Peerless Tips About Operating Investing And Financing Activities Examples

Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable, cash proceeds from issuance of.

Operating investing and financing activities examples. Financing, investing and operating activities operating activities include cash activities related to net income. The cash flow from operating. Question 1 which of the following would be classified as a cash flow from investing activity?

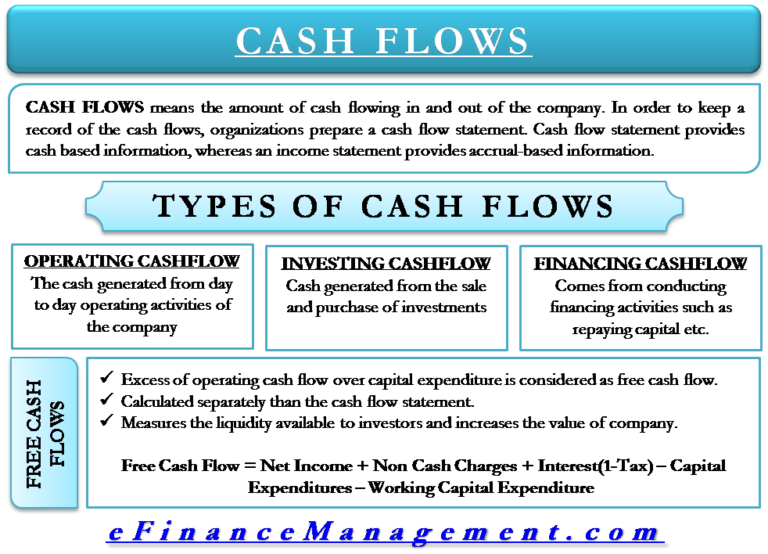

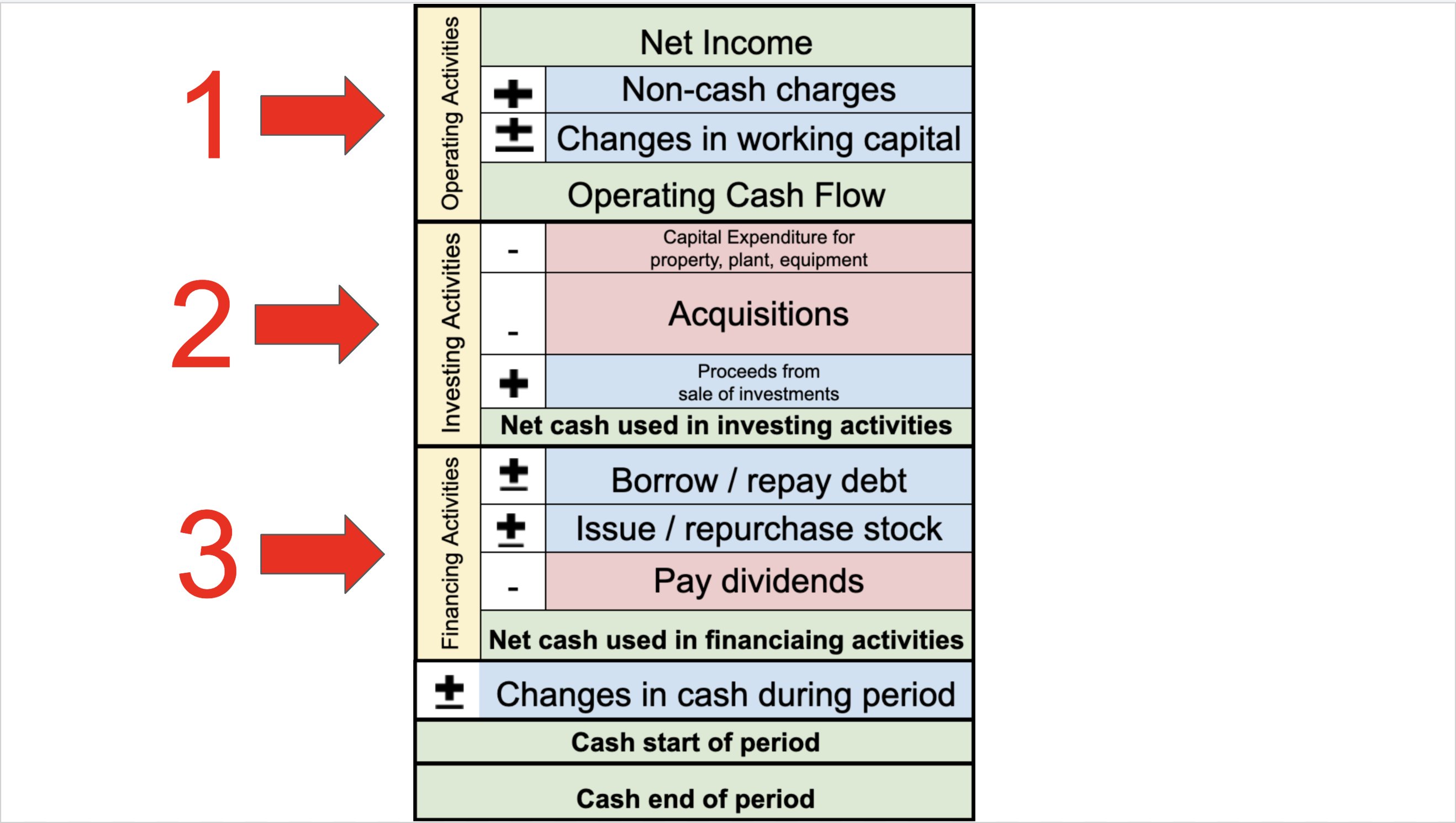

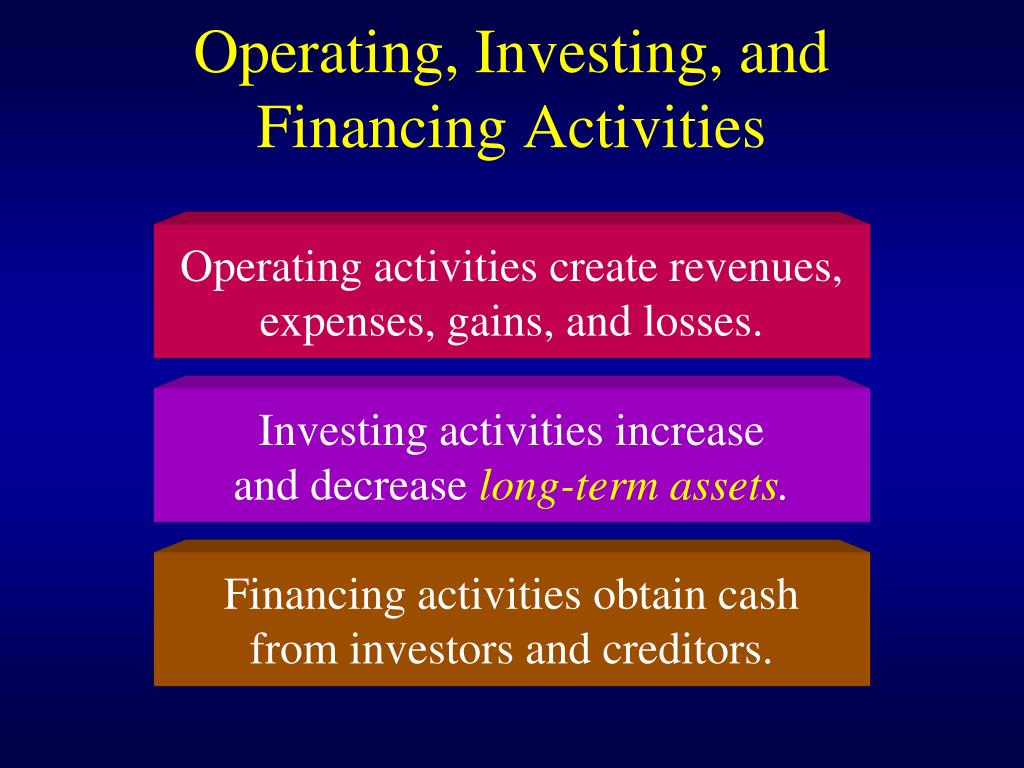

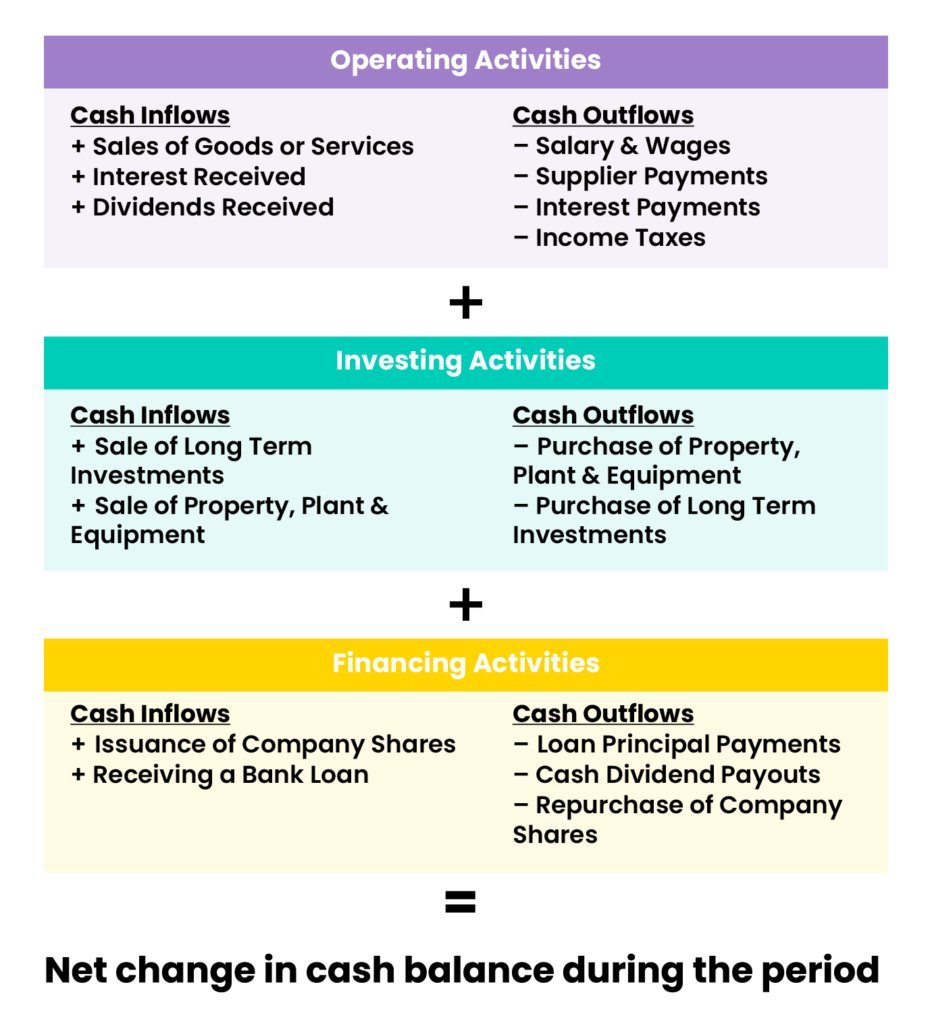

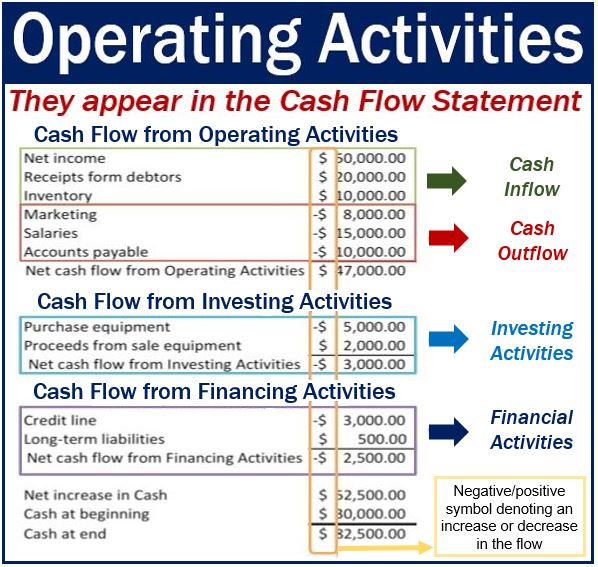

Cash flows from operating activities arise from the activities a business uses to produce net income. It's typically broken down into operating, investing, and financing activities. The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during.

Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable, cash proceeds from issuance of capital stock, cash. Operating cash flows also include. Some cash flows relating to investing or financing activities are classified as operating activities.

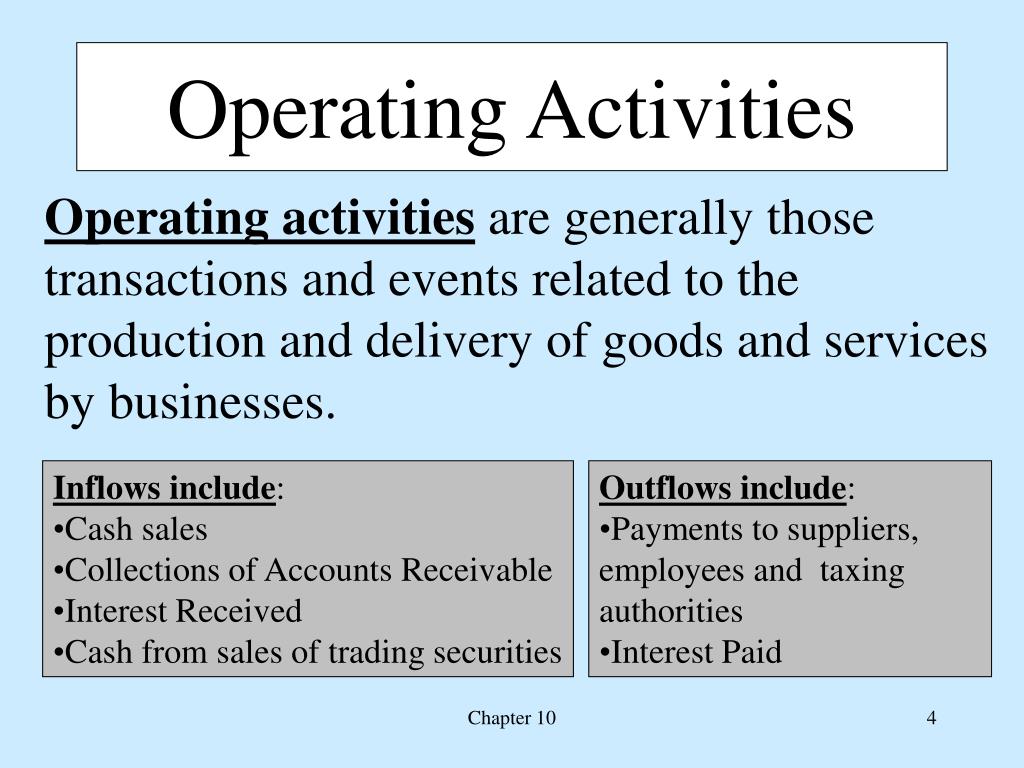

For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries and utilities. Differences between operating, investing, and financing. Differences between operating, investing, and financing activities;

Proceeds from the sale of. The statement of cash flows is prepared by following these steps: Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable, cash proceeds from issuance of.

For example, operating cash flows include cash sources from sales and. Using the indirect method, operating net cash. There are three types of cash flows:

Operating activities involve cash flows directly related to a company's core. Cash flows from operating activities arise from the activities a business uses to produce net income. As an example, let's say a company has the following information in the financing activities section of its cash flow statement:

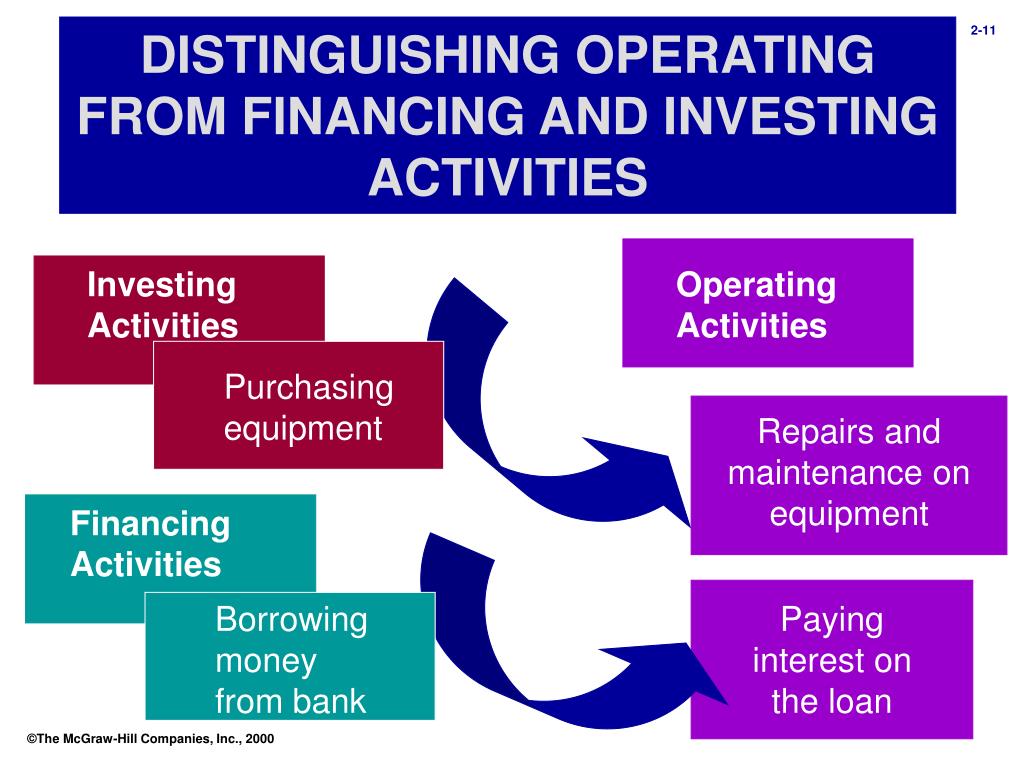

Operating activities are distinguished from investing or financing activities, which are functions of a company not directly related to the provision of goods. Cash flow from operating activities (cfo) indicates the. Proceeds from the issuance of bonds.

Cash flows stem from operations, investing and financing activities. David kindness fact checked by suzanne kvilhaug what is cash flow from operating activities (cfo)? All cash transactions―cash in (receipts) and.

Financing activities reporting cash flows from operating activities from paragraph 1 4 6 7 10 13 16 reporting cash flows from investing and. For example, receipts of investment income (interest and dividends) and. Determine net cash flows from operating activities.

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)