Ace Tips About 4 Types Of Financial Ratios P&l Account And Balance Sheet Format

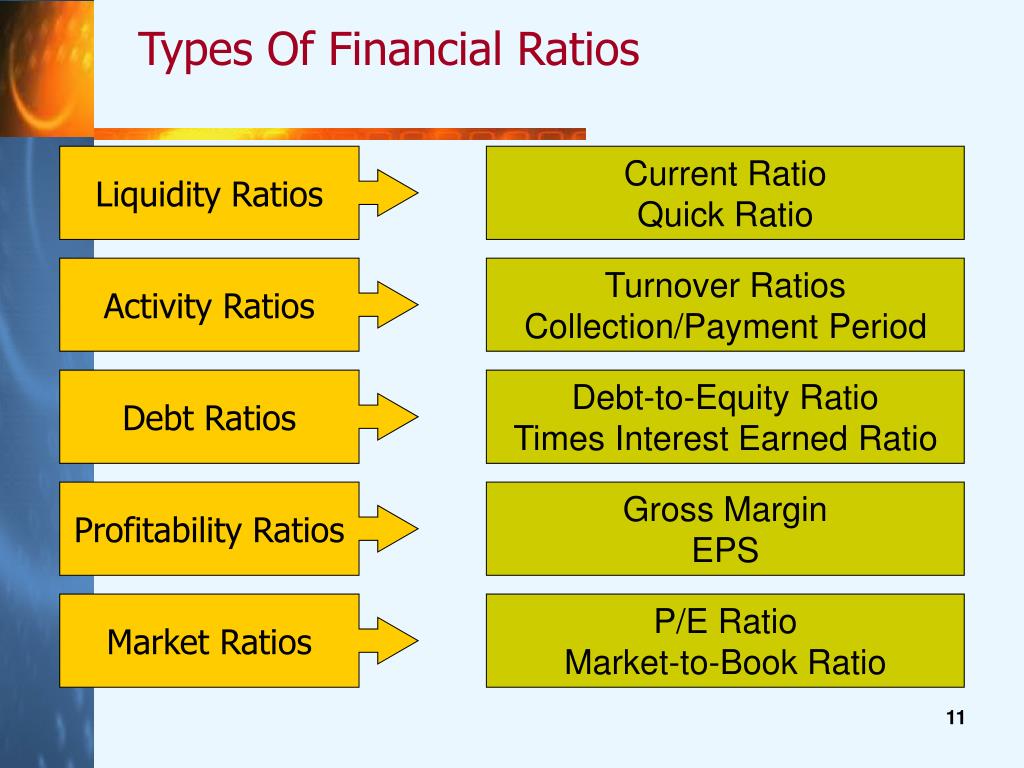

The different types of balance sheet ratios are as follows:

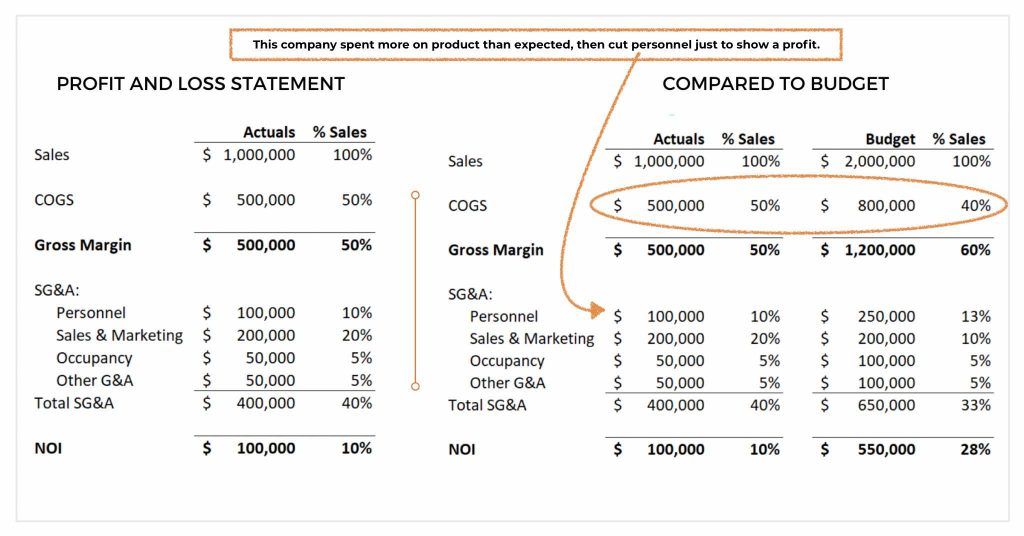

4 types of financial ratios p&l account and balance sheet format. Profit and loss statement vs balance. Let us see in detail the types of financial statements. A balance sheet is basically an accurate representation of assets and liabilities of a business.

This ratio analyzes the company’s liquidity by using its current asset to pay the current liability. A balance sheet and a profit and loss (p&l) statement serve different purposes and provide distinct financial insights: The prime aim of this is to monitor whether the.

For example, the ratio of current. Part 1 introduction to financial ratios part 2 financial ratios using balance sheet amounts part 3 financial ratios using income statement amounts part 4 financial. An analyst can generally use the balance sheet to calculate a lot of financial ratios that help determine how well a company is performing, how liquid or solvent a company is,.

Types of balance sheet ratios. Balance sheet ratios: With this information in mind, let’s do a comparison of the balance sheet versus the p&l statement.

Assets = liabilities + equity the above equation means that at any point in time, a business’s assets should be equal to its liabilities and equity. Types of balance sheet ratios; If both the variables of the ratios are from the balance sheet, then it is classified as the balance sheet ratios.

Current assets / current liabilities: A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)