Perfect Info About Ifrs 16 Balance Sheet Example

Ability to work on own initiative, prioritise work to deadlines and pay attention to detail.

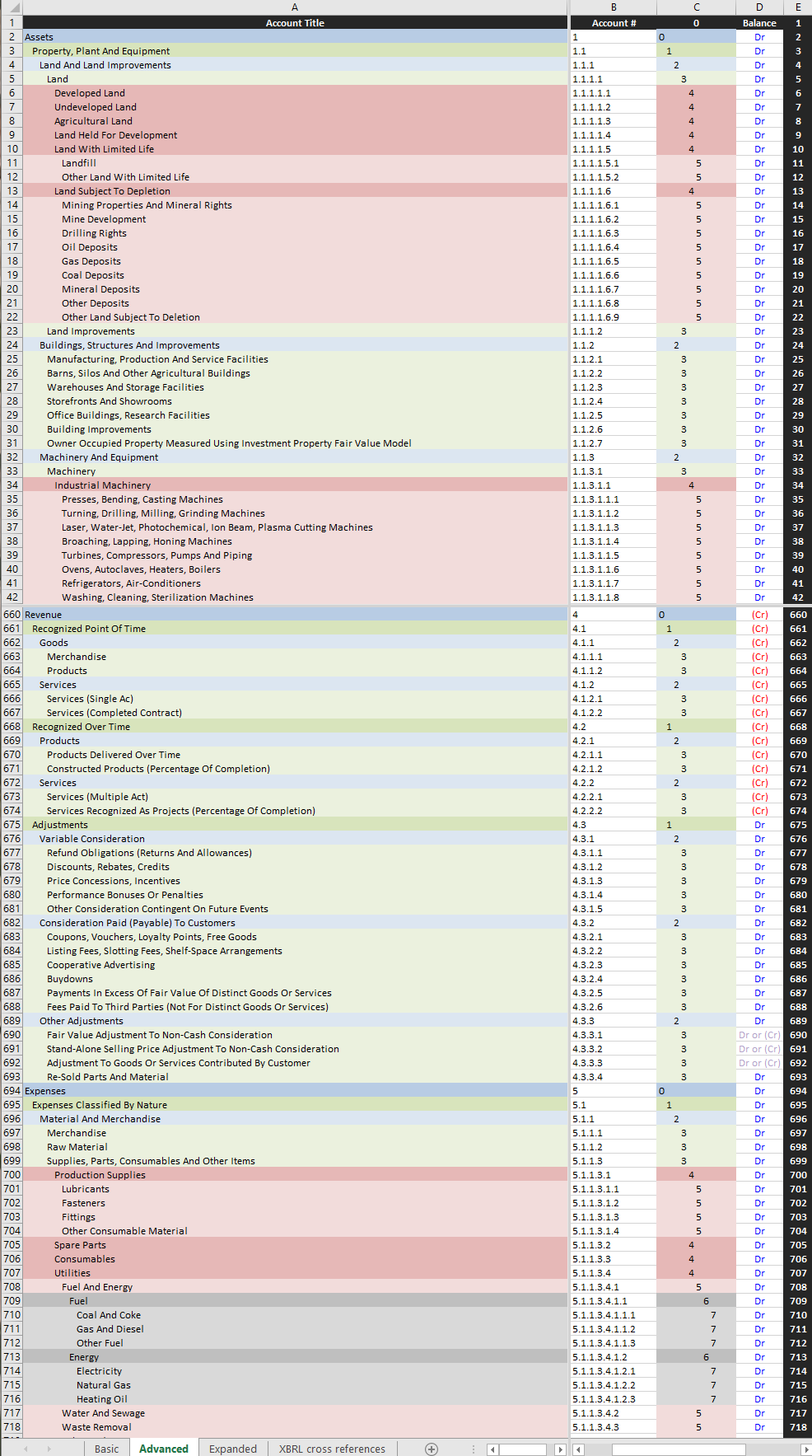

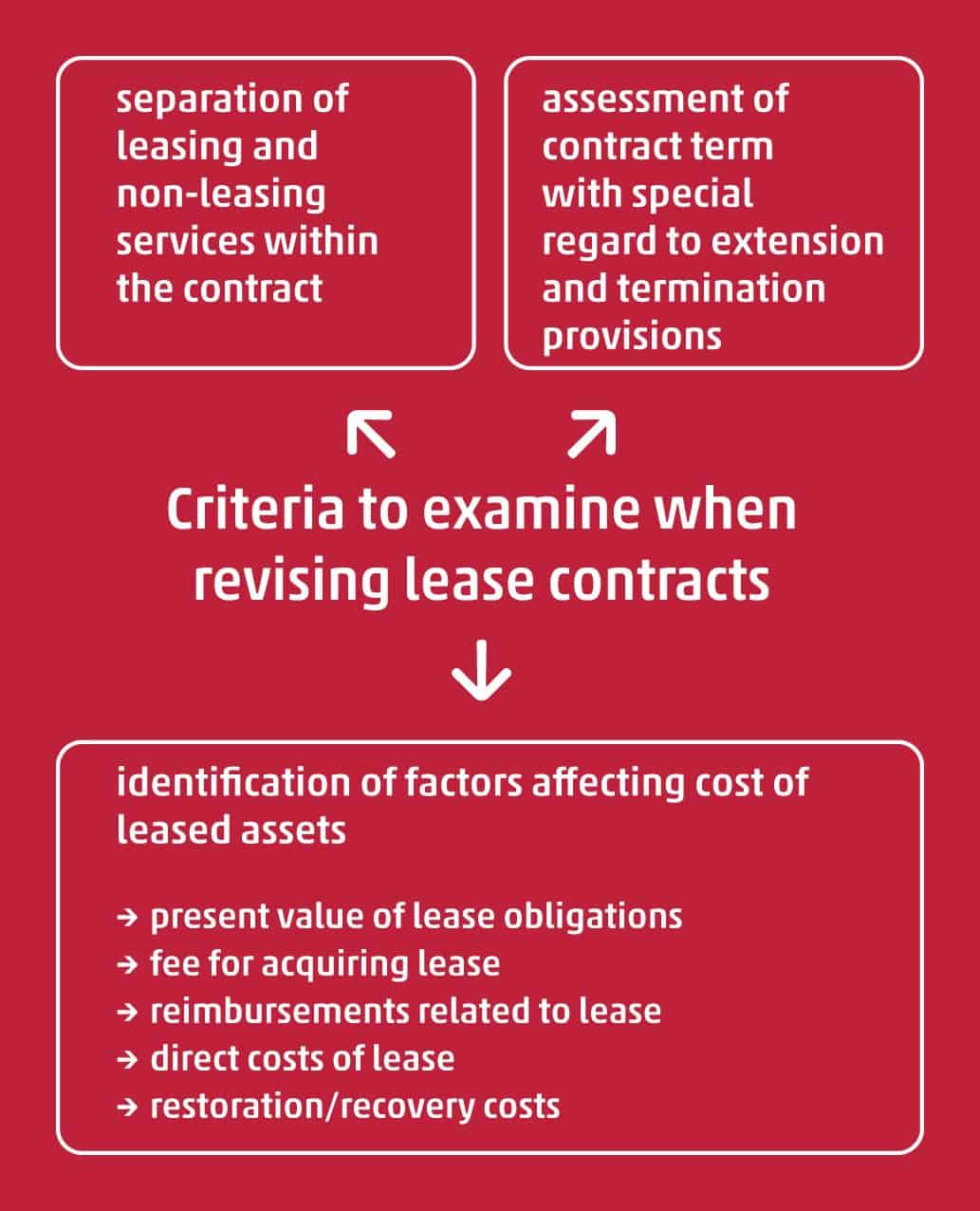

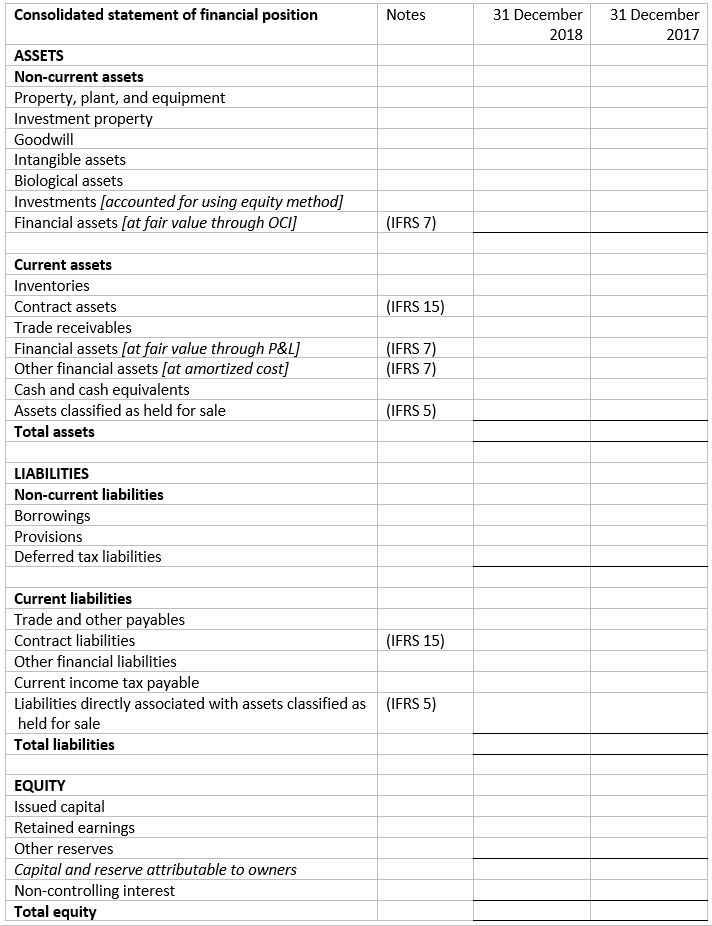

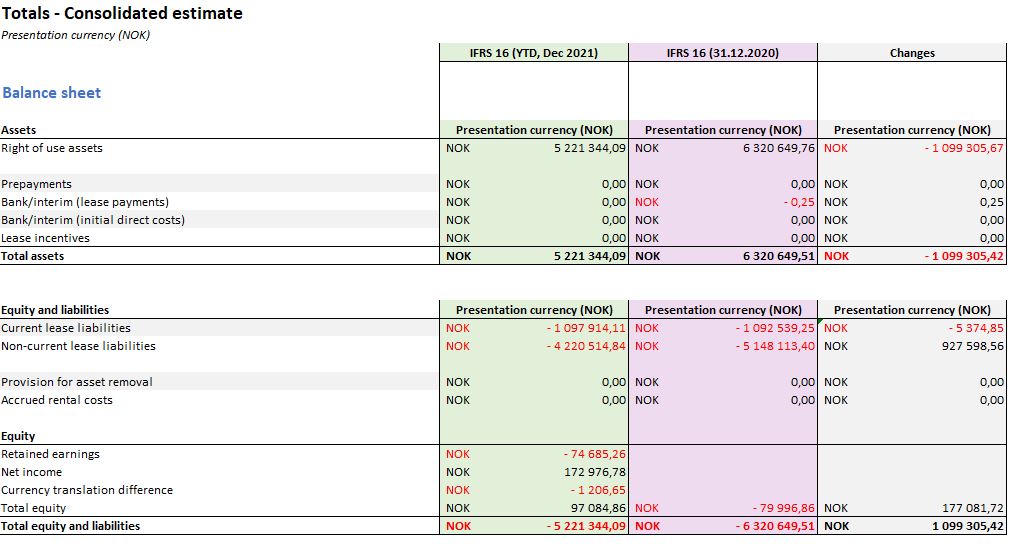

Ifrs 16 balance sheet example. The iasb published ifrs 16 leases in january 2016 with an effective date of 1 january 2019. Amounts relating to leases are presented separate from other assets and liabilities on the balance sheet or in the notes to the financial statements. This exercise will help to highlight any impact of the new accounting rules on existing financial covenants.

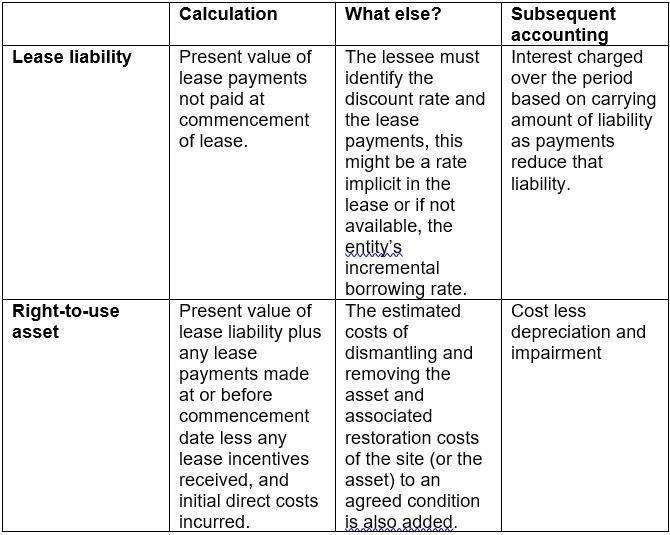

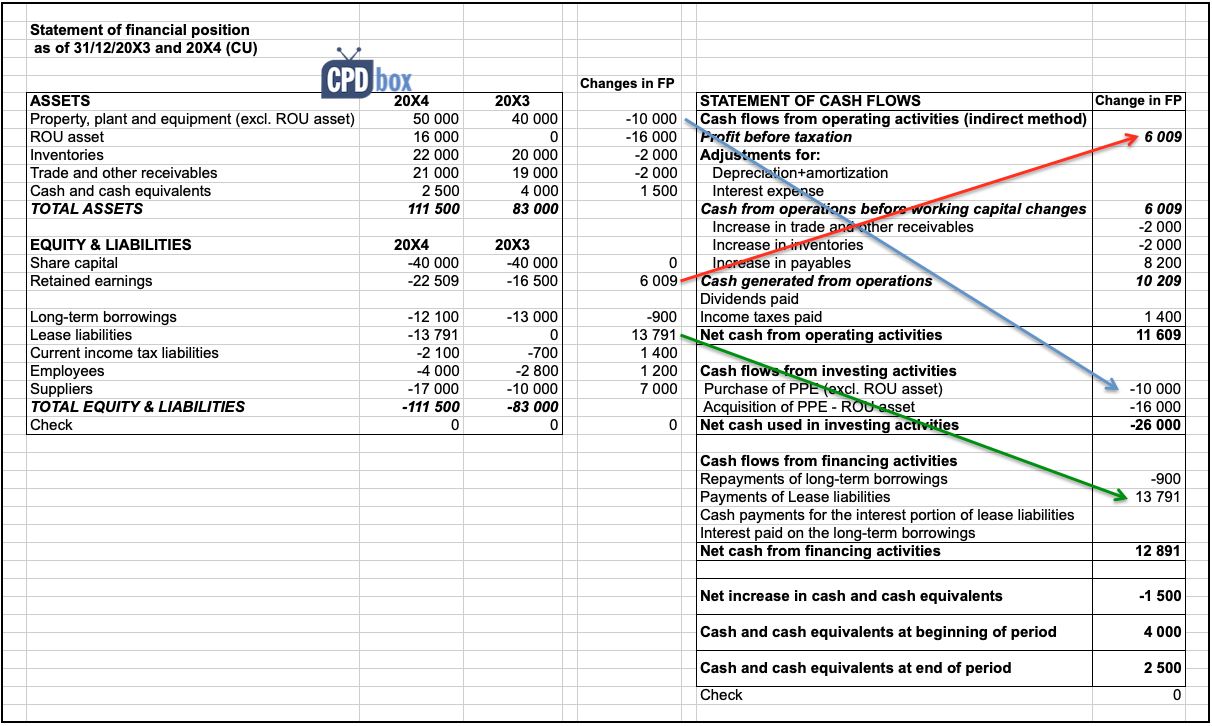

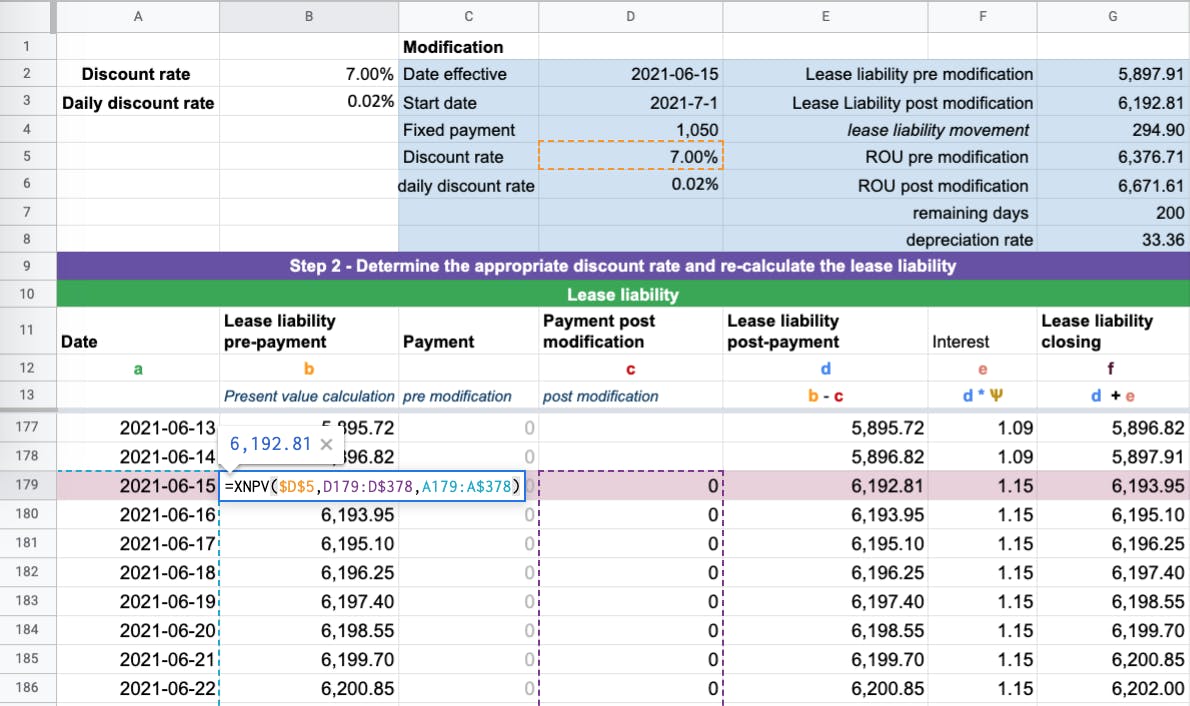

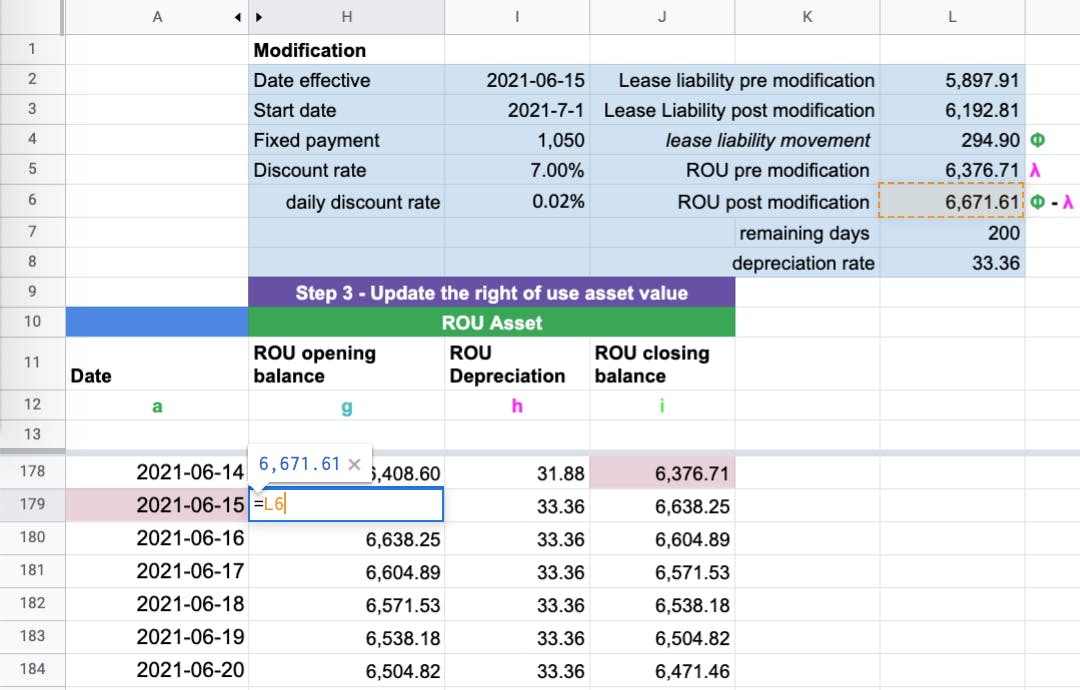

Under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is referred to as the right of use asset. Below we present the entry recorded as of 1/1/2021 for our example: Transparency and comparability have been improved, with companies most affected providing more extensive discussion in the management commentary.

Leasing is an important financing activity for large corporate and financial institutions with the majority not reported on balance sheet. All lease contracts will be landing on the balance sheet of the lessee under ifrs 16. 1 ifrs 16 at a glance 1.1 key facts this publication provides an overview of ifrs 16 and how it affects the financial statements of the lessee and the lessor.

This expands the balance sheet. Under ifrs 16 this distinction no longer applies to lessees. Study resources financial reporting (fr) technical articles and topic explainers ifrs 16, leases 1.

How to account for the lease following ifrs 16? But which lease payments should be included in the lease liability, initially and subsequently? Ifrs 16 requires different and more extensive disclosures about leasing activities than ias 17.

Lease accounting in ifrs 16 the company has rented an office with 5 years and the payment of $120,000 is at the end of each year. Objective ifrs 16 establishes principles for the recognition, measurement, presentation and disclosure of leases, with the objective of ensuring that lessees and lessors provide relevant information that faithfully represents those transactions. What changes in a company’s balance sheet?

The lease liability is measured at the present value of the lease payments. This article will cover two practical examples of how to calculate for a lease as a lessee under ifrs 16. Assist with the annual budgeting process.

The objective of ifrs 16 is to report information that (a) faithfully represents lease transactions and (b. Ifrs 16 eliminates the classification of leases as either The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date.

1 january 20x1 discount rate: Requires lessees to recognise nearly all leases on the balance sheet which will reflect their right to use an asset for a period of time and the associated liability for payments. Our illustrative disclosures supplement (pdf 1.8 mb) will help you to navigate the new requirements and enable you to focus on the information that is relevant to users of.

Ifrs 16 is effective for annual reporting periods beginning on or after 1 january 2019, with earlier application permitted (as long as ifrs 15 is also applied). Ifrs 16 (inclusive of the examples in the supplemental implementation Assuming the interest rate is 6% per annum.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)