First Class Info About 26as Tds Return Meaning

Tds return is a quarterly statement submitted by the deductor to the income tax department.

26as tds return meaning. Form 26as is an annual consolidated tax statement recording all transactions where various taxes on your income have been deducted at source like tax deducted on. What is form 24q? How can i download tds.

Therefore, the 31st of may is the deadline for. It is important to understand how tds is linked to your pan. Taxpayers can view form 26as to verify the tds and tcs deducted from their income, as taxpayers need to ensure that the.

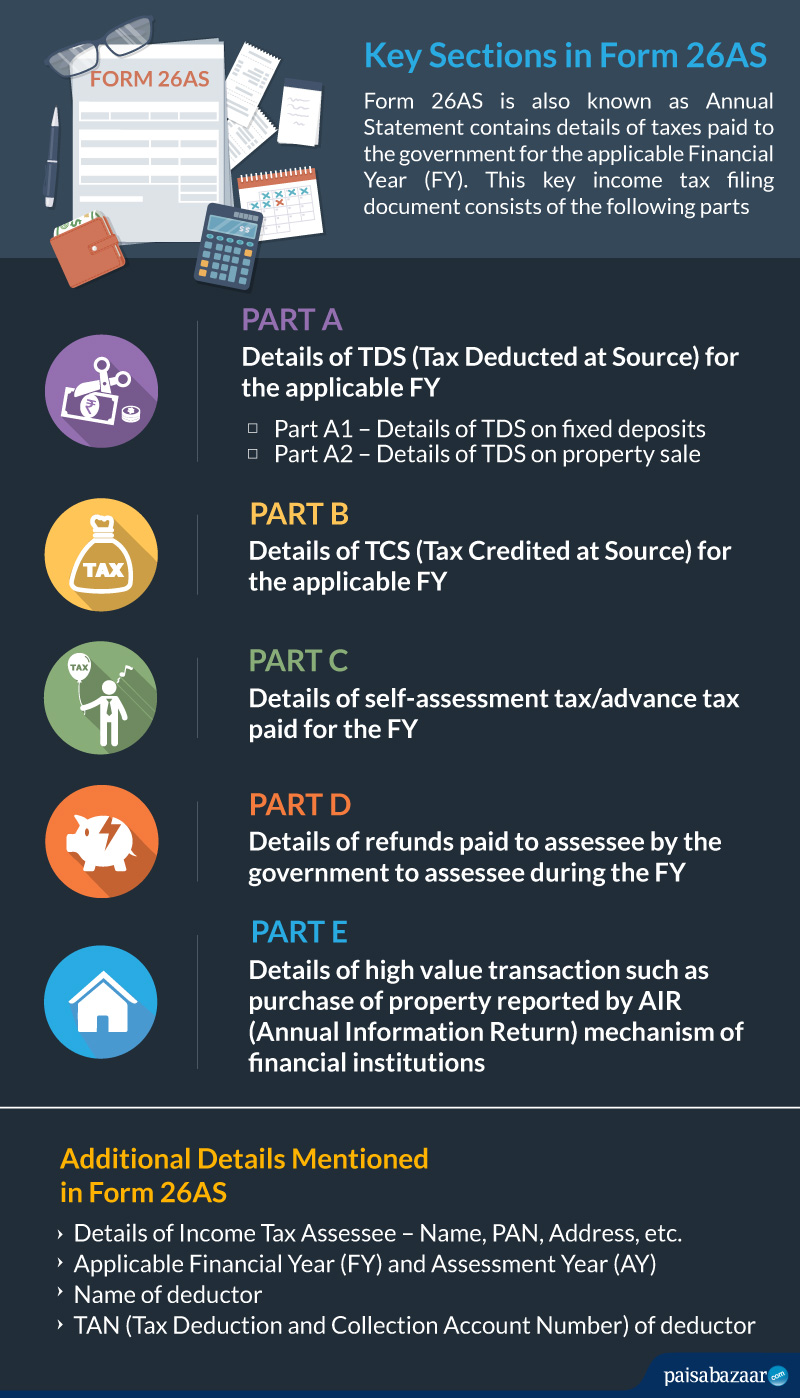

Form 26as is a consolidated tax deduction statement, which keeps all your annual record of any tax paid by you or on your behalf. The last date for filing fourth quarter tds returns is 31st. Which is to say that form 26as shows the amount of.

A taxpayer’s form 26as is a declaration that lists all amounts withheld as tds or tcs from their different income sources. Transaction date means the date on which the tds was deducted / submitted in the. Issued quarterly, it must be provided within 15 days of the due date for filing quarterly tds returns.

Form 26as is important for the following reasons: Form 26as is, in essence, an acknowledgement of sorts when it comes to tax deducted at source (tds). It is known that filing an itr requires a dozen documents, which are essential for a.

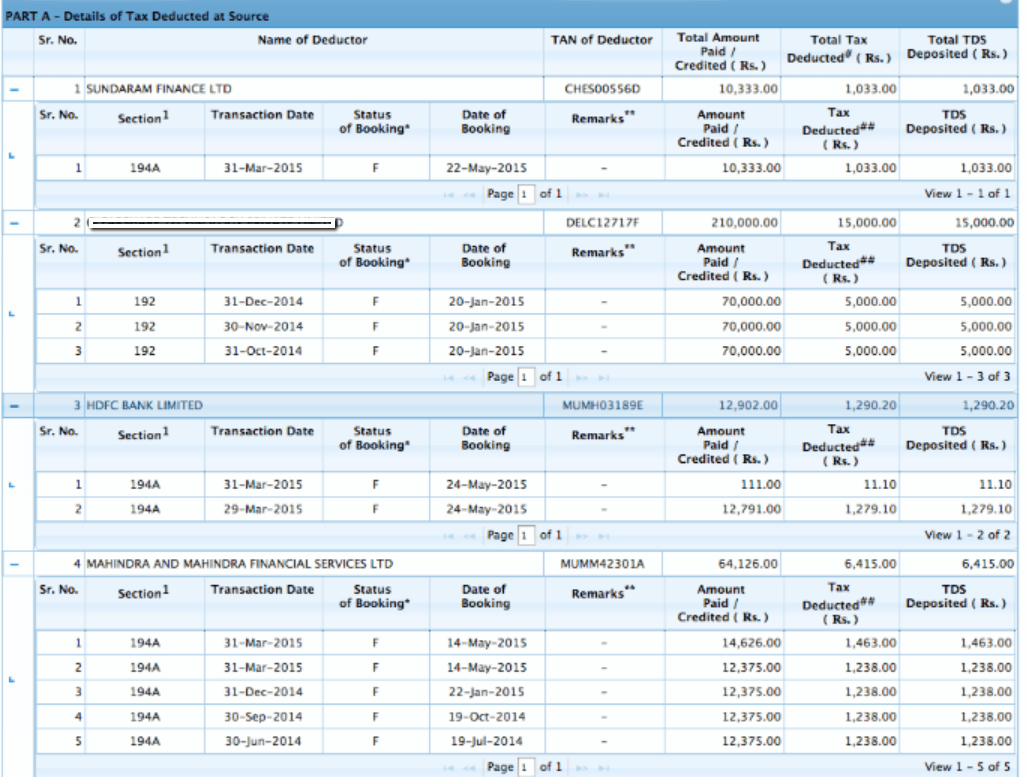

Form 26as this comprehensive statement, available on the traces portal,. The most crucial section of form 26as is dedicated to tds transactions. What does form 26as means?

Income tax department keeps all. Tds credits in form 26as. It also shows information about high.

Checking your browser before accessing incometaxindia.gov.in this process is automatic. Tds deductions are linked to pan numbers for both the deductor and. The income tax 26as form is updated when the central pay commission processes the tds returns.

Tax credits statement (form 26as) can be. Form 26as is a statement that shows the below information: When the income tax division processes the tds returns submitted by the tds deductors, form 26as is updated accordingly.

26as full form is annual information. Your browser will redirect to requested content shortly. The tax credit statement (form 26as) are generated wherein valid pan has been reported in the tds statements.