Fabulous Tips About Line Of Credit Disclosure In Financial Statements

Published on 26 sep 2017.

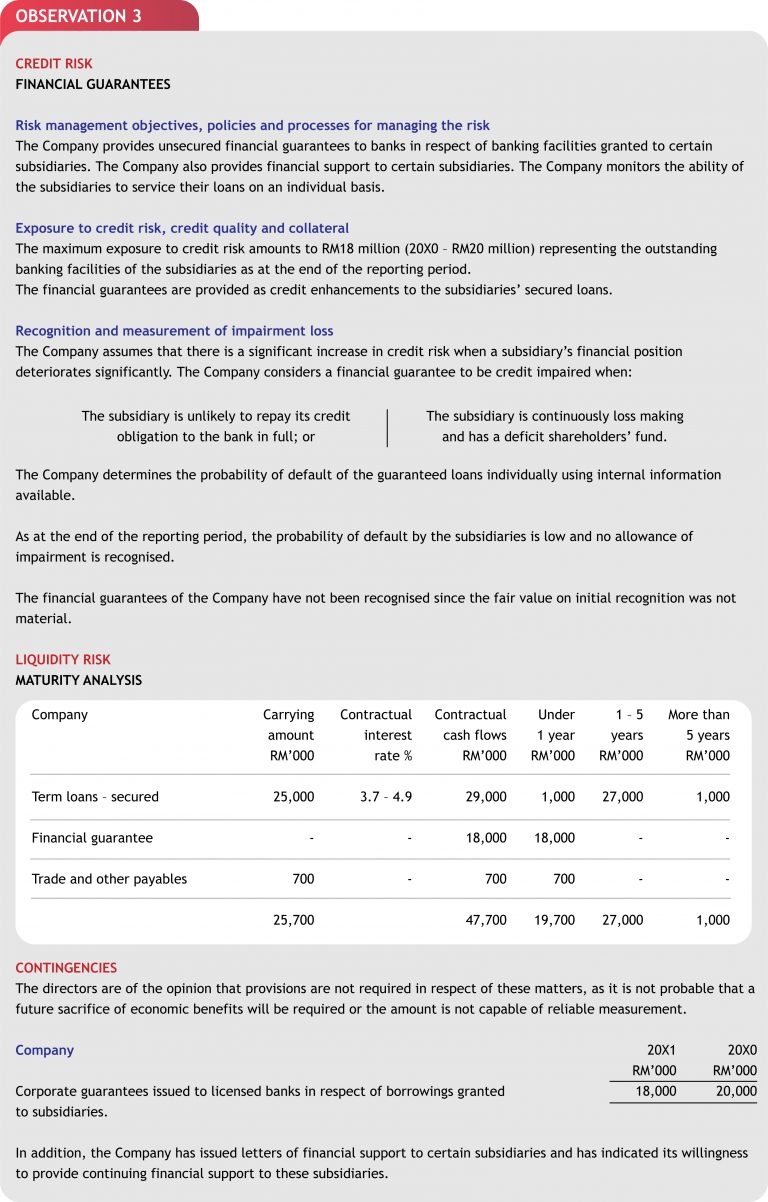

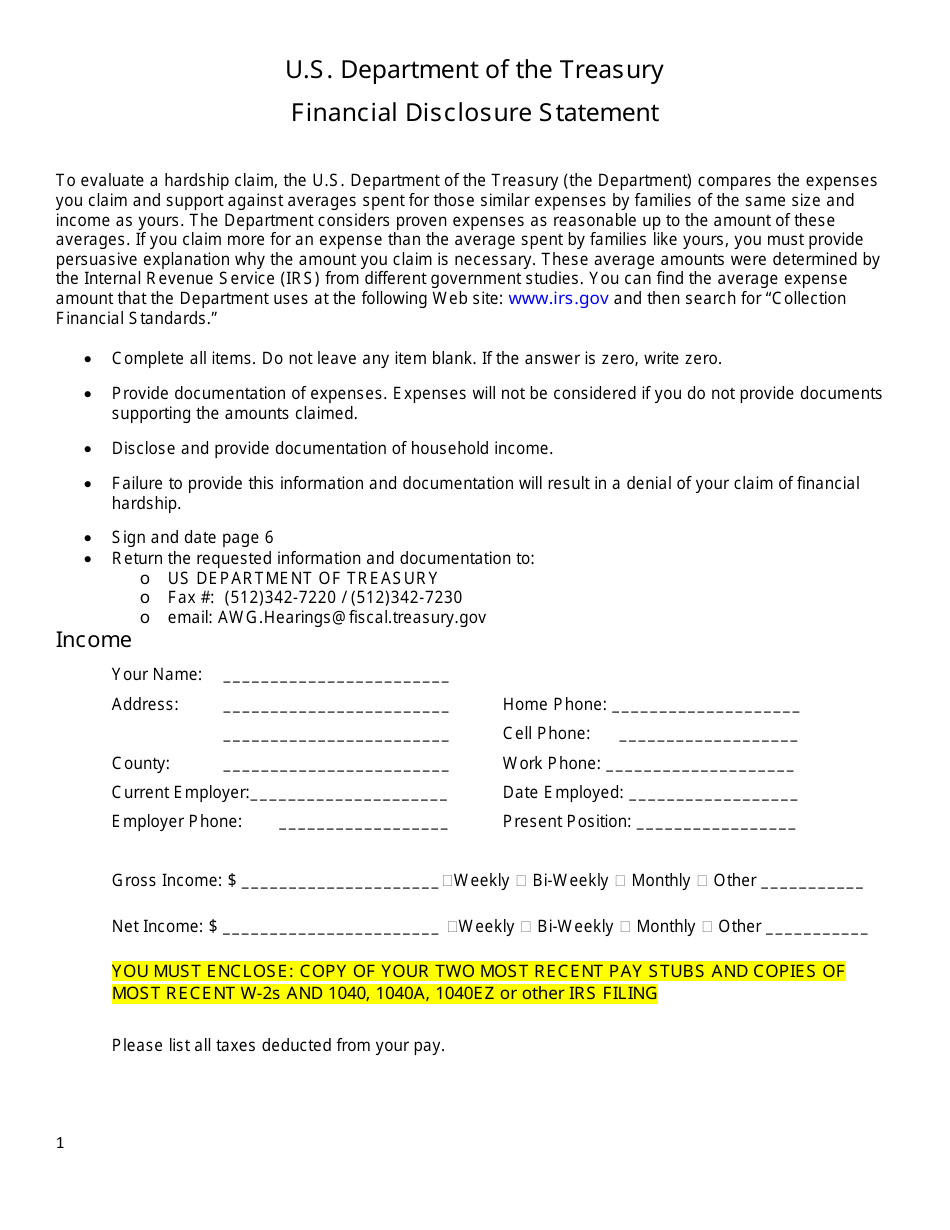

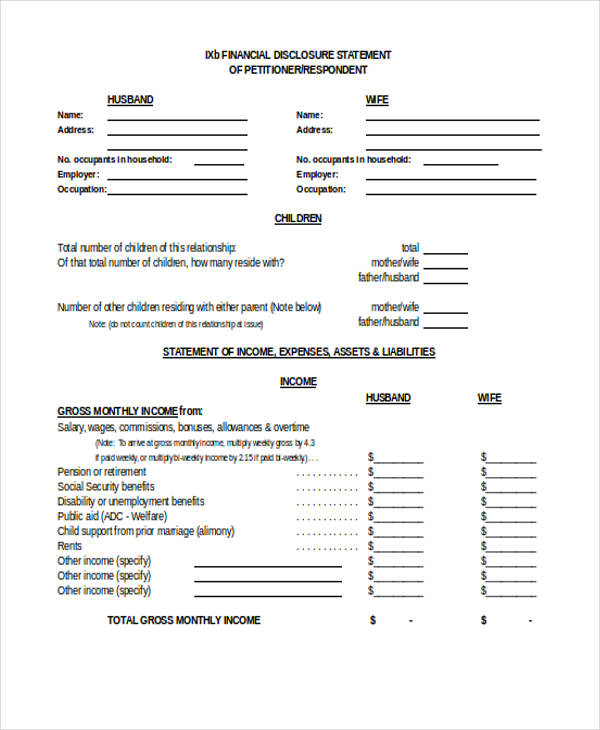

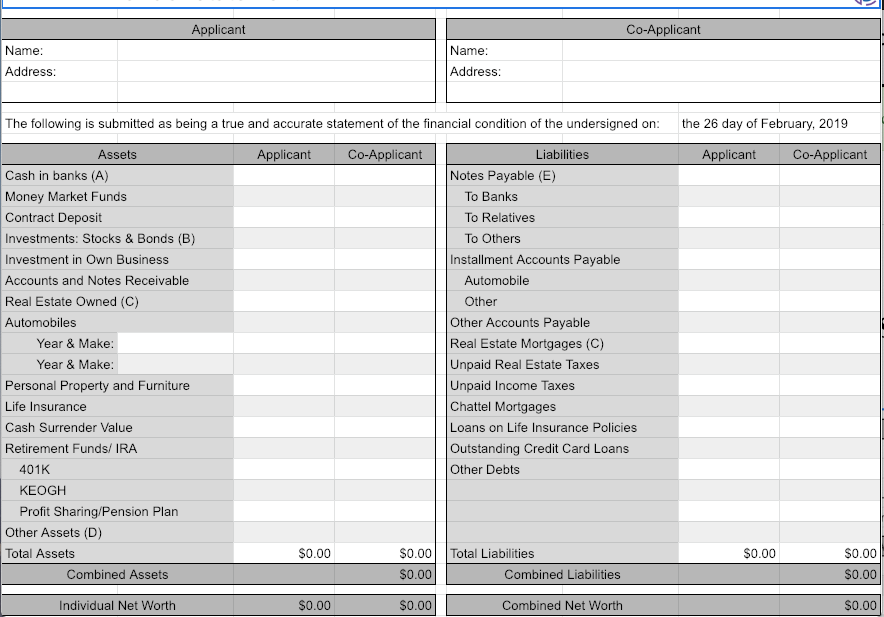

Line of credit disclosure in financial statements. Disclosure definitions credit risk risk that one party to a financial instrument will cause a financial loss for the other party by failing to. If your business has a letter of credit, it is important to properly account for it. Us loans & investments guide.

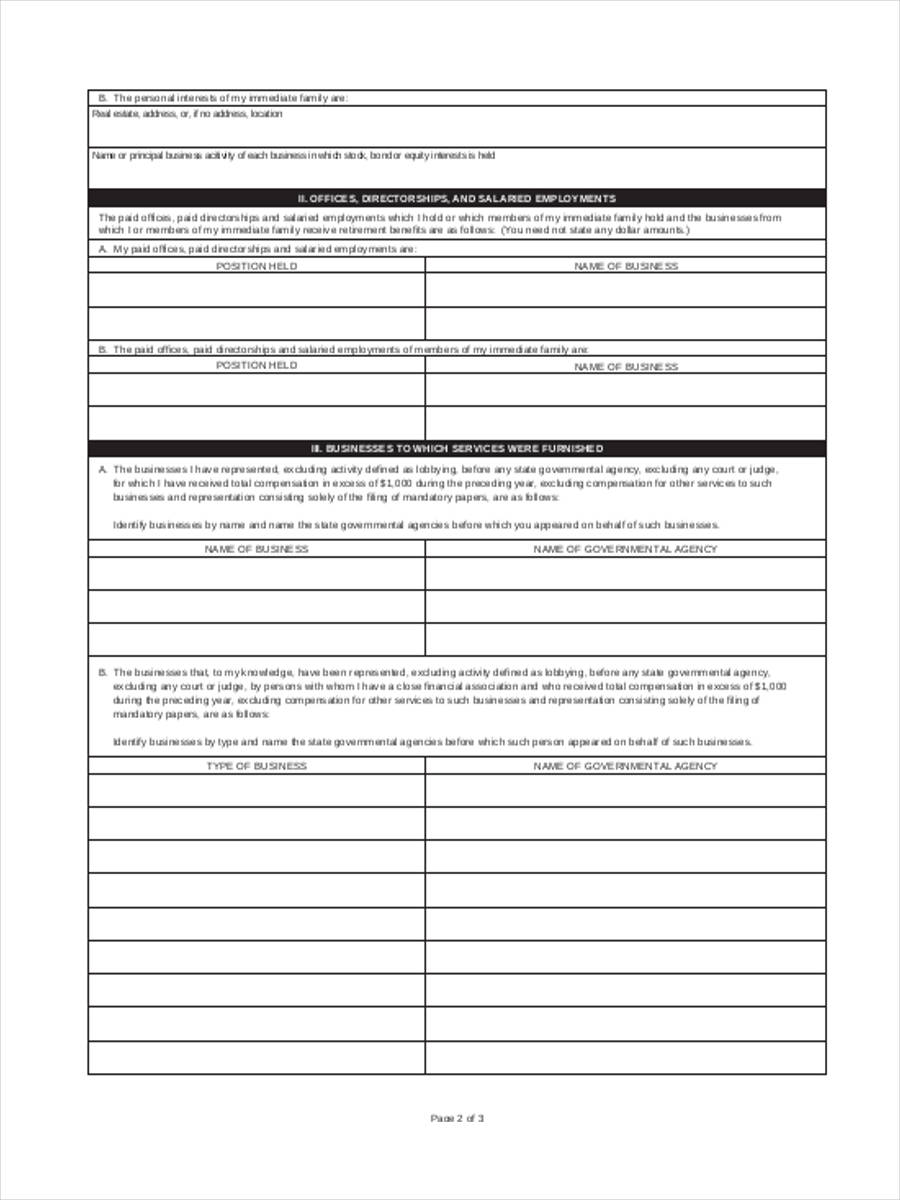

This document provides a non. A line of credit is a revolving loan. Auditing disclosures in financial statements.

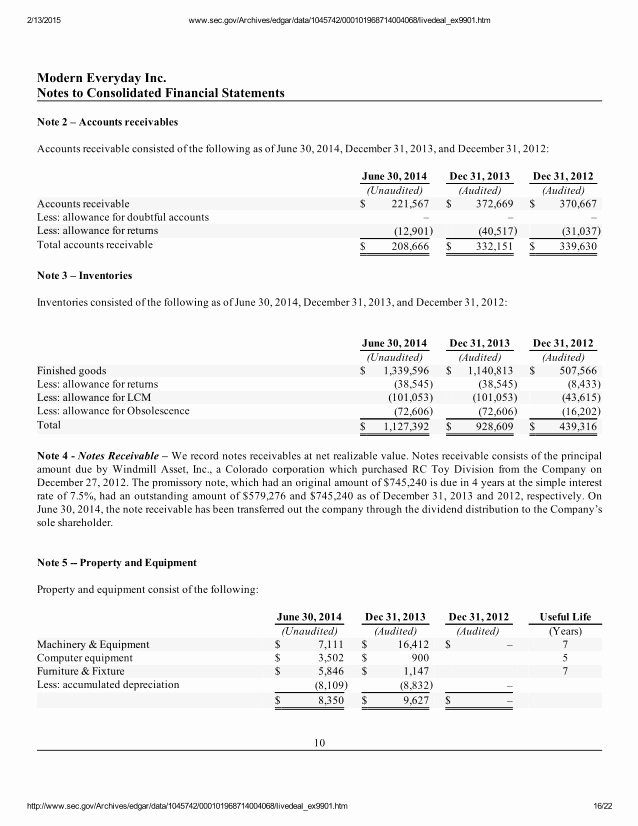

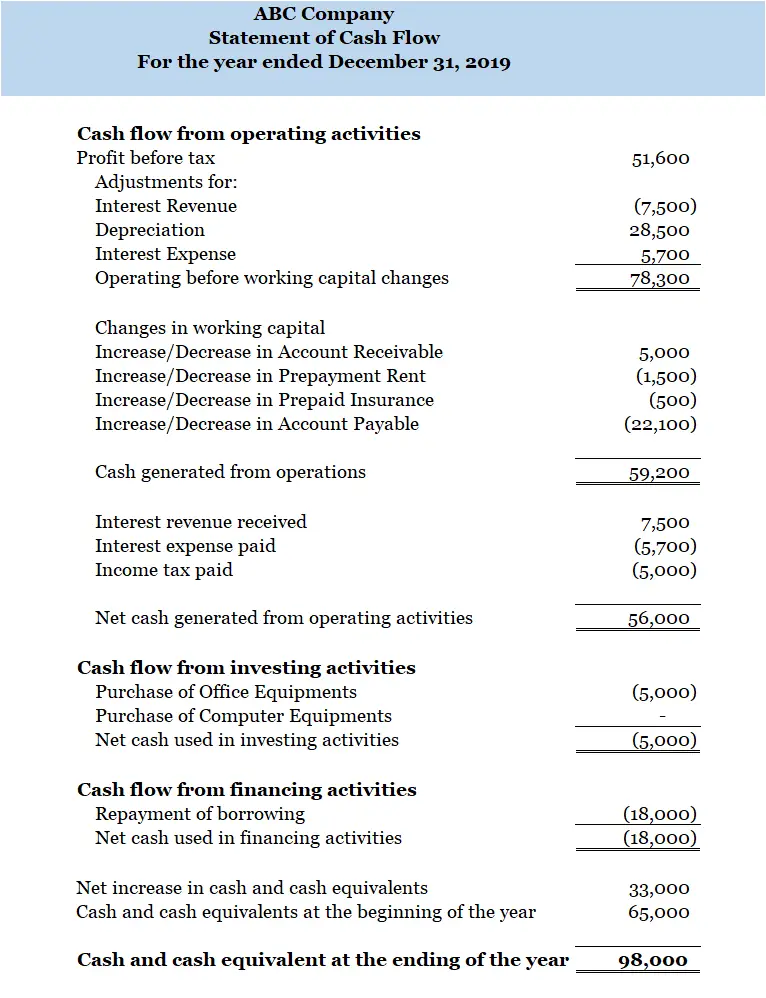

A line of credit or revolving debt arrangement is an agreement that provides the borrower with the ability to do all of the following: Financial year starting on or after: Disclosures on debt typically include information such as the stated and effective interest rates, maturity dates, covenants, and any collateral that is pledged.

The line bears interest at prime plus 1% per annum. We provide context for the proposed approach. What are disclosures in financial statements?

Changes to the financial statements that investors will see if the proposed approach is finalised, including illustrative examples. Borrow money at different points in time, up to a. Ias 1 sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such.

Measurement of credit losses on financial instruments, as amended. A business that wants ready access to cash can set up, say, a $4 million line of credit backed by company assets. 30 apr 2022 (updated 30 sep 2022) us financial statement presentation guide 11.3.

However, the appropriate level of disclosure. In recent years, the international auditing and assurance standards board (iaasb) has considered the issue of auditing. Usfinancial statement presentation guide 1.1.

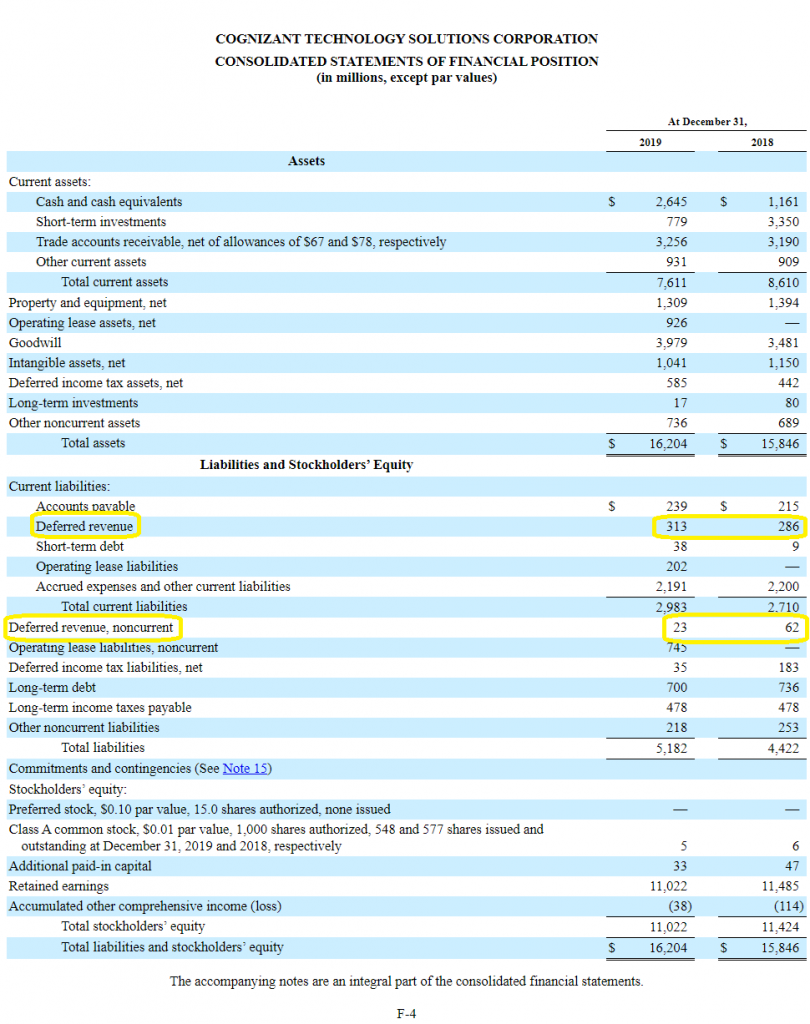

The company has a $300,000 bank line of credit. Borrowings under a line of credit. A line of credit is an extension of credit to a borrower that can be accessed or “drawn down” at any time at the reporting entity’s discretion.

A nonpartisan congressional watchdog filed an ethics complaint against rep. It is secured by all company assets and personal guarantees by the. The codification provides guidance on the financial statement presentation of loans and investments and the related credit allowance.

Entities which satisfy two of the following three criteria: New disclosure requirements apply about the credit risk of financial instruments (and contract assets in the scope of ifrs 15. If you have not used the line of credit yet, disclose its existence in a footnote.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)