Painstaking Lessons Of Info About Profit And Loss Report Definition

The result is either your final profit (if.

Profit and loss report definition. What is profit and loss statement? It is also known as the income statement or the statement of operations. A profit and loss statement is defined as a financial statement that provides a record of the revenues, expenses, and profits/losses incurred by a business over a specified time frame, typically issued monthly, quarterly, and annually.

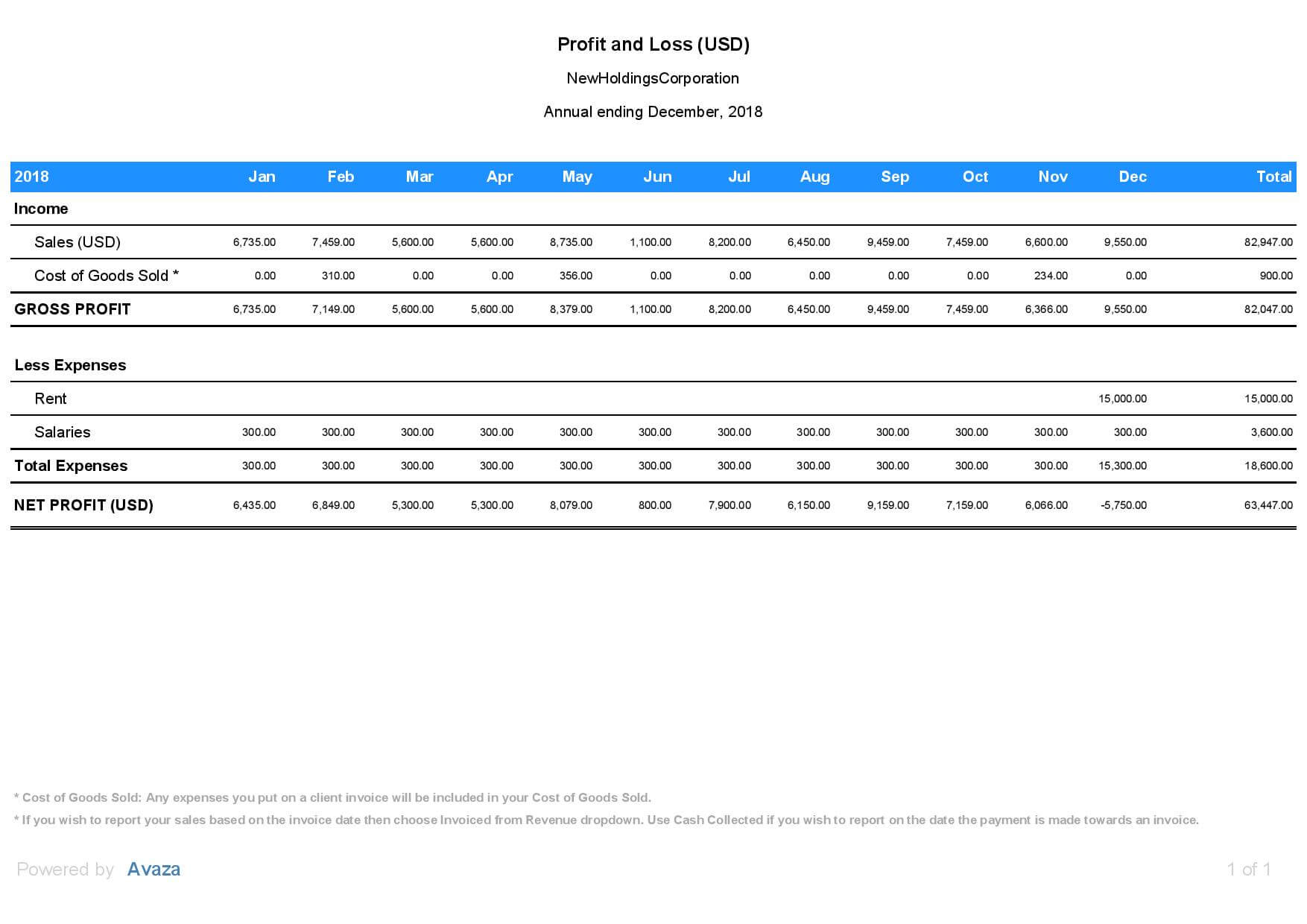

The profit and loss report is a financial report that functions to show expenses, income, and profit and loss from your business in a certain period. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. You can calculate the net profits of your business by subtracting all the costs incurred by the company from the gross profit.

Then, carry over loss above limits and report it on schedule 1 of form 1040, or schedule se, line 2, depending on whether all business investment is at risk. The profit and loss report represents the total income and total expenses of a business. Calculate the total business profit or loss and input it in line 31.

This entry takes into consideration the total profits made after excluding all the expenses of a company. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. It captures how money flows in and out of your business.

It shows your revenue, minus expenses and losses. The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. The rising costs overshadowed a decent holiday quarter.

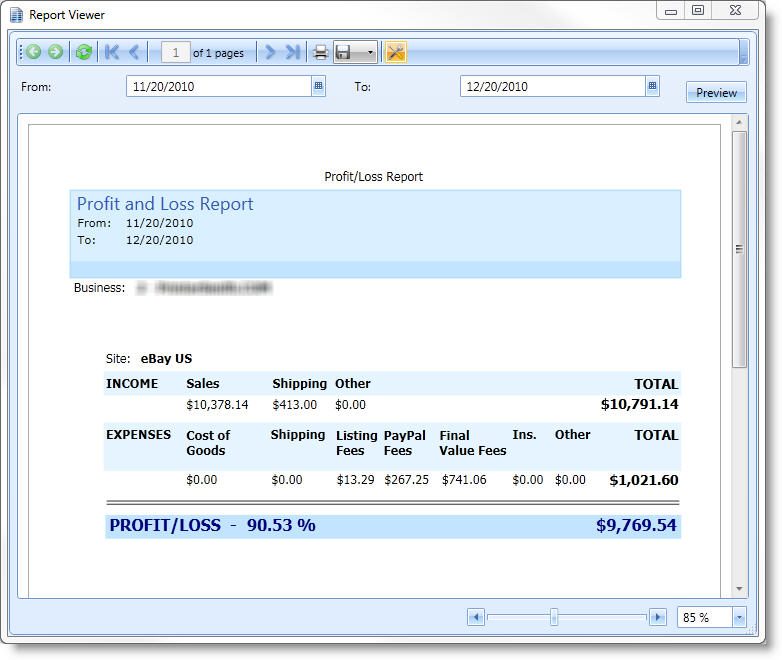

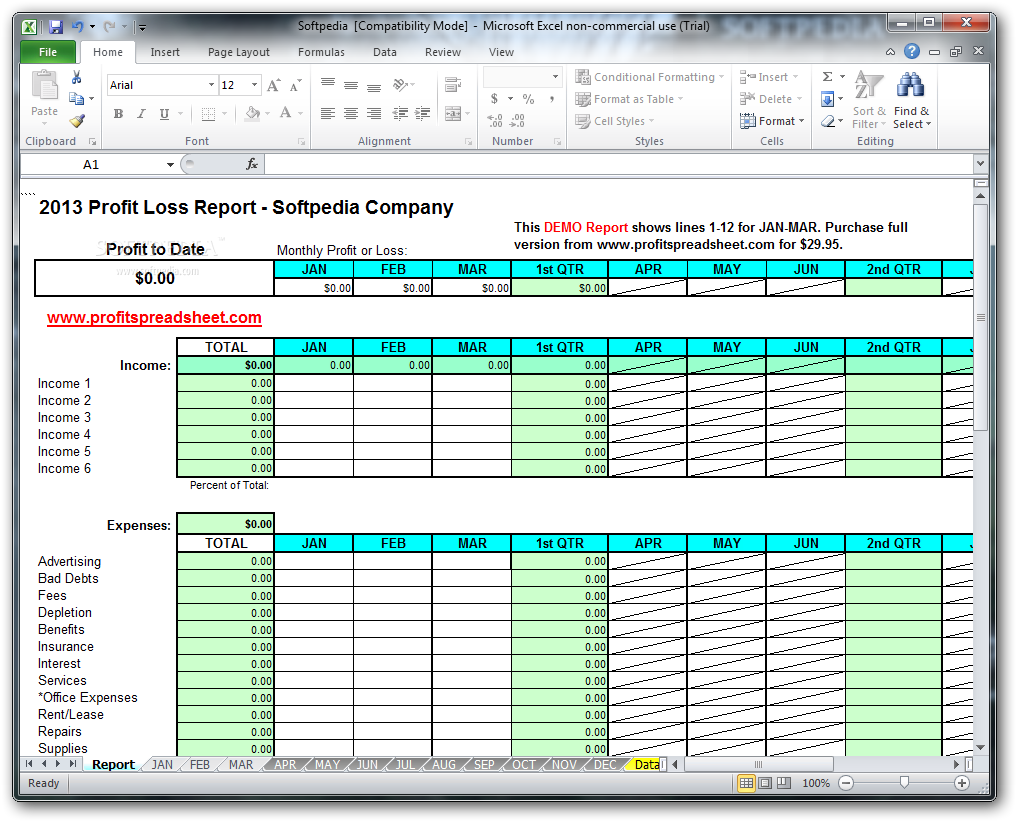

The p&l summarizes a company’s revenues, expenses, and net profit or loss over a given period of time, typically quarterly or annually. It's a straightforward presentation of a. Here is an example of a profit.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. A profit and loss statement is a financial report that shows how much your business has spent and earned over a specified time. Dividend of € 1.80 per share;

This report is the first to be made in the accounting cycle because profit and loss must be reported to investors or capital owners before other types of financial reports are prepared. In line 32, if the business has a loss above the loss limit, report these losses and check the appropriate box. A review of the top 100 sales in 2023 found that the best.

A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. Here are some tips on running a profit and loss report that actually helps your business. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

The outcome is either your final profit or loss. The profit and loss report’s objective is to determine a business’s financial health by excluding the expenses. It contains summarized information about firm’s revenues and expenses over the reporting period.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-for-Small-Business-TemplateLab.com_-scaled.jpg)