Matchless Tips About Profit And Loss Format

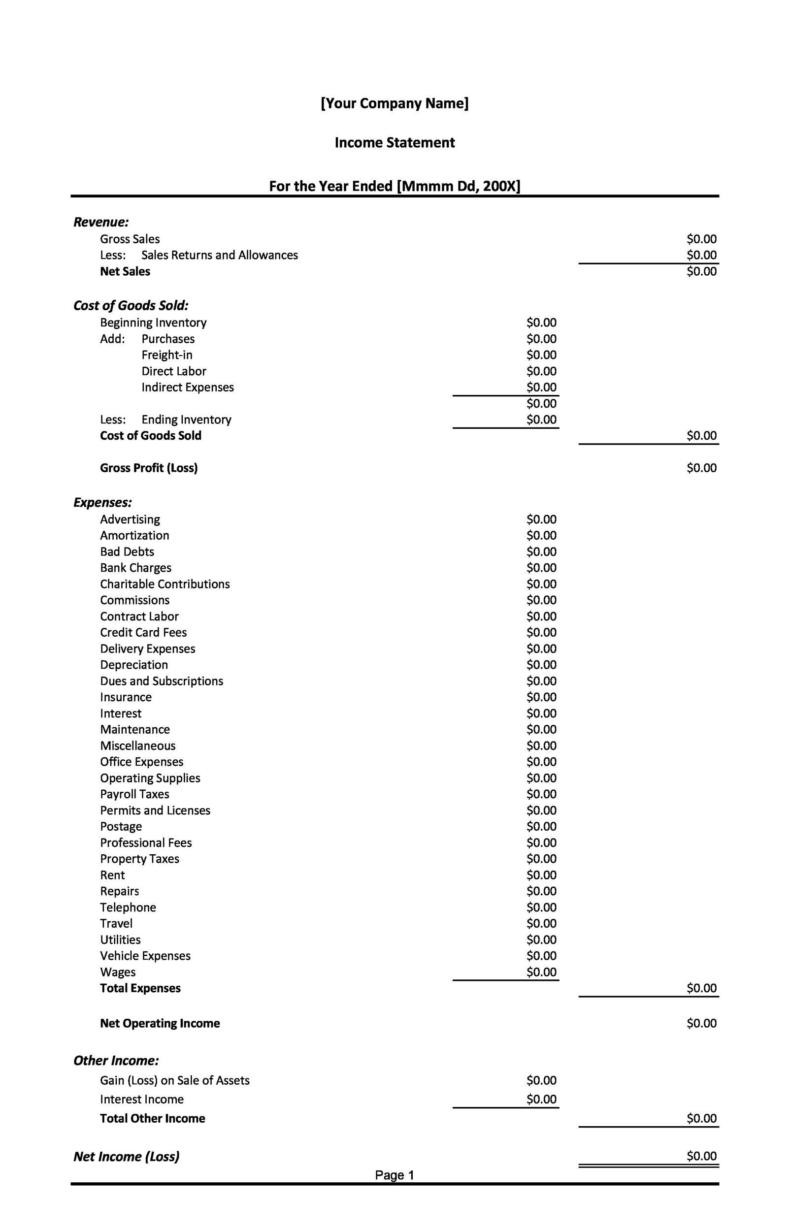

You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings.

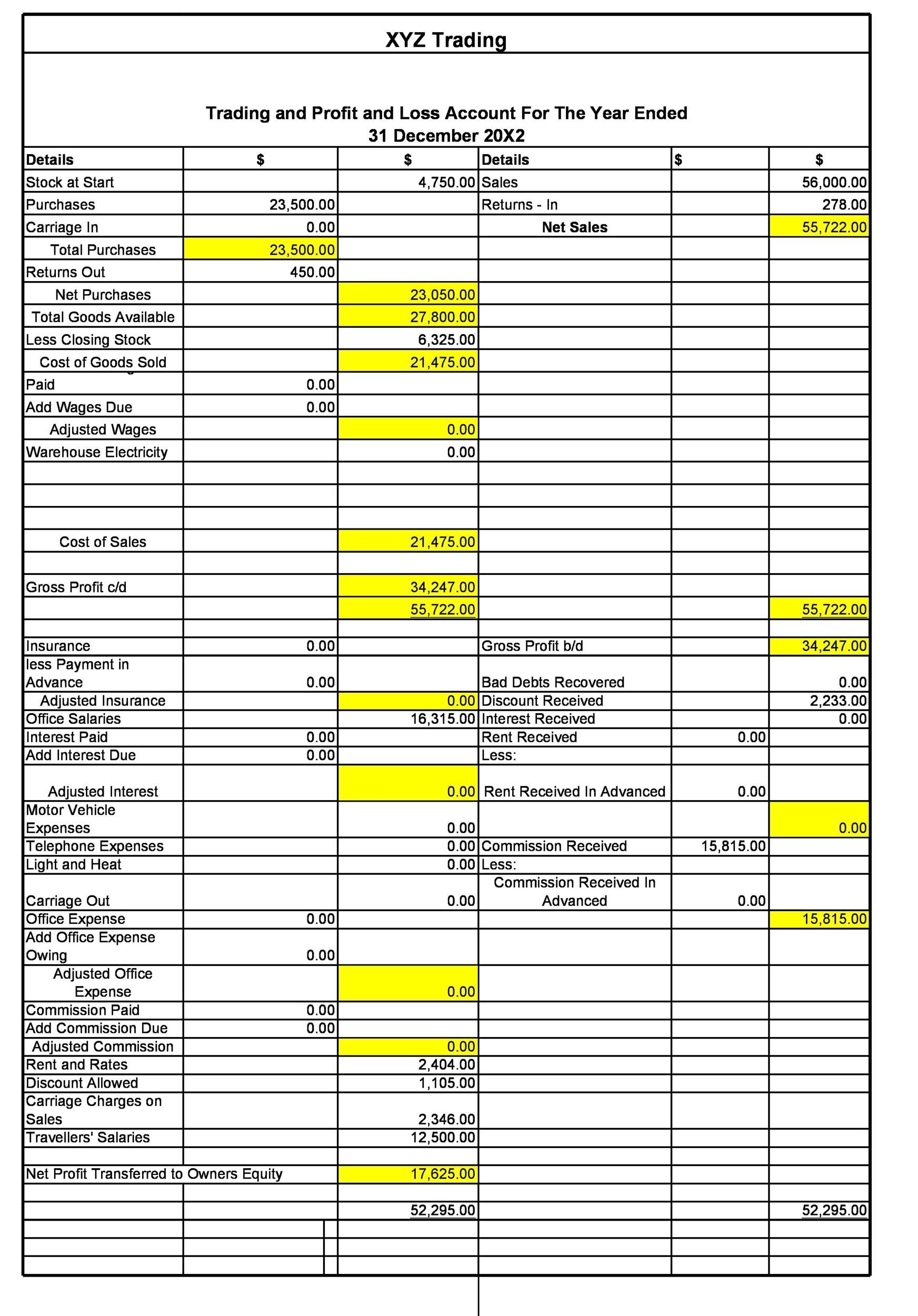

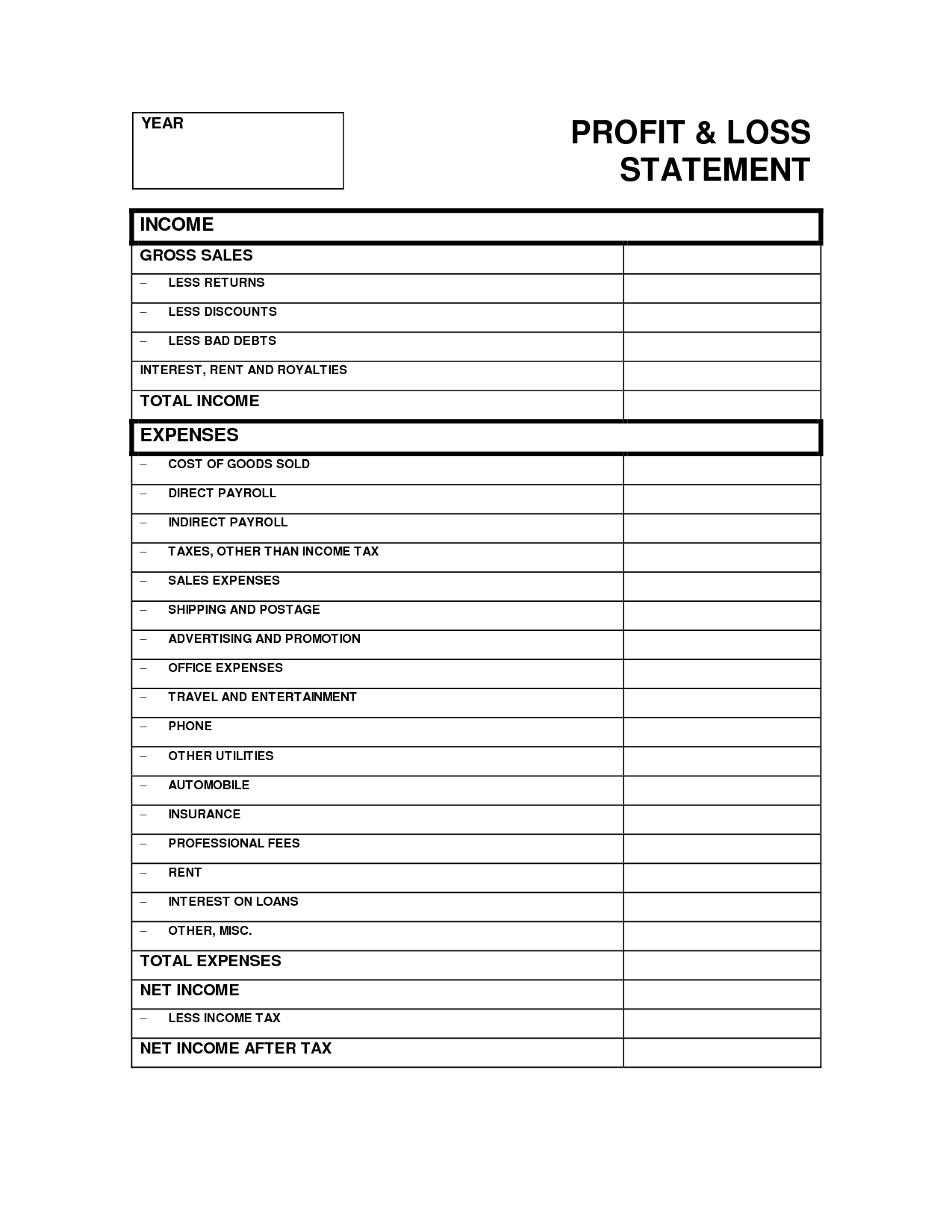

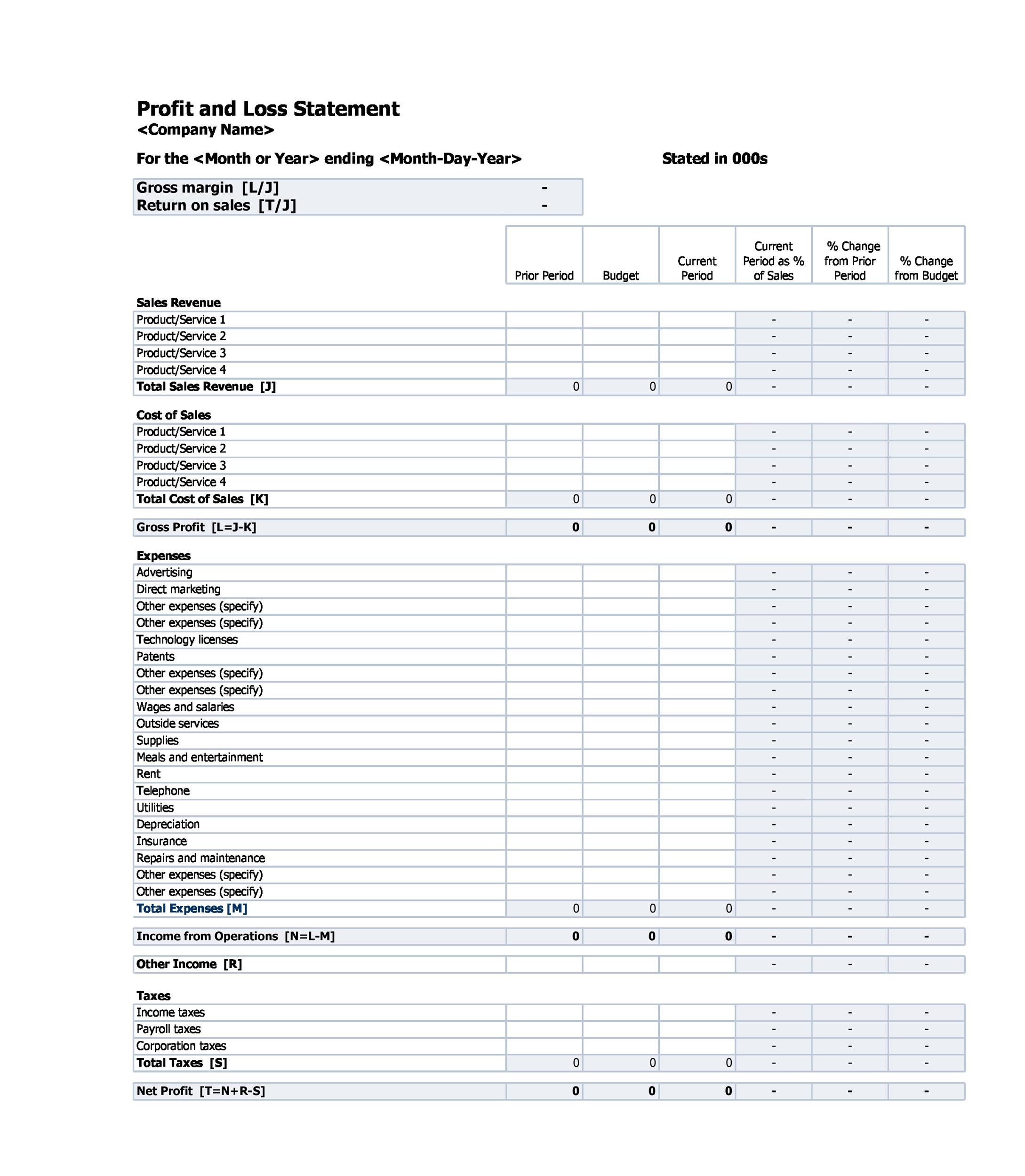

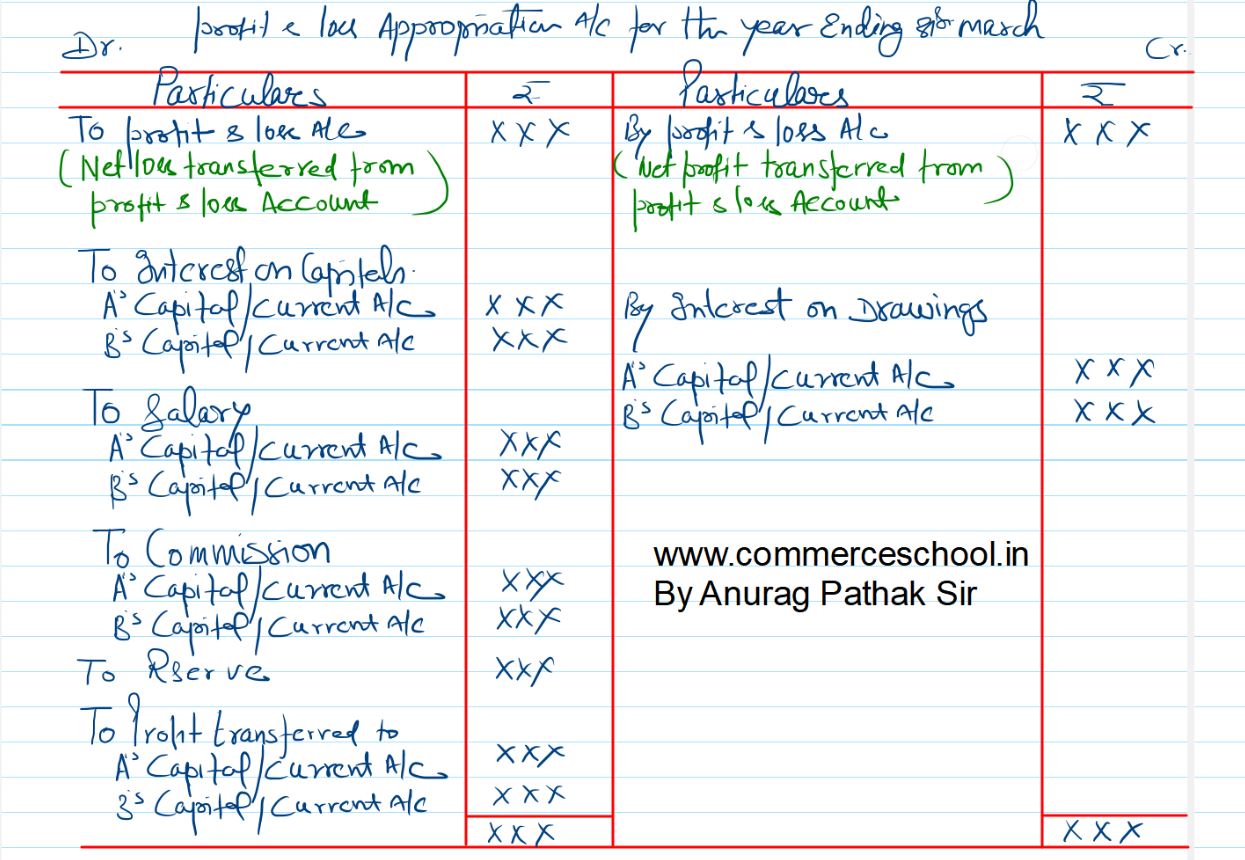

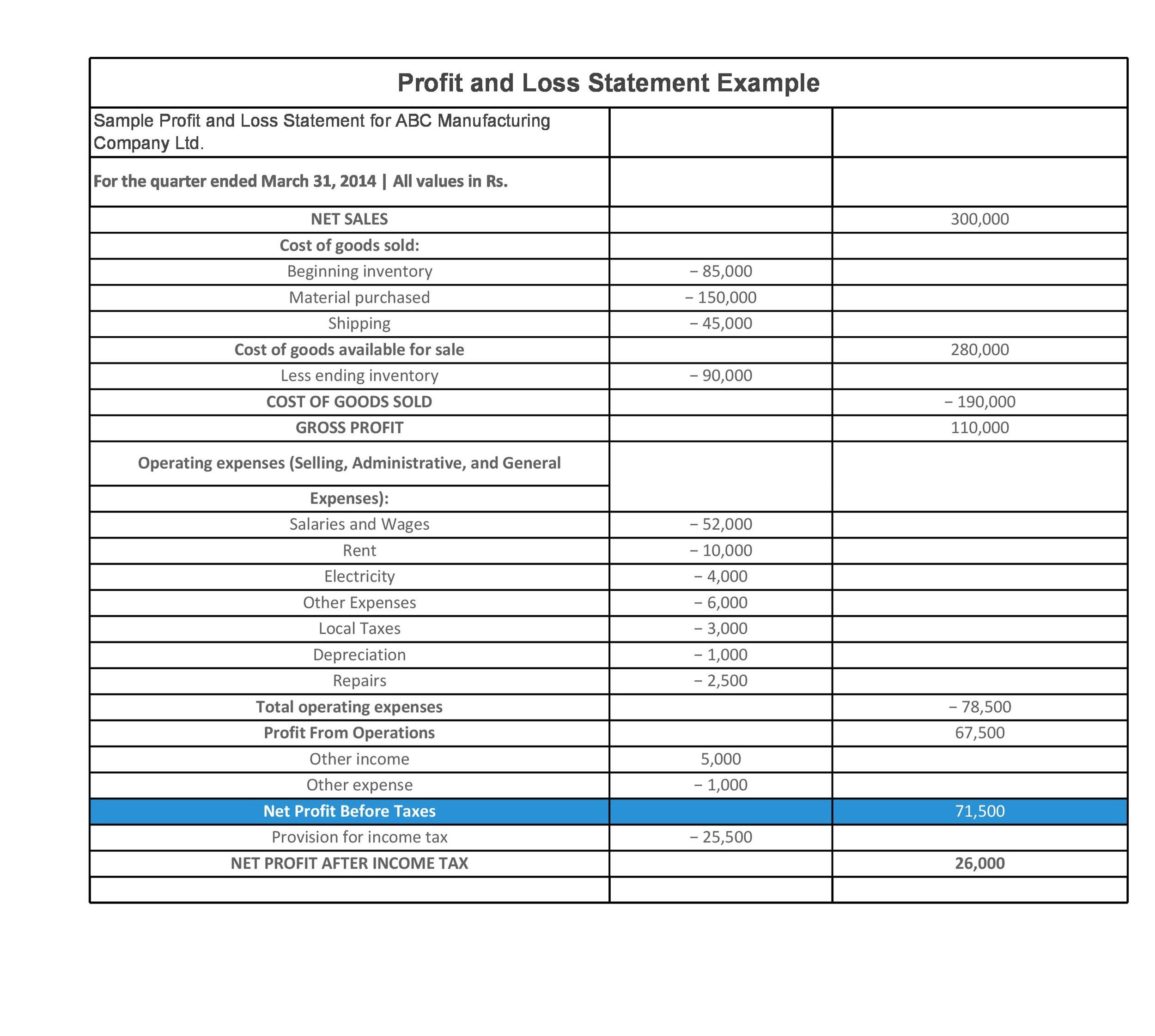

Profit and loss format. A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit. A p&l statement includes three primary sections: See a solved example of pqr company with trial balance and income tax.

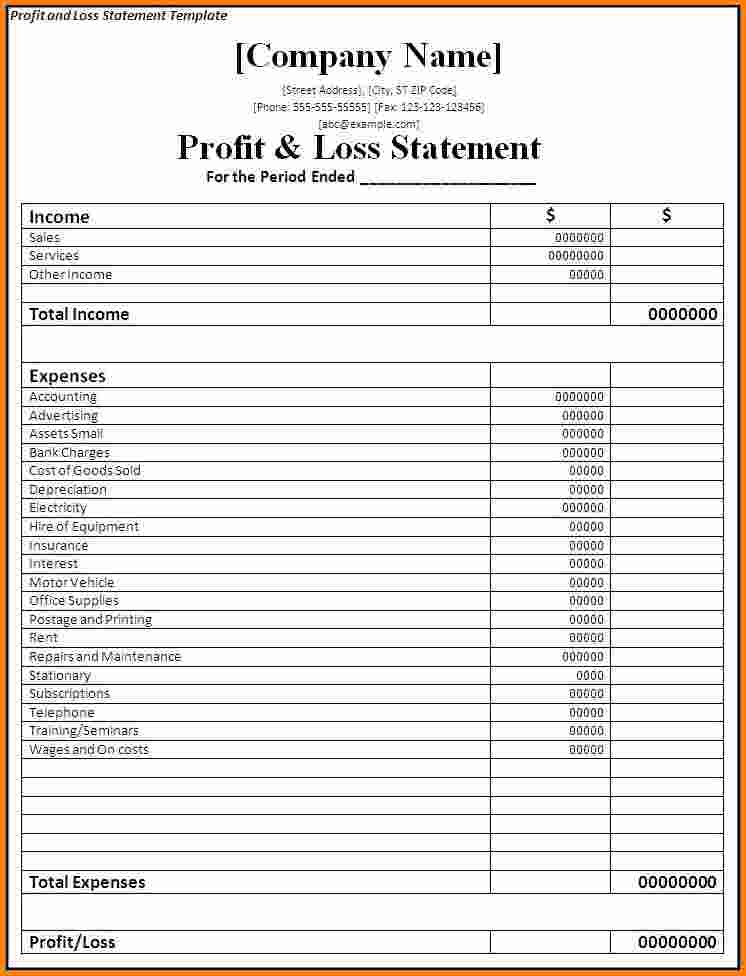

A profit and loss (p&l) account shows the annual net profit or net loss of a business. What is a profit and loss statement? Enter your company name, income sources, discounts or other allowances, business expenses, and tax details.

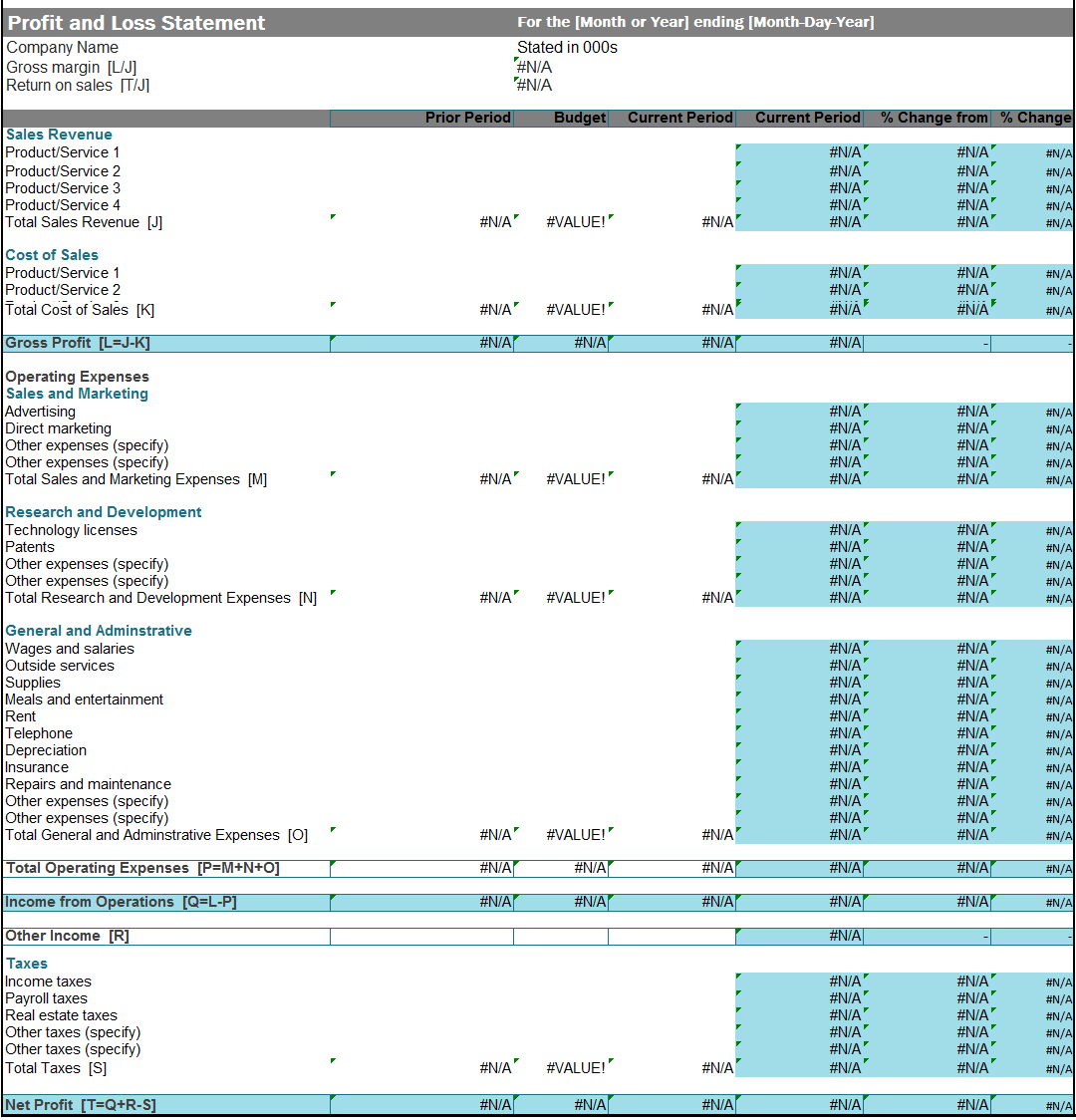

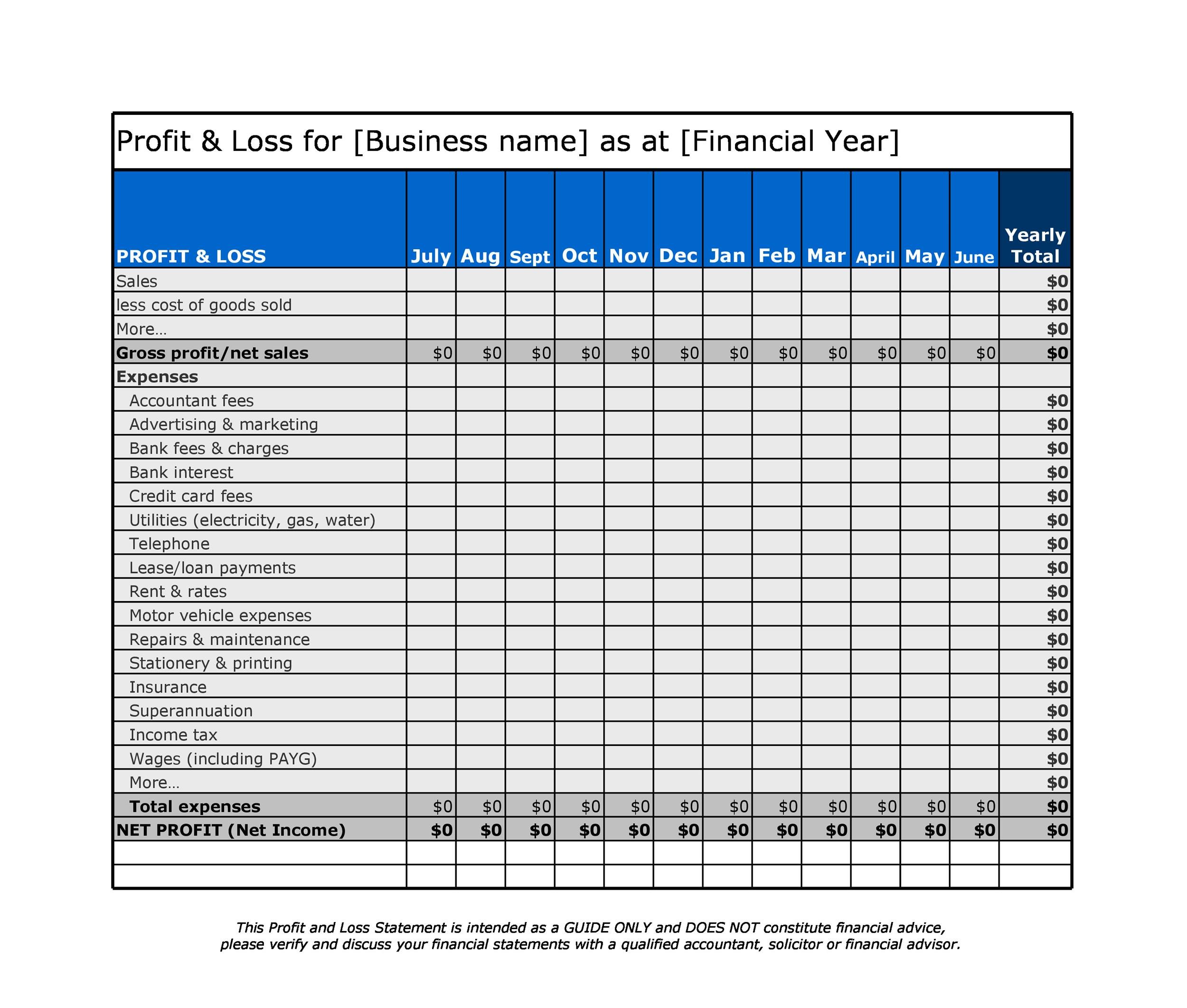

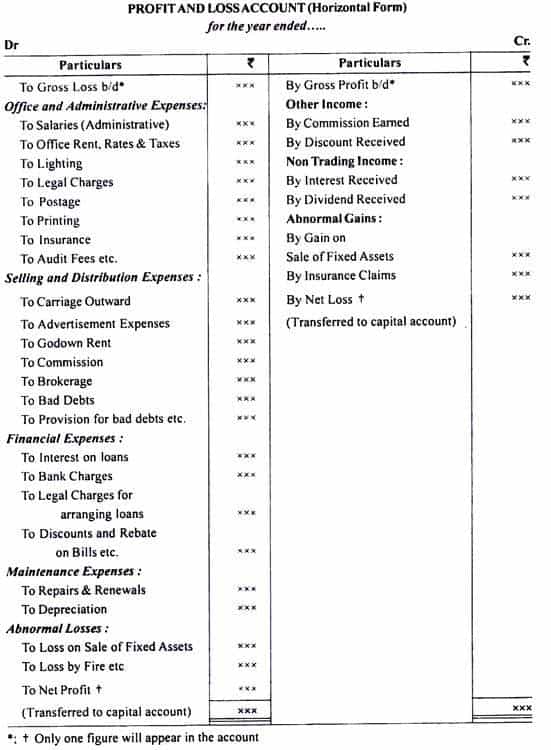

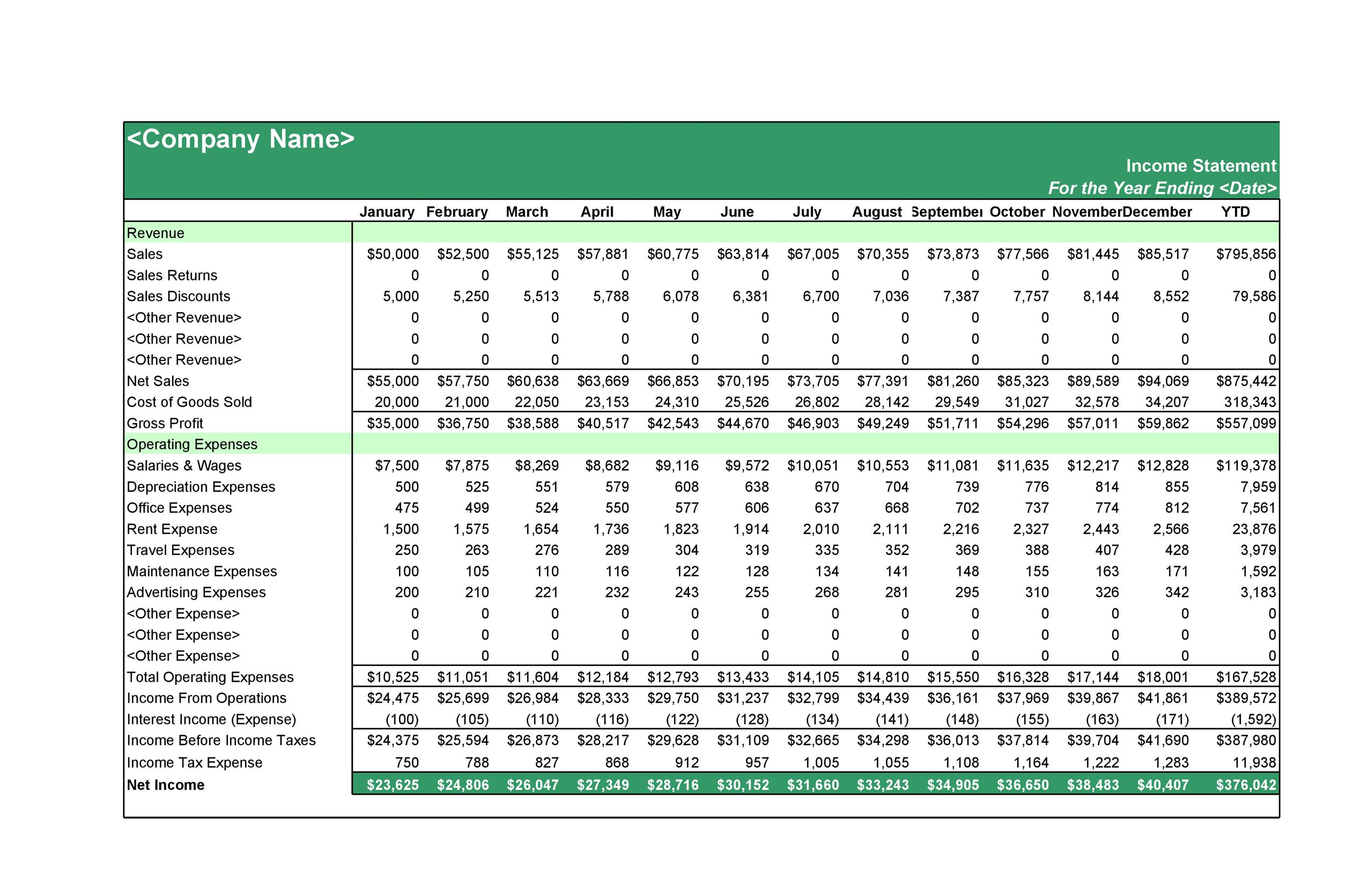

A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. 33 rows learn the types, format, and closing entries of profit and loss account for sole proprietors. This blank profit and loss statement allows you to record quarterly financial data over one year.

The template layout is simple and intuitive, including sections for tracking business revenue, expenses, and tax information. It is prepared to determine the net profit or net loss of a trader. #1 monthly profit and loss template the monthly p&l template is perfect for businesses that require regular reporting and detail.

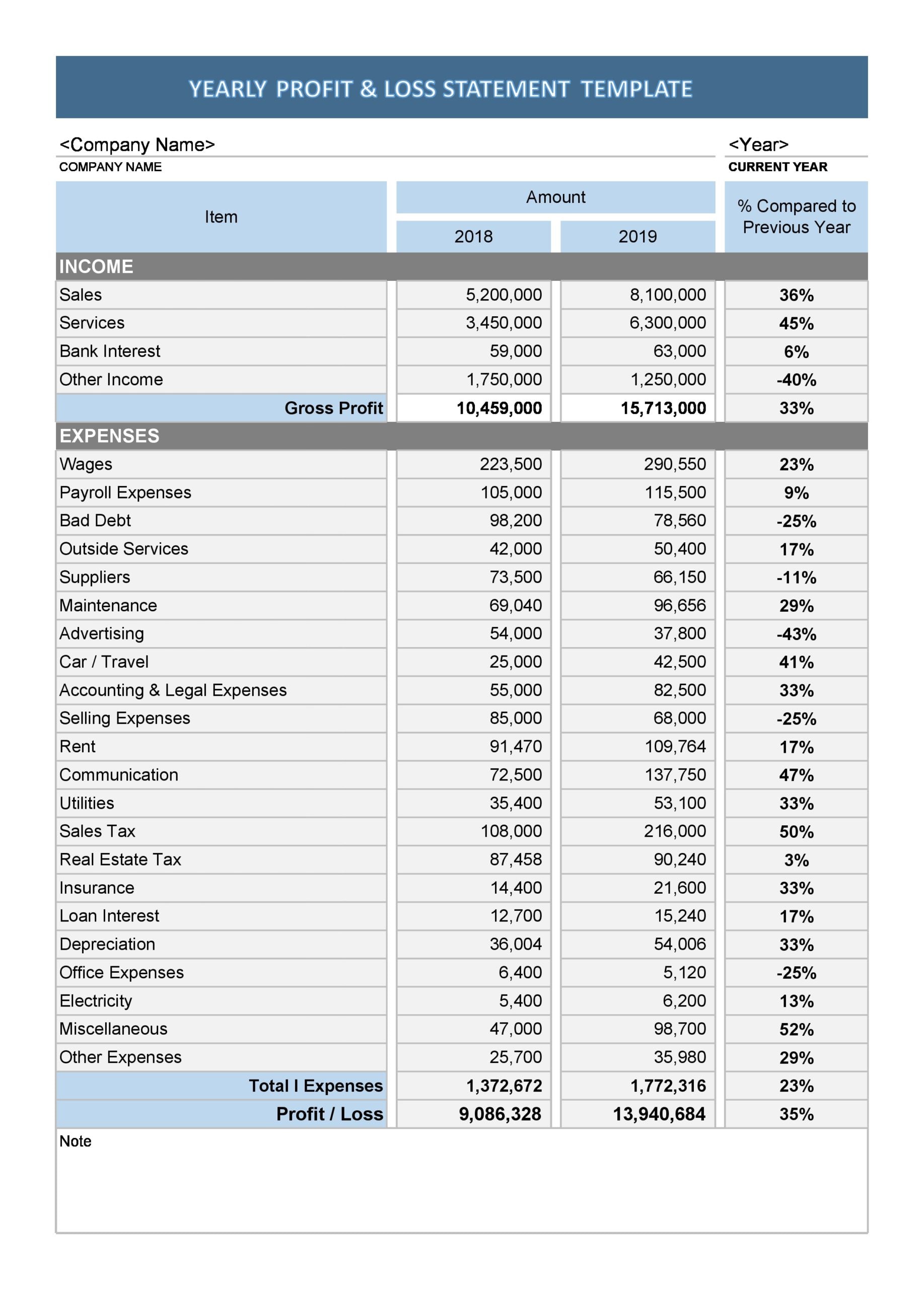

Cost of goods sold (or cost of sales) 3. By contrasting your business income with your expenses, profit and loss statements help track your overall profits and identify periods of loss. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

Revenue or sales streams fixed expenses (like rent) The result is either your final profit (if. It provides a comprehensive snapshot of the financial health of the business through items like:

The main categories that can be found on the p&l include: Maths math article profit and loss profit and loss profit and loss formula is used in mathematics to determine the price of a commodity in the market and understand how profitable a business is. This profit and loss (p&l) statement template summarizes a company’s income and expenses for a period of time to arrive at its net earnings for the period.

The basic formula for a profit and loss statement is: Customize and use these p&l templates to plan and track your organization’s financial performance and profitability. Below is a screenshot of the p&l statement template:

A profit and loss statement, or p&l statement, is a financial document that helps you understand your business’s profitability over time. Find out the items not shown in profit and loss account and the difference between trading account and profit and loss account. A company’s statement of profit and loss is portrayed over a period of time, typically a month, quarter, or fiscal year.

The p&l account is a component of final accounts. Learn how to prepare a p&l statement with examples, free templates, and. Explanation a profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period.

![17+ Profit And Loss Template EDITABLE Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/07/pal-6.jpg)