Matchless Tips About Cash Flow Financial Ratios

Aim for your accounts receivable figure to be less than your creditors turnover.

Cash flow financial ratios. Cash flow ratios are sometimes reserved for advanced financial analysis. The cash ratio is a measurement of a company's liquidity. Trump cash stockpile at risk.

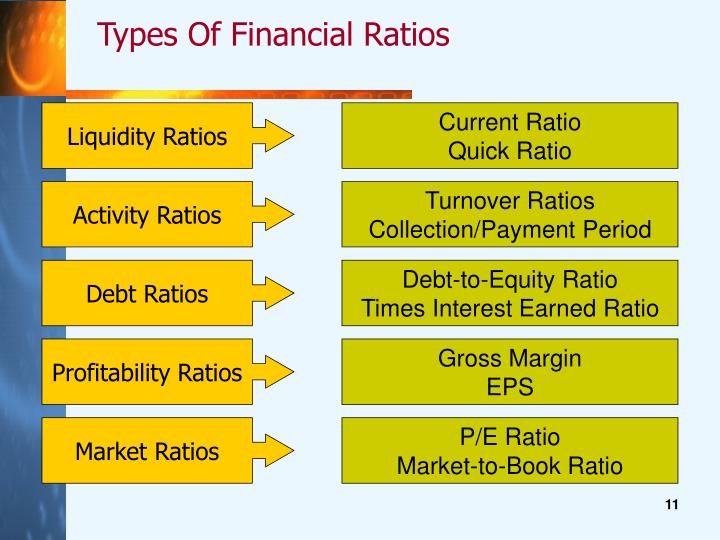

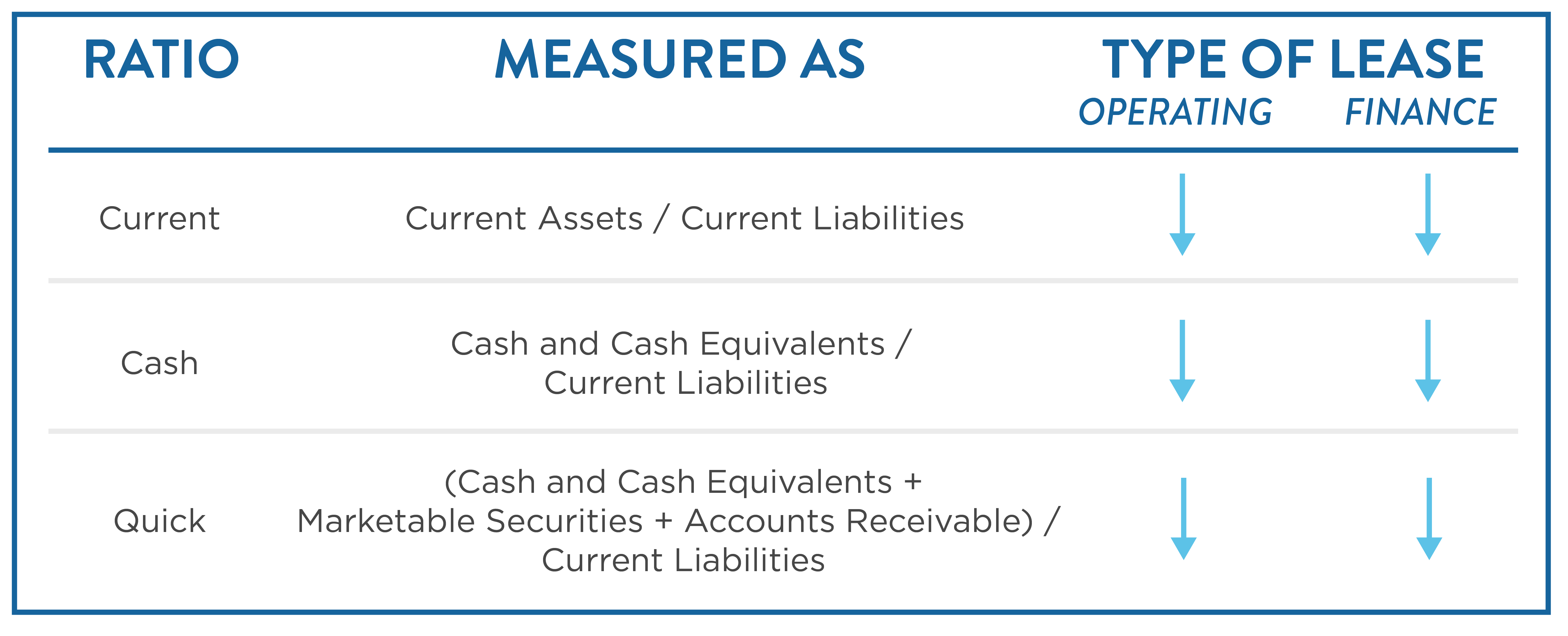

A cash flow ratio is a measure of the number of times a company can pay off current debts with cash generated within the same period. The working capital ratio is calculated by dividing current assets by current liabilities: Current ratio the current ratio is similar in some respects to the cash inflow to cash outflow ratio.

View sogp financial statements in full. Pick n pay will embark on a rights issue to raise up to r4bn to stabilise the company, which faces. Balance sheet and income related ratios are one of the first sets of financial ratios you learn to use when analyzing a company.

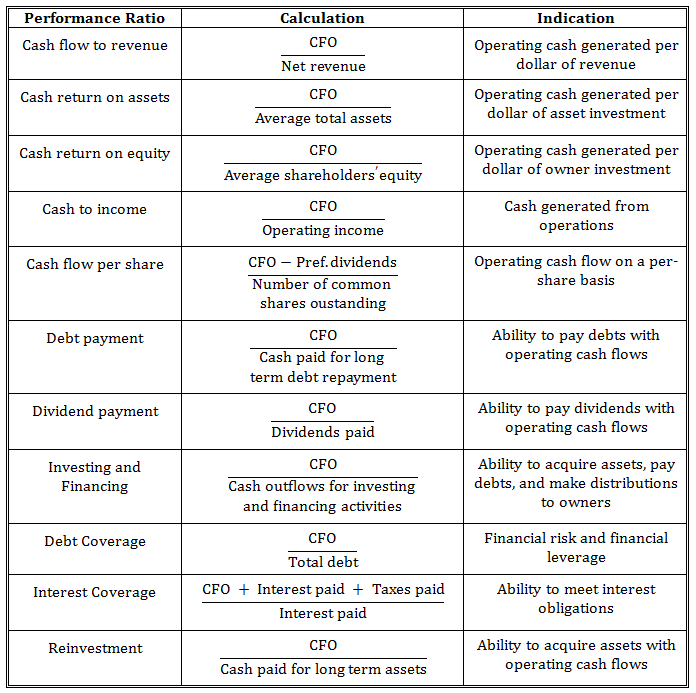

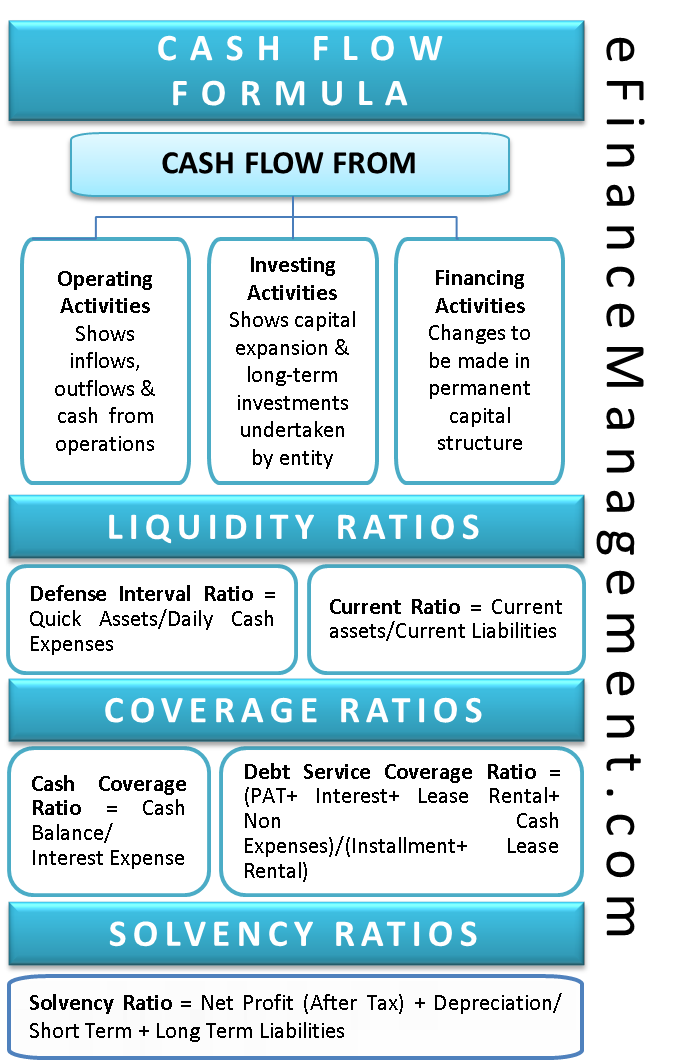

Cash flow ratios compare cash flows to other elements of an entity’s financial statements. A higher level of cash flow indicates. This ratio calculates if a company can pay its obligations on.

A high number, greater than one, indicates. Adr balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. It’s essential because it mirrors your financial health and is the.

Operating cash flow can tell you how much cash flow a business generates in a given time frame. Manage your cash flow by trying to collect cash from your debtors before paying your creditors. Cash flow ratios are financial ratios calculated by comparing the metrics in the cash flow statement with other items in the financial statements.

The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a company's operations. The ratio reflects the operating cash flow adjusted by the. Ifrs operating cash was an inflow of.

It specifically calculates the ratio of a company's total cash and cash equivalents to its current. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out. Cash flow from operations can be found on a company’s statement of cash flows.

Cash flow to income ratio is the indicator of the overall monetary amount of profits that a company gains. The formula for calculating the operating cash flow ratio is as follows: Current and quick ratio debt to equity return.

In the case of a small business,. This financial ratio is useful for. Large and small businesses alike need to be aware of the firm's cash position at all times.

![Sonicericsg [Post 93]Learning investing/trading together part 18How](https://www.accountingcoach.com/wp-content/uploads/2013/10/03X-table-11@2x.png)