Fantastic Info About Example For Accrued Expenses

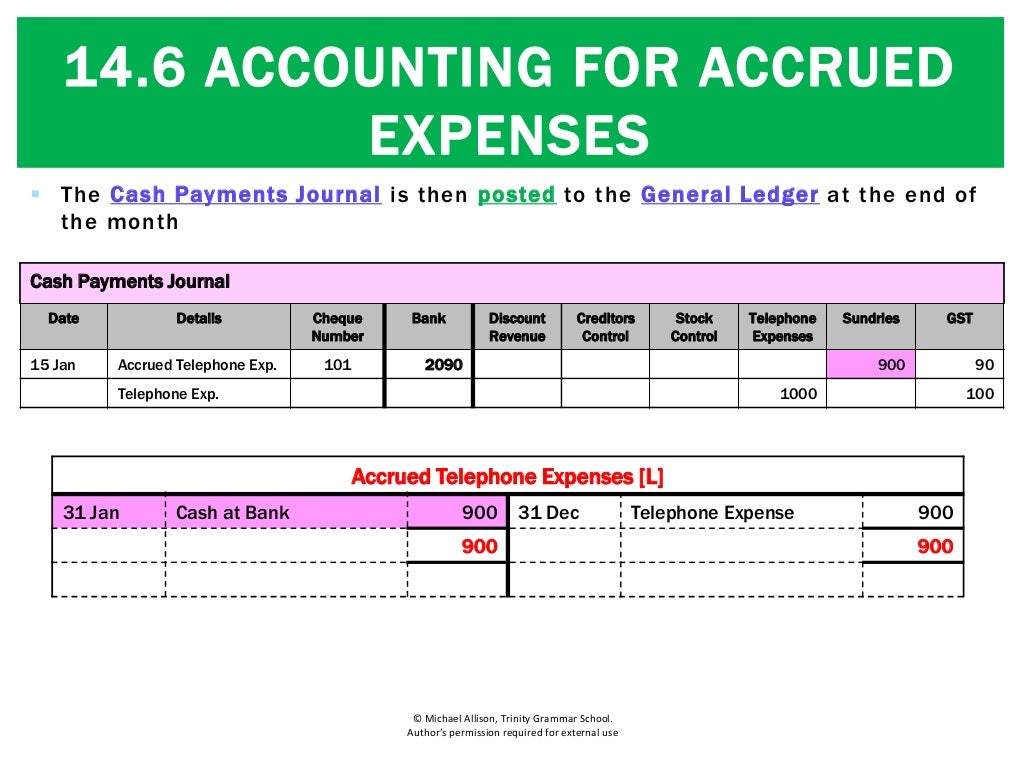

When you use utilities throughout the month, the bill or invoice is only issued the following month.

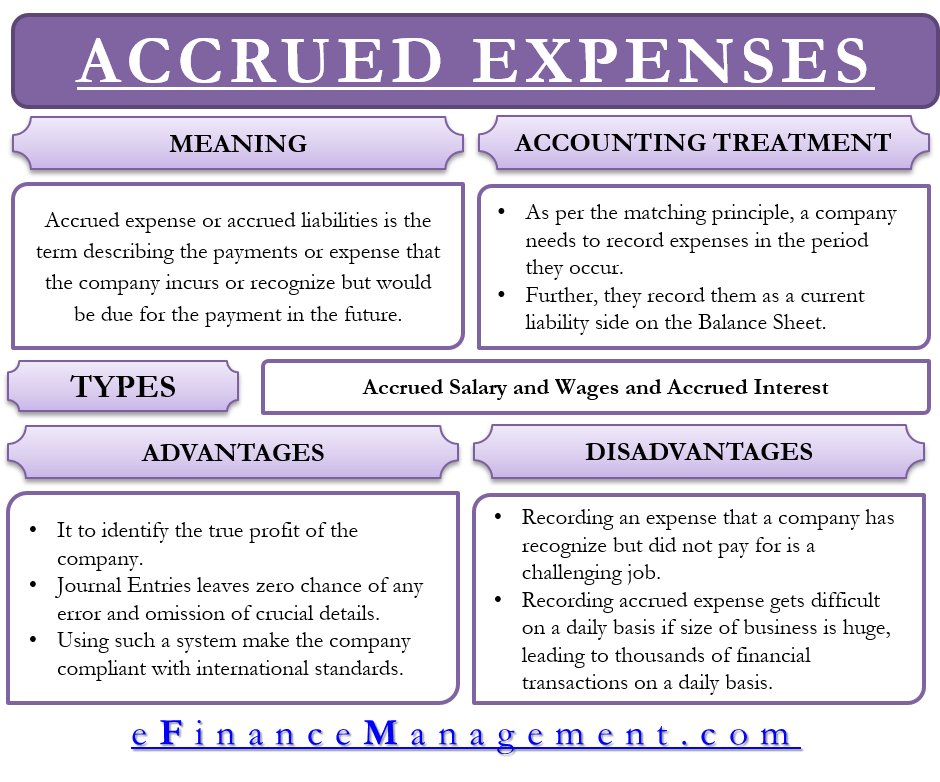

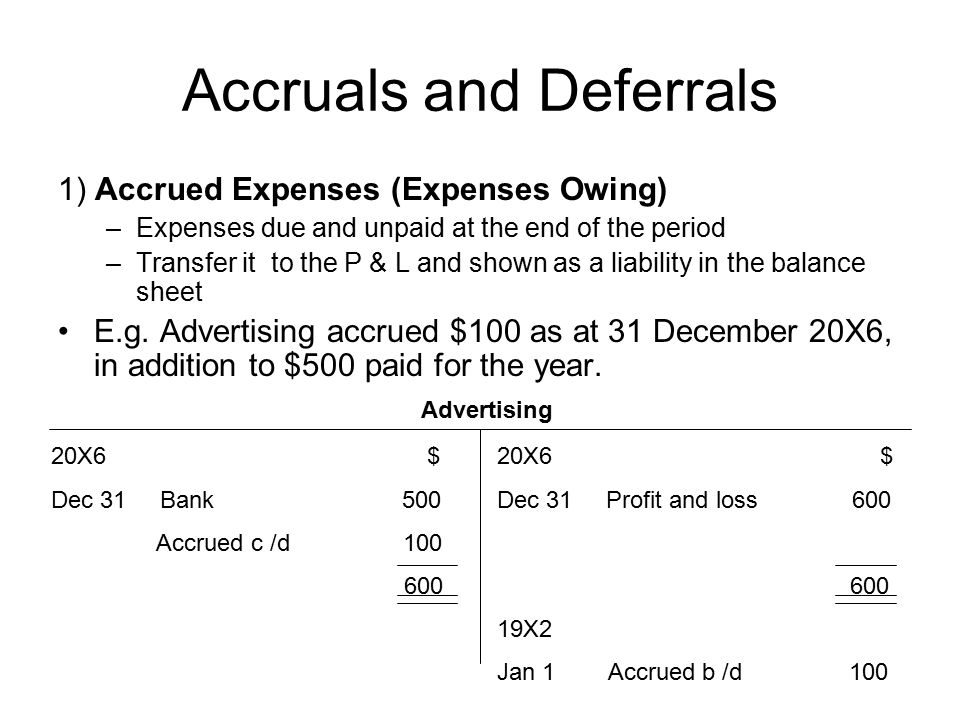

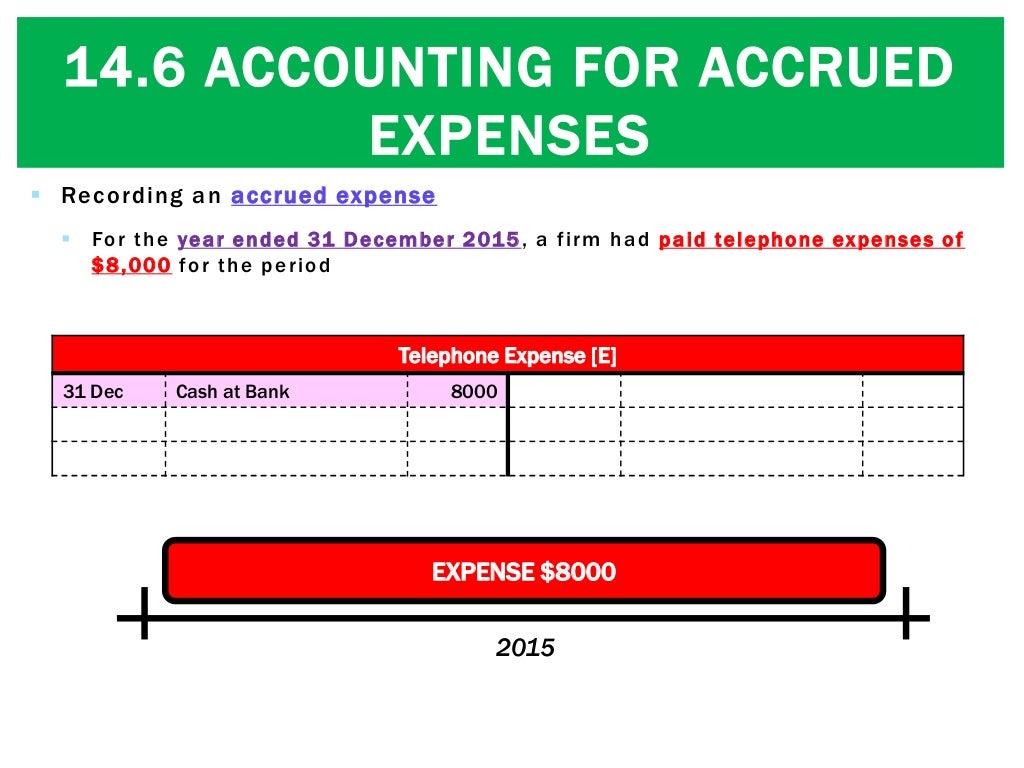

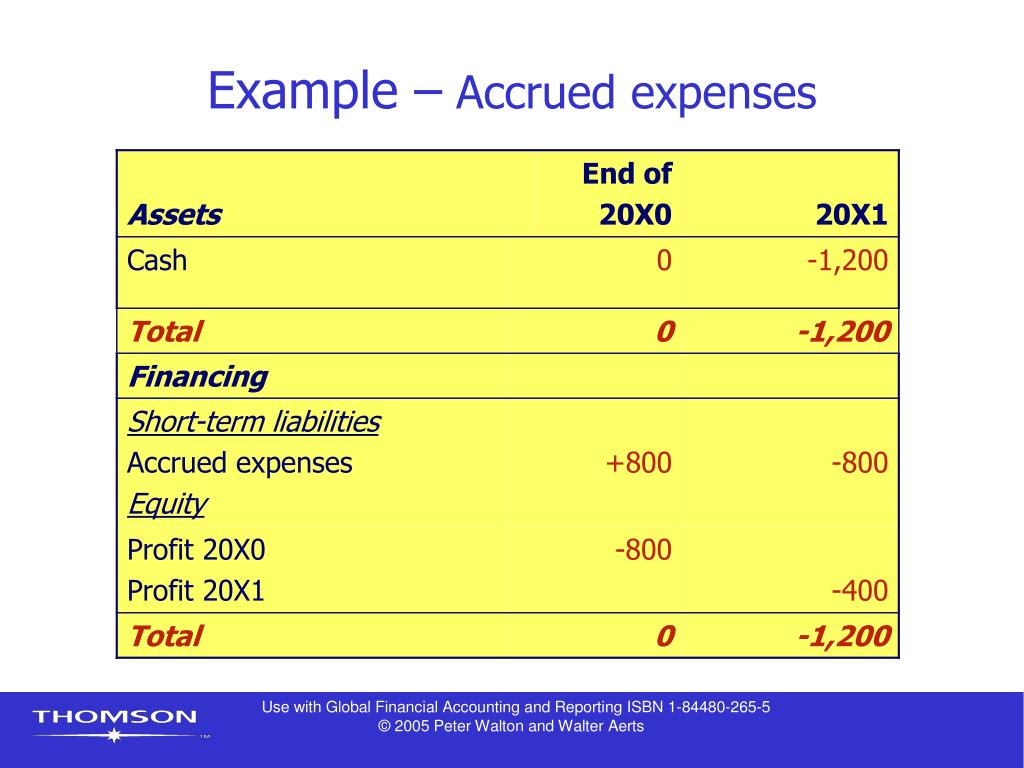

Example for accrued expenses. Accrued expenses are costs that are incurred in the current period but not paid for until the next period. For motoring expenses for a van provided for private use. By ashlyn brooks october 26, 2023 in the world of accounting, there is a rhythm of sorts that has to be followed in order to account for financials properly.

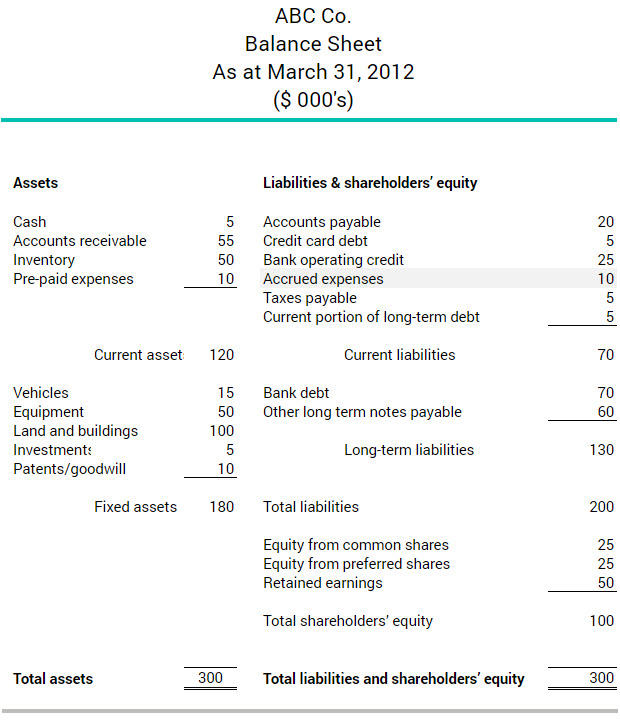

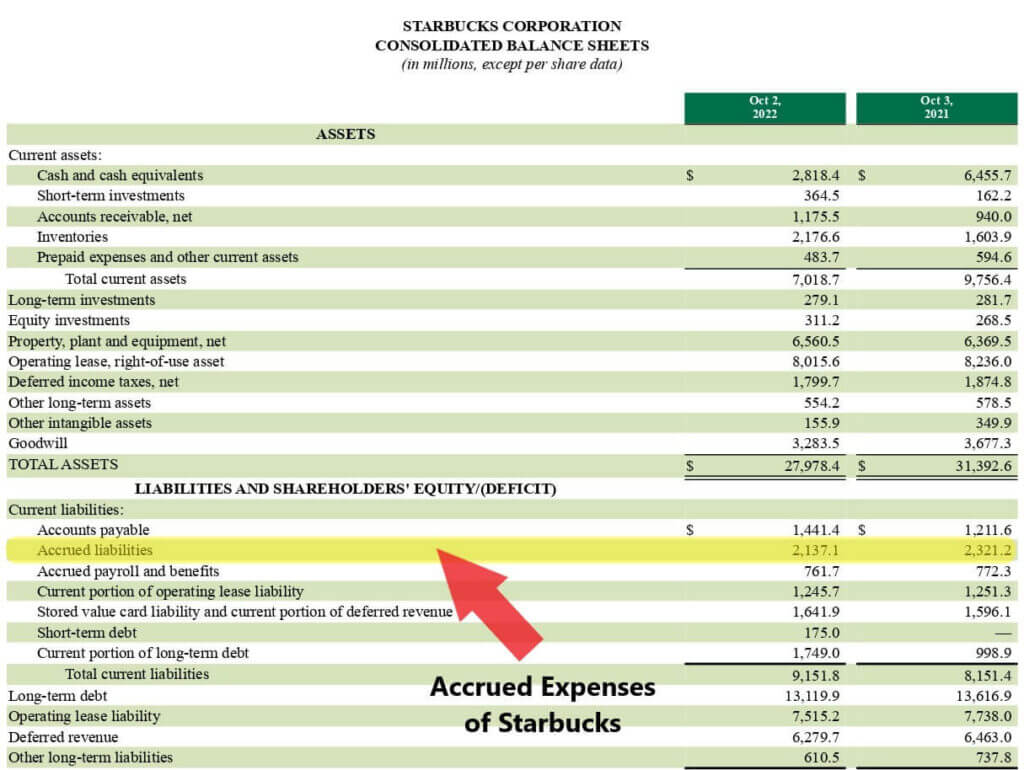

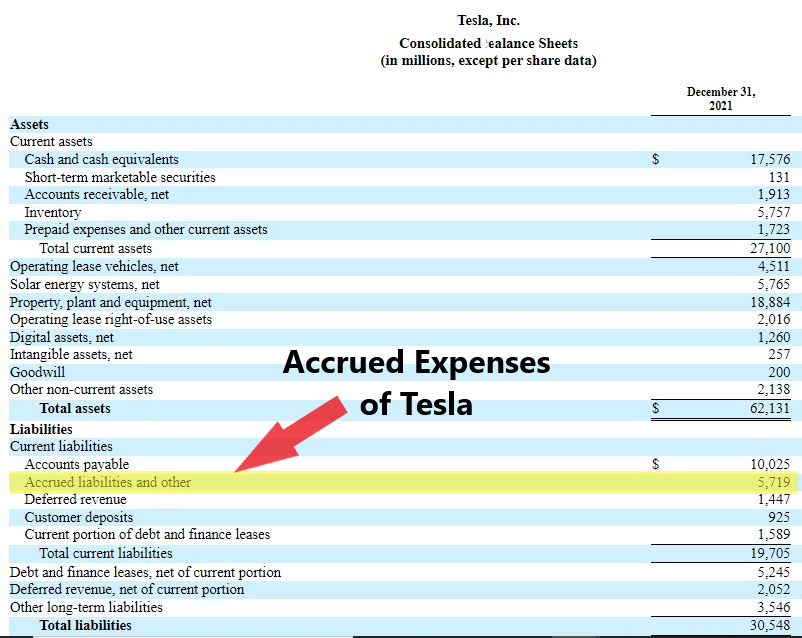

Interest on loan (s) goods received services received wages for employees taxes commissions utilities rent what are accrued expenses on a balance sheet? John installed a telephone in his shop in august 2019. An example of an accrued expense might include:

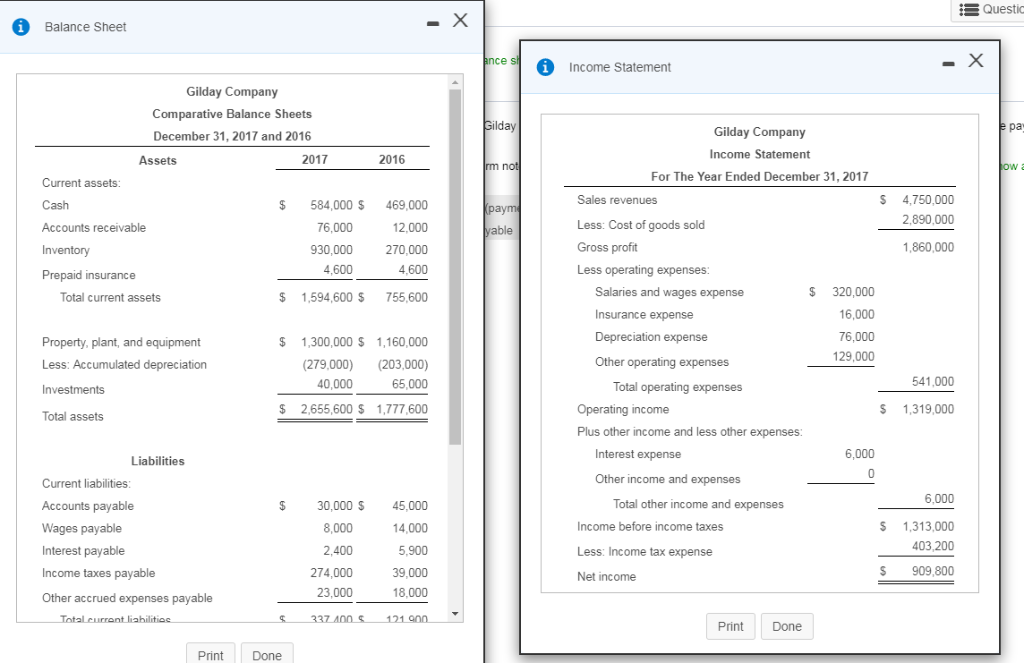

A most popular example of accrued expense includes salaries payable salaries payablesalary payable refers to the liability of the company towards its employees against the amount of salary of a period that became due but has not been paid yet to them by the company and it is shown in the balance of the company under the head liability. $840 bill for october, received and paid in november: Accrued expenses are reported on a company’s balance sheet.

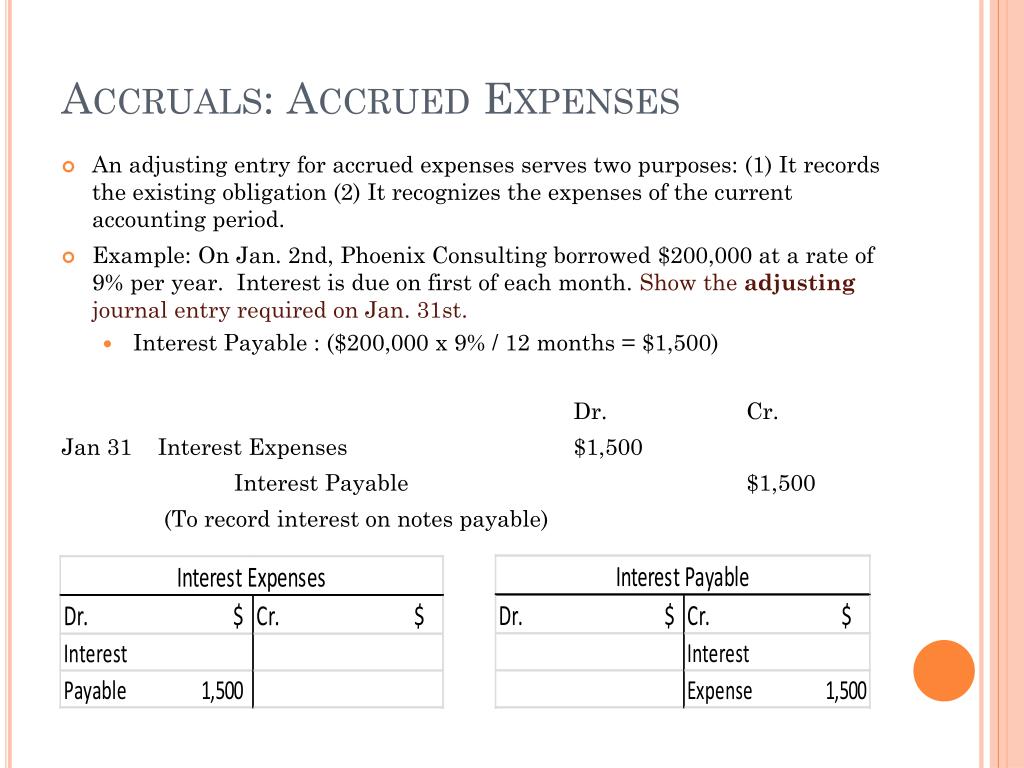

Typical accrued expenses include utility, salaries, and goods and services consumed but not yet billed. For example, if a company incurs $1,000 in expenses in january but does not pay the bill until february, the expense would be considered an accrued liability. For example, the 2024 to 2025 tax year starts on 6 april 2024 and ends on 5 april 2025.

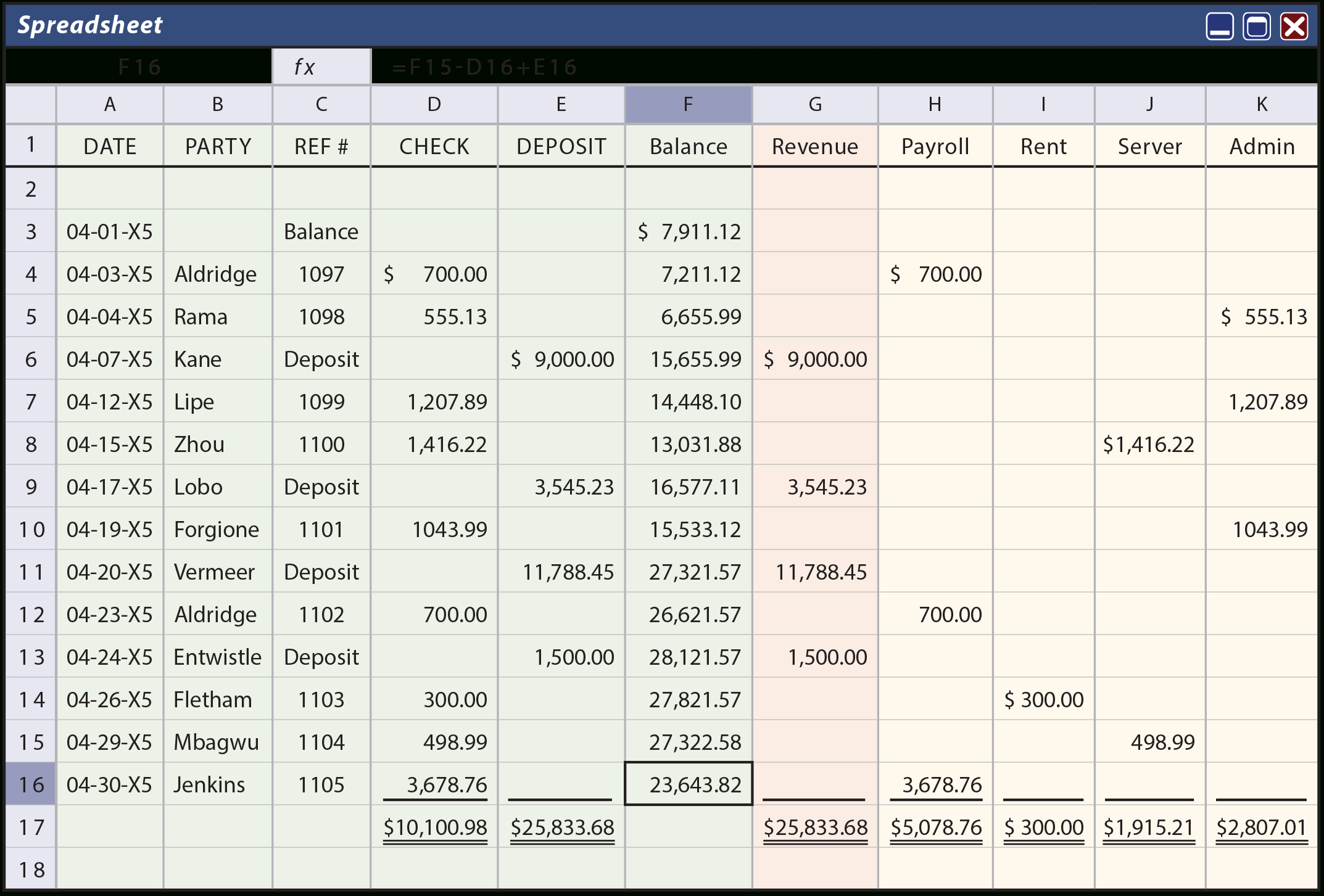

Using the same scenario from above, a cash method business would not record revenue until the customer actually paid for the product. Accrued expenses are expenses that have occurred but are not yet recorded in the company's general ledger. $750 bill for september, received and paid in october:

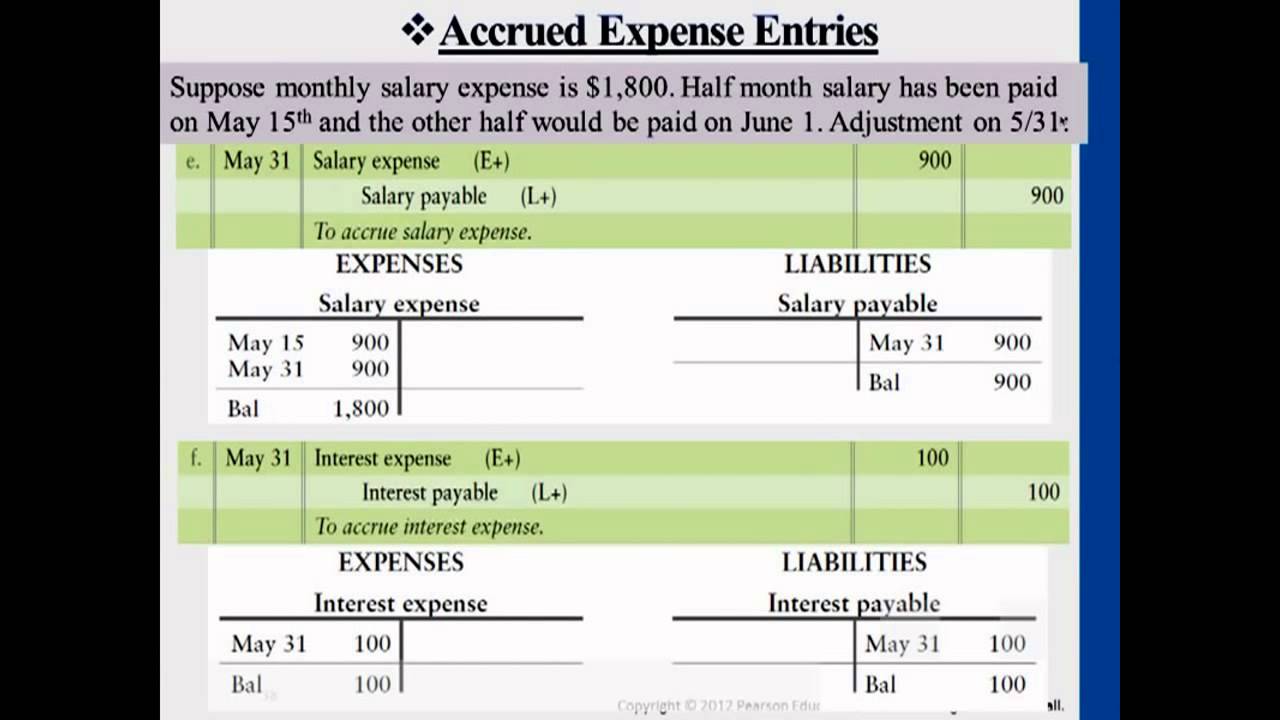

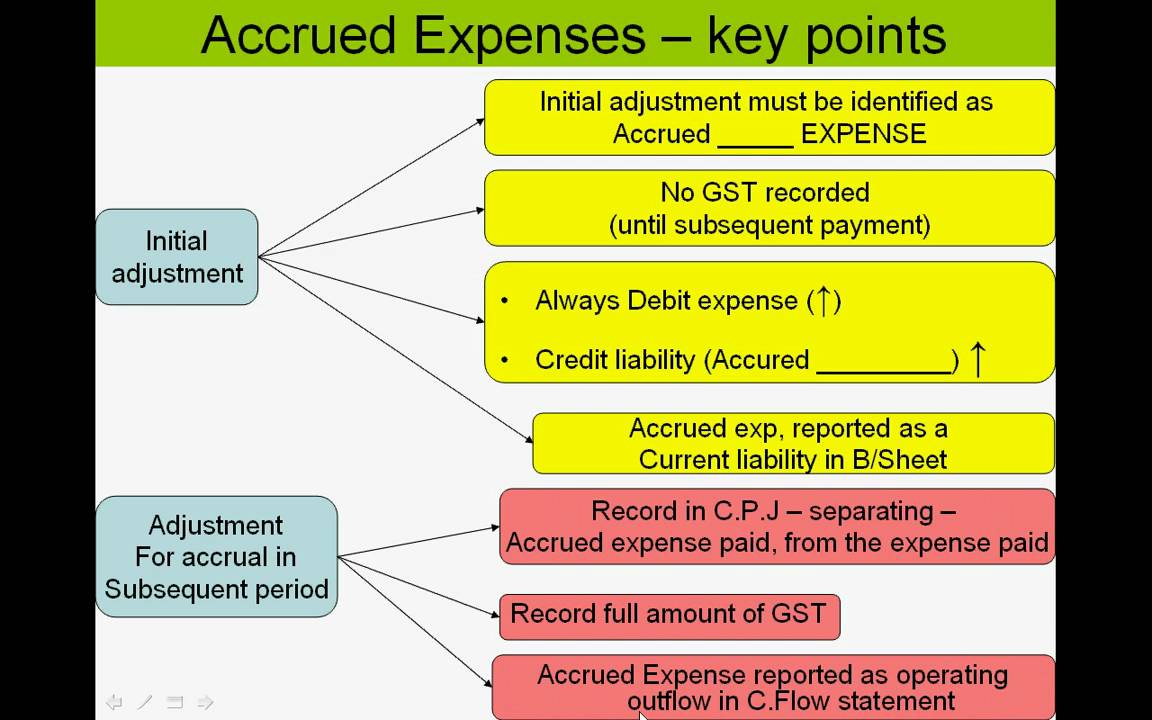

He received the following bills: At that point, the business would record a credit to revenue and a debit to its cash account. For example, the accrued expense for salary expense should be salary payable, etc below is the simple journal entry for accrued expenses:

Example of an accrued expense. This can be in the form of a wage, salary, or bonus. An example of an accrued expense is when a company purchases supplies from a vendor but has not yet received an invoice for the purchase.

The accounting treatment of accrued expenses is as follows: An example of an accrued expense for accounts payable could be the cost of electricity that the utility company has used to power its operations, but has not yet paid for. The agreement requires that the company repay the $200,000 on february 28 along with $6,000 of.

Now, we know that employees have already worked and the company has incurred the salary expense. Accrued expenses are accounted for in the following manner. Bill for august, received and paid in september:

In other words, it’s an expense that the company has benefited from but hasn’t paid for or recorded yet. Accrued expenses, also known as accrued liabilities, are expenses recognized when they are incurred but not yet paid in the accrual method of accounting. If interest payment is due for an amount of ₹1000, then it will be.

:max_bytes(150000):strip_icc()/TermDefinitions_AccuredExspense_recirc_3-2-ab4e70486db34a81bf9098e2b1da6407.jpg)