Fabulous Info About Audit Response Letter

When drafting an audit response letter, include these key elements:

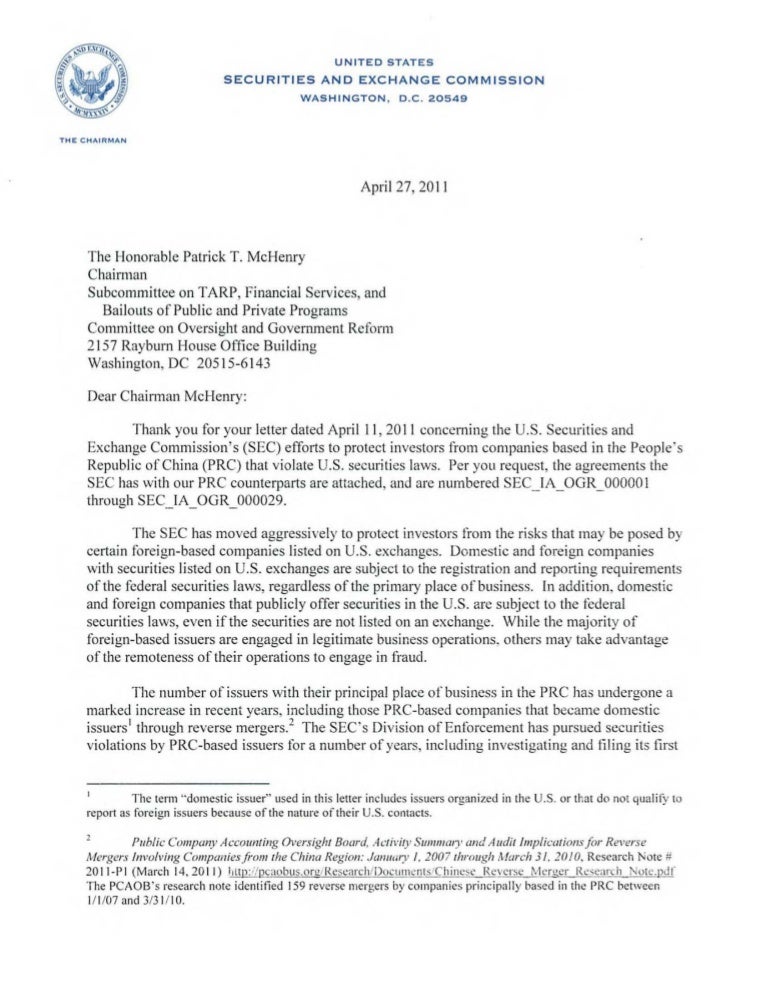

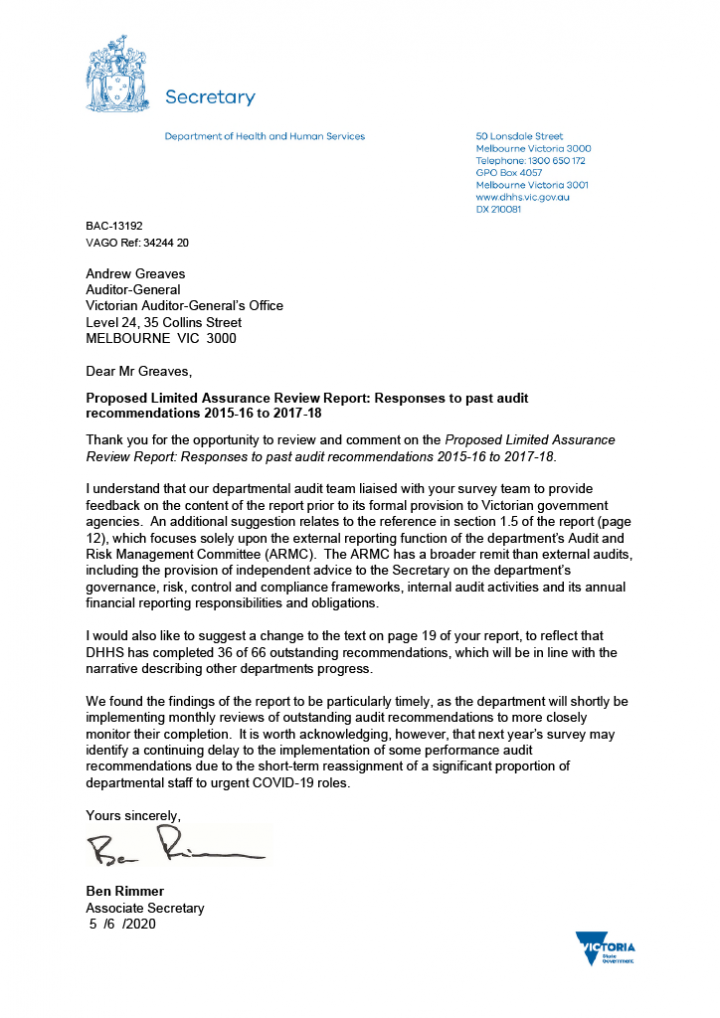

Audit response letter. This article summarizes key developments in the preparation of audit response letters concerning loss contingencies since the american bar association. An “update” or “bringdown” is an audit response letter provided to the auditor in which a lawyer provides information about loss contingencies as of a date after the. An “update” or “bringdown” is an audit response letter provided to the auditor in which a lawyer provides information about loss contingencies as of a date after the date of the.

A framework that has stood. Address the irs representative, state the date and purpose of the audit, provide the requested. 183 (2021/2022) the aba statement on audit responses:

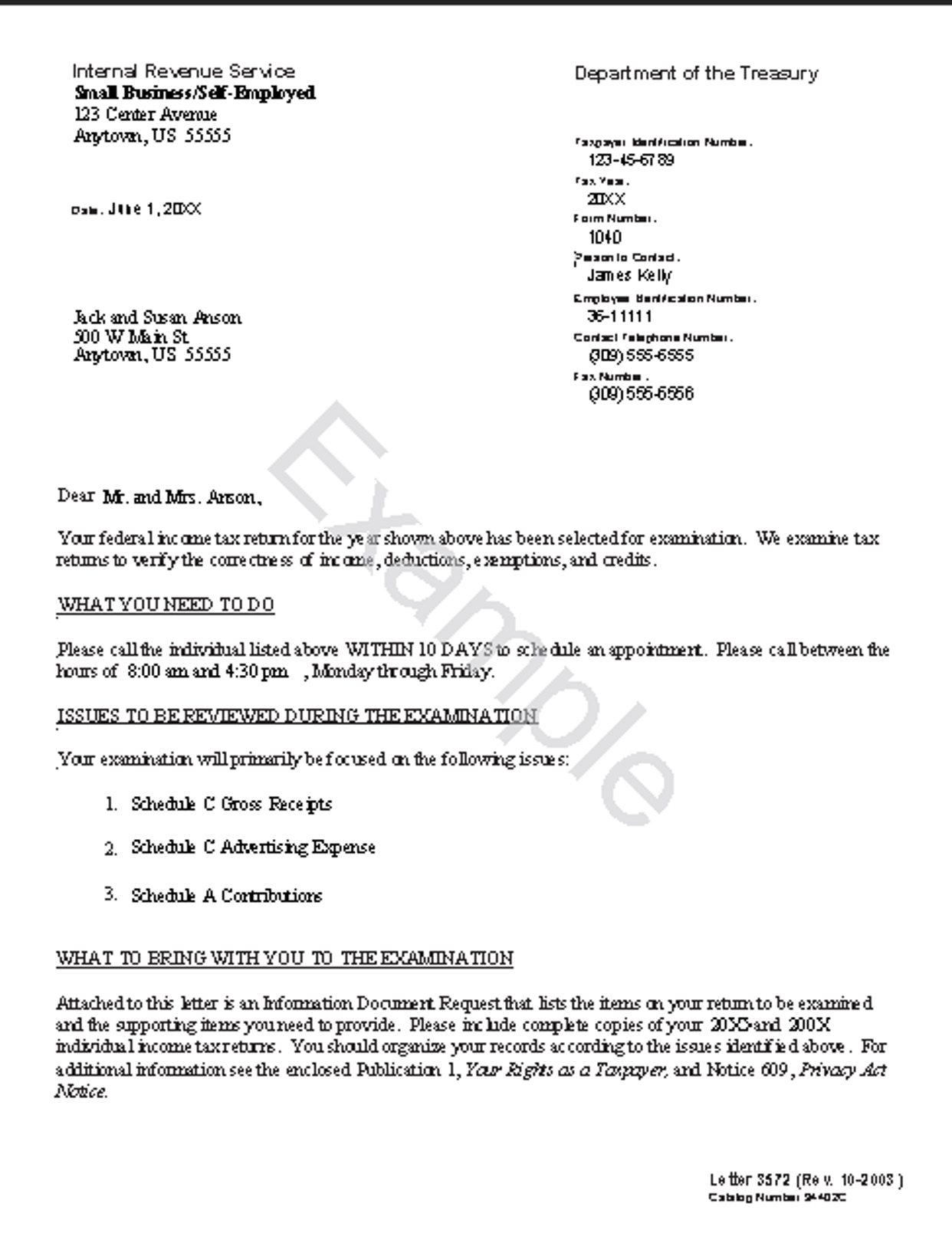

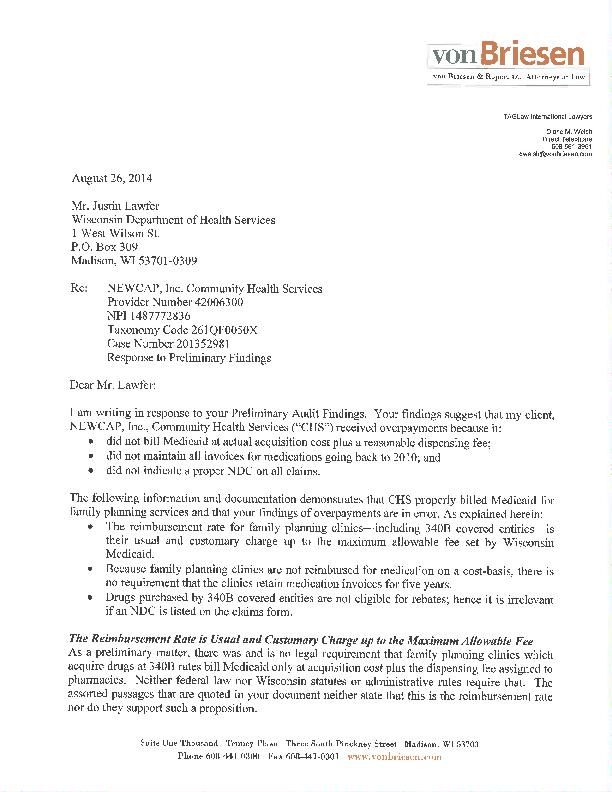

Sample audit response letter september 21, 2015 this is a sample audit response letter. How to write a letter to the irs. Although the information below is not an exhaustive list, there are some strategies taken by firms that indicate to an auditor the firm’s unwillingness to change or inability to make appropriate corrective actions.

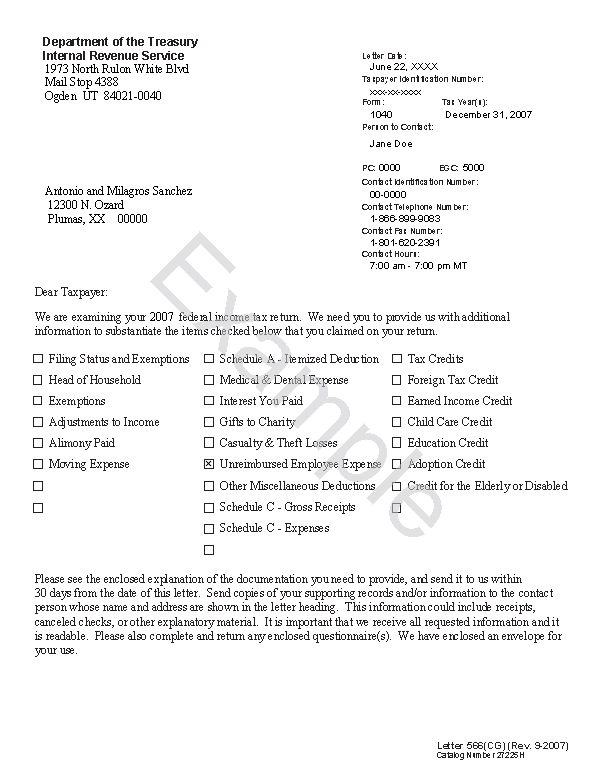

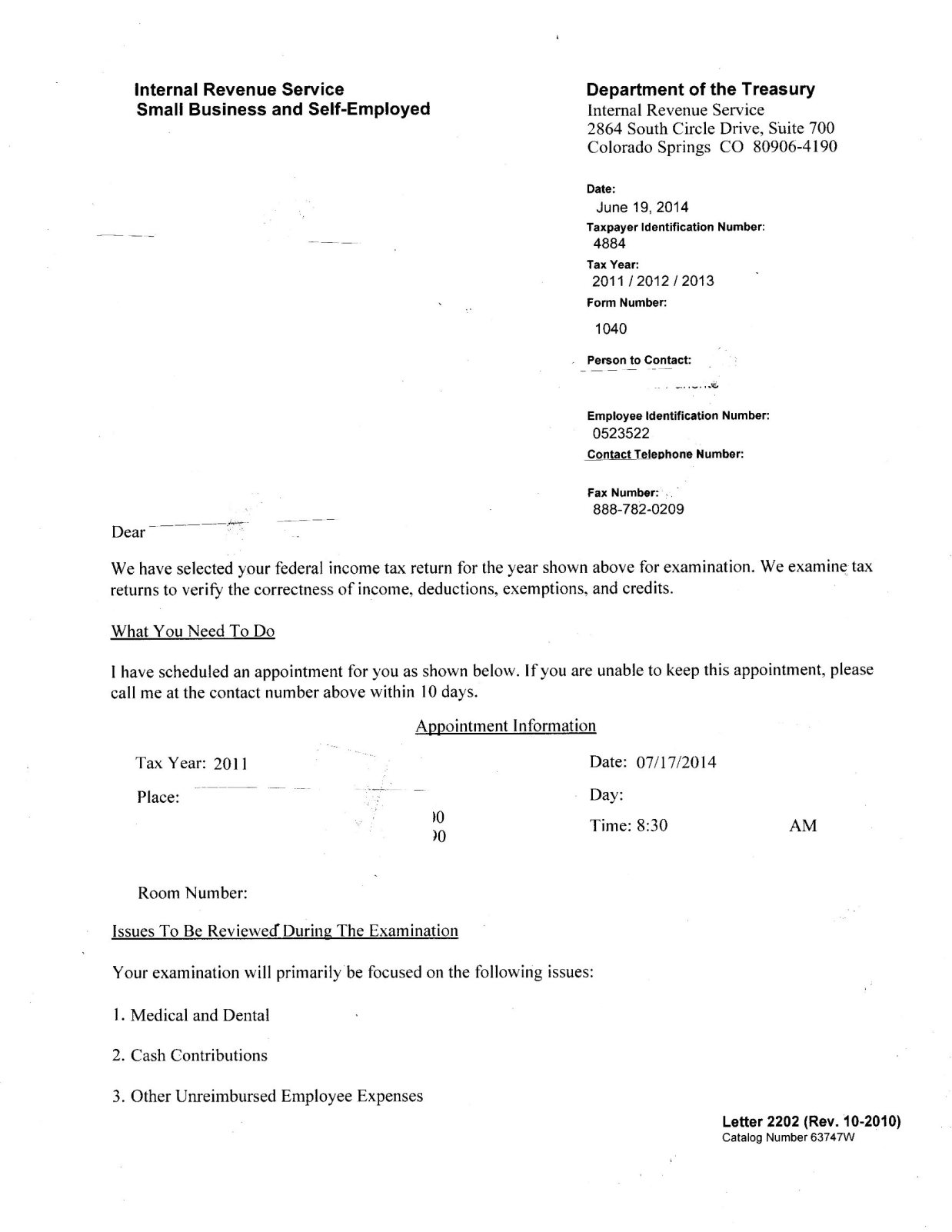

Sample cp2000 letter. This irs letter sample, also called an irs correspondence letter, seeks additional information to support. Respond by any deadlines noted in the letter.

Aba audit responses materials. Report on audit response timing issues, 77 bus. The client financial inquiry letter will often request delivery of the audit response on.

It provides links to resources,. According to asc 450, the lawyer should provide the following information to the auditor: A description of the nature of each matter, the progress of each matter to date, how the.

This article summarizes key developments in the preparation of audit response letters concerning loss contingencies since the american bar association. If a firm does not have the capability, time or experience to respond appropriately to an. The irs generally asks for a response.

Responding professionally, promptly, and cooperatively will help ensure a smoother and more favorable resolution to your irs audit. A blog post that discusses the aba statement of policy, aicpa rules, and the opinions of various experts on audit letter response. By the audit answers committee, aba business law section*.

For each claim or litigation matter, the auditor will request the lawyer’s response include: A law firm’s delivery of an audit response letter confirming certain information about loss contingencies, such as pending or threatened litigation or claims. (1) a description of the nature of each matter, (2) the progress of each matter to date, (3).