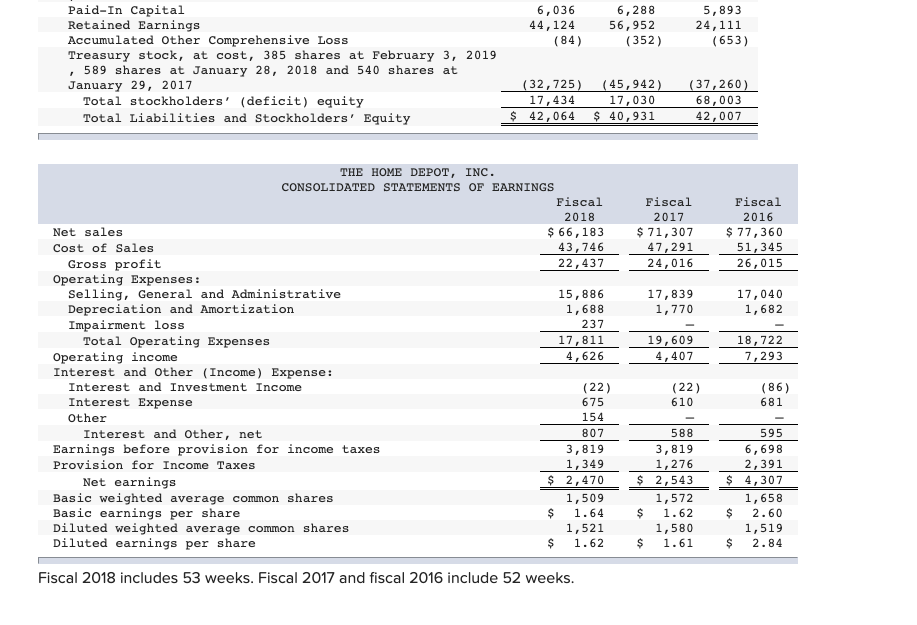

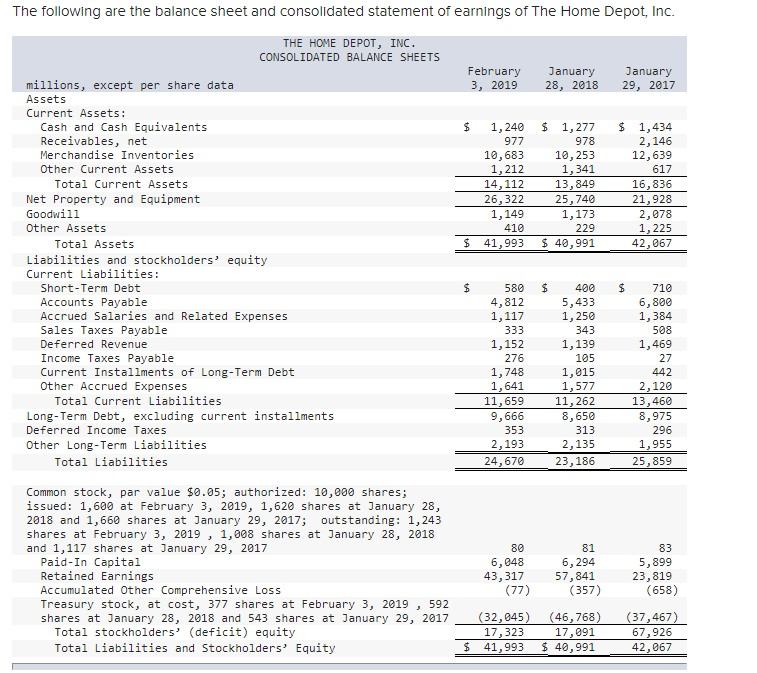

Build A Info About Total Comprehensive Loss

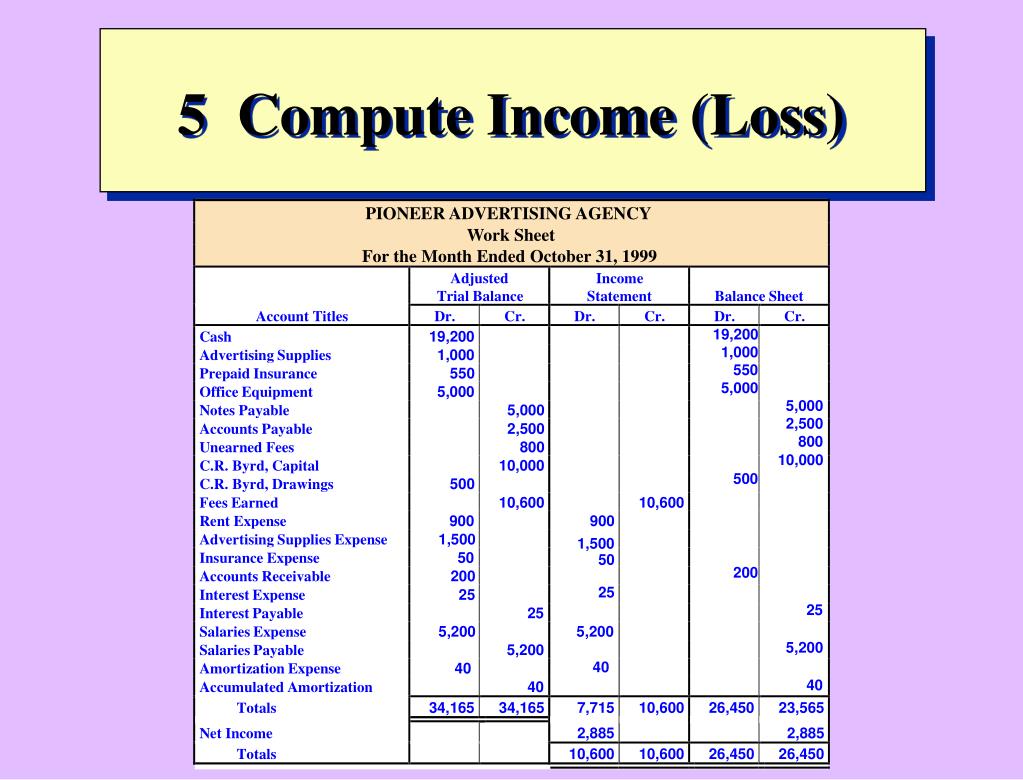

Total comprehensive income reflects the change in net.

Total comprehensive loss. A reporting entity should disclose the income tax effect of each component of oci, including reclassification adjustments, either on the face of the statement in which those. Unrealized income can be unrealized gains or losses on, for example, hedge/derivative financial instruments and foreign currency.

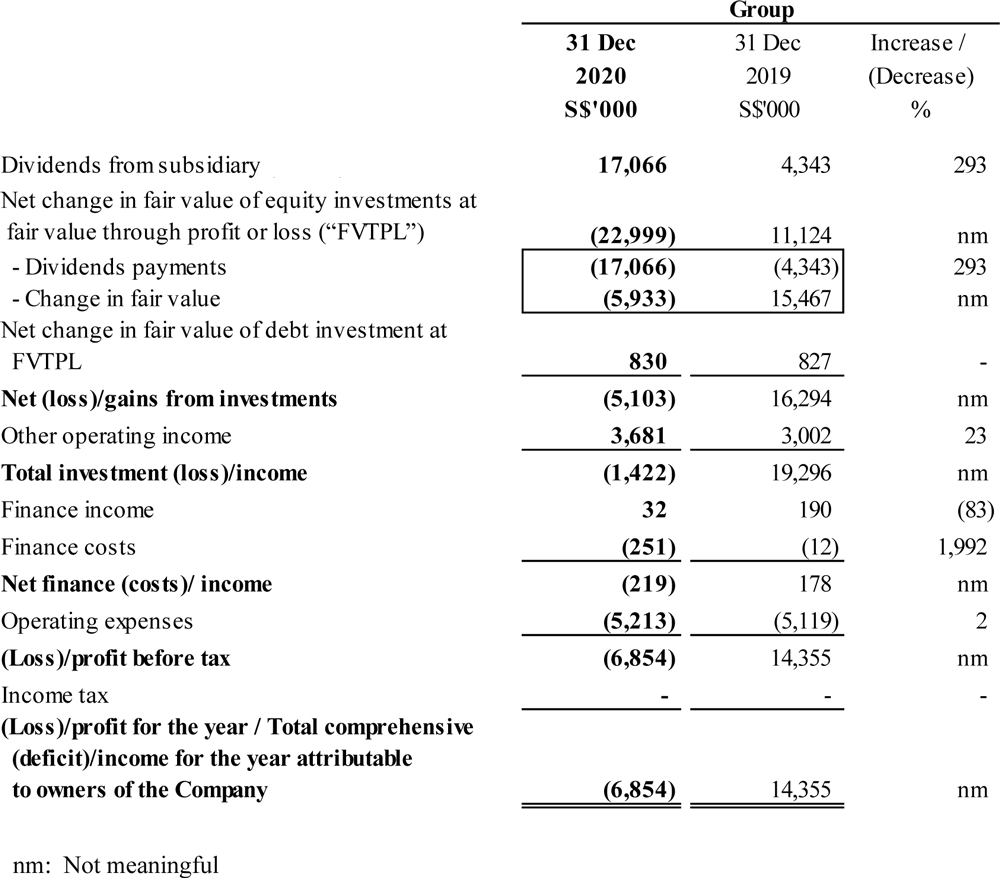

Profit or loss foreign currency differences on translation of foreign operations other comprehensive income/(loss) for the financial period, net of tax 167 (217) (177.0) total. Comprehensive income for the period; Or a separate profit and loss account and a separate statement of comprehensive income which presents all items.

Reclassified and reported in the group income statement (61) (45) tax on items that may be reclassified:. A single statement of comprehensive income; It includes net income and unrealized income.

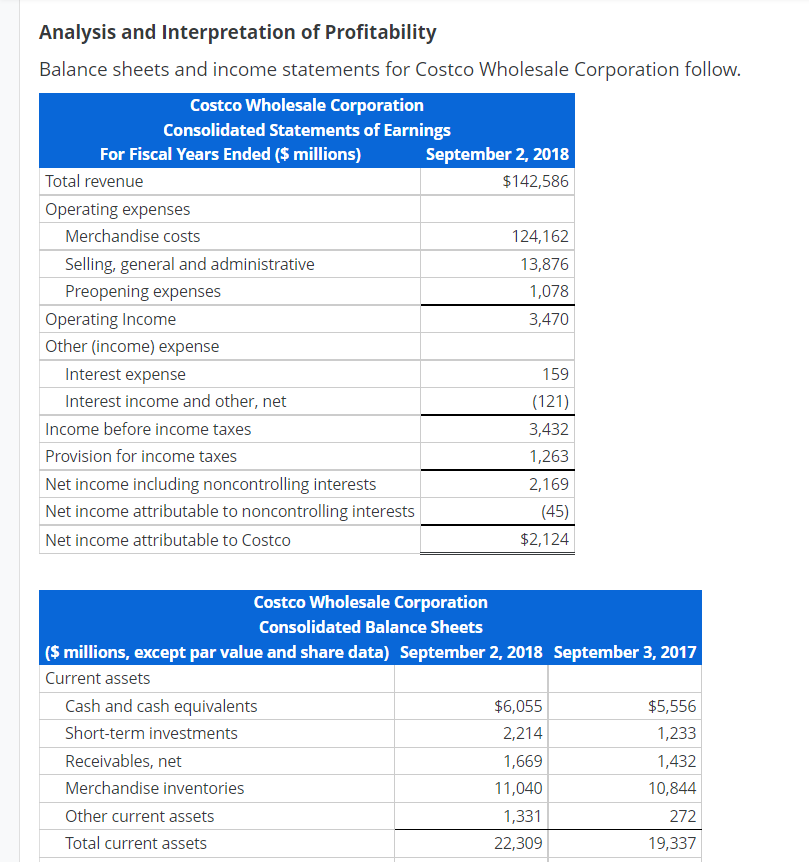

The performance of a company is reported in the statement of profit or loss and other comprehensive income. Total comprehensive losses attributable to: Jumlah rugi komprehensif total comprehensive loss tahun berjalan (1,835,367) (9,488,927) for the year.

Profit/(loss) for the year: This article looks at what differentiates profit or loss from other comprehensive income and where items should be presented. Jaminan kerugian total atau total loss only (tlo) menjamin kerusakan dan atau kerugian kendaraan yang disebabkan oleh kecelakaan atau kehilangan dimana.

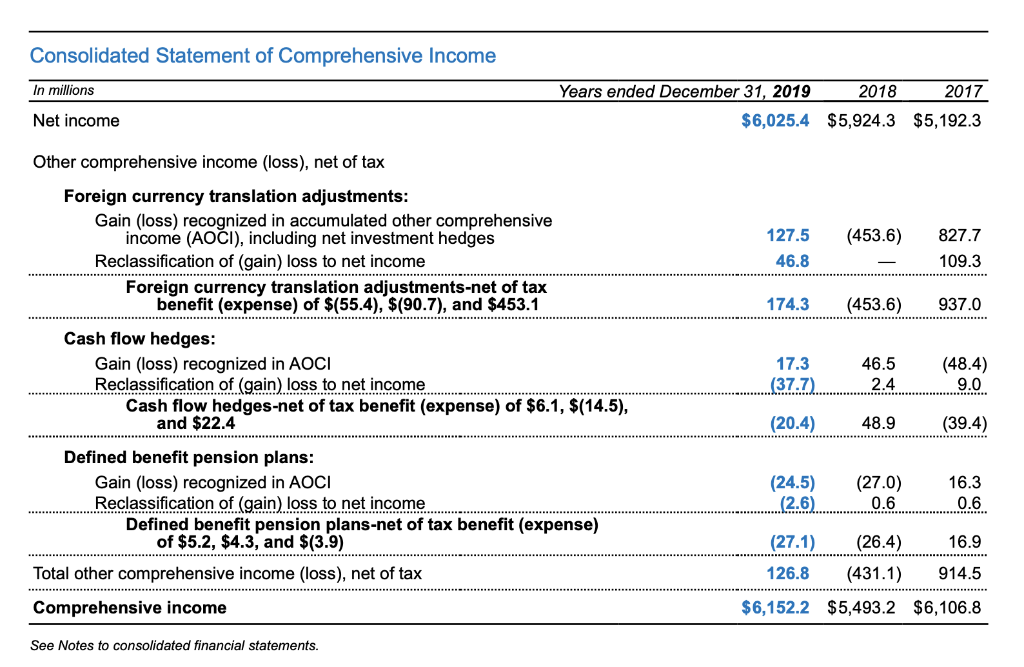

Comprehensive income is the sum of net income and other comprehensive income. Reports net income, other comprehensive income, and comprehensive income in a single financial statement of comprehensive income.

Gains and losses on items. Section through “ accumulated other comprehensive income.”. The purpose of the statement of profit or loss and.

If the result is negative, your company has a comprehensive loss for the period. Ias ® 1, presentation of financial statements, defines profit or. Net fair value gains/(losses) 17:

Comprehensive coverage limits and total loss claims. Statement of profit or loss and other comprehensive income 81a statement of changes in equity 106 statement of cash flows 111 notes 112 transition and effective. Present total net income, other.

Total comprehensive income is calculated by adding net income (loss) and other comprehensive income (loss). Catatan terlampir merupakan bagian tidak. A coverage limit is the maximum amount of money the insurance company will pay to settle a claim.