Simple Tips About Treatment Of Net Loss In Balance Sheet

Key takeaways net operating loss signifies a tax incentive when business tax benefits exceed the annual net earnings.

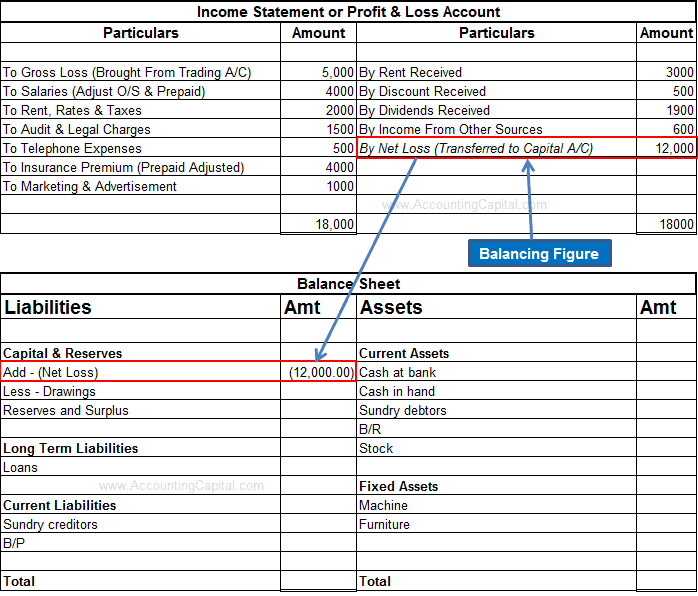

Treatment of net loss in balance sheet. Net accumulated loss is shown on the asset side in the balance sheet. Net loss or net income is a key indicator used to evaluate the company operating results in a specific period. The following formula is used to compute it:

Importance of net income/net loss. Final accounts are prepared on the basis of trial balance. Here is an example of a typical.

If you have retained earnings, you enter them in. In this tutorial, we will walk through how to build a general industry business operating model. Following is the profit and loss account of pqr for the year ending dec 20yy in the above example, the debit total is 20,000, and the credit total is 10,000.

Investors look at the size of the net loss and trends from previous periods to assess the company’s performance. How do you treat net loss on a balance sheet? It is similar to retained earnings, which is impacted by net income, except it includes those items that.

Therefore, the net profits or. In this section, we demonstrate how to model a merger of two public companies. Fundamental analysis balance sheet vs.

Both involve a company’s finances, but their differences are significant. A net operating loss (nol) or tax loss carryforward is a tax provision that allows firms to carry forward losses from prior years to offset future profits, and, therefore, lower future. The credit balance on the account is then transferred to the statement of profit or loss (added to gross profit or included as a negative in the list of expenses).

Understand the accounting treatment of the adjustments in trading a/c, profit and loss a/c and balance sheet. The total of the bottom half of the balance sheet will equal the top half. Beyond the profit and loss statement.

Trading account is a part of profit & loss account. Net operating losses definition: The net profit belongs to the ownership of the business which is represented by the capital account.

A net loss occurs when earnings fall below the number of costs and cost of products sold in a certain period. Analysts must go beyond the profit and loss statement to get a full picture of a company’s financial health. Transfer to capital a/c.

Reporting and analysis 3rd edition isbn: These two totals are called the balance sheet total.