Brilliant Tips About Prepaid Supplies In Balance Sheet

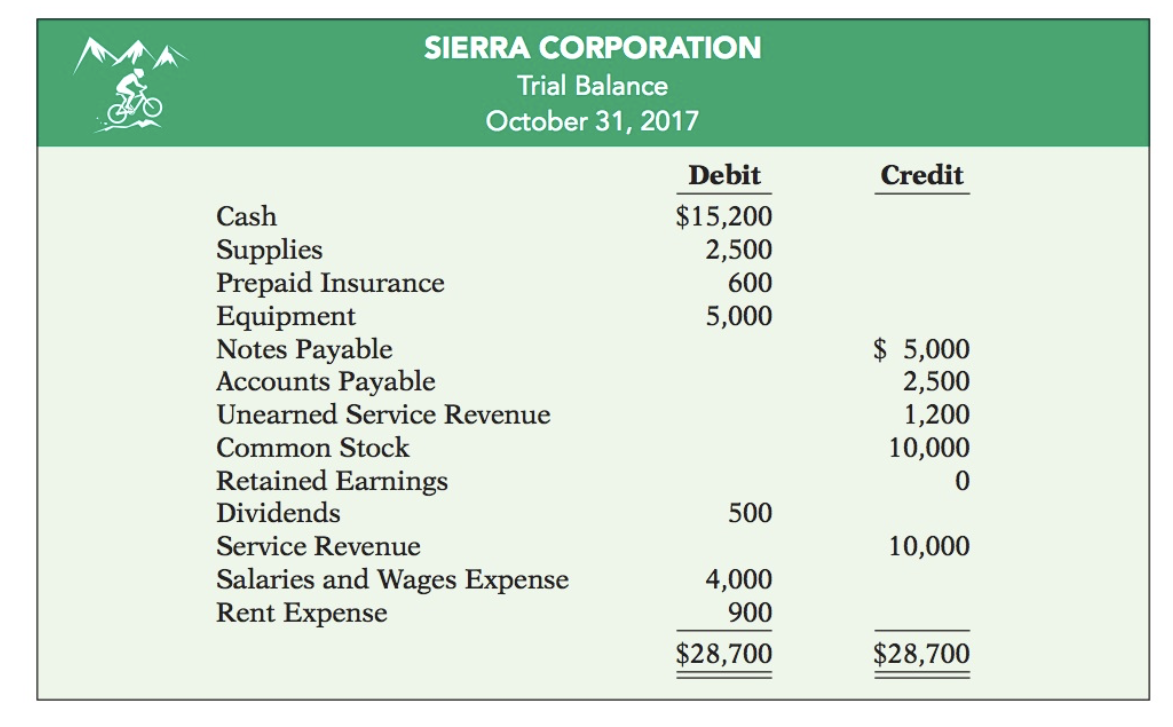

In this journal entry, the supplies account is.

Prepaid supplies in balance sheet. Prepaid expenses in balance sheet are listed as assets, too. On june 15, 2020 abc ltd. The prepaid insurance amount is recorded as an asset on the balance sheet until it is gradually expensed over the coverage period.

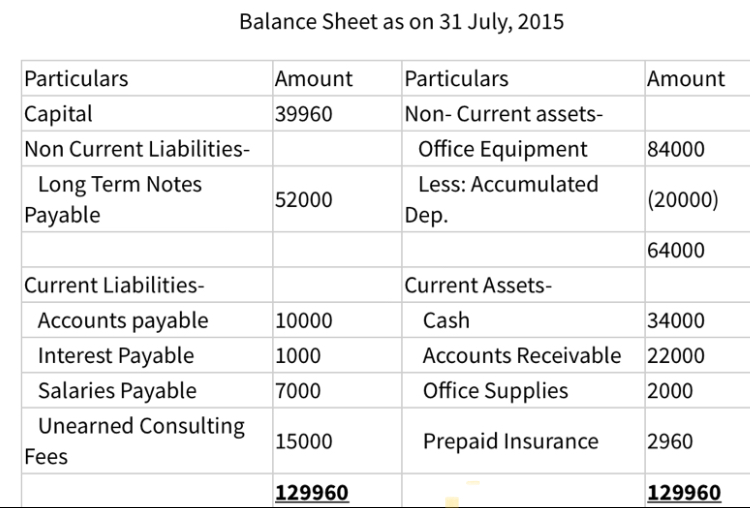

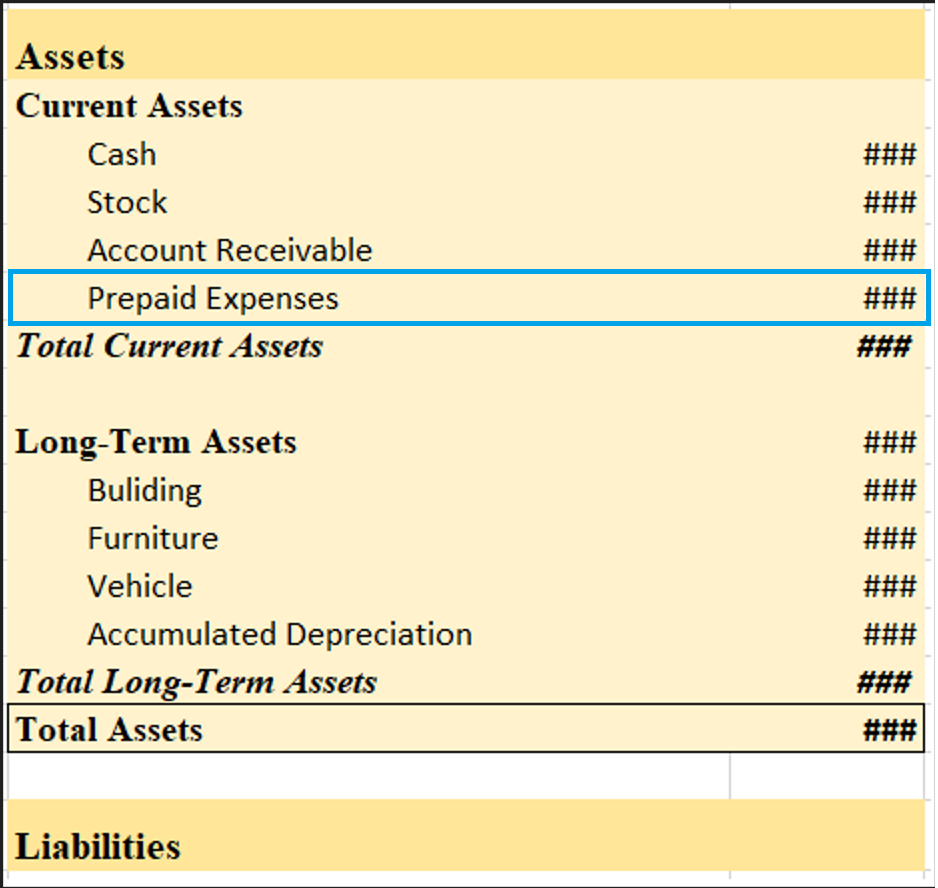

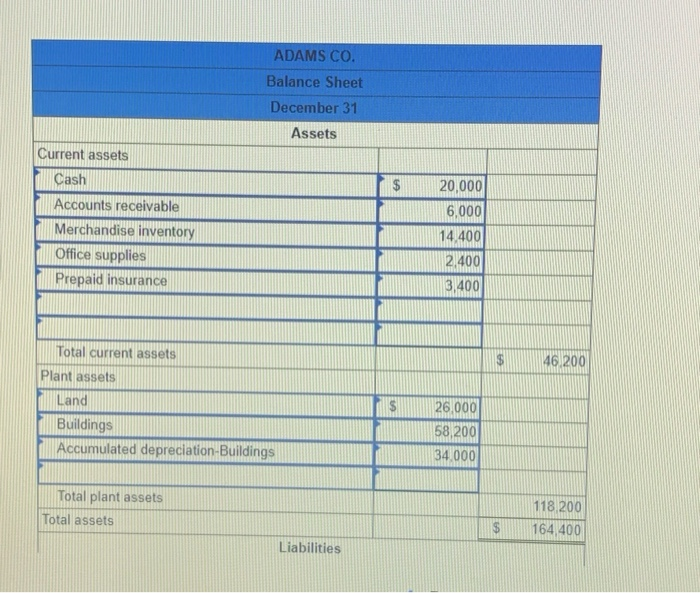

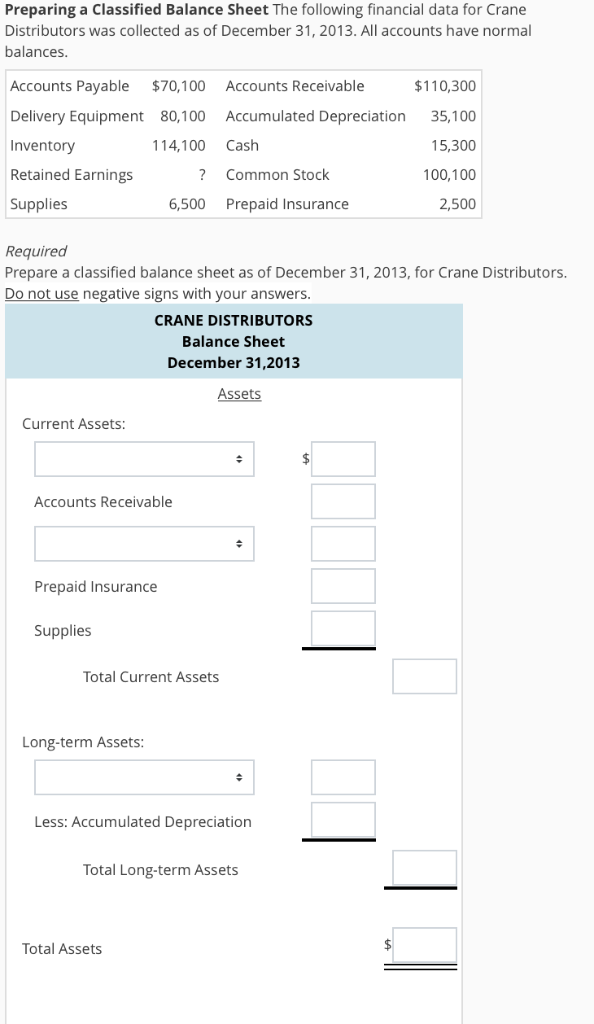

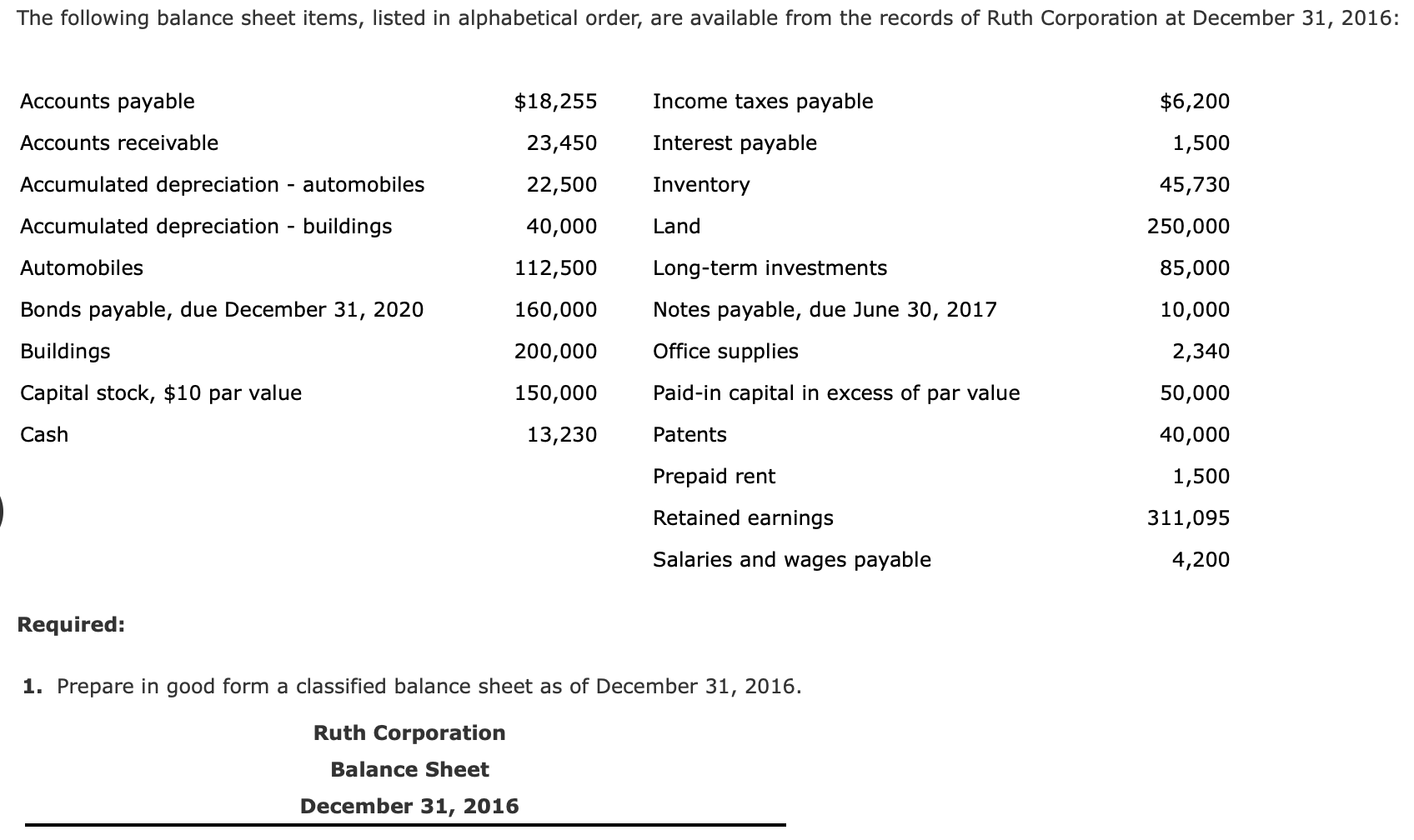

After making that change, prepaid supplies will. For example, the following screenshot from the balance sheet of. The two main classifications of prepaid expenses on the balance sheet are:

Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. Accounting prepaid expenses are an important part of. These may be pooled together and listed on.

Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. How to log prepaid expenses in your balance sheet. Can make the prepaid expense journal entry for office supplies on june 15, 2020, as below:

Companies prepay many other types of expenses, including taxes, utility bills, rents, insurance, and interest expense. Introduction prepaid expenses is a financial maneuver that allows businesses to navigate their financial obligations with finesse. It is an asset because the expense has already been incurred;

These are both asset accounts and do not increase or decrease a company’s. For example, refer to the first example of prepaid rent. Prepaid expenses refer to expenses that a company pays in advance for goods or services that it will receive in the future.

Prepayments) represent payments made for expenses which have not yet been incurred or used. A prepaid expense is carried on the balance sheet of an organization as a current asset until it is consumed. The gaap matching principle prevents expenses from being recorded.

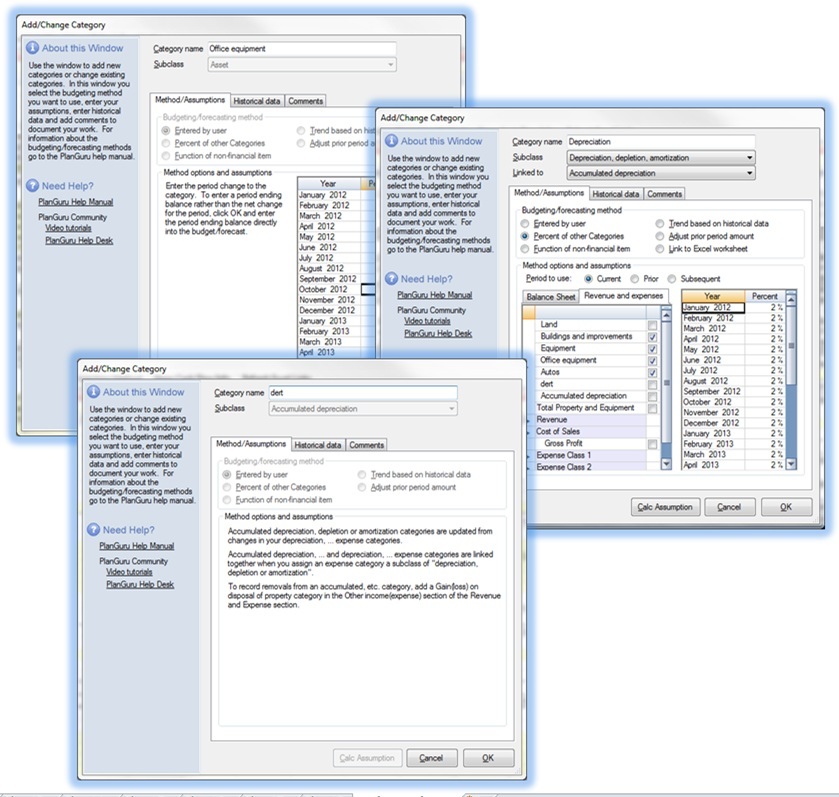

Prepaid expenses that are expected to be utilized or consumed within. Simply change your prepaid supplies’ account type from bank to other current asset, as shown in figure 6. Study guides accounting principles i prepaid expenses prepaid expenses prepaid expenses are assets that become expenses as they expire or get used up.

In the firm’s balance sheet, such an expense is shown as an asset. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. Logging your prepaid expenses in the balance sheet can help you accurately track these costs and maintain accurate financial.

In other words, these are advanced payments by a. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet. The reason for the current asset designation is that.

![[Solved] The worksheet of Bridget's Office Supplie SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/07/60ec1874cfd57_1626085491227.jpg)