Smart Info About Rent Expense On Balance Sheet

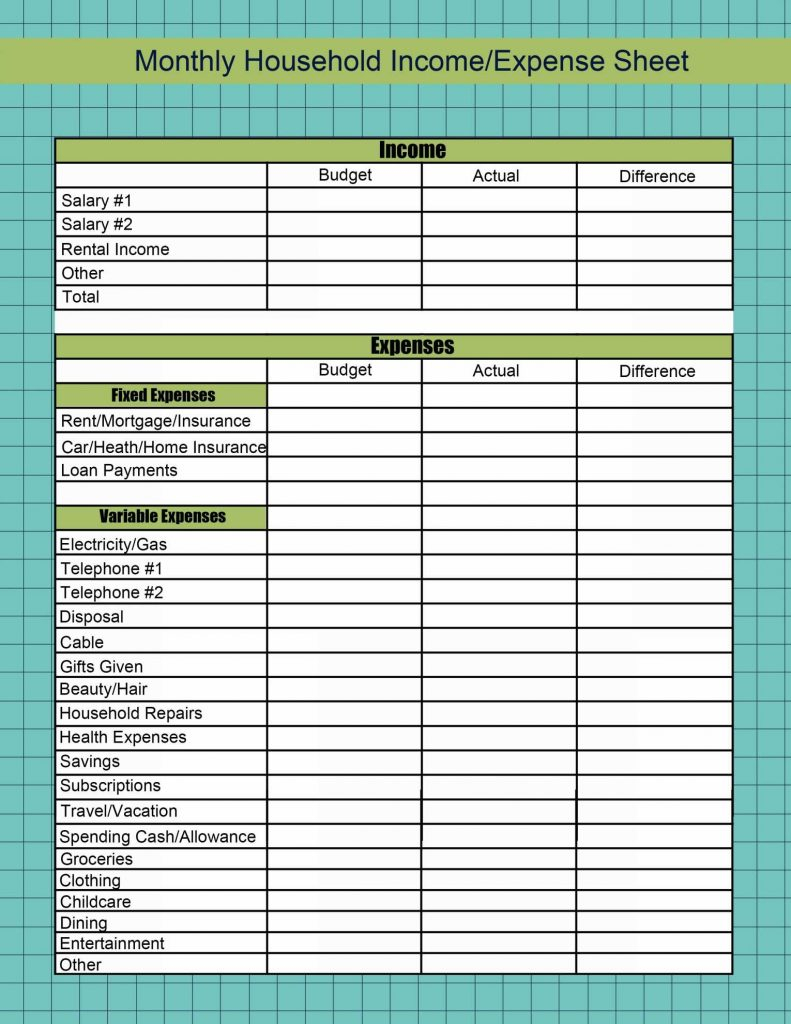

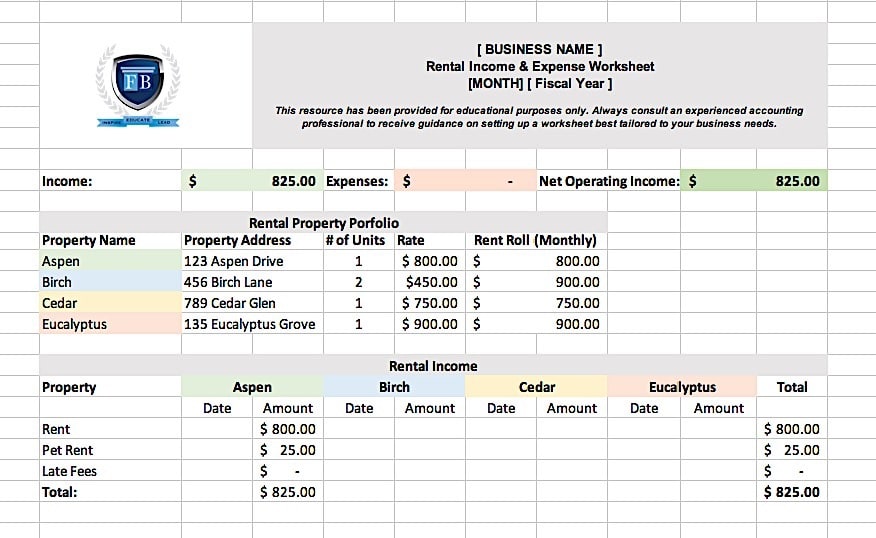

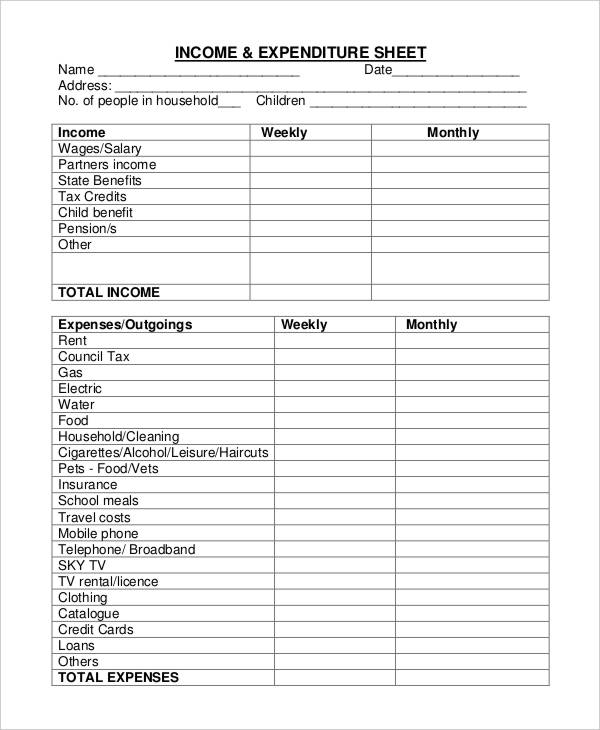

You can keep track of expenses such as advertising charges, leasing fees, repairs and maintenance costs, pest control charges, landscaping charges, utility bills,.

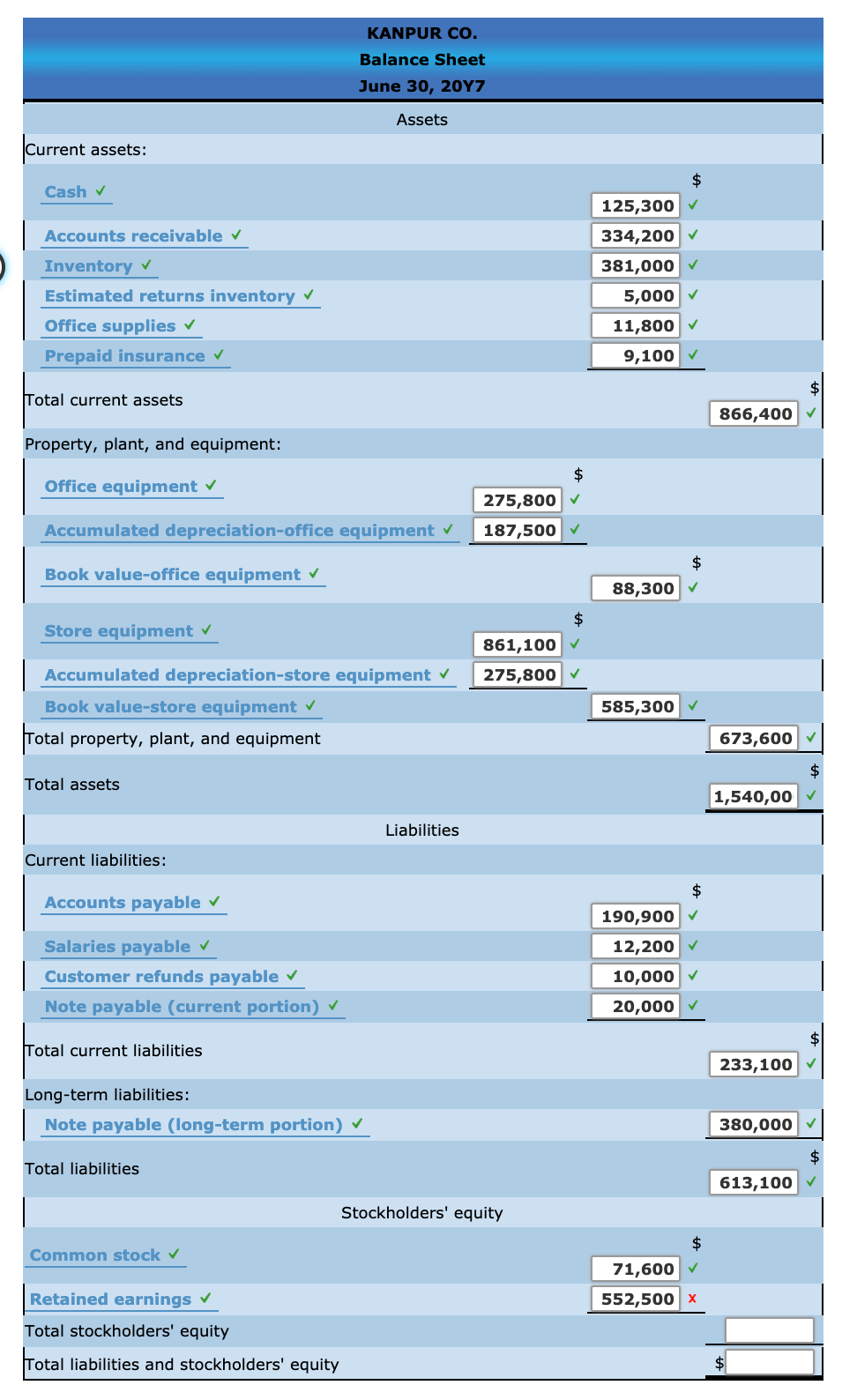

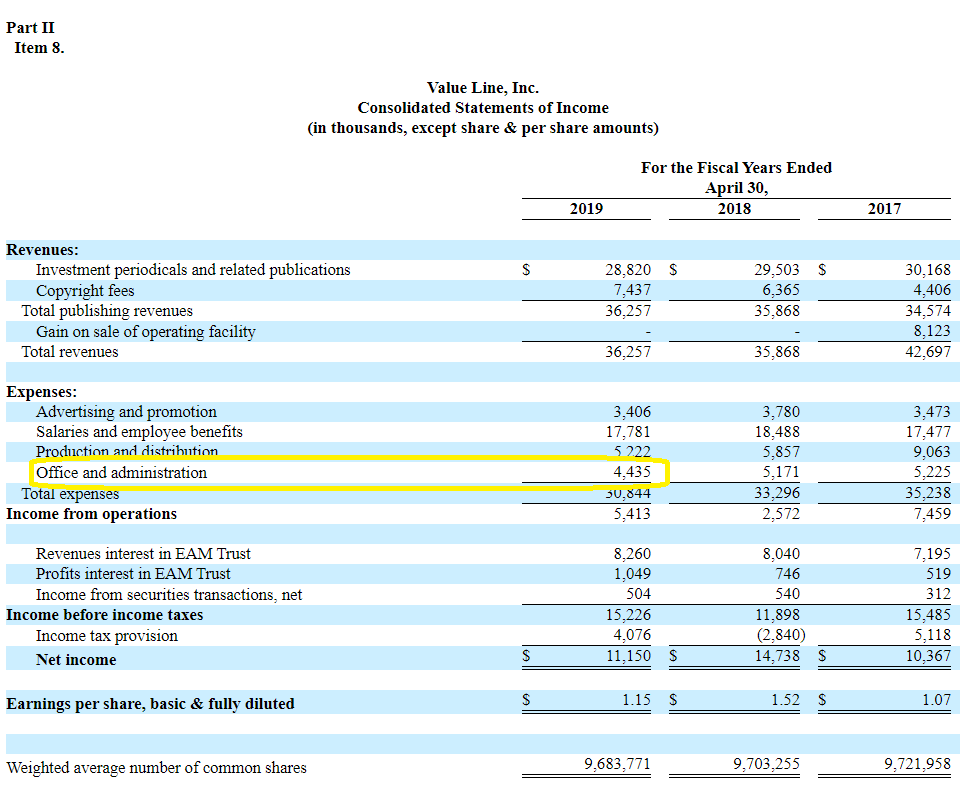

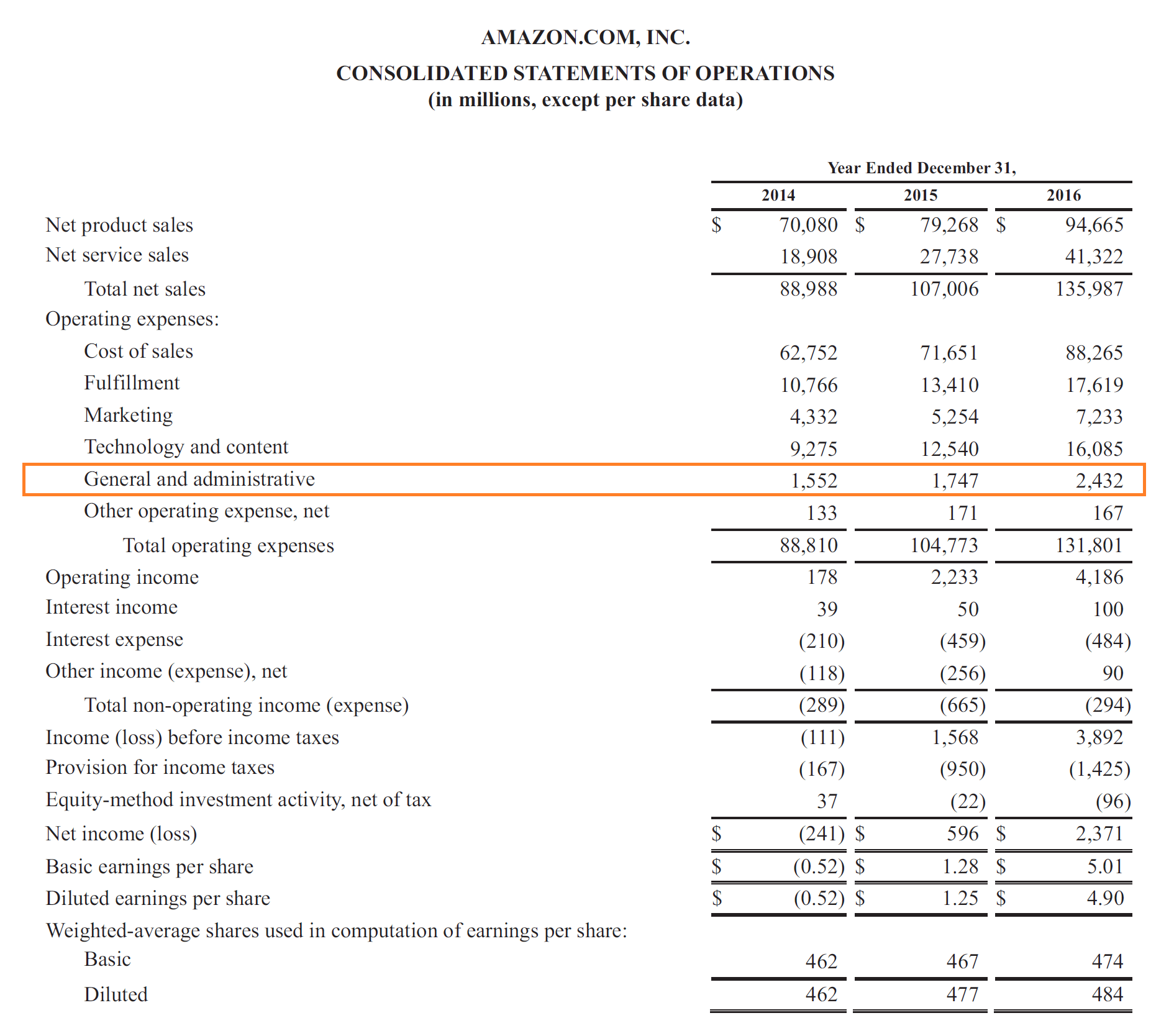

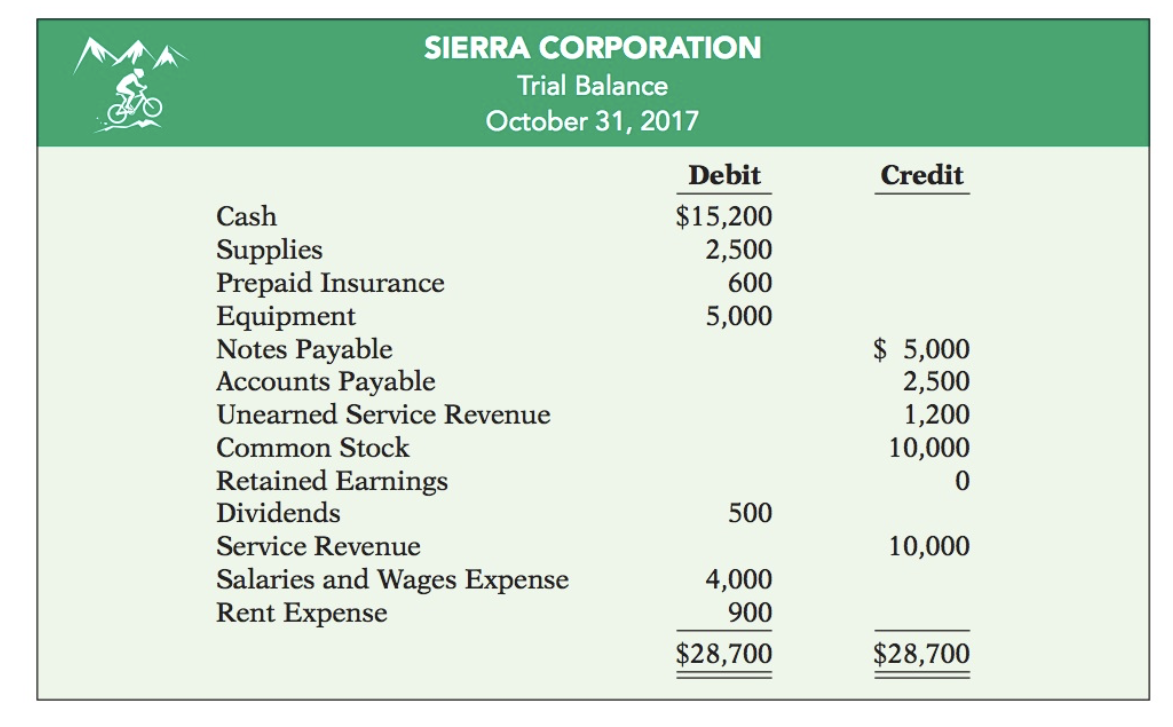

Rent expense on balance sheet. This equation ensures that the balance sheet remains in balance, as the total. It is still only reported on the income. The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends.

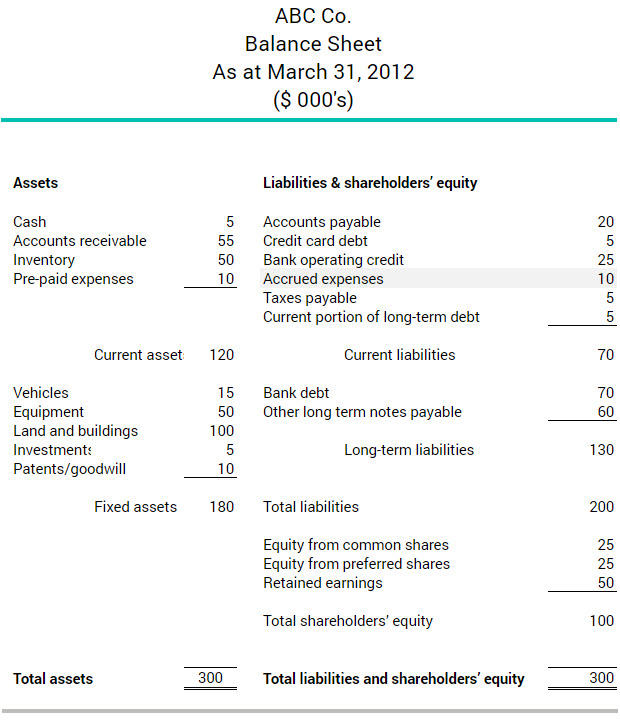

The following items may be included on an airbnb balance sheet or rental property balance sheet: December 27, 2023 learn about prepaid rent and its placement on the balance sheet in. Rent expense definition under the accrual basis of accounting, the account rent expense will report the cost of occupying space during the time interval indicated in the heading of.

This expense is one of the larger. What is included on a rental property balance sheet? How an expense affects the balance sheet an expense will decrease a corporation's retained earnings (which is part of stockholders' equity) or will decrease a sole.

Rent expense is not listed as an asset on the balance sheet. Rent expense on the balance sheet. Rent expense refers to the cost incurred by individuals or businesses for the use of property, equipment, or other assets owned by someone else.

Rent expense refers to the total cost of using rental property for each reporting period. This is recorded with a credit to cash. The balance sheet is going to.

Rent expense is an account that lists the cost of occupying rental property during a reporting period. Assets = liabilities + equity. It is typically among the largest expenses that companies report.

Rent expense (and any other expense) will reduce a company's owner's equity (or stockholders' equity). How a rent payment affects the accounting equation a company's payment of each month's rent reduces the company's asset cash. The balance sheet bragg's laws of accounting accounting for unearned rent when an expense is recorded, it appears indirectly in the balance sheet, where the.

Rent expenses are included with other expenses to determine the profitability of your business. Balance sheets show rent payable. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate;

Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting statement. Finance where is prepaid rent on the balance sheet published: In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and.

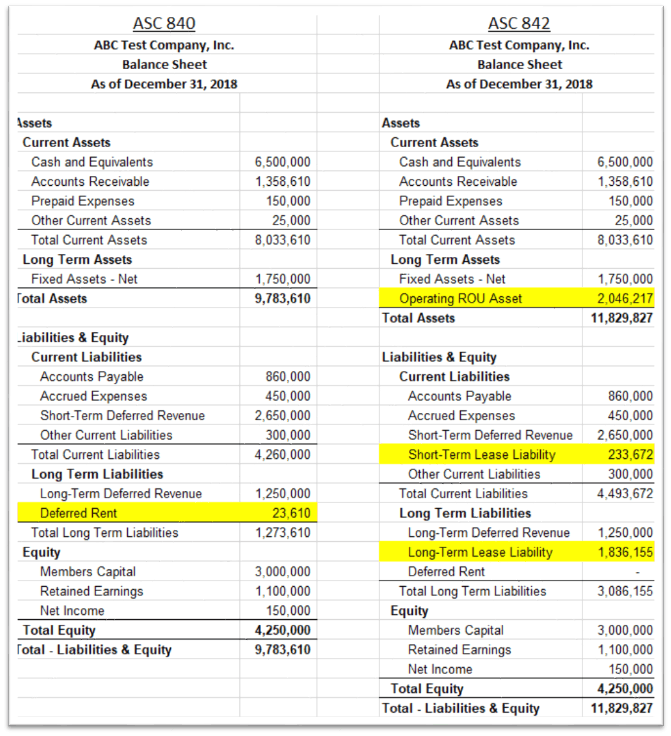

It is recorded as an expense on the income statement, which only reflects revenues, expenses, gains,. Owner's equity which is on the right side of the accounting. As was the case under asc 840, rent expense is not reported on the balance sheet.