Impressive Info About Direct Method Of Reporting Cash Flows

The direct method (cash flow) is an accounting approach used in the preparation of a cash flow statement, which portrays the exact payments and receipts of cash by a company during a certain period.

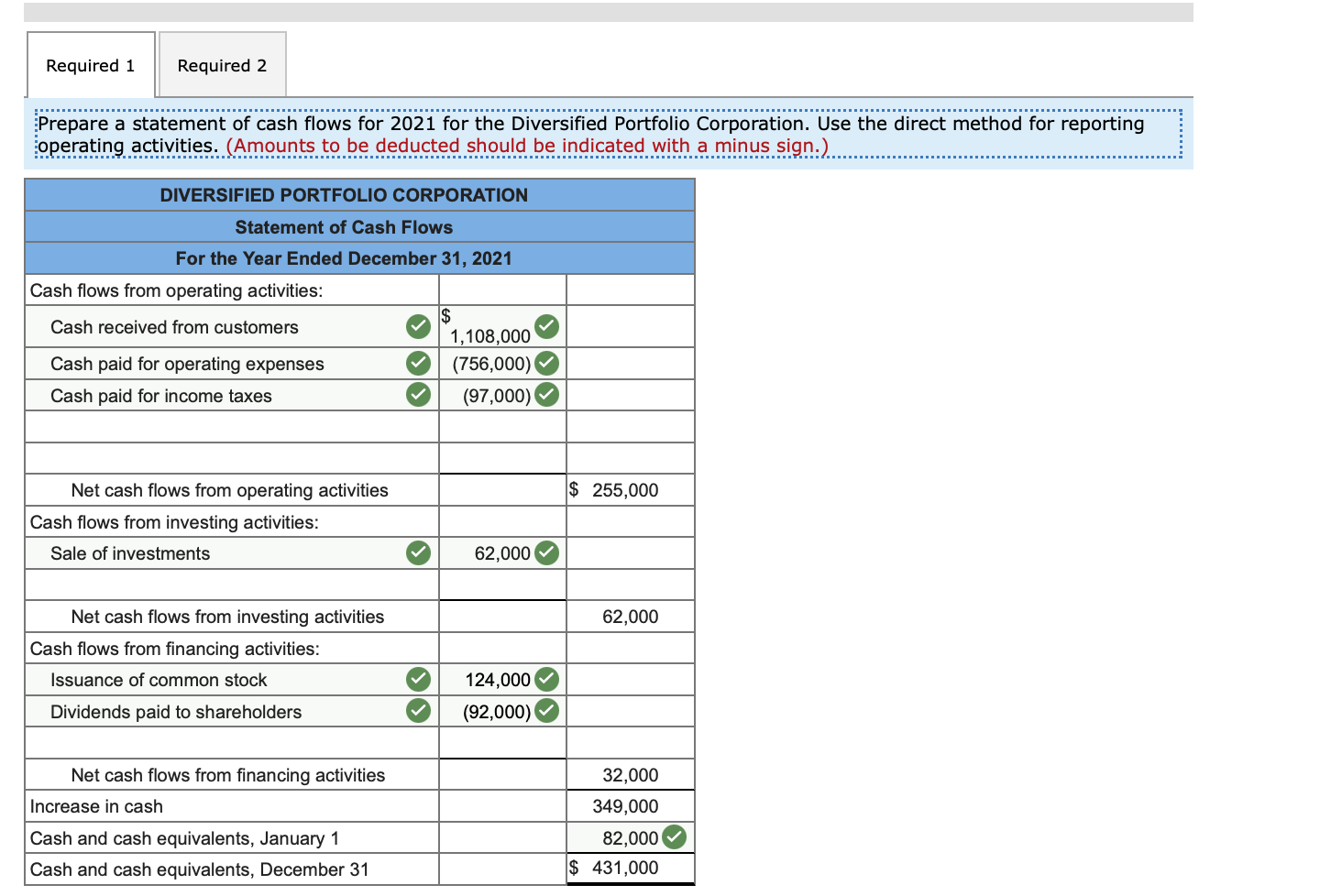

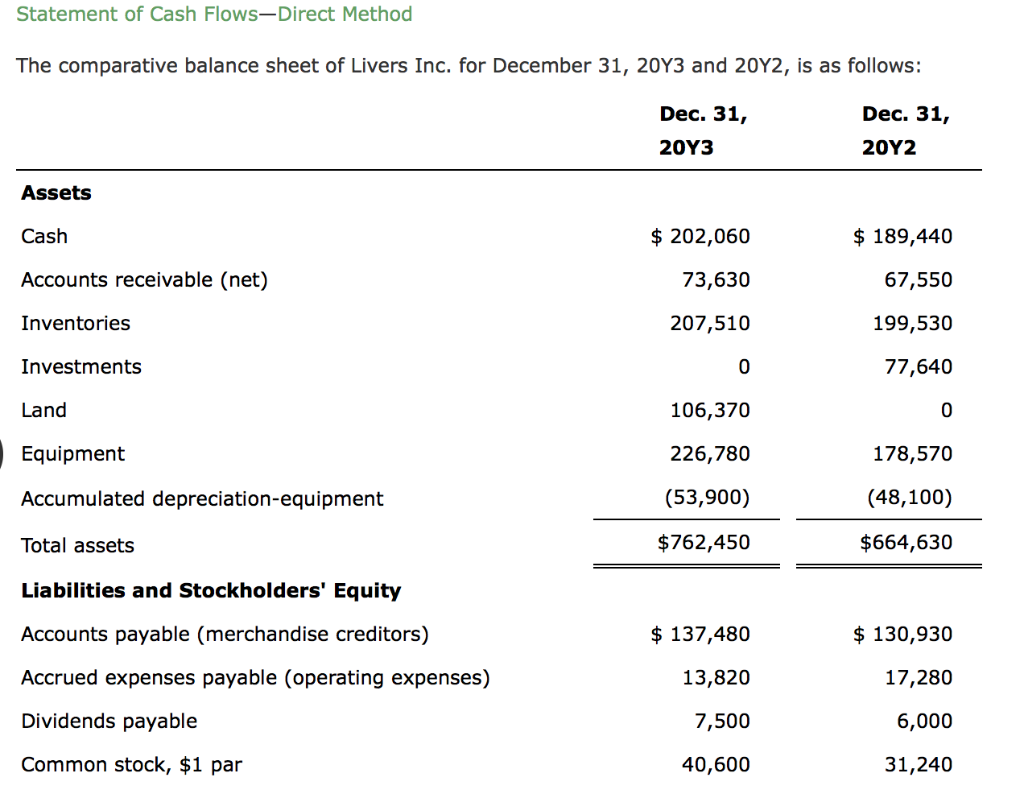

Direct method of reporting cash flows. The statement of cash flows direct method uses actual cash inflows and outflows from the. This value can be found on the income statement of the same accounting period. The pros and cons of direct cash flow reports pros.

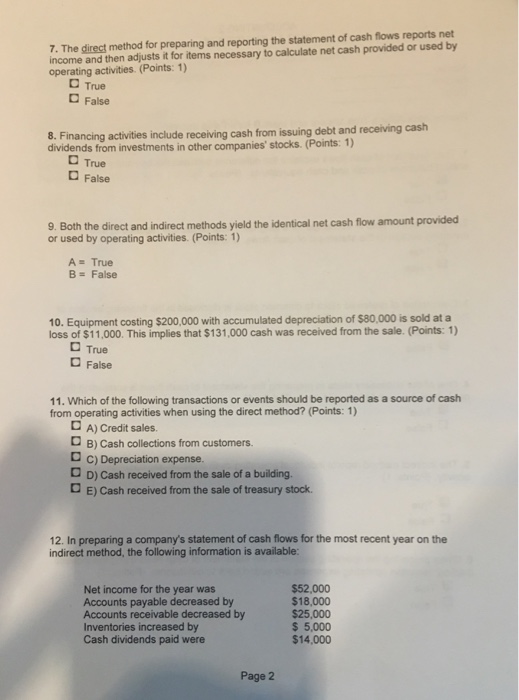

The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source. (there are no differences in the cash flows from investing activities and/or the cash flows from financing activities.) Two methods are used to prepare a statement of cash flows, namely the indirect method and the direct method.

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. The direct method only takes the cash transactions into account and produces the cash flow from operations. Essentially, it tracks actual cash inflows and outflows from operating, investing, and financing activities.

In the direct method, the presentation of cash flows from operating activities section is the same as the cash flows from investing activities and cash flows from. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. The cash flow statement direct method format includes the following steps:

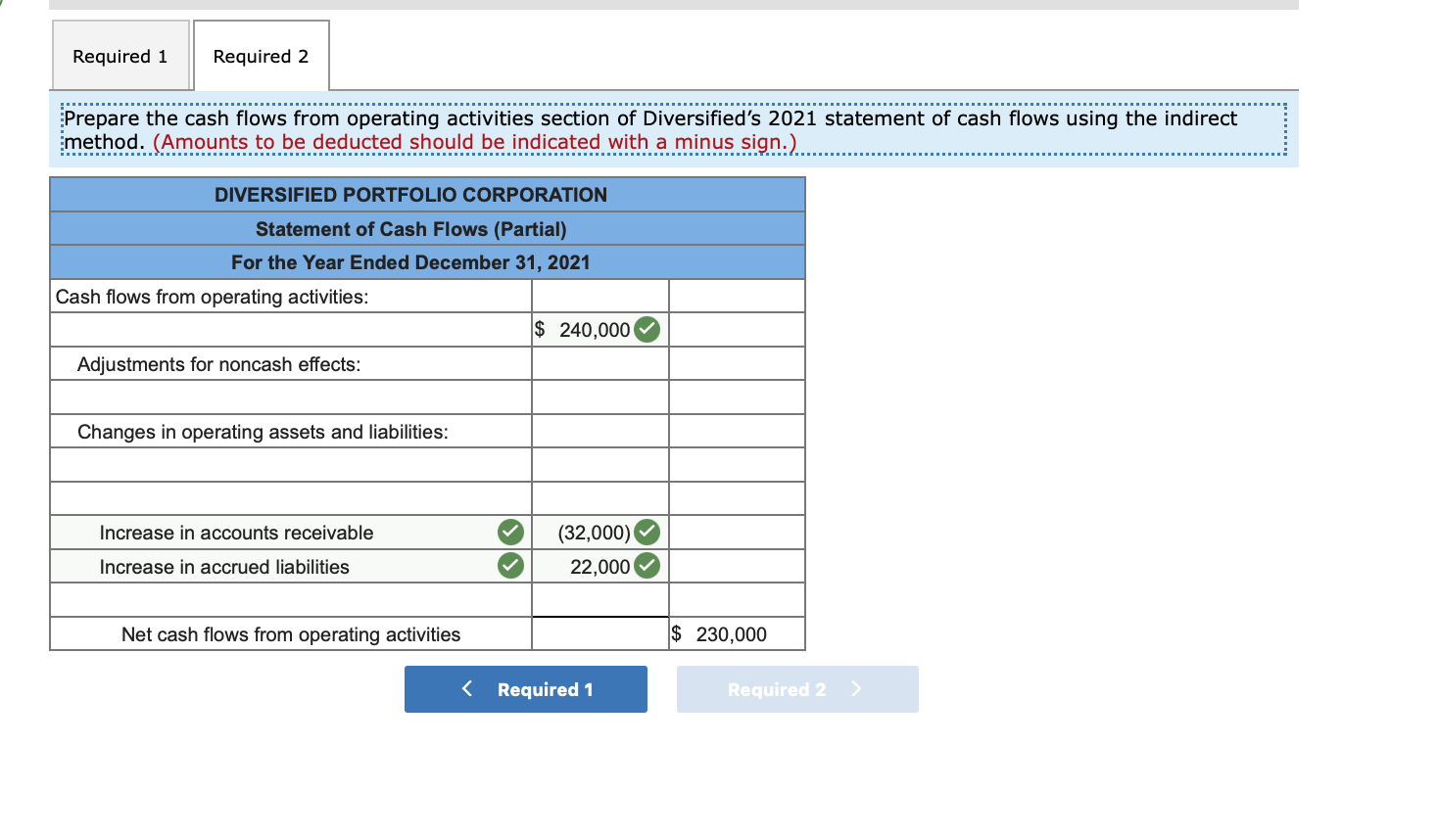

A path to more descriptive reporting. Preparing a statement of cash flows: The main difference between the direct method and the indirect method of presenting the statement of cash flows (scf) involves the cash flows from operating activities.

In many cases, some companies may have a salaries payable balance. The indirect method was discussed earlier in this chapter. Fasb expressed preference for the direct method but the indirect method is used by most businesses in the united states.

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. Preparing a cash flow statement using the direct method can be as easy as using the indirect method, if the lines that will be displayed are given some forethought and individual receivable and payable accounts are set up for each line in the preceding year. Items that typically do so include:

The direct cash flow method is one of two accounting treatment methods used to generate a cash flow statement. Direct method as with the indirect method, preparing a statement of cash flows using the direct method is made much easier if specific steps are followed in sequence. The advantage of the direct method over the indirect method is that it reveals operating cash receipts and payments.

The method lists every transaction on the company’s cash flow statement. Both methods organize the reported cash flows into three activities: The direct method is one of two accounting treatments used to generate a cash flow statement.

In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically employees, vendors, etc. When is the direct method used? Direct cash flow is an accounting method that creates a detailed cash flow statement showing the cash changes over an accounting period.

:max_bytes(150000):strip_icc()/Direct_method_final-819489c8494e43f498e8b084e922bee0.png)

![Problem 49 (Algo) Statement of cash flows (L048] The Diversified](https://img.homeworklib.com/questions/89874790-79a0-11ea-bdc5-6f5e8276b9ee.png?x-oss-process=image/resize,w_560)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)