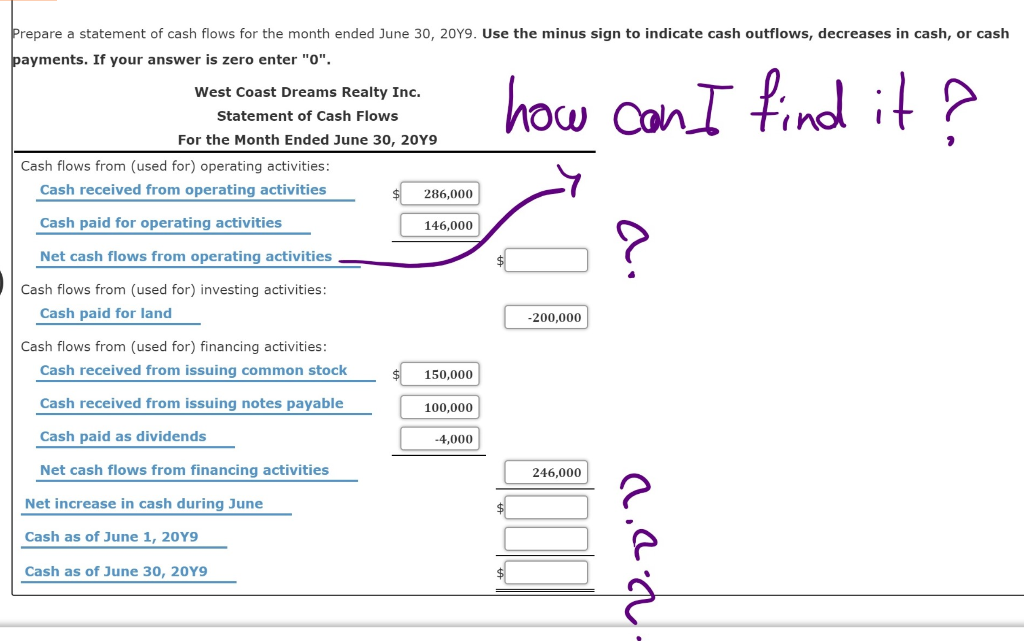

Cash used in investing activities. Begin with net income from the income. Later, as the value of stock x changes this will change the value of the account. What are cash flows from investing activities?

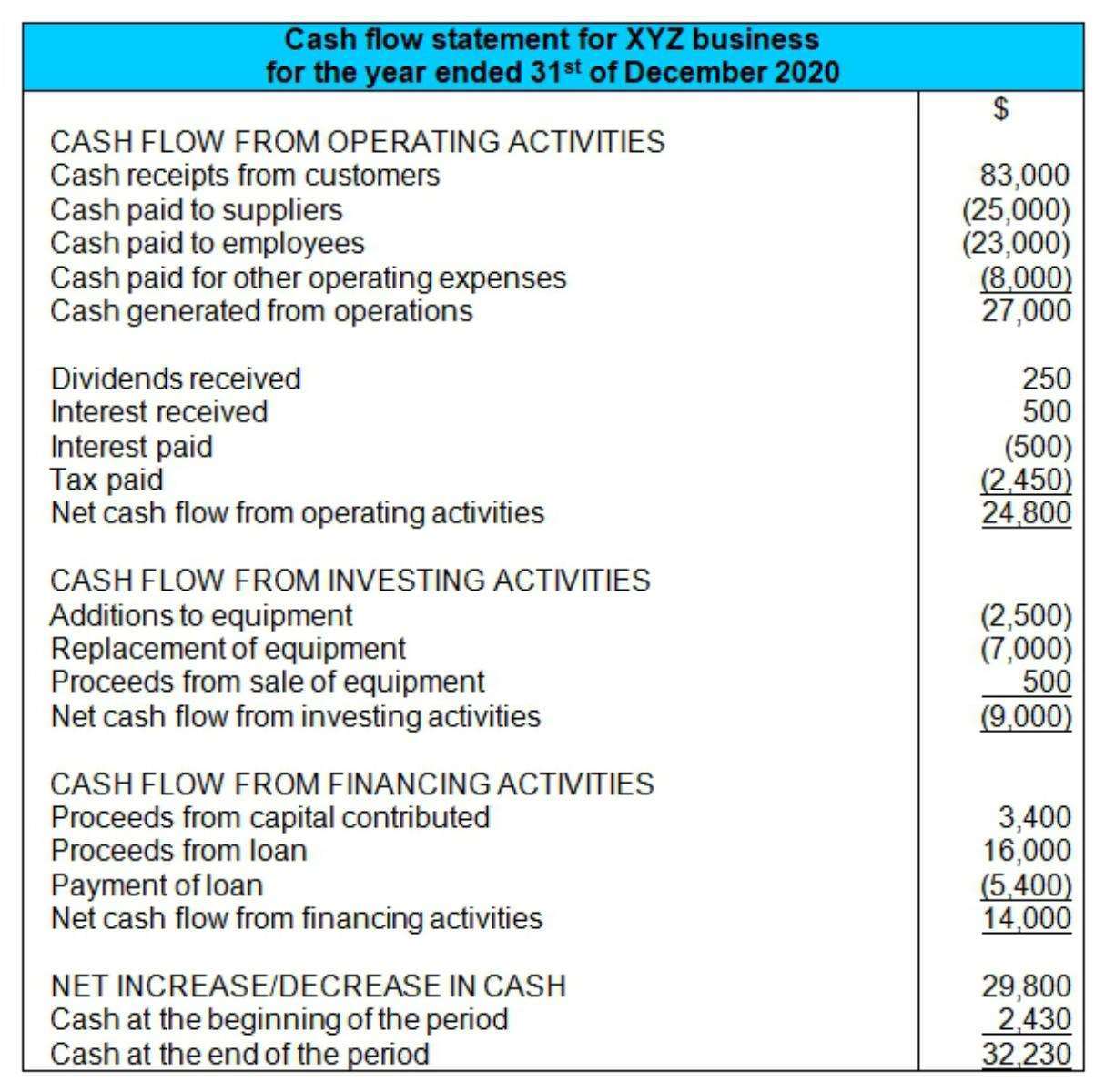

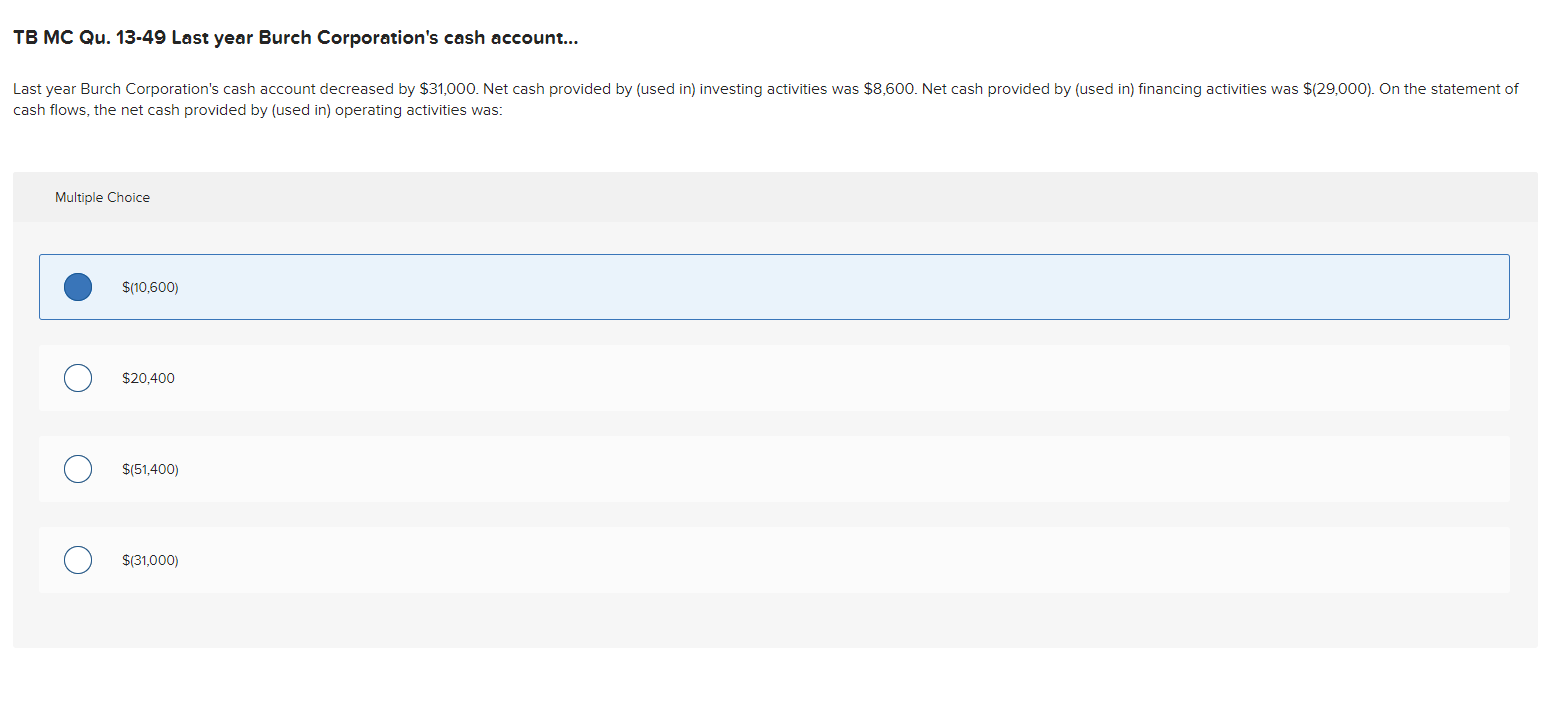

They show how a company. Net cash used in investing activities (430) the net change in the fixed asset accounts was an increase of $430, but that corresponds to a decrease in cash. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets.

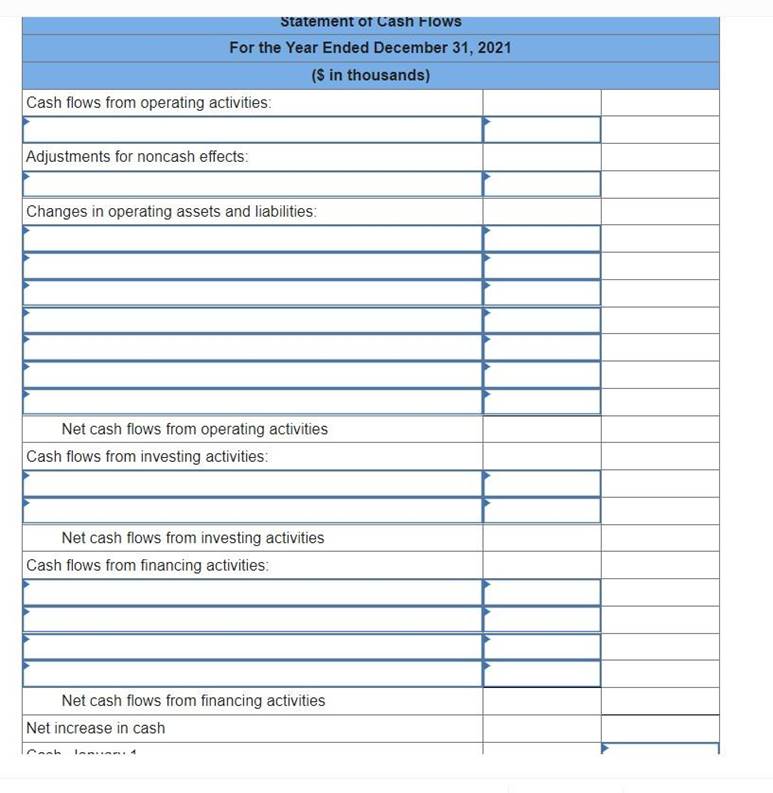

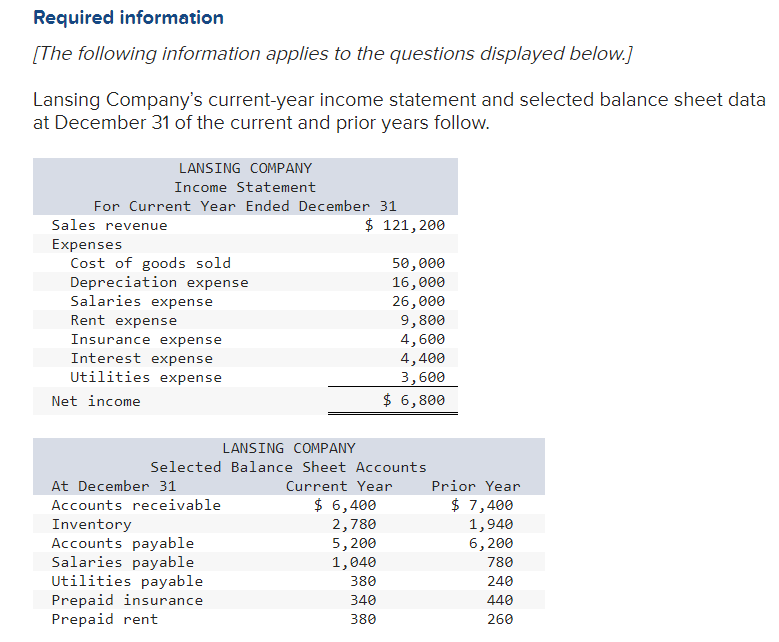

The plan has download speeds of 264mbps. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Investing activities are one of the main categories of net cash activities that businesses report on the cash flow statement.

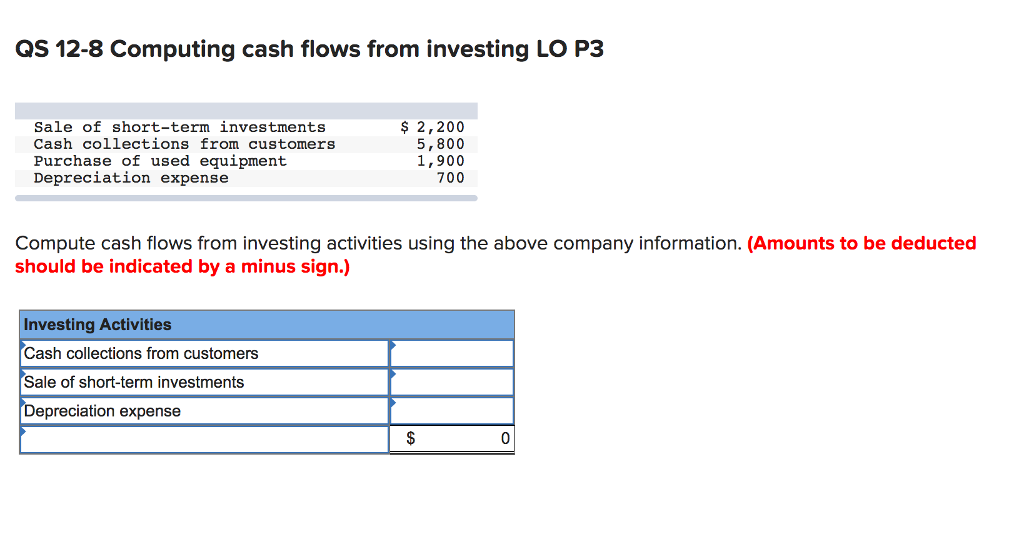

Cash flow from investing activities refers to the inflow and outflow of cash related to the purchase and sale of assets. Items to include in cash flow from investing activities. Cash flows from investing activities is a line item in the statement of cash flows, which is one of the documents.

Key takeaways if a company has a negative cash flow from investing activities, it will appear on the cash from investing activities section of their cash flow. Of course if you start with an account value of $100,000, transfer $10,000 into the. Cash from investing activities formula so far, we’ve outlined the common line items in the cash from investing activities section.

Cash flow from investing activities is the section of a company’s cash flow statement that displays. The formula for calculating the. Cfi includes a whole range of investing activities that involve the cash purchases and disposals (selling) of.

Read on to learn why it is crucial. Investing activities include purchases of physical assets, investments in securities, or the sale of. The purchase or sale of a fixed asset like property, plant, or equipment would be an.

Investing activities account for additions to property, plant, and equipment, while financing activities account for changes in notes.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)