Wonderful Tips About Dividends On Income Statement

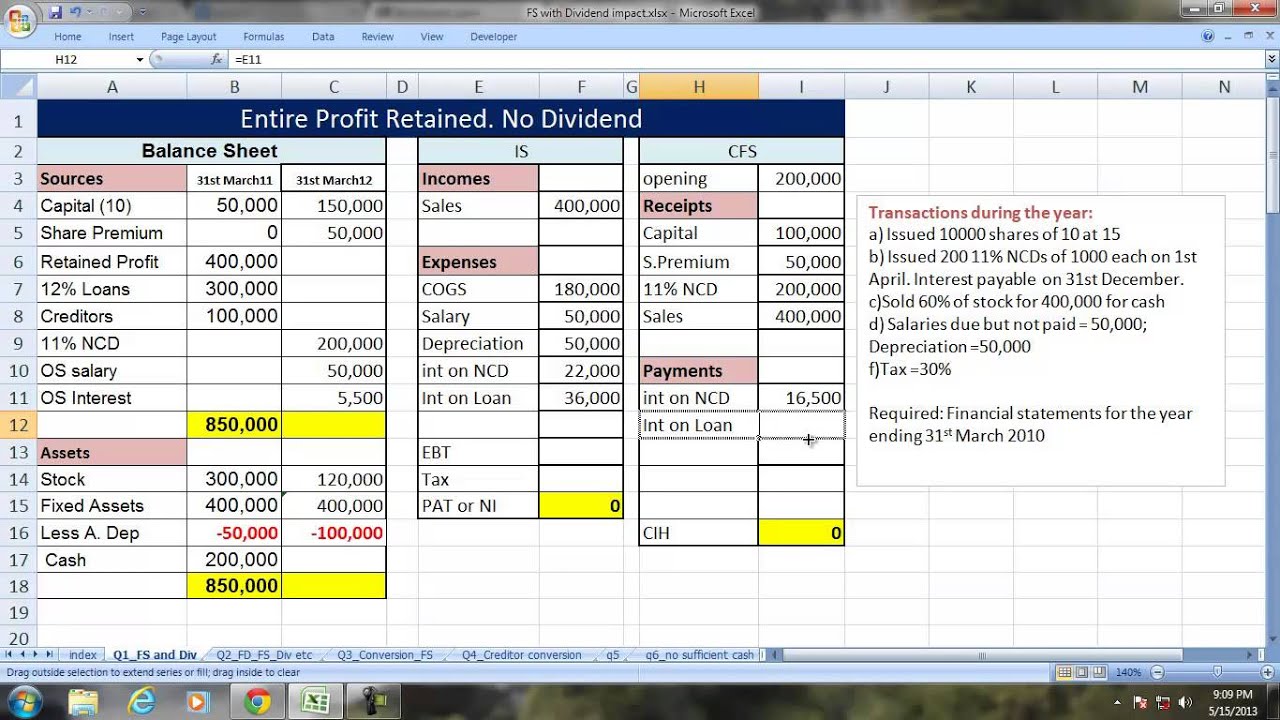

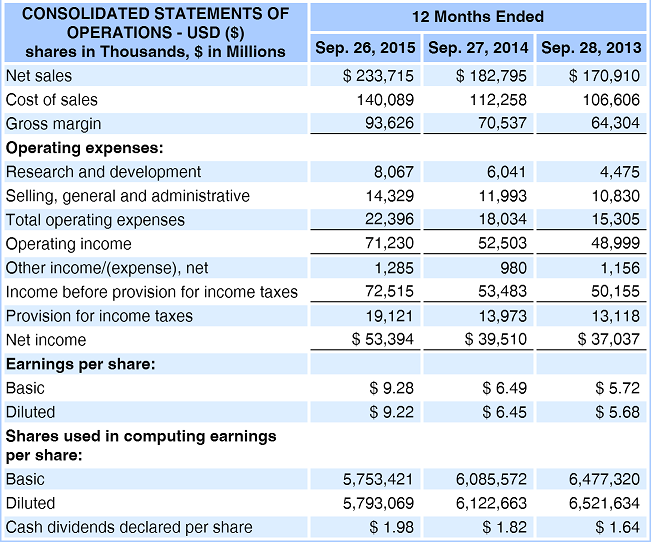

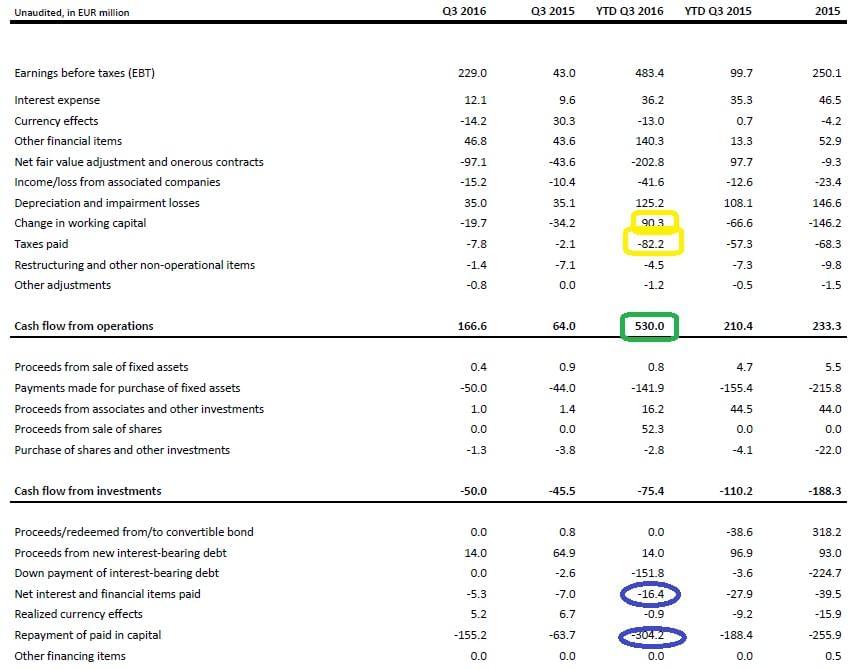

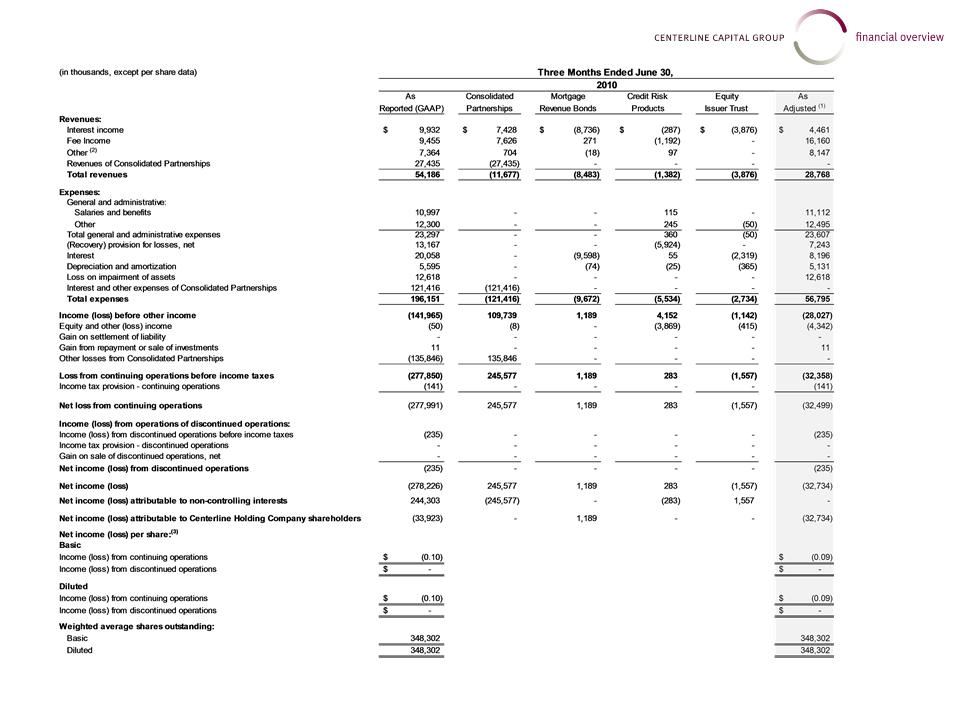

Dividends are a distribution of a company's profits that are reported on the income statement, the statement of cash flows, and the statement of stockholders' equity.

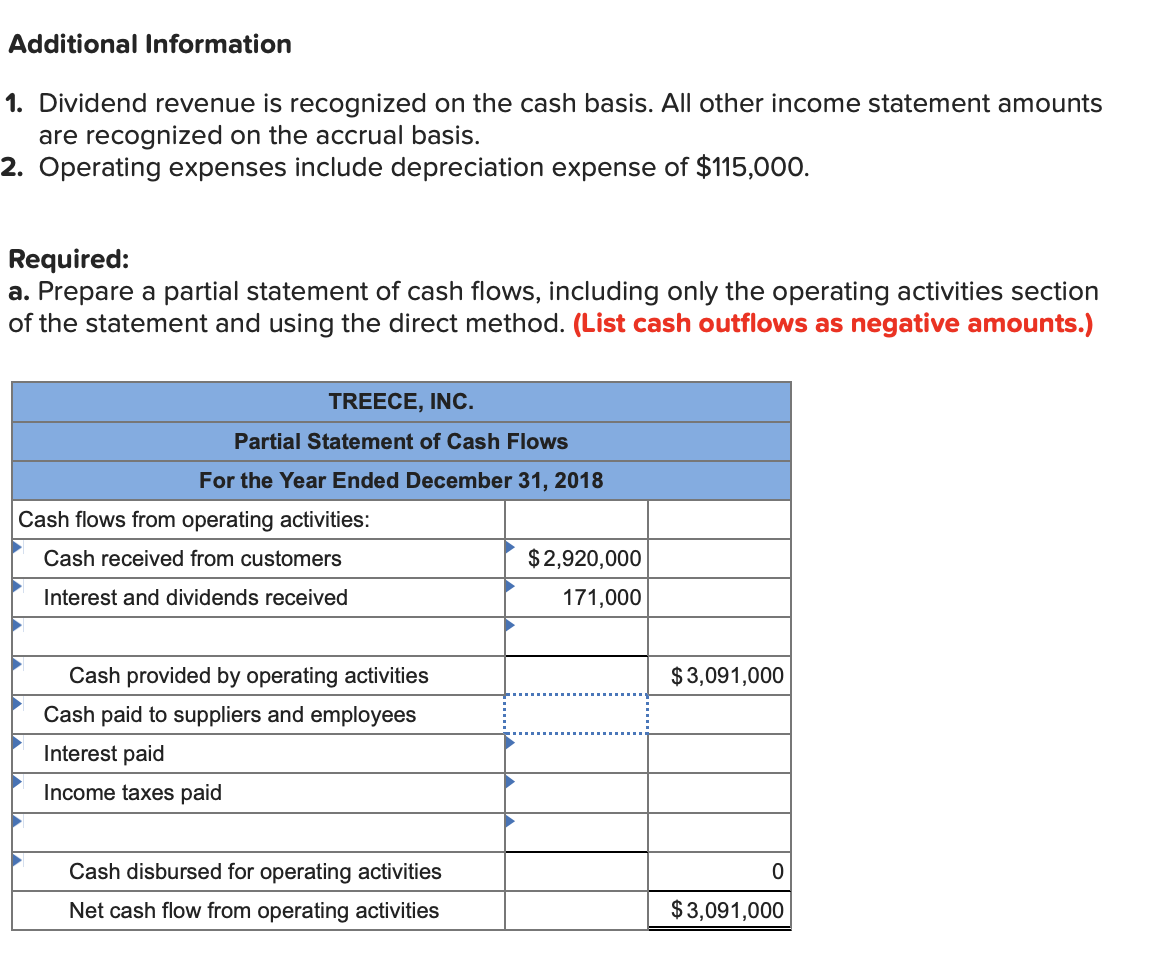

Dividends on income statement. Plus, you’re getting in at a 5.7% discount, too. Preferred stock dividends are deducted on the income statement. How do dividends affect financial statements?

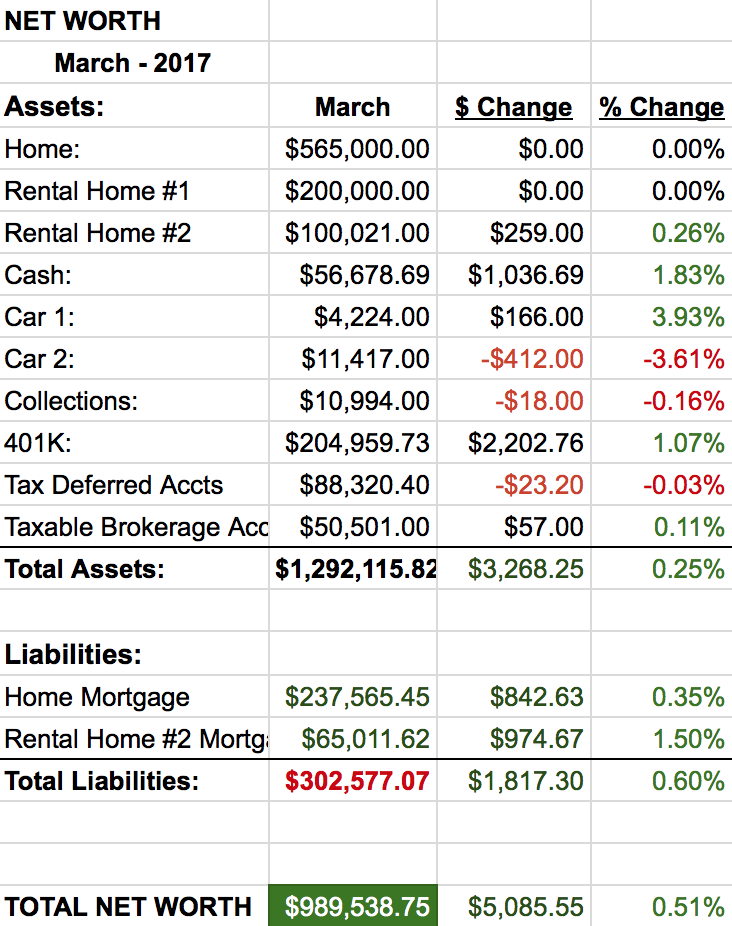

5 rows dividends in the balance sheet. The dividends paid by a business can be calculated from its income statement and beginning and ending balance sheets, if it is not disclosed elsewhere. Investors should consult with their tax accountant before.

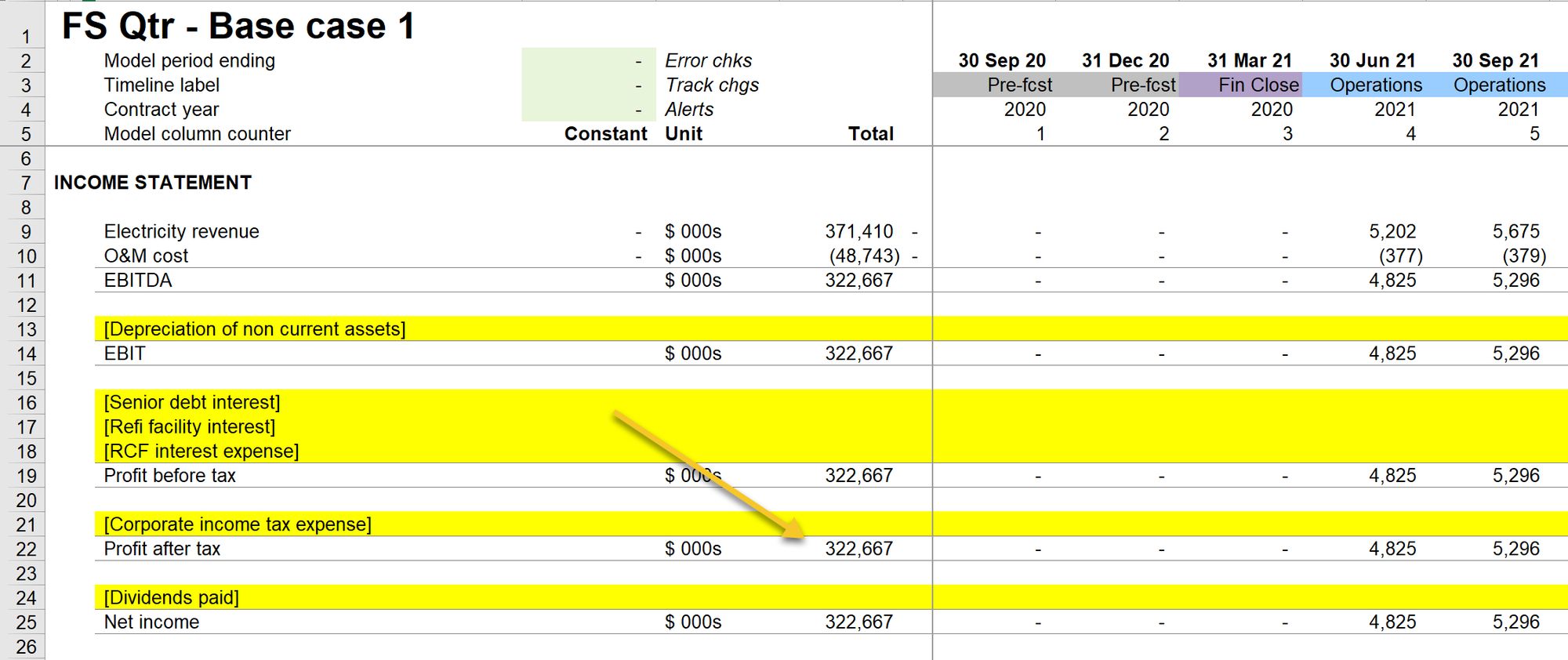

Dividends aren't listed on the income statement, but you may be able to calculate a rough estimate. Special dividend of € 1.00 per share. What is the income statement?

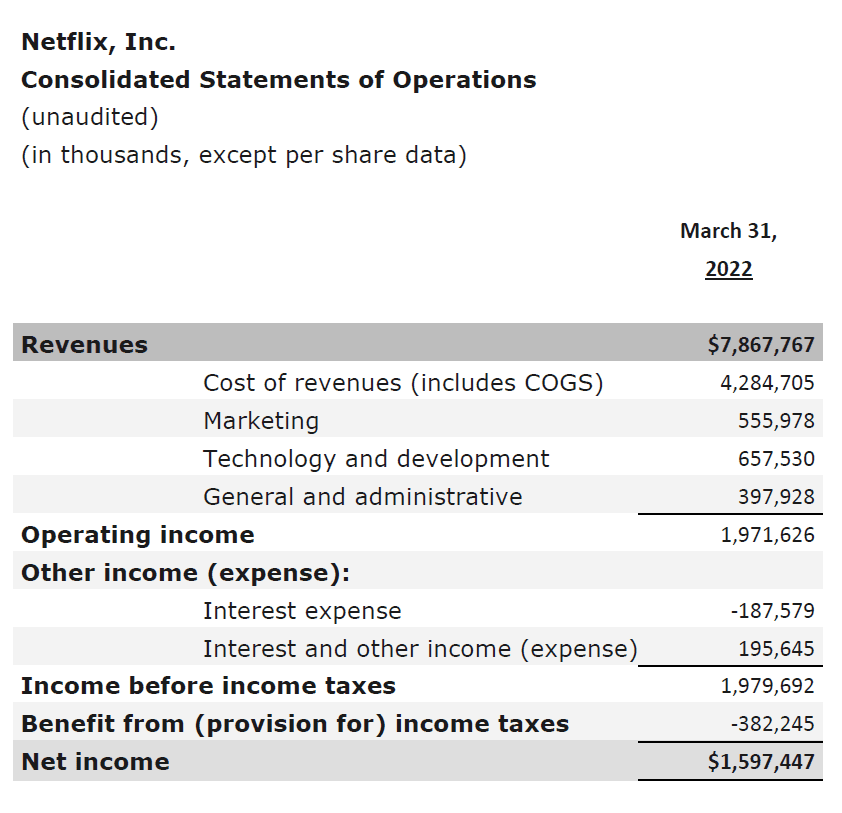

A dividend is a method of redistributing a company's profits to shareholders as a reward for their investment. Stock and cash dividends do not affect a. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

A dividend represents income received by investors and is not always taxable by federal and state governments. Dividend of € 1.80 per share; Feb 21, 2024, 3:00 am est.

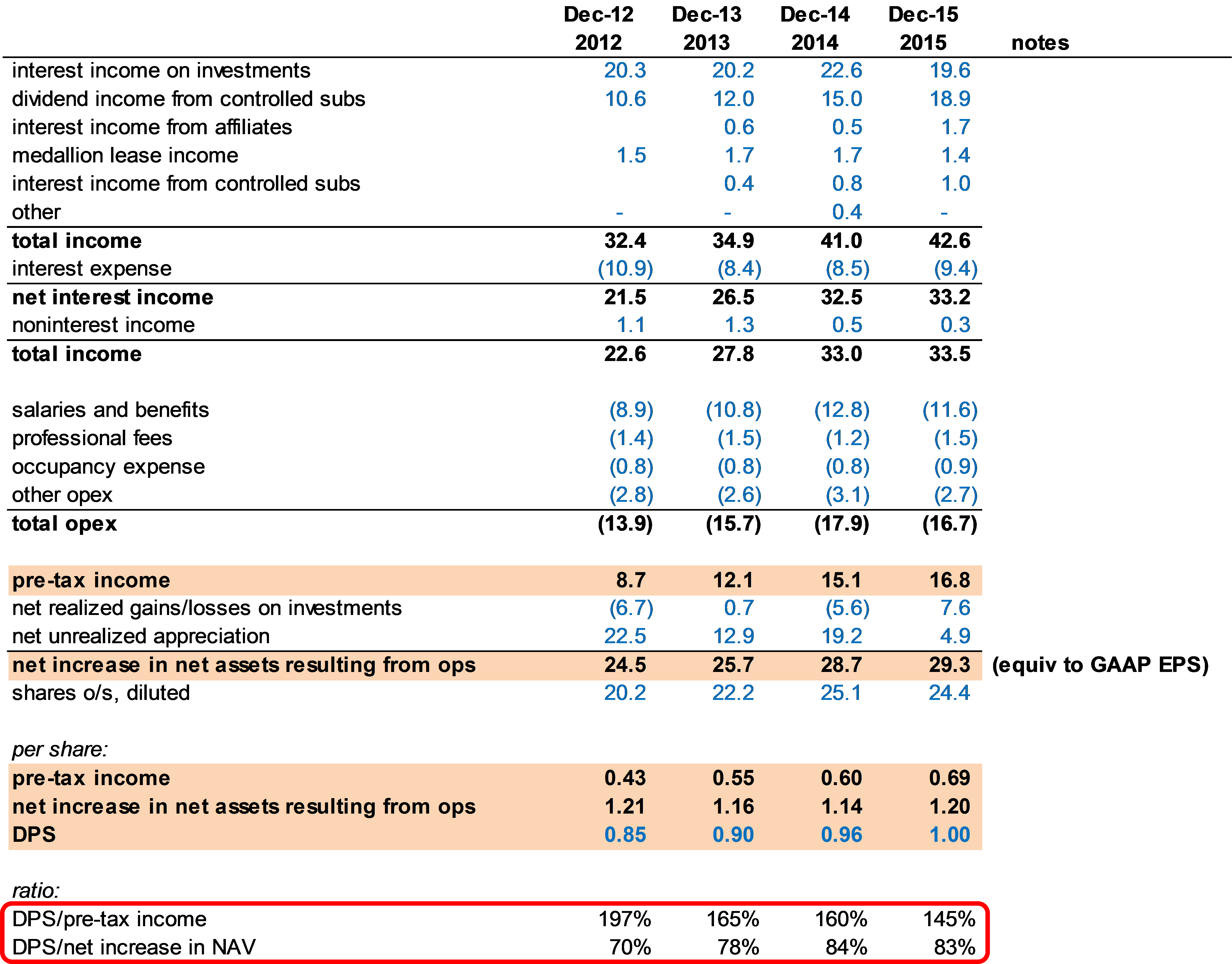

Cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement. The first step in calculating dividends from the income statement is. Calculating dps from the income statement.

Consolidated net income (2) was € 3,789 million (2022: How to calculate dividends from the income statement step 1: Nvidia will pay its next quarterly cash dividend of $0.04 per share on march 27, 2024, to all shareholders of record on march 6, 2024.

How to calculate dividends from the balance sheet and income statement to calculate dividends for a given year, do the following: A dividend payout ratio is a way to find out how much money in dividends is paid out by a company using its income statement. Companies are not required to issue dividends on.

We are given the last two year’s dividends and net profit as $150.64 million, $191.70 million, and $220.57 million, $711.28 million, respectively. If you don’t pocket but instead reinvest the dividends, the principal will compound to $600,000 in 25 years. The income statement is one of the three main financial.

If a company follows a consistent dividend payout ratio (i.e., the company is known to pay a consistent percentage of its earnings as. Examples of how cash dividends affect the financial statements when a corporation's board of directors declares a cash dividend on its stock, the following will occur:. Take the retained earnings at the beginning.