Top Notch Info About Financial Management Ratios

Analysis of financial ratios serves two.

Financial management ratios. Activity ratios (also called efficiency ratios) profitability ratios; Basel iii is a global regulatory framework adopted by regulators all over the world. Considering factors like fund manager's track record and ratios—such as churn and sharpe—can prevent costly mistakes for retail investors, according to aditya shah, founder of.

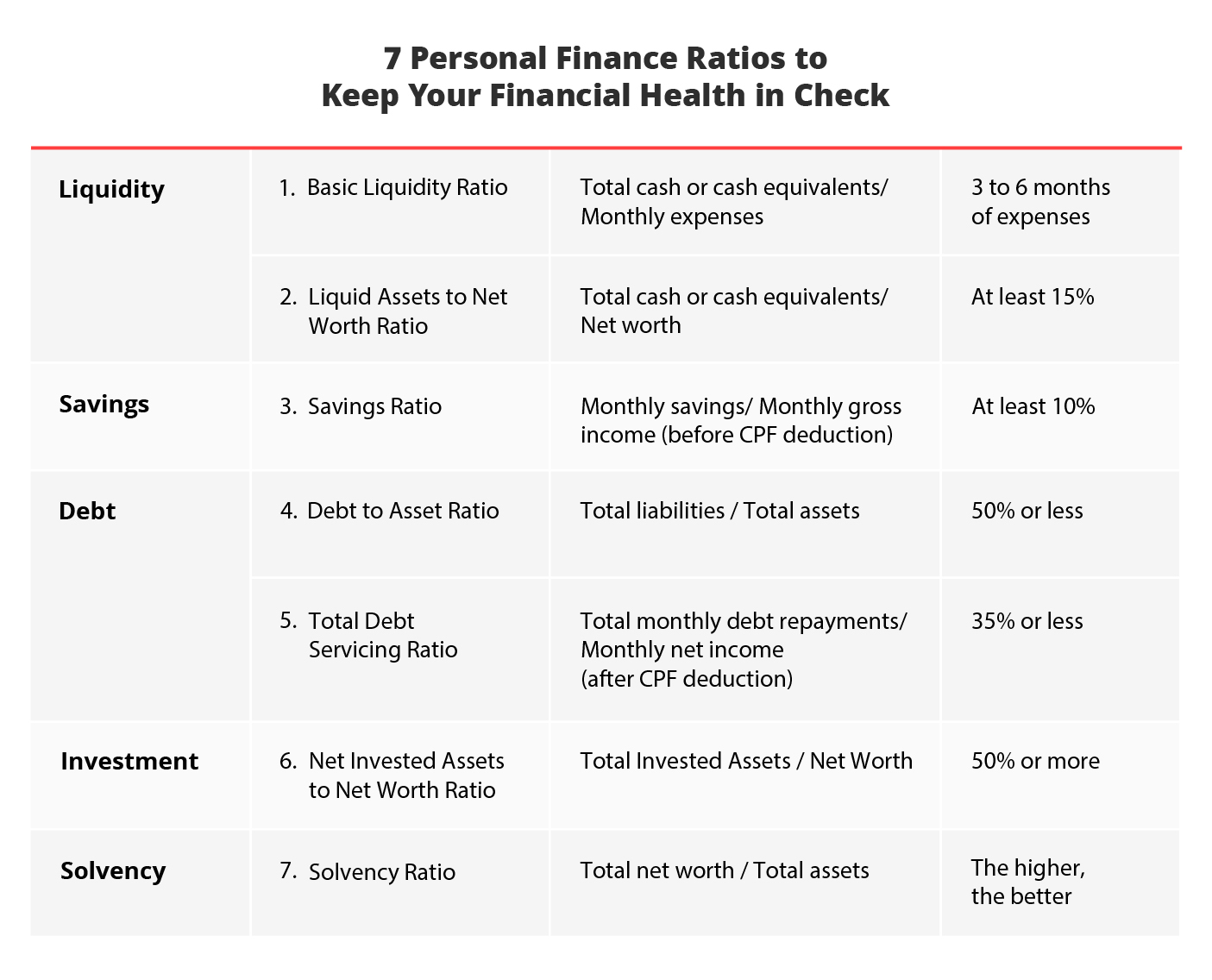

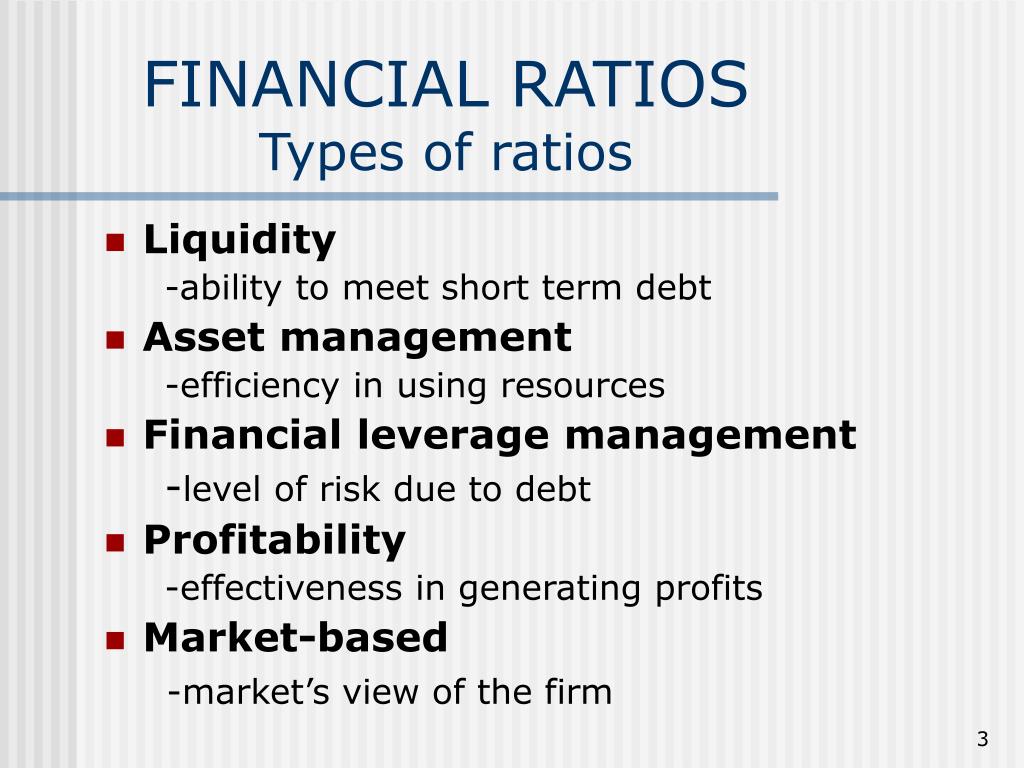

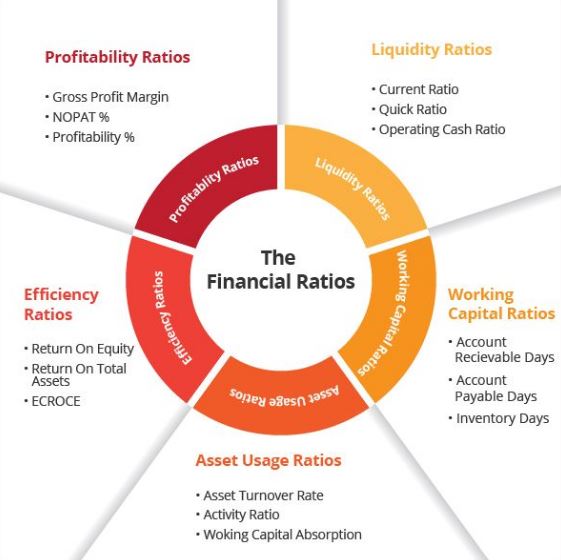

Liquidity ratios solvency ratios efficiency ratios profitability ratios market prospect ratios financial leverage ratios coverage ratios receivables turnover ratio asset turnover ratio Financial ratio analysis is often broken into six different types: Liquidity ratios liquidity ratios measure a company’s ability to.

Financial ratios are often divided up into seven main categories: Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. The ratios also measure against the industry average or the company’s past figures.

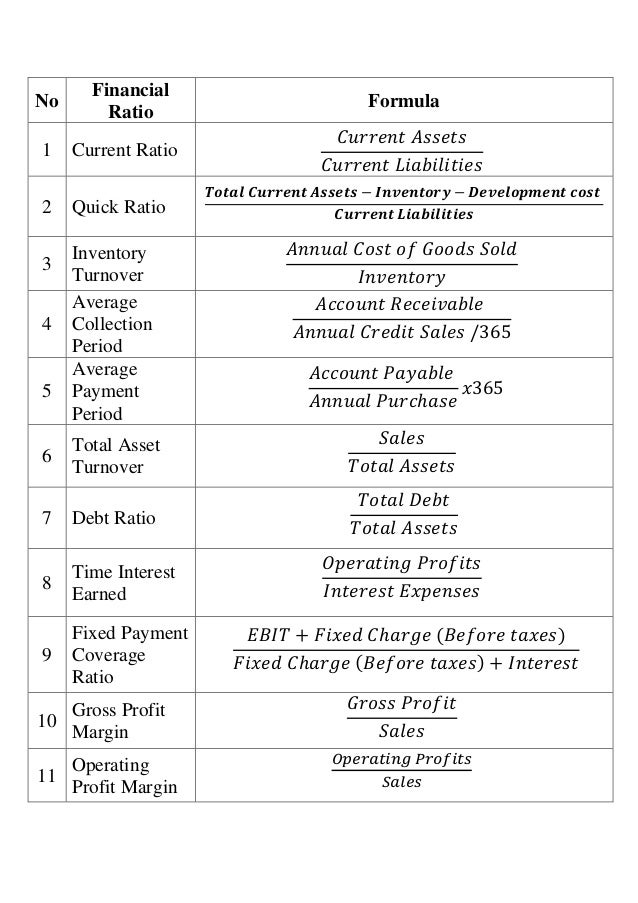

List of financial ratios here is a list of various financial ratios. Ratios in each of these five categories provide a different view of the firm’s financial strengths and weaknesses. Any banking role within risk management will be impacted by the requirements of basel iii.

Even though there are plenty of important financial ratios out there, investors only tend to focus on a handful of them. Each ratio is also briefly described. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise.

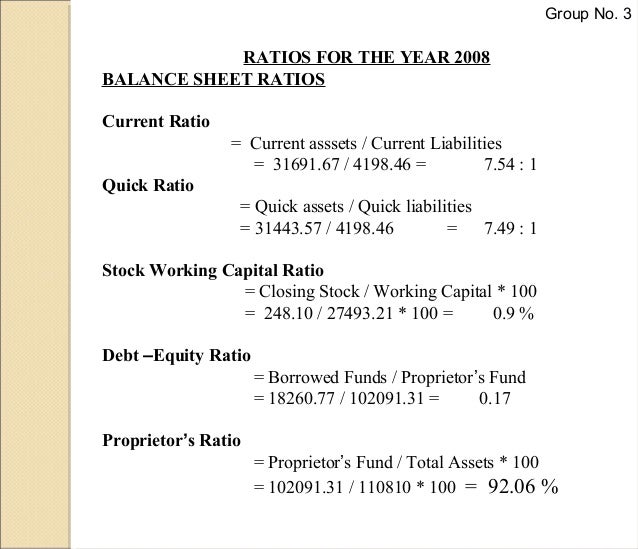

List of top 5 types of financial ratios. Financial statement ratios can be helpful when analyzing stocks. Corporate finance ratios are quantitative measures that are used to assess businesses.

Things such as l iquidity , profitability , solvency, efficiency, and valuation are assessed via financial ratios. Therefore, it is crucial for risk management. These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions.

As such, it remains the most influential regulatory framework for banks, hugely impacting the ways banks manage their risks. Choosing the right investment scheme can be overwhelming for many investors due to the multitude of options available. Financial ratios or accounting ratios measure a company’s financial situation or performance against other firms.

Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. Cfi’s financial ratios definitive guide provides a focused look at 30+ of the most essential financial ratios that a financial analyst uses to analyze a business. Profitability, solvency, liquidity, turnover, coverage, and market prospects ratios.

22 feb 2024, 11:08 am ist. The us business school, part of the. Summary of financial ratios for xyc, inc.